Your Issues

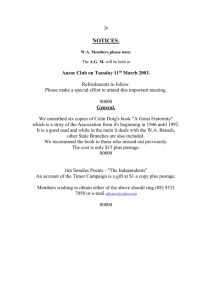

advertisement

County Extension Directors In-Service Suzanne McNatt Extension Finance May 19, 2011 1 Update on Audits Unannounced Reviews Travel Issues Records Retention Miscellaneous Your County, Your Issues 2 Corrective Actions Noticed – Deposit registers are being reviewed & signed by you Elimination of vendor credit cards, loans, lines of credit Independent Contractor form (& 20 Factor Test, when applicable) being used More timely deposits 3 Still seeing some of the following – Sales tax being paid on purchases Checks received not restrictively endorsed upon receipt Soils log - Receipt # issued to customer not documented Purchases of flowers out of M&O for employees &/or family Receipt book missing dates or have a lot of strikeovers Late Deposits (Still seeing too many of these) 4 What we look at in an Audit – Disbursements – Checks / Backup documentation Deposits / Registers / Receipts / Cash on Hand Bank Reconciliations / bank statements / Quicken Leave Records Inventory County-paid Expenditures Soils Lab Logs / Postage / Fair Board Judges List 5 Purpose is Three-Fold: (1) Verify Adequate Internal Control/Security over Cash – Restrictive endorsement of checks Money/checkbook locked up at night No signed, blank checks on hand 6 Purpose is Three-Fold (Continued): (2) Verify All Incoming Cash Is Properly Receipted & Documented – Receipt is written and issued to customer Deposit register/Deposit/Bank/Quicken/Bank Reconciliation/Annual Leave Trace cash transactions through the system 7 Purpose is Three-Fold (Continued): (3) Verify Timely Deposit of Cash Per Oklahoma Statute or Your Last Audit – Clock starts ticking when the funds are received 8 Out of State Requests – How Far in Advance to be Submitted? 30 + Days; Not 4, 5, or 6 months Allows enough time for signatures if/when people are out Airline Ticket prices 9 For Out of State “Day” Trips (not over-night), the Out-of-State Request is not Required For County-Paid claims – include on your monthly travel For State-Paid (AIRS) claims – File a separate in-state “paper” voucher 10 Request for Overnight Stay Within 60 Miles OSF – 60-mile distance is the rule Exception – when there is a valid reason Examples – Required to chaperone 4-H’rs; Required to prepare/coordinate/stay on-site for workshop or programs List specific reason (i.e. “why”) you had to stay on-site. 11 How Long must you keep financial records? The records most recently audited + the unaudited records since that date... BUT NOT LESS THAN 5 YEARS Items to keep permanently (