Expired Tax Provisions - Mississippi Society of Certified Public

advertisement

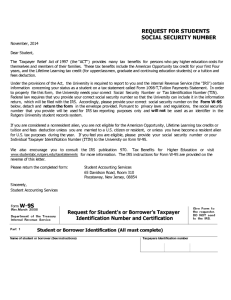

42nd Annual Mississippi Tax Institute Mark D. Puckett, CPA, MST, PFS BDO USA, LLP Memphis, Tennessee December 3, 2015 mpuckett@bdo.com 901-680-7608 Current Developments in Federal Income Taxation Legislation, Practice and Procedural Matters Expired Tax Provisions • Last year The 2014 Tax Increase Prevention Act, the so-called “extender” bill was signed by the President December 19, 2014 • The 2014 legislation retroactively extended for one year many tax breaks that expired at the end of 2013 • What about 2015??? Page 4 Expired Tax Provisions (Cont.) • More than 50 expired tax provisions await action in Congress • The big hang-up – permanence in the tax code or a two-year extension • Presently, Republican lawmakers have made determining which business – related provisions could be made permanent their priority while Democratic lawmakers are aiming at making tax credits aimed at lower-income households permanent their priority. Page 5 Expired Individual Provisions Include • $250 above-the-line deduction for classroom expenses paid by teachers • Option to take an itemized deduction for state and local general sales taxes • Tax-free distributions to charity from an IRA by taxpayers age 70½ or older • Exclusion of up to $2 million of discharged principal residence indebtedness • Deduction for mortgage insurance premiums deductible as qualified residence interest Page 6 Expired Business Provisions Include • Research tax credit • New markets tax credit • Work opportunity tax credit • 50% bonus depreciation and other beneficial depreciation provisions • Increase in asset expensing election up to $500,000 Page 7 Don’t Look for Tax Overhaul This Year or Next “Facing fast-approaching legislative deadlines and soon to be preoccupied with the 2016 presidential race, Congress is unlikely to take action on any measures to overhaul the U.S. Corporate income tax.” Pamela Olson – former assistance secretary for tax policy with Treasury speaking at the 2015 Pacific Rim Tax Institute in Palo Alto, CA 2-19-2015 (now with PWC in Washington) Page 8 IRS Budget Woes • The agency’s inflation – adjusted budget has been reduced by about 17% between 2010 and 20151 • The IRS audited 0.57 percent of U.S. business in fiscal 2014, the lowest rate since 20052 • The IRS audited 0.86 percent of individual taxpayers in fiscal 2014, the lowest rate since 20042 1 Taxpayer Advocate Service – 2014 Annual Report to Congress – Vol. 2 2 Bloomberg BNA Citing IRS statistics released March 2, 2015 Page 9 IRS Budget Woes (cont.) Who’s Minding the Store? • 35.6 percent of phone calls went unanswered by IRS customer service representatives • 50 percent of pieces of correspondence were not handled timely • Virtually zero tax returns were prepared by IRS walk-in sites Source: Taxpayer Advocate Service – 2014 Annual Report to Congress – Vol. 2 Page 10 Decay in Taxpayer Service The Taxpayer Advocate predicts: • Millions of taxpayers will not be able to reach the IRS when they need to • Taxpayers will not get their math error notices corrected or penalties abated – leading to incorrect assessments and expensive downstream dispute resolution activities • Unnecessary liens, levies and collection disputes will intensify as taxpayer/IRS communication avenues break down Source: Taxpayer Advocate Service – 2014 Annual Report to Congress – Vol. 2 Page 11 TIGTA Report Faults IRS Handling of Education Tax Credits1 • Treasury Inspector General of Tax Administration report says IRS handed out $5.6 billion in potentially erroneous education credits • TIGTA reported that the agency has to do a lot more to improve in this area and the appropriate processes are still not in place 1TIGTA’s report, “Billions of Dollars in Potentially Erroneous Education Credits Continue to be Claimed for Ineligible Students and Institutions” (No. 2015-40-027) Page 12 Tax-Related Identity Theft • Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund1 • About 2.4 million U.S. taxpayers’ names or Social Security numbers appeared in falsified returns in 2013 – a nearly tenfold increase from 20102 • IRS estimates that about $5.8 billion was paid out in 2013 on returns it later determined were fraudulent3 1IRS Taxpayer Guide to Identity Theft 2March 2015 report from the Treasury Inspector General for Tax Administration 3BNA Daily Tax Report, April 30, 2015 Page 13 10 Smart Things to Do While on Hold with the IRS1 With call wait times exceeding an hour or more on the IRS Practitioner Priority Service line, here are 10 suggestions to use your time wisely: 1. 