- The American Logistics Association

advertisement

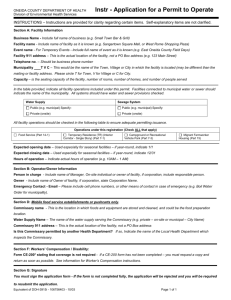

Partners in progress Your business is our business Support of ALA these days is not optional….it is necessary part of your business and an investment that returns many fold in many ways. Dynamic environment calls for energized partnership Publicly supported entities usually predictable This has changed Manufacturing, distribution, store support Industry employment Industry respects agency prerogatives Stability and predictability key to cost control Agency decisions reverberate across the chain Industry can react and support with adequate notice Advance notice avoids disruption of product flow Cooperation and communication key in dynamic environment Patron support is mutual bottom line Your investment in ALA proved its worth in 2014 Support of ALA yields real, tangible benefits for your business. Furloughs and closures averted by 11 days resulting in hundreds of millions of dollars in sales that would not have otherwise occurred. $200 million cut in 2015 would have resulted in $3 billion lost sales and $600 million cut in 2016 would have resulted in $6 billion in lost sales. Averted major issues that could have impacted exchange ability to earn revenue and contribute MWR dividends. Averting hundreds of millions in lost sales. Keep your seat at the table 2015 is going to be a pivotal year Things are going to change and a lot of balls are going to be thrown up in the air. Need pull the cart where you want it to go instead of getting dragged behind it. Active participation in ALA ensures that your interests are represented in decisions that are g0ing to be made Decisions on product availability reverberate in commercial sector Strength in Numbers Table is going to be set this coming year. Help your Board of Directors reach out to sign up companies in the Association. Help demonstrate to policy-makers that the power of industry is behind us. American Logistics Association Logistics is our middle name Members have invested hundreds of millions of dollars in systems, facilities and other programs to support resale agencies Manufacturers, Distributors and Brokers represent 95 percent of the supply chain Have a stake, hand and a voice in what happens Can help agency partners get to where they need to get SITREP DoD is targeting the commissary appropriation in its 2016 budget submission, reducing $322 million of the $1.4 billion annual appropriation, $1 billion in 2016, leaving it with $400 million The proposal is direct reduction to military compensation and is inciting fierce opposition. On-base business model threatened Saw storm clouds gathering five years ago $1.4 trillion deficit Budget problems and the sequester Sprung into action Gathered data Mobilized key constituencies Created coalition to Save Our Shopping Benefit Educated allies System is strong but fragile and vulnerable Convergence of factors all at once could destroy it Convergence of challenges Commissary funding & Title changes SDT and base operations funding Product and pricing restrictions—tobacco (CVS), beverage alcohol Wage hikes (minimum and SCA) Shrinking force structure Cross category encroachment (legislative proposal) Off-base competition • Initiated and launched the Coalition to Save our Military Shopping Benefits to increase patronage and galvanize affinity group and patron support against threats. • Worked to gain Authority in the NDAA to allow exchanges to borrow from the Treasury to finance operations. • Worked with House Armed Services Committee, Ways and Means, Senate Finance Committees to repeal the 3 percent withholding requirement. • Worked to get relief on interchange fees in the Dodd-Frank bill. • Protecting tax immunity • Internet tax immunity • Protecting FAR immunity & fighting other restrictions • Protecting MWR NAF siphoning to support legitimate appropriated fund requirements • Protect private & public sector mix • • • • • • Fighting for freedom of choice Alcohol & Tobacco restrictions Dietary supplements Sugar Fight supply chain impediments Support open most efficient sourcing and resist unreasonable local sourcing • Support keeping commissaries open to drive more exchange traffic • Fighting the Bangladesh provision • Protecting second destination appropriations and appropriations in other categories • Advancing Federal Financing Bank authority for exchange debt • ASER relief • Resisting outright privatization initiative • Expanding patronage in cyber and brick and mortar--Veterans Worked to turn back and discredit: The Congressional Budget Office recommendation on consolidation of commissaries and exchanges, price increases, and commercially redeemable vouchers. It also results in price increases, primarily for retirees. • Findings of the Bowles Simpson Deficit Reduction Commission to reduce commissary and exchange funding and raise prices to patrons. • . S 277 as discharged by the full Senate Veterans Affairs Committee to provide benefits for injured military personnel at Camp Lejeune, North Carolina. The bill payer was the commissary and exchange benefit. • Senator Tom Coburn (R-WV) Back in Black report that recommended consolidation of commissaries and exchanges and price increases as part of a $9 trillion deficit reduction proposal. • An amendment proposed to the 2014 National Defense Authorization Act to consolidate and increase prices. • • • • Protecting status of NAF workforce Protecting status of DeCA workforce Health care, pensions, other benefits, Portability JCS Hearing “Cutting