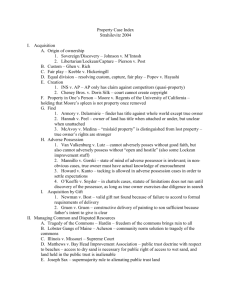

Property Outline_002

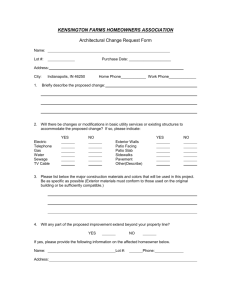

advertisement