2. 3. 4. 5. Organize your desktop Read the Tangible Property Regs (TD 9636) – all 222 pages Plan a beautiful and relaxing getaway Do your timesheet…for the past six months Take a nap 1by Susan Allen, CPA, CITP, CGMA AICPA Tax Section News, October 13, 2015 Page 14 10 Smart Things to Do While on Hold with the IRS (Cont.) 6. Brainstorm process improvements for your practice 7. Eat breakfast, and perhaps lunch and dinner too 8. Start (and perhaps finish) online holiday shopping 9. Burn some calories: jumping jacks, yoga, etc. 10.Browse the AICPA website Page 15 OVDP will remain open for an indefinite period IR 2015-9, 01/25/2015 In a news release, the IRS has: • Stated that the Offshore Voluntary Disclosure Program (OVDP) will remain open for an indefinite period, i.e., until it announces otherwise • Cautioned that avoiding U.S. taxes by hiding money or assets in unreported offshore accounts remains a tax scam on its “Dirty Dozen” list • Cautioned that illegal scams can lead to significant penalties, interest, and even criminal prosecution Note: The National Taxpayer Advocates’ recently issue report to Congress was highly critical of the IRS’s administration of the OVDP and its lack of fairness and consistency as a voluntary settlement program. Page 16 Tax Case Litigation Outcomes1 • Taxpayers prevail in whole or in part 16% of the time overall • Pro Se taxpayers prevail 10% of the time • Represented taxpayers prevail 26% of the time 1Taxpayer Page 17 Advocate Service – 2014 Annual Report to Congress Vol. 1 Debt Discharge on Late Filed Returns Mallo v. IRS., 774 F3d 1313, (CA10), 12/29/2014 • Taxes owed on late-filed returns cannot be discharged in bankruptcy • The 10th Circuit agreed with the 5th Circuit that previously ruled similarly in In re McCoy, 666 F3d 924, (CA5), 2012 • The Court stated that the “plain and unambiguous language of Section 523(a) [Bankruptcy Code of 2005] excludes from the definition of return all late-filed tax forms, except those prepared with the assistance of the IRS.” Page 18 Suspended Corporation Can’t Petition Tax Court Medical Weight Control Specialist, TC Memo 2015-52, 03/18/2015 • Taxpayer corporation’s corporate privileges were suspended by the State of California • While its privileges were still suspended, the corporation received a statutory notice of deficiency and thereafter, filed a Petition with the Tax Court. The corporation filed for reinstatement but did so several months after the statutory notice was received and the Tax Court Petition was filed • The IRS filed a motion to dismiss alleging that the corporation lacked the capacity to sue • Held – for the Government: The Tax Court held that the Sec. 6213(a) 90-day period cannot be tolled or suspended. The corporation lacked the capacity to file during the 90-day period. Page 19 Business Income and Deductions New Accounting Method Change Procedures Rev. Proc. 2015-13 • Exclusive procedures for automatic and advance consent change in method of accounting • Supersedes Rev. Proc. 2011-14 (prior mass automatic change procedures) and Rev. Proc. 97-27 (longstanding nonautomatic change procedures) • New procedures for taxpayers under IRS exam enable Form 3115 requests to be filed at any time, with caveats • Effective for Form 3115 applications filed on or after 1-162015 for a year of change ending on or after May 31, 2014 Page 21 New Accounting Method Change Procedures Rev. Proc. 2015-13 (Cont.) • Still requires certain eligibility requirements to be met for filing automatic Form 3115 (e.g., no final year of trade or business, no 5-year overall method, no 5-year same item change, no 381(a) transactions) • All Form 3115 copies previously sent to the IRS National Office under duplicate filing requirements must now be mailed to the IRS Ogden, UT office • Election to recognize positive section 481(a) adjustment in the year of change • De minimis election for positive adjustments of less than $50,000 • Eligible acquisition transaction election (election statement required) Page 22 New Accounting