Pricing & RM - Sauder School of Business

Biography for William Swan

Currently the Chief Economist for

Boeing Commercial Aircraft.

Visiting Prof. at Cranfield. Previous to Boeing, worked at American

Airlines in Operations Research and Strategic Planning and United

Airlines in Research and

Development. Areas of work included Yield Management, Fleet

Planning, Aircraft Routing, and

Crew Scheduling. Also worked for

Hull Trading, a major market maker in stock index options, and on the staff at MIT’s Flight Transportation

Lab. Apparently has a hard time holding a steady job. Education:

Master’s, Engineer’s Degree, and

Ph. D. at MIT. Bachelor of Science in Aeronautical Engineering at

Princeton. Likes dogs and dark beer.

© Scott Adams

Pricing and Revenue Management

What and Why?

Bill Swan

Chief Economist

Boeing Commercial Airplane Marketing

Fall 2003

Outline

HISTORY development over the last 20 years

PRICING why several prices for tickets

REVENUE MANAGEMENT making pricing work

TYPE OF FARES 4 basic kinds

BUSINESS FARES high value travel

COACH FARE the posted fare

DISCOUNT FARES tourists and vacations

PROMOTIONAL FARES low fares to stimulate travel

PRICE ELASTICITY traffic changes when fares change

DILUTION the problem of everyone getting the lowest fare

VOCABULARY "bucket," "authorization," and "nesting"

USING THE RESERVATIONS SYSTEM an example

FORECASTING DEMAND combining data and knowledge

LOW COST CARRIERS a simpler pricing world

OVERBOOKING adjusting for No Shows

SUMMARY

Early Idea: Pricing

• Some days flights were far from full

•

Protect seats sold at normal prices

• Set aside some seats to sell cheaper

•

Find a way to keep normal trips from buying cheaper seats

- Require early purchase (14 days ahead)

- Require Saturday night stay

• Original “Surplus Seat Sales” idea

62% Load Factor with 16% Space

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Mon Tue Wed Thr Fri Sat Sun

Space

Buffer

Demand

Revenue Management is Born

• Surplus seats can be sold at a discount

•

Discount purchases tend to be earlier than fullfare purchases

•

Discount sales must be limited to protect fullfare space

–

Limit to estimated surplus seat count

– This is a second limit, beyond the limit on total seats

• Revenue Management sets discount limits

Early Computerization

•

Computers used to forecast full-fare demand

•

Mathematical rules used to set buffers and surplus seat count

•

Difficult or nearly full flights separated out for people to monitor and manage

•

Pricing and Revenue Management became departments at airline.

Revenue Management Grows

•

Yet bigger discounts used to fill very empty flights

•

Carriers without a Revenue Management system put at a competitive disadvantage

•

Computer systems become increasingly complicated

•

Outside companies sell systems to airlines

The Why behind Different Prices

•

Larger airplanes cost less per seat than smaller ones

•

High-Value Demand Pays for High-Cost

Seats

•

Lower-Value Demand pays for lower cost additional seats

•

Both Groups of Demand benefit from sharing fixed costs

2.0

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

0

Small Airplanes have High

Cost per Seat

50 100 150

Seats

200 250 300 350

1.2

1.0

0.8

0.6

0.4

0.2

0.0

2.0

1.8

1.6

1.4

0

Cost for Added Seats is Constant

Cost of Seats

(Slope)

50

Cost of

Frequency

100 150

Seats

200 250 300 350

Cost Per Seat High for First Seats,

2.0

but Lower for Additional Seats

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

0 50 100 150

Seats

200 250 300 350

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

Demand at One Price Can Be

2.0

Below Average Cost Curve

1.8

Demand at One Price

Cost Per Seat

0 50 100 150

Seats

200 250 300 350

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

2.0

Full-Fare and Discount Both

Pay Less Than Their Values

Full

Fare

Demand Curve

Discount Fare

0 50 100 150

Seats

200 250 300 350

2.0

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

0

Total Revenues = Total Costs and both Fares Cheaper than Alone

Full

Fare

50

Discount Fare

100 150

Seats

200

Cost Curve

250 300 350

Reasoning Behind Pricing

•

Full-fares pay much of cost of frequency

•

Discount fares pay some of the cost of frequency

•

Total fares cover total revenues

•

Both types of customers are better off than with one price.

Revenue Management Protects Seats

• High fares make reservations close to departure day

• Low fares could fill airplane and prevent high-fare sales

•

Revenue Management limits low-fare sales and protects high-fare space

•

Revenue Management does not set fares, pricing does

• Most airlines match each other’s high fares

• Lowest fares may vary by airline

$1900

$1700

$900

$600

High and Low Fares: 4 Kinds of Fares

• First or Business Class

–

The usual fare of high-value business travel

– Typically 5% to 20% of passengers

• Full-fare Coach

–

Smaller seat and smaller fare than business

– Typically 0% to 20% of passengers

• Discount Coach

–

The usual fare for tourist or personal travel

– Typically 30%-50% of passengers

• Promotional

Discounts/tours/bulk/consolidator

–

Fares used to fill up seats on off-peak flights

– Typically 30% to 50% of passengers

$600

$1700

$1900

$900

Business Fares are for Premium Service

Business Travel on long-haul demands high quality of service

Comfort/food/airport/luggage/reliable departure

This is the most valuable part of demand highest fare, least fare sensitive least dependent on economic cycles most frequent flyers