commissaries is a sore point for me…the commissary issue is radioactive”—General Amos— Marine Corps Commandant “$200 million initial impact will be modest”—Admiral Winnefeld, Vice-Chairman, JCS “Difficult to understand the effect that a reduction in the subsidy will have, until you make a decision to do it.” -- General Dempsey, Chairman, Joint Chiefs of Staff Private label can make up for support reduction. Next move—DoD’s top line House and Senate working their budget blueprint this week Defense hawks want $561 B (President’s request) $38 B above budget caps in BCA HASC already marking above caps SASC to Budget Committee—lift the caps If caps busted for defense, others want it busted for non-defense Budget Committees indicate staying within BCA Use OCO as an escape valve—go from $51 B to $90 B? Raise defense and domestic caps by equal amounts? Next move—DoD’s top line • CHIMPS—Changes in Mandatory Spending—Money Treasury is obligated to spend without going to Congress every year—would enable shifting spending to discretionary spending--Defense • Point of Order – Senate—could block defense spending hike • Always defaults to appropriations committees • Higher number provides flexibility for Congress to add back DeCA cuts State of play—FY 2015 Administration recommended a $200 million cut for Fiscal 15 that begins October 1. Congress pushed back. HASC and HAC only allowed a $100 million cut. SASC and SAC said no cuts for 15 and asked to wait for the Commission report and is seeking other information, i.e., usage statistics. etc. Outcome—SAC fully restored commissary cuts 2016 Defense budget request $322 million cut to DeCA • $183 million in reduced operating costs • $139 million in “efficiencies” 2016 Defense budget request Scheduled store closures: $27.3M Labor reduction of 200 FTEs (10.9 percent of above store level support): $18.8M Transportation efficiencies of fresh fruits and vegetables to the Pacific: $40.8M (assumes contract start date by January 1, 2016, but is subject to change based on ACTUAL contract start date) Cancellation of case lot sales events: $900K Elimination of subsidy to six overseas NEXMARTs (Navy Exchanges that sell specific lines of commissary goods at cost): $3.0M 2016 Defense budget request Close stores on holidays: $4.5M Reduce operating hours: $29.5M Reduce days of operation (includes direct labor and contract labor reductions): $58.2M Major impacts of reducing days and hours of operation include: Reduction of 1,480 FTEs (in addition to the 200 above store level FTEs set forth above) Reduces the average number of employees per store to 45 – a reduction of 6 per store 2016 Defense budget request Days of operation per week would be reduced at 183 stores: 30 stores would go from being open 7 to 5 days per week; 47 stores would decrease from 7 to 6 days a week; and 106 stores from 6 to 5 days a week. Examples of reduced hours and days include: Kaneohe Bay Marine Corps Base Hawaii would have its weekly operating days and hours reduced from 7 days and 60 hours per week to 5 days and 49 hours per week; Fort Irwin, California, reduced from its current posture of 7 days and 62 hours per week to 5 days and 42 hours per week; Minot Air Force Base, North Dakota, reduced from its current 6 days and 66 hours per week to 5 days and 42 hours per week; and Yokosuka Naval Fleet Activities, Japan, reduced from its current 7 days and 75 hours per week to 5 days and 50 hours per week. Second and third order of effects include: Larger crowds and longer checkout lines Potential decrease in exchange sales: According to the Army and Air Force Exchange Service, approximately 20 to 30 percent of military exchange traffic is directly tied to customers visiting the commissary 2016 Defense budget request An additional $139M reduction. Including transportation of commissary goods shipped overseas in the price of the goods (second destination transportation (SDT))--$100M Shifting the funding source for commissary operating supplies from the Defense Working Capital Fund (DWCF) to the commissary surcharge. --$39 M 2016 Defense budget request Authorize collection of a fee for service for value-added commercial practices (online ordering/shopping and curb-side pickup). Authorize the collection of a fee for the use of single-use plastic and paper. Authorize demonstration project to contract out the operation of the produce department 2016 Defense budget request Pursue a $1B reduction in appropriated fund support of DeCA with more robust legislative relief to: Eliminate the current “sale-at-cost” model, allowing items to be sold at a markup; and Enable additional revenue generation by authorizing the sale of additional goods and services that are commonly available in commercial grocery stores, such as beer and wine, a variety of gift cards, greeting cards, and seasonal items.. 