Method Change Procedures Eligible Acquisition Transaction Election • Elect an accelerated 1-year section 481(a) adjustment period (rather than 4 years) for all positive section 481(a) adjustments for the year of change if an “eligible acquisition transaction” occurs • Typically applies to the target in a transaction that files a Form 3115 to correct an impermissible method • Practical Benefits: • No need for acquirer to inherit part or all of a positive section 481(a) adjustment from target’s use of improper accounting methods • Reduced need for acquirer to ensure it is compensated for the additional tax obligation (e.g., indemnity provision or purchase price adjustment) • Shift tax obligation entirely to target’s final tax year – target with NOLs that may be limited following the transaction can use NOLs to offset adjustment • Simplification and minimize disputes over unforeseen tax liabilities Page 23 New Automatic Change Listing Rev. Proc. 2015-14 • Complete updated list of automatic accounting method changes – over 200 automatic accounting method changes are available • Revisions to some existing accounting methods • Provides several new automatic changes: • • • • Section 4.02, relating to changes for conformity election by a bank Section 5.02, relating to changes to comply with section 163(e)(3) Section 10.12, relating to railroad track structure expenditures Section 11.13, relating to changes to the US ratio method by a foreign person for section 263A Page 24 New Automatic Change Listing Rev. Proc. 2015-14 (Cont.) • Provides several new automatic changes: • Section 11.14, relating to changes to treat depletion as an indirect costs for section 263A • Section 23.02, relating to changes from the mark-tomarket method to a realization method • Section 25.03, relating to changes in qualification as a life/nonlife insurance company under section 816(a) Page 25 Examples of Beneficial Automatic Accounting Method Changes Having Broad Application • • • • • • • Acceleration of prepaid expense deductions Deferral of advance payments Overall accrual-to-cash and cash-to-accrual Software development costs Impermissible to permissible depreciation or amortization Timing of incurring medical IBNR expenses Sales incentives, rebates, and allowances Page 26 Examples of Beneficial Automatic Accounting Method Changes Having Broad Application (Cont.) • • • • • • Section 263A UNICAP Timing of incurring bonus liabilities Timing of deducting deferred compensation Bad debt allowances Inventory valuation and identification methods Tangible property regulations Page 27 Rev. Proc. 2015-39, 7/30/2015 Ratable Accrual Safe Harbor Method To reduce controversy, Rev. Proc. 2015-39 provides a safe harbor to treat economic performance as occurring ratably over the term of a qualifying “Ratable Service Contract” Ratable Service Contract: 1. Similar services provided on a regular basis; 2. Each occurrence of service provides independent value; and 3. Term does not exceed 12 months Examples of ratable services: • Landscaping maintenance • Janitorial Service • IT Support and software maintenance • Subscriptions and dues Page 28 Rev. Proc. 2015-39, Ratable Accrual Safe Harbor Method Benefits: • Enables the deduction of the portion of the services provided within the 3 ½ month period following the prepayment date • Applies to TPs that previously could not accelerate prepaid services because the contract exceeded the 3 ½ month period If 3 ½ month rule has been adopted: • File an automatic #220 Form 3115 If 3 ½ month rule has not been adopted: • File a nonautomatic Form 3115 to change to the 3 ½ month rule • File an automatic #220 Form 3115 to change to the safe harbor method Page 29 Tangible Property Regulations • As background representatives of the IRS and Treasury have stated in informal comments made in public forums that they expect most taxpayers to file a Form 3115 accounting method change application • Since the rules for UOP and the routine maintenance safe harbor, for example, did not previously exist, taxpayers cannot be compliant without IRS consent via a Form 3115 Page 30 Rev. Proc. 2015-20, 02/13/2015 Small business taxpayers, including sole proprietors, may make a change in accounting method on a prospective basis and avoid filing a 3115 • Small businesses having assets totaling less than $10 million, or • Small business having 3-year average annual gross receipts totaling $10 million or less preceding the year of change The catch: Prior year “audit protection” does not apply to taxable years beginning prior to January 1, 2014 Page 31 FAQs Shed New Light on Tangible Property Regulations de Minimus Safe Harbor Election www.irs.gov/businesses/small-businesses-&-self-employed/tangibleproperty-final-regulations • The de minimus safe harbor election allows many businesses to do away with capitalizing and depreciating many lower cost assets • The FAQs clarify that the de minimus safe harbor election is not a change in accounting method and no Form 3115 is required • The FAQs also explain the rules for the treatment of materials and supplies costs Page 32 Increase in De Minimus Safe Harbor Limit Notice 2015-82, 11/24/2015 • To reduce the compliance burden to account for business asset purchases taxpayers can elect to currently deduct expenditures for the purchase of tangible property that would otherwise have to be capitalized • Taxpayers without “applicable financial statements” were limited to $500 per invoice or per item • After numerous comments from the tax community, the IRS raised the expensing limit to $2,500 per item • Effective for costs incurred for tax years beginning on or after Jan. 1, 2016, although the Notice specifically states that the IRS will not pursue this issue for amounts not exceeding the $2,500 threshold for years beginning after Dec. 31, 2011 Page 33 When is a Building Considered “Placed in Service”??? Stine, LLC v. USA, 115 AFTR 2d 2015-637, (DC LA), 01/27/2015 • Certificates of occupancy had been obtained before year end for two newly completed retail store buildings allowing them to receive equipment, shelving, racks, and merchandise • However, certificates of occupancy to allow customers to enter the building had not been issued • Held – for the taxpayer: the Court stated that “…there is no requirement that a building be open for business for it to be placed in service for purposes of a depreciation allowance.” Buildings were substantially complete and fully functional to house and secure shelving, racks, and merchandise Page 34 11th Circuit affirms the District Courts denial of research credits for funded contracts Geosyntec Consultants, Inc., 115 AFTR 2d 2015-644, (CA11), 01/29/2015 • Geosyntec claimed research credits for a number of contracts which were denied by the IRS. The contracts were cost-plus arrangements subject to a maximum, or so-called “capped contracts.” • The regulations allocate the research credit to the party that bears the financial risk of failure of the research to produce the desired product or result. See Fairchild Indus., 76 AFTR 2d 95-7707, (CA Fed Cir), 11/29/1995, Reg 1.41-2(e)(2) • Held-for the Government: The Court concluded that the relevant inquiry was whether payment was contingent on success of the research. Since the relevant contracts were funded contracts entitling Geosyntec to payment regardless of success, Geosyntec was ineligible to claim the research credits. Page 35 Research Credit for Internal Use Software REG – 153656-03, Prop. Reg. 1.41-4, 1/20/2015 • Sec. 41(d)(4)(E) excludes most computer software from the research credit if developed primarily for a Company’s own internal use • Proposed regulations define internal use software and allow a research credit for certain internal use software if it satisfies the high threshold of innovation test • Also included are rules for software that is developed for both internal use and non-internal use and a safe harbor for determining if any of the development cost are qualified research expenditures Page 36 Exclusion of Partners Debt Cancellation Income AOD 2015-001, 02/03/2015 • In an Action on Decision, the IRS announced its non-acquiescence with four Tax Court Cases that dealt with a partner’s debt cancellation income • According to the IRS, the Tax Court’s rulings were inconsistent with the structure of Sec. 108 and Congressional intent which applies only to partners who are debtors in bankruptcy • See: Garcia, Jose, TC Memo 2004-147 Mirarchi, Ralph, TC Memo 2004-148 Price, Chester, TC Memo 2004-149 Martinez, Jose Est., TC Memo 2004-150 Page 37 Disguised Payment for Services Proposed Regulations REG-115452-14 • The IRS issued proposed regulations establishing