Revenue Management protects Business Seats

$1900 may save extra space in case a competitor “spills” traffic does not overbook business class seats

- cannot have “oversales” of a premium customer

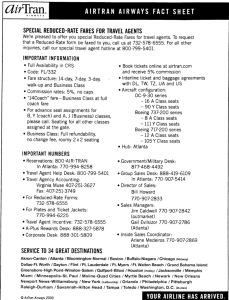

Standard Discounts are for Pleasure Travel

• These are fares regularly posted and sold by all travel agents.

•

The biggest danger is that these fares will be used for

Business travel ("Dilution").

• Otherwise, these tickets are used for tourist and vacation travel.

•

Low end of regular discount fares may be below some promotion bulk fares, particularly after commissions are considered.

$900

Promotional Discounts fill Empty Seats

Promotion types:

1. "sales" lasting a week to generate bookings to fill off-peak flights

2. tickets sold by special discount agents when space is available

3. space sold in blocks to agents who resell at their own prices

4. low fare connections with other airlines (low

"pro rates")

5. any other idea for selling without dilution of regular discounts

$600

Four Types of Fares

Fare Type: BUSINESS COACH DISCOUNT PROMOTION

Prices: 250-140% 140%-70% 60%-30% 40%-25%

Letter codes: F, C, J Y H, Q, M

Commissions: 10%-30% 10%-15% 10%-15%

K, V

0%-10%

Seat size:

Service:

Elasticity:

BIG high

-0.5

small normal

-0.7

small normal

Early

Purchase?

Refundable?

0 days 0 days 14-30 days yes yes partial

Min. Stay?

no no 7-14 days

Days “full”: under 5% under 5% 5%-50%

Typical user: business business holiday

-1.4

small normal

30-60 days no

7-14 days

20%-80% group

-2.0

Fare Distribution for a Sample Market

$2,000

$1,800

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

Business

Coach

Discount

Promotion

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Percentile Passenger

Higher Fares increase Business Revenue

Elasticity = -0.7 Illustrated

$11,500

Starting Price and Demand

$11,000

$10,500

$10,000

$9,500

$9,000

$40 $60 $80 $100 $120 $140

T icket Price

Airlines try to cooperate in keeping fares high

$160

If one airline lowers fare, others will follow

Different from Discount demand

Lowering Discount fares Increases Revenues

Elasticity = -1.4 Illustrated

$13,500

$13,000

$12,500

$12,000

$11,500

$11,000

$10,500

$10,000

$9,500

$9,000

$40 $60 $80

Starting Price and Demand

$140 $160 $100

T icket Price

$120

Lower fares gain Revenue when aircraft are empty

Lower fare traffic must not be allowed to fill high-fare seats

Revenue Management offers only surplus seats at low fares

"Dilution" means Business buying Discounts

Dilution happens when a customer who should be paying a high fare type manages to get a lower fare type.

For instance when a Business traveler uses a Discount ticket.

Fare restrictions are designed to prevent "dilution":

1. Advance purchase requirements of 14-30 days

2. Stay requirements such as over Saturday night, or 7-14 days

3. Limitations on changing reservation or refunding ticket

4. Agent through which ticket was purchased, such as tour operator

REVENUE MANAGEMENT IS NOT DESIGNED

TO PREVENT DILUTION

Revenue Management uses Special

Vocabulary

1.

Fare "Bucket" = a fare letter code representing a single type of fare:

" Business C ," " Full-Fare Coach Y ," or " Discount H ."

2.

"Authorization" = the number of seats allowed to be sold for one fare bucket.

3.

"Nesting" = the idea that the Authorization for a high-fare bucket contains and has access to space of all lower fare buckets.

Nesting is the Way Space is Shared

Example of standard revenue management “Nesting:”

Authorizations of 174Y 170h 90K “nested” mean:

K sales come out of larger H bucket

H sales come out of larger Y bucket

Y sales can use H or K space if Y-protected is full

Nesting allows higher fares access to lower fare space

“Protection” for each fare is space between next smaller nested bucket

Example: 80 seats are “protected” for H, against K sales

Example of Yield Management on a Flight

A flight AAA-BBB on Monday 3 October at 9:00 has 218 seats:

64 First/Business and 154 Coach

Fares offered are: C = First/Business = $1900

Y = Full Fare Coach = $1800

H = Discount = $900

K = Promotion = $600

C fare gets Business Class seat (6 abreast, 96 cm pitch).

Y fare is seldom sold in this market. It serves as an overflow for C.

H fare is the standard tourist discount fare.

K fare is sold by consolidators and special discount ticket agents .

Managing a Flight: Thinking it Through

Revenue Management has estimated the demands:

C = 34 with an possible high value of 44

Y = 0 with a possible high value of 4

H = 65 with a possible high value of 95

K = no estimate is made because no estimate is needed

At the start, the seat counts are 64 for Business, and 154 for Coach.