2016 Defense budget request Authorize markup of product and establish sales prices of products to off-set appropriated fund operating costs. Authorize the sale of all items (except distilled spirits), sold by commercial supermarkets, to generate revenue. Use “cost recovery” as a primary criteria in establishing and closing commissaries in non-remote U.S. locations. Authorize purchase of goods from whatever source has the best price. Modify the Berry Amendment to authorize the purchase of operating supplies necessary to process products (e.g., meat trays) and protective clothing in overseas areas from non-U.S. sources. Exempt the provision of goods and services for Defense Retail Systems from the application of the Service Contract Act. Economic Case 70 percent increase in food stamp redemption Sunk costs – buying the car but not putting gas in it Sales imperative—increase share of AD who use benefit Tax savings alone justify benefit Family and Veteran employment Contribution to economy/balance of payments Benevolence and Good Will Wounded Warriors Snowball Express Joining Forces Fisher House USO NMFA Cause promotions …and a multitude of others ALA position on MCRMC and Commissary proposals Budget proposal would destroy commissary benefit. Commission stands behind commissary benefit. Review of MCRMC must consider warnings from past studies. Don’t bank savings ahead of reality. Budget cuts wreck benefit before any savings proposals can be realized. Commissaries and exchanges rank at top of list for beneficiaries. Shell game stacked with illusory savings that transfer costs to beneficiaries. Troops already have co-pays in resale—mark-ups and surcharge. $750 million of own capital financed by the troops. ALA position on MCRMC and Commissary proposals Shell game stacked with illusory “savings” that would transfer costs to the exchanges and put the burden of financing their own benefits squarely on the backs of the troops. Cuts target those who need these programs the most— military families with children and retired folks on fixed incomes. The troops already have a co-pay that finances their own commissary and exchange benefits through surcharges and mark-ups on their purchases. Last year, nearly threequarters of a billion dollars of their own programs were financed by the troops. DoD proposes to up this amount by another $1 billion. ALA position on MCRMC and Commissary proposals The Commission cited surveys that showed 90 percent use these benefits, and a host of other surveys show that commissary and exchange benefits consistently rank at the top of the compensation items that are provided to the military. Yet they cost less than one percent of the total compensation cost of the military and less than .3 percent of the DoD budget. Commissary benefit advocates were encouraged when the President told Marines and families at Camp Pendleton that closing commissaries…“is not how a great Nation should be treating its military and military families.” It also was encouraging when the White House publicly thanked the resale system and its supporting industry for being the first to step forward to hire 25,000 veterans and family members…the first major contribution to First Lady Michelle Obama’s Joining Forces initiative, an initiative personally launched by President and Mrs. Obama at Langley Air Force Base. ALA position on MCRMC and Commissary proposals Supports keeping protections in law for commissary and exchange benefits in place until the Department of Defense renders an objective report that documents how DoD plans to achieve reductions to the commissary appropriation without diminishing the savings that are realized by commissaries and the impact on exchange operations and patrons. Fair and objective process free of any pre-determined budgetary constraints. ALA position on MCRMC and Commissary proposals Commissaries and exchanges have already taken out costs over the years in excess of $1 billion a year. They stand as a model for the rest of Government to emulate, not decimate for short term-budget expediency. Consider facts, not conjecture aimed at hitting a budgetary target regardless of the risk to a system that has given and continues to give so much to so many for so little. Congress and past Administrations have carefully designed and crafted resale programs that provide the right balance of taxpayer and patron support. Yes, they receive a level of appropriations, but the benefits that military families, DoD, and the Nation derives from these programs are way out of proportion to their cost. ALA position on MCRMC and Commissary proposals This list is long, from financing on-base community programs, providing subsistence to families trying to make ends meet, providing healthy programs that serve to reduce health care costs, to tens of thousands of jobs for military families, to maintenance of a stateside support base for overseas operations, a secure source of products for military families in times of danger and threat, and massive impact to exchange operations from commissary cutbacks and closures that will result in major reductions to exchange earnings that are used to sustain vital military community programs. ALA position on MCRMC and Commissary proposals Congress and the White House review must take great care not to allow radical and irreversible changes to these benefits that they will regret without looking at the facts, assessing a broad range of unintended consequences that will reverberate across the force, the families, and the base support programs that sustain the military community. Obama at Pendleton-Aug 7, 2013 Closing commissaries “Not how a great Nation should treat it’s military and military families” Compensation Commission Compensation Commission • Talk of cost-cutting started in 2008—post-9/11 spending • • • spree July 22, 2010 DBB Report “Reducing Overhead and Improving DoD’s Business Operations” Spend more on health care and benefits for former military than on troops in uniform Personnel costs unsustainable Cost per person in active force increased 46 percent 75 percent of budget At current growth rate, personnel costs will consume entire defense budget by 2039 OK as long as budget rising—now it is colliding Compensation Commission Retirement