a test based on Sec. 707(a)(2)(A) legislative history to determine when a partnership distribution or allocation arrangement will be treated as a disguised payment for services. • Uses a six factor test of which significant entrepreneurial risk as to the amount and fact of payment is given the most weight. • Effective when published as final. Page 38 Partner’s Distributive Shares When Interests Change TD 9728 • Regulations modify and finalize the varying interest rules contained in the 2009 proposed regs. • These regulations carry out the provisions of Sec. 706(d) as added by the Deficit Reduction Act of 1984 (P.L. 98-369) to clarify that the varying interests rule applies to the disposition of a partner’s entire interest in the partnership as well as the disposition of less than a partner’s entire interest. • Effective for partnership’s tax years beginning or after 8/3/15. Page 39 Partnership Audit Provisions Streamlined Bipartisan Budget Act of 2015 • The Act replaces the current TEFRA uniform audit and electing large partnership rules. • The Act prescribes a streamlined single set of rules for auditing large (100 or more partner) partnerships and their partners at the partnership level (Sec. 6221-6241, as amended). • Any adjustment to partnership income, gain, loss, deduction, or credit is determined at the partnership level. Similarly, any tax or penalties attributable to such adjustment is assessed and collected at the partnership level. • The new rules generally apply to partnership tax years that begin after December 31, 2017 with an option to apply these rules to years beginning after November 2, 2015 (Act Sec. 1101(g)). Page 40 Highway Act Changes Business Return Due Dates Surface Transportation and Veterans Health Care Choice Improvement Act of 2015 (H.R. 3236), 07/31/15 Beginning in 2016: • Partnership and S corporation returns are due March 15th. • C corporation’s returns are due April 15th (except fiscal year C corps with June 30 year-ends the change is deferred for 10 years, i.e., 2026). • Some extended due dates were revised. • FinCEN (FBAR) Reports are now due April 15th with extensions permitted until October 15th. Page 41 Consolidated Returns – Proposed Regulations Provide Guidance for “Day of” Transactions REG – 100400-14, 03/06/2015 • Proposed regulations provide guidance under Reg. 1.1502-76 which prescribes rules for determining the taxable period in which taxable items of a corporation are reported when a member joins or leaves a consolidated group • A “next day rule” will mandatorily apply to specific extraordinary items • An “end of day rule” must be used for items that arise simultaneously with the event that causes the corporation’s change in status • Takeaway: the new guidance prohibits parties from picking and choosing on which return the tax items are to be reported Page 42 Final Rules on F Reorganizations TD 9739, 09/21/2015 • Final regulations provide guidance on qualifying for an F reorganization. • Involves tax-free changes in a corporation’s identity, form, or place of organization transactions. • Effective for transactions occurring on or after 9/21/15. Page 43 Temporary Regulations Cover Allocation of Sec. 199 Wages in Short Tax Years and in Acquisitions or Dispositions TD 9731, 08/26/2015 (Temporary and Proposed) • Since the manufacturer's deduction under Sec. 199 is limited by employees W-2 wages, guidance was needed to properly determine the wages attributable to short taxable periods. • Effective for tax years beginning 8/26/15 but may be applied for open tax years for which the statute had not expired before 8/27/15. Page 44 Portion of Bonus to Physician Recharacterized as a Nondeductible Dividend Midwest Eye Center, S.C. v. Comm., TC Memo 2015-53, 03/23/2015 • A sole shareholder and medical director was paid a $2 million bonus after he had to increase his workload when one surgeon quit and another reduced his hours. • The IRS disallowed $1 million and recharacterized that amount as a nondeductible dividend and also assessed an accuracy-related penalty of $62,000. • Held – for the Government: the Corporation taxpayer failed to provide any evidence of comparable salaries or any supporting methodology as to how the bonus was determined as related to the services rendered. The Sec. 6662(a) penalty was upheld. Note: Compare to Pediatric