1. Decide to protect 44 seats for C

Show C44 as authorization. Sell remaining 20 seats as coach

Total Coach authorization becomes 154 + 20 = 174

Shows Y174 as Y authorization.

The person setting the level of 44 added 10 seats to the estimate of C demand. With C fares over twice the normal coach fare, he wanted to be sure to have space for extra C demand.

Example: Numerical Answers

The airline's computer shows seat limits as:

C44 = sell up to 44 in C class

Business seats are put in separate category from Coach

Y174 = sell up to 174 reservations in Y+H+K together.

This could mean allowing up to 20 use Business seats

H170 = sell up to 170 reservations in H+K together

This "protects" 4 seats for possible Y reservations

K90 = sell up to 90 reservations in K alone

This "protects" 80 seats for possible H reservations

$2,500

Y174

H170

$2,000

$1,500

$1,000

$500

$0

0

C44

20 40 60

K90

80 100 120 140

Protected Seats

160 180 200 220

Forecasting Demand is Important

Discount sales happen 2 to 10 months in advance.

A forecast of higher fare demand is needed at that time.

Before several years of historical data have been recorded, the insight of an experienced person ( * ) should be better than a computer forecast.

Forecast depends on:

1. Recent history for the same flight

*2.

Adjustments for seasonal changes and growth rates

*3.

Knowledge of special events

*4.

Recent history of same flight, other days of week

*5.

Recent history of similar flights

6. Early booking performance of the flight in question

*7.

Knowledge of traffic on competing airlines’ flights.

Protection Levels display as Authorizations

The values ( C44 , Y174 , H170 , K90 ) are limits on seats sold for flight.

Setting the values is the job of

Revenue Management.

Values are passed to outside computers as: C04 Y04 H07 K07

•

Information passed to outside does not reveal more than 4-7 seats

•

This display allows agents to sell up to 4 C or Y seats, up to 7 H or K

• A zero (such as K00 ) prohibits sales of K tickets

New Low Cost Carriers’ Systems can be much Simpler

•

Only one Sales outlet

– Usually the internet

– Reduced ability to sell deep discounts in different places to different customers

• Closeness to departure date is best surrogate for value of trip

•

Markets tend to be price-elastic

•

Pricing has three principles:

1.

Start with best guess of right price to just fill airplane

2.

Adjust price up if sales are too brisk, down if too slow

3.

Raise price in last two weeks for inelastic, high-value demand

Simple Revenue Management

Pricing Profile Depends on Time

Price Plan

Price if Demand too small

Price if Demand too Strong

-90 -75 -60 -45 -30

Days Before Departure

-15

$190

$170

$150

$130

$110

$90

$70

$50

0

Revenue Management System needs

Watching

If the Yield Management system works well:

1. Protected space will usually have SOME unused seats.

2. Protected space will sometimes have NO unused seats.

3. If all K seats are sold, on average only 15 seats will be empty.

4. Almost all high fare demand will be accommodated.

5. Most traffic turned away is low-fare ( K ) fare traffic.

No Shows mean Flights Should Overbook

Not all people who reserve a seat on a flight show up at the gate.

A reservation without a customer at the gate is a "No Show."

Some Reasons for No Shows:

1. passengers change plans at the last minute

2. passengers also have bookings on another flight or airline

3. passengers cancel their reservations incorrectly

4. connecting passengers absent when inbound flight is delayed

5. false bookings by agents with no ticket written

6. record keeping errors

"No-Show" rates can vary between 5% and 25%.

Overbooking Balances Sales and Oversales

"Overbooking" means taking more reservations than you seats on the airplane.

Counting on "No Shows" to match load to seats.

Or counting on later cancellations to reduce bookings back down.

For example:

An aircraft with 218 seats

An average "No Show" rate of 15%

Overbooking to 245 reservations (12% extra)

100%-15% = 85% of bookings show up, on average

85% of 245 = 208 passengers, the "average" at the gate

1 time in 10 may have over 218 passengers

A Revenue Management System is

Responsible for Overbooking

Overbooking is part of revenue management

Manager estimates no-show rate from past experience.

Best amount of overbooking achieves correct numbers of unused seats.

Measure "seats light" on flights booked "full"

"Seats Light" means empty seats at departure time

Measure on any flight booked full in discount

Too many "seats light" means raise overbooking

Too few "seats light" means lower overbooking

Gate agents will always want less overbooking.

Best revenues come from high overbooking.

Summary of Revenue Management

1. Pricing and Sales control Dilution, not Revenue

Management.

2. Overbook to compensate for No Shows

3. Forecast high fare demands by fare type

4. Estimate errors for forecasts

5. Protect space for forecast demands and part of error

6. Keep track of "Seats Light" and Closed high-fare cabin statistics

7. Adjust forecasts and rules if items in (6) are not right

8. Remind Senior Management that revenue management does not raise yields. Revenue

Management allows Pricing to increase revenues.

William Swan:

Data Troll

Story Teller

Economist