payments expected to double by 2035 to $116.9 billion By 2017, DoD plans to have 100,000 fewer troops but spend as much as today on personnel Army personnel costs grown by 50 percent over last ten years Health care costs up $30 billion over last decade Iraq and Afghanistan health care bubble 80 percent say they would trade retirement policy changes for a 1 percent increase in pay Compensation Commission Included in 2013 NDAA “Military Compensation and Retirement Modernization Commission” Ensure long-term viability of all-volunteer force Enabling high quality of life for military families Achieving fiscal sustainability of compensation and retirement systems Examine all laws and policies affecting various programs and benefits Compensation Commission Added by conferees: “Department of Defense morale, recreation, and welfare programs, the resale programs (military exchanges and commissaries) and dependent school system” “Closely weigh its recommendations regarding the web of interrelated programs supporting spouses and families of members of the uniformed services, so that changes in such programs do not adversely impact decisions to remain in the uniformed services.” Compensation Commission -exchanges $512 million in appropriations SDT--$188.2 In theater support--$224.5 Other--$99.8 Sales--$13,379 million Earnings--$350 million MWR contributions--$320 million Compensation Commission Recommendation 9: Protect both access to and savings at Department of Defense commissaries and exchanges by consolidating these activities into a single defense resale organization. Compensation Commission A single organization should be established that consolidates DoD’s commissaries and three exchange systems into a single defense resale system, herein referred to as the Defense Resale Activity (DeRA). Compensation Commission • Would decrease DoD budgetary costs and Federal outlays by $1.0 billion during FY 2016–FY 2020 and result in annual steady-state savings of $515 million by FY 2021. • Reductions result from a series of efficiencies, primarily in consolidating back office functions, logistics systems, and staffing. • Studies have projected that both financial savings and nonfinancial benefits can be achieved through a consolidation of the three exchanges. Including the commissaries in such a consolidation increases potential efficiencies. • Proposes a new defense resale executive team that would be responsible for evaluating, selecting, and implementing these potential efficiencies. Realized costs and savings therefore depend upon the set of efficiencies selected for implementation. Compensation Commission A DeRA Executive Director should be appointed who reports to a consolidated and simplified BOD. The BOD should replace the boards that currently oversee each of the separate exchange systems and DeCA. The consolidated DeRA BOD should also assume the responsibilities of the Executive Resale Board and the Cooperative Efforts Board and should incorporate expertise from private-sector retail. Compensation Commission A DeRA executive team, along with operational advisors from the current organizations, should immediately be established to define the key attributes of the new organization and plan the transition. Creation of a single organization should facilitate consolidation of many back-end operation and support functions, alignment of incentives and policies across commissaries and exchanges, as well as consistent implementation of best practices for aligning with the needs of Service members and the Military Services. Compensation Commission Core commissary and exchange benefits should be maintained at military installations around the world by continuing the sale of groceries and essential items at cost (plus a surcharge) and other merchandise at a discount. Some or all commissary staff could be converted from APF to nonappropriated funds (NAF) employees to reduce commissary employee costs. Compensation Commission • Branding of the current exchange systems and commissaries initially should be retained. • A director for each of these branded exchange systems and the commissaries should be appointed under the DeRA Executive Director. These directors should oversee operation of these systems as needed to represent the unique needs of each military service. • Personnel evaluations for these executives should be cosigned by the DeRA executive director and appropriate Service representatives. • Branding and organizational structure can be modified over time by the BOD. Compensation Commission • DeRA should assume responsibility for the operation of exchanges but not the other organizations currently managed by NEXCOM and MCCS. • If approved by the BOD, the current points of integration and shared resources can be maintained through liaison positions and formal memoranda of agreement. For example, if it is mutually advantageous to share support staff between DeRA and Marine Corps MWR, options are available to continue the arrangement that currently exists with the MCX. Compensation Commission Laws and policies should be updated to reflect this consolidated structure and allow greater flexibility related to how products are sourced, where they are sold, and how they are priced: Allow the sale of convenience items in commissaries at a profit, including products and services typically found in commercial grocers. Food and other essential items should continue to be sold at cost when sold in commissaries or combined commissary and exchange stores (excluding convenience stores). This expanded