Surgical Associates, TC Memo 2001-81, 04/02/2001 Page 45 Company held liable for failing to properly withhold FICA on nonqualified deferred compensation Davidson v. Henkel Corp, 115 AFTR 2d 2015 – 369, (DC MI), 01/06/2015 • Company failed to properly withhold FICA taxes on employees’ nonqualified deferred compensation (NQDC) plan benefits • Company did not follow the rule that wages are subject to FICA tax under the “special timing rule” for NQDC • “Special timing rule” requires that amounts deferred under a NQDC plan are taken into account on the later of: • When services are performed, or, if later, • When the deferred amount is no longer subject to a substantial risk of forfeiture (Sec. 3121(v)(2)) Page 46 Small Captive Insurance Companies added to the IRS “Dirty Dozen” list IR 2015-19, 02/03/2015 In a news release, the IRS takes aim at small captive insurance companies under Sec. 831(b). We know that: • The IRS is currently investigating several captive managers with a focus on how the captives are being marketed and how risk pools are designed and operated • A large number of the clients of these managers have been contacted and placed under examination • The IRS is placing significant resources behind this initiative and may further ramp up its investigative efforts Reference: Accounting Today, May 22, 2015 “Small Captive Insurance Companies Hit the IRS Dirty Dozen List”, by Steven Miller Page 47 Activities Performed at Retail that don’t Qualify for Sec. 199 Deduction LB&I-04-0315-001, “Large Business & International Directive on the IRC Sec. 199 Definition of Manufactured, Produced, Grown, or Extracted” (March 16, 2015) • The IRS has provided its examiners guidance on activities that won’t qualify for the Sec. 199 manufacturing deduction • Takeaway: the directive is seen as possibly a reaction by the IRS to an extremely taxpayer-favorable holding in Dean, 112 AFTR 2d 2013-5592, (DC CA), 05/07/2013 relating to repackaging gift items Page 48 Nonqualified Deferred Compensation Audit Guide www.irs.gov (search for “nonqualified deferred” to locate the Audit Technique Guide (ATG)) • With the advent of Sec. 409A, deferred compensation plan compliance has increased greatly in complexity. • The ATG provides IRS auditors with a roadmap to the issues and what to watch for when reviewing plans. Page 49 Can a Charitable Donation be a Business Expense??? CCA 201543013 • A new Chief Counsel Advice examines the deductibility of amounts given to charity associated with advertising programs where businesses give a certain percentage of their sales to particular causes. • Charitable Contribution deductible under Sec. 170 (with associated deductibility limitations) or a business expense under Sec. 162 (not limited)??? • Conclusion: a payment to a qualifying charity which is directly related to a taxpayer’s business with a “reasonable expectation of financial return commensurate with” the amount transferred, is deductible as a business expense and not as a charitable contribution citing Reg 1.162-15(a), Reg. 1.170A-1(c)(5). Page 50 Fiduciary Duty Breached by Failing to Monitor Investments Tibble v. Edison International, (2015, S Ct) 2015 WL 2340845 • In a unanimous decision, the Supreme Court has ruled in favor of participants in Edison International’s 401(k) plan who claimed company fiduciaries violated their duty to monitor three retail-class mutual funds. • During 1999 and 2002, 401(k) plan funds were invested in retail-class mutual funds instead of institutional-class funds, resulting in higher management or administrative fees. • The Supreme Court ruled for the plan participants with Justice Breyer noting that a trustee “has a continuing duty to monitor trust investments and remove imprudent ones. This continuing duty exists separate and apart from the trustee’s duty to exercise prudence in selecting investments at the outset.” Page 51 Estates, Trusts & Gifts Final Regulations on Portability Election TD 9725 • Allows an executor to transfer a decedent’s unused exclusion amount to the decedent’s surviving spouse. • Estates making the election must file an estate tax return (Form 706) even if assets are below the filing threshold. • Regulations indicate that the IRS is considering making the safe harbor in Rev. Proc. 2014-18 permanent for estates not otherwise required to file, i.e., allowing