commissary product line would include beer and wine. Compensation Commission Allow for the payment of second destination transportation costs with NAF. Allow significant flexibility on local sourcing overseas, particularly when it is beneficial to the Service member. Allow more flexibility in the creation of combined stores, as currently controlled by Section 2488 of Title 10 of the U.S. Code. Allow the use of the commissary 5 percent surcharge for similar expenses in the exchanges. Conversely, allow the use of exchange profits to cover commissary costs currently covered by the surcharge. Compensation Commission A portion of Military Service MWR programs should continue to be funded from DeRA profits. The BOD should approve the amount of net revenue to be contributed as MWR dividends and should ensure an equitable distribution among the Military Services. Compensation Commission 10 U.S.C. § 2481 should be amended to make clear that commissary and exchange stores may be combined into single stores, and that commissary stores or the commissary sections of combined stores must still sell grocery items at reduced prices. It should also state that the Secretary of Defense will designate the defense resale system’s executive director and the DeRA BOD described above. 10 U.S.C. § 2483 should be amended to authorize the defense resale system to receive appropriated and nonappropriated funds, and to use nonappropriated funds generated by the system to cover the expenses of operating the system. Compensation Commission 10 U.S.C. § 2483 should be amended to authorize the defense resale system to receive appropriated and nonappropriated funds, and to use nonappropriated funds generated by the system to cover the expenses of operating the system. 10 U.S.C. § 2484 should be amended to state that the commissaries’ requirement to sell items at reduced prices should be limited to the following categories of items: (A) Meat, poultry, seafood, and fresh-water fish. (B) Nonalcoholic beverages. (C) Produce. (D) Grocery food, whether stored chilled, frozen, or at room temperature. (E) Dairy products. (F) Bakery and delicatessen items. (G) Nonfood grocery items. Compensation Commission 10 U.S.C. § 2485 should be amended to establish the DeRA BOD granting the Secretary of Defense the authority to establish the board, which should include five voting members— A senior representative from each Military Service Under Secretary of Defense for Personnel and Readiness Nonvoting members with experience related to logistics military personnel and entitlements, and other relevant areas. Compensation Commission 10 U.S.C. §2487 should be amended to eliminate references to the separation of commissaries and exchanges and disestablish the Defense Commissary Agency. • U.S.C. §2488, which sets forth limited conditions under which commissary and exchange stores may be combined, should be repealed. Boston Consulting Group Study Determine the qualitative and quantitative effects of: Using variable pricing in commissary stores to reduce the expenditure of appropriated funds to operate the defense commissary system; Implementing a program to make available more private label products in commissary stores; Converting the defense commissary system to a nonappropriated fund instrumentality; and Eliminating or at least reducing second destination funding. Boston Consulting Group Study The impact of changes to the operation of the defense commissary system on commissary patrons, in particular junior enlisted members and junior officers and their dependents, that would result from displacing current value and name-brand products with private-label products; and (B) reducing or eliminating financial subsidies to the commissary system The sensitivity of commissary patrons, in particular junior enlisted members and junior officers and their dependents, to pricing changes that may result in reduced overall cost savings for patrons. Boston Consulting Group Study The feasibility of generating net revenue from pricing and stock assortment changes The relationship of higher prices and reduced patron savings to patron usage and accompanying sales, both on a national and regional basis. The impact of changes to the operation of the defense commissary system on industry support; such as vendor stocking, promotions, discounts, and merchandising activities and programs. Boston Consulting Group Study The ability of the current commissary management and information technology systems to accommodate changes to the existing pricing and management structure. The product category management systems and expertise of the Defense Commissary Agency. The impact of changes to the operation of the defense commissary system on military exchanges and other morale, welfare, and recreation programs for members of the Armed Forces. Boston Consulting Group Study The identification of management and legislative changes that would be required in connection with changes to the defense commissary system. • An estimate of the time required to implement recommended changes to the current pricing and management model of the defense commissary system. • Report by September 1, 2015. Defense Chief Management Office Defense Chief Management Office Press report—April 23, 2015: Weighing plan to convert DeCA workforce to NAF. Align pay, benefits and job protection with NAF. Savings on personnel, standardized accounting, joint contracts, combined supply operations. Argues that shift to NAF would allow considerable savings on store operations while preserving current business models for resale activities and service-unique exchange operations. Distract and Divide ALA is mobilizing Educating members of Congress. Putting data to use Gathering more data Outreach—don’t lobby ourselves 80 briefings to Senate and House Economic report More underway Frame the argument and shape the debate Blunt new normal Support our friends, educate adversaries Coalition and patron involvement Energizing advocacy groups – Grass roots--Unions Moving resale to top priority Congressional Caucus Messaging – economic, compassionate, mission DoD outreach—military and civilian Prevention Pre-emption Preservation ALA positions on the budget The Pentagon has a budget problem but the resale system is part of the solution and not part of the problem. ALA positions on the budget and the Commission • Budget proposal will wreck cherished benefits • Budget is a shell game stacked with illusory savings • Hits those who need it most—families— fixed income retirees • Transfers costs to the exchanges. Rand “raising overall price levels will not be a successful strategy to cover shortfalls in costs caused by the elimination of the annual Department of Defense appropriation.” Raising prices will also negatively affect servicemembers and retirees who currently patronize the commissary system through increased grocery bills…” “changes in commissary pricing may have negative secondary and nonmarket effects, including effects on retention and recruitment; reductions in contributions to Morale, Well-Being, and Recreation programs; possible demand reductions for military exchanges; and changes in the calculated cost of living adjustment.” BENS “The benefit appears to have strong value.” Makes up two percent of an active duty officer’s and four percent for active duty enlistee's compensation while costing less than one percent of the military compensation budget. DeCA estimates military families are receiving $3 billion in annual savings for DoD’s $1.3 billion dollar investment – more than a 2:1 return on investment. Informal survey results from the Army Times and the Center for Strategic and Budgetary Assessments indicate service members from all ranks and age groups value the benefit more than it costs to provide.” “Any increased cost of the program has largely been attributed to inflation,” BENS found. “Numbers from the Department of Defense (DoD) in fact show that the cost of the commissary system has steadily decreased or flattened since the inception of DeCA in 1990 if cost is evaluated through constant dollars. The oft cited rise in costs can therefore be misleading absent this perspective.” BENS “there is intrinsic value in the military having a system of grocery distribution in place, both domestically and especially internationally.” Additionally, “since the subsidy covers the costs of staffing the commissaries, not of buying the groceries, that subsidy creates jobs, and 64% of those jobs are held by persons connected to a military service member.” “If the commissaries were to close, the consequences would go beyond increased food prices; the jobs of many spouses and youths in military families would be eliminated.” AFGE Commissaries and exchanges are an earned benefit treasured by military families. Converting DeCA employees to NAF status will cause significant hardship for the agency’s workforce. DeCA employees would face a significant reduction in pay. Highest paid NAF cashier makes 10 percent less and 23 percent less for highest paid cashiers. NAF-ing the DeCA workforce means a shopping pay cut for employees doing the same work. AFGE DeCA employees would face a reduction in benefits. NAF employees not eligible for Federal Employees Health Benefits. Lose civil service protections against job loss. NAF employees are “at-will” employees subject to businessbased actions. Exempt from 20 USC 2461 restricting outsourcing. Working and middle class Americans who work for DeCA are often military spouses. AFGE Walmartizing the DeCA workforce in order to generate fake and punitive economies at the expense of American workers is wrong. Savings from consolidation are illusory at best. Commission acknowledged that DeCA and AAFES have achieved significant savings on their own from implementing better business practices. No programs provide more bang for the buck. Modest cost of providing military families with inexpensive but essential goods and services is almost invisible to DoD’s budget. 80 percent of all active duty, retirees, and spouses ranked commissaries as a high or the highest priority benefit, and the Defense Manpower Data Center confirmed that commissaries are used by 90 percent of military service members. “Tread lightly on merger” How to reconcile structural disparity could far more complicated. Potential minefield for the troops Devil is in details Congress must vet every last wrinkle to ensure beneficiaries do not get shortchanged. Very much an open question. Army resiliency assessment • Startling signs of problems • Nutrition • Scored well—14 % • Scored borderline—30 % • Scored poorly—56 % Shareholders have a voice The system belongs to the troops ALA position on the budget and the Commission findings • Applaud the Commission for recognizing the value of the benefits • Keep protections and budget intact until proof is presented • If it ain’t broke, don’t break it • Consequences will reverberate across the base commerce ecology—MWR, exchanges, base support services ALA position Puts at risk $500 million in annual industry support. Eliminates $300 million in patron co-pays Puts at risk $500 million in earnings and dividends from exchanges to military community programs. Still requires DoD to underwrite overseas and remote location operations but eliminates the supply chain and economies of scale. ALA position ½ percent of compensation costs 1 fifth of a percent of tot DoD budget 2 percent of the DoD’s health care budget. Yet one of the most valued benefits. Patrons have financed billions of dollars in facilities. System is nearly fully capitalized. Helps keep cost of living allowance costs low. ALA positions on budget System has already cut no more cuts-inherently efficient Stop irresponsible dialogue with facts—no more new normal As a vital compensation program, should be exempt from cuts. For Sequestration, these programs should not be cut disproportionately beyond the minimum reductions that are mandated by law. Certainly should not be singled out for major reductions or illadvised experimentation or reengineering The resale system is inherently efficient with DeCA alone reducing its annual operating costs nearly $900 million a year. These programs are part of the solution not part of the problem as our report “Costs and Benefits of the Military Resale System” demonstrates—their contribution to the Defense Department far outweighs their costs by a factor of 6:1. ALA positions on budget Nonappropriated funds and surcharge funds are generated by charges to military personnel and their families. These funds should not be siphoned off in a convoluted shell game to pay for legitimate appropriated fund obligations that have been set forth by Congress over the years. NAF balance sheets should not be used to balance the budget on the backs of the troops ALA position on the budget There should be no commissary reductions beyond the over $700 million a year in annual reductions that have already been taken out of the commissary budget (includes the $46 million in the just-passed Omnibus FY 2014 Appropriations Act, and the $500 million inventory savings from outsourcing distribution. Commissaries are one of the few DoD programs that has held costs constant; in FY92 constant dollars, commissary appropriations have actually declined since 1992. The primary purpose military families use the commissary is the savings offered, they will stop coming when the savings go away. ALA position on the budget This is an earned benefit, not just a store. Commissaries and exchanges are a community hub and bring the military together. Food inflation is expected to double this year. Would greatly impact DoD’s efforts to promote healthy lifestyles. DoD may say the stores will remain open but the practical effect of the appropriations reductions will be that the stores in the U.S. will close. Cutting commissaries is punishing success. These operations have already cut spending while other Defense programs continue to increase. ALA position on the budget The cuts will reduce the current 30 percent savings to zero and the stores in the U.S. would close. Economies of scale would be lost for remaining overseas stores and costs and prices would rise. There are huge unknown consequences such as cascading impact on military PX operations and on-base community support programs, loss of U.S. supply infrastructure to support remote and overseas operations. Commissary cuts would demoralize the military at a time when there is so much uncertainty over the entire compensation package and force structure cuts. ALA position on the budget DoD says that commissaries will not have to pay rent or taxes under their proposal. Commissaries should not have to pay rent anyway on stores built and maintained with patrons funds. The military is already exempt from taxes under the Supremacy clause of the Constitution. If you shut down the stateside hub stores, the supply chain will lose economies of scale and prices overseas will rise as well. Commissaries support the Defense mission including DoD efforts to promote healthy lifestyles. H.R. 1735—FY16 NATIONAL DEFENSE AUTHORIZATION BILL CHAIRMAN’S MARK Committee action, April 29, 2015 Section 4501, Title XLV—Other Authorizations Working Capital Fund, DeCA Request--$1,154 M Committee recommendation--$1,476 M Restoration of proposed efficiencies--$183 M Restoration of Savings from Legislative Proposals--$139 M HASC provisions added last night • By Walsh--to prevent any closures of commissaries until reports are completed and assessed by Congress. By Hunter--amendment protecting the commissary benefit by requiring a comprehensive review of the AsiaPacific produce supply before any harmful changes are made to regional second destination policy. By Hunter--amendment upholds the commissary benefit and military readiness by urging DoD to maintain existing overseas transportation funding. Rational Access Military personnel are entitled at least to the same rights and privileges as the citizens they are charged to defend. Sectors have inherent challenges Just in past year: Concessions Tobacco Alcohol Supplements Energy drinks Sugar Healthy foods Hunter Amendment (Sec. 633) The Secretary of Defense and the Secretaries of the military departments may not take any action to implement any new policy that would limit, restrict, or ban the sale of any legal consumer product category sold as of January 1, 2014, in the defense commissary system or exchange stores system on any military installation, domestically or overseas, or on any Department of Defense vessel at sea. ALA position Military folks are entitled to the same shopping rights and privileges as the citizens they are charged to defend. Products that are legal in the general civilian market should be available to military personnel. From a practical standpoint, we find that if legal consumer products are regulated on base, it merely forces the troops to go off base. If the military wants to control consumption of any product, it has to be a behavioral change, not an access change. ALA position The debate over individual product categories such as alcohol and tobacco (or any other product) should be settled in the general American populace and marketplace and not specifically targeted to military personnel. Over the years, the oversight committees have adopted this view and have judiciously and deliberately expanded product availability through Title 10 and review of the Armed Services Exchange Regulations. By exercising this authority, the Defense … ALA position …authorizing committees have been able to monitor and sometimes intervene when other members of Congress or committees have attempted to regulate product availability. The SASC and HASC viewpoint generally reflected prevailing practices and product availability in the civilian marketplace. Usually, the Executive branch conforms to this philosophy but Congress has occasionally stepped in when efforts have been made to prejudice product availability. ALA position The wide price disparity between off base and on base for tobacco and alcohol has narrowed over the years to the point where it is virtually even. The demographic has changed where most of the military live off base and artificial market manipulation merely serves to inconvenience those on base. Manipulating the military marketplace for legal products is a slippery slope that opens the door for further sanctions on a wide range of other products directed only at the military. Durbin provision—SAC-D bill SEC. 8068. The Secretary of Defense shall issue regulations to prohibit the sale of any tobacco or tobacco-related products in military resale outlets in the United States, its territories and possessions at a price below the most competitive price in the local community: Provided, That such regulations shall direct that the prices of tobacco or tobaccorelated products in overseas military retail outlets shall be within the range of prices established for military retail system stores located in the United States. Report language on Sec. 8068 The Committee applauds these efforts and encourages the Department to continue to advance rapidly toward a tobacco-free military. In support of these goals, the Committee includes a provision directing the elimination of the price subsidy provided to tobacco products at military exchanges. This reform directs the Department to implement a consistent, verifiable price benchmark for tobacco products at exchanges, as recent surveys by the National Institutes of Health indicate that Army and Air Force exchange prices for cigarettes in practice to be between 14–25 percent lower than market price, despite Department of Defense Instruction 1330.9, which allows only a 5 percent discount. ALA position on Veteran online shopping Support any effort to open military resale offerings to larger, deserving audience. 2015 Timetable Budget Committees set top line number—March 20 President’s Commission report to Congress—April 1 or may be delayed to May 1 or later HASC Mark-up of Defense bill—April 29 House floor action on Defense bill—May 13 ALA Congressional Caucus & Public Policy Forum-June 10 SASC Mark-up of Defense bill—June/July??? Senate floor action on Defense bill—September BCG report to Congress—September 1 at latest HASC/SASC conference—September-October Appropriations bills—discharged from Committee in July Appropriations bills floor action--September 2015 Congressional Caucus June 10 Rayburn House Office Building The premiere event on the politics & policy of resale Members of Congress Defense experts Pentagon and Administration Officials Congressional Caucus Congressman Scott Rigell, Seapower and Projection Forces Subcommittee, House Armed Services Committee Steven Parker, Joining Forces Executive Director, The White House Rory Brosius, Joining Forces Deputy Director, The White House Congressman Sanford Bishop, Co-Chairman, Military Family Caucus Congressional Caucus Honorable John Conger, Deputy Under Secretary of Defense, Installations and Environment Mr. Charles Milam, Director, Military Family and Community Policy Steve Ham Defense Policy Advisor to Senator Barbara Mikulski, Chairwoman, Senate Appropriations Committee Ms. Joan Walters, Chief Operating Officer and Vice President for Military Medical Research, Samueli Institute Congressman Walter Jones, Personnel Subcommittee, House Armed Services Committee Senator Tim Kaine, Member, Senate Armed Services Committee Congressman Robert Wittman, Chairman, Readiness Subcommittee, House Armed Services Committee Mr. Tom Philpott, Author, Military Update Congressional Caucus Mr. John Kamensky, Senior Fellow, IBM Center for the Business of Government Congresswoman Susan Davis, Ranking Member, Personnel Subcommittee, House Armed Services Committee Mr. Russell Rumbaugh, Director, Budgeting for Foreign Affairs and Defense, and Senior Associate, The Stimson Center Congressman Randy Forbes, Chairman, Seapower and Projection Forces Subcommittee, House Armed Services Committee Congressman Joe Wilson, Chairman, Emerging Threats Subcommittee, House Armed Services Committee Congressman Buck McKeon, former Chairman, House Armed Services Committee ALA & Resale Protecting the Benefit