late-filed elections. • Regulations effective June 12, 2015. Page 53 Estate Closing Letters Issued Only on Request IRS Website • IRS announced that it will issue estate tax closing letters only upon request. • Applies for Forms 706 filed on or after June 1, 2015. • Taxpayers are advised to wait at least four months after filing the return to request a closing letter. • The IRS’s policy for issuing closing letters has been changed to reflect the portability election rules. Page 54 New Law Imposes Estate Basis and Reporting Requirements Highway Act (H.R. 3236), 7/31/15 • Executors of taxable estates must notify the IRS and estate heirs as to the property values reported on Form 706 for inherited assets. • Beneficiaries are required to use the reported Form 706 values as their income tax basis in the inherited assets. • Effective for Forms 706 filed after 7/31/15 (although Notice 2015-57 delays its reporting requirement until 2/29/16). Page 55 Failure to Adequately Disclose Gifts Keep Statute of Limitations Open Field Attorney Advice 20152201F • A timely filed Form 709 gift tax return provided incorrect names for interests in partnerships that were given as well as an incorrect EIN for one of the partnerships and also contained other disclosure deficiencies. The statute was deemed open. • CAUTION: the 3-year statute of limitations for gift tax returns remains open under Sec. 6501(c)(9) if the gifts are not “adequately disclosed”. Therefore, the IRS can assess gift tax based on these transfers at any time. Page 56 Return Preparer’s Malpractice Not Reasonable Cause for Estate’s Late Filing Specht, 115 AFTR 2d 2015-315, (DC OH), 01/06/2015 • Citing the Supreme Court in Boyle, (S Ct 1985), 55 AFTR 2d 851535, an executor has a duty to ascertain the statutory deadline and meet it • Reliance on an attorney to prepare and file an estate tax return doesn’t relieve an executor of his duty to meet the filing deadline • Reliance on professional advice on matters of tax law was contrasted with reliance on an agent to meet the filing deadline – two different concepts Page 57 Estate Not Entitled to Charitable Income Tax Deduction Estate of Eileen S. Belmont, 144 TC 84, 02/19/2015 • Decedent left amounts in her will to a charitable organization which the estate claimed an income tax deduction for the amounts “permanently set aside” • Reg. 1.642(c) – 2(d) disallows a deduction unless the possibility that the amount to be used for the charitable purpose will not be devoted to it is so remote as to be “negligible” • The estate was embroiled in a legal dispute with the decedent’s brother and used a portion of the funds set aside for the charity • Held – for the Government: because the estate was aware that a prolonged legal battle was more than just a remote possibility at the time the deduction was claimed, the deduction was disallowed Page 58 No Letter Rulings on Asset Basis Adjustments for Grantor Trusts Rev. Proc. 2015-37, 06/15/2015 • The IRS added to its “no rule” list any determinations on whether assets in a grantor trust will receive a Sec. 1014 basis “step-up” upon the death of the deemed owner of the trust when the assets are not includable in the owner’s gross estate. • This issue is particularly important for intentionally “defective” grantor trusts structured to be complete transfers for estate tax purposes but incomplete tranfers for income tax purposes. Page 59 Individuals Capital Gain Upheld by Eleventh Curcuit Overturns the Tax Court Ordinary income Determination Long v. Comm., 772 F3d 670, (CA11), 11/20/2014 • Taxpayer was a real estate developer who sold a position in a lawsuit to enforce a land purchase contract and reported the gain as capital gain • The Tax Court sided with IRS that because the taxpayer would have incurred ordinary income tax from the eventual sale of the land, the gain on the sale of the lawsuit position should be considered ordinary income • Held – for the Taxpayer = The Eleventh Circuit reverses, in part, the Tax Court decision noting that the lawsuit position was what the taxpayer sold which would be considered a capital asset under Sec. 1221 Page 61 Compensation or Excluded Damages??? Nichelle G. Perez, 144 TC 51, 01/22/2015 • Taxpayer was compensated $20,000 as an inducement to be an egg donor and received a Form 1099-MISC which she did not include on her return • Taxpayer’s argument was that the payments were nontaxable because she endured “pain and suffering” during the lengthy egg-retrieval process”, i.e., excludable damages under Sec. 104(a)(2) • Held-for the Government: Her consent to the procedures and her attendant physical pain, although real, was just a by-product of performing a service contract. She voluntarily foreswore a legally recognized interest against bodily invasion for payment that had to be included in gross income Page 62 Previous Passive Investor’s Activities Determined Material Participation Jose A. Lamas, TC Memo 2015-59, 03/25/2015 • A previously passive investor stepped in to rescue several related family businesses. Taxpayer worked at least 691 hours in day-to-day management and operations of one of the troubled entities that were grouped with the related businesses as an appropriate economic unit under Reg. 1.469-4(c) • Over $5 million of refunds were disallowed by the IRS due to NOL carrybacks from the business. • Held – for the taxpayer: the Court found that the businesses were an appropriate economic unit and should be grouped as a single activity and that taxpayer’s work which exceeded 500 hours was adequately proven by credible testimony and phone records. Page 63 No Alimony Deduction for Payments Made in Arrears – OUCH!!! David Iglicki, TC Memo 2015-80 • Taxpayer defaulted on his alimony payments required under his divorce decree. A Colorado state court ordered him to pay all past-due amounts. Taxpayer then paid all amounts owed and deducted them as alimony. • The IRS denied the deduction and imposed an accuracy-related penalty • Held – for the Government: The Court agreed with the disallowance of the alimony deduction because, under Colorado law, past due amounts under an order enforcing spousal support arrearages becomes a final money judgment, which wouldn’t terminate if the ex-wife were to die violating the “no liability beyond death” requirement of Sec. 70(b)(1)(D). Accuracy penalties were upheld. Page 64 No Rental Losses for Home Leased to Relative Charles and Cecilia Okonkwo, TC Memo 2015-181, 09/24/2015 • Sec. 280A limits applied to a cardiologist’s and wife’s deduction for expenses relating to a home they built and originally attempted to sell and then rented to their daughter. • Held-for the Government: The Court held that the daughter’s use of the house was personal and attributed to the taxpayers as the daughter did not pay fair rental. Accuracy penalties were upheld. Page 65 Supreme Court Legalizes Same-Sex Marriages Obergefell v. Hodges, 115 AFTR 2d 2015-2309, (S. Ct.), 06/26/2015 • The Supreme Court legalized same-sex marriage in all 50 states entitling married individuals to file join federal and state tax returns and be entitled to spousal benefits. • Some states required same-sex couples to file separate income tax returns regardless of marital status. • Amended returns to file jointly could be filed for open years if beneficial. Page 66 When is Foreign Earned Income Excluded? Joel B. Evans, et al v. Comm., TC Memo 2015-12 • Taxpayer was a U.S. citizen working on a Russian-owned oil rig. During this time, the taxpayer owned a house in LA where he returned for a month at a time, six times per year, to be with his family. • Upon the advice of a professional tax preparer, taxpayer excluded his wages earned in Russia under Sec. 911(a) taking the position that his tax home was in Russia. • Held-for the Government: the Sec. 911 foreign earned income exclusion requires that a U.S. citizen be a bona fide resident of a foreign country for an entire taxable year. Maintaining a U.S. residence (LA home) was fatal to his eligibility to claim the exclusion. Accuracy-related Penalties under Sec. 6662 were not applied due to taxpayer’s reliance on his tax preparer. Page 67 To ensure compliance with Treasury Department regulations, we wish to inform you that, unless expressly stated otherwise in this communication (including any attachments) any tax advice that may be contained in this communication is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or applicable state or local tax law provisions or (ii) promoting, marketing or recommending to another party any tax-related matters addressed herein. BDO USA, LLP, a New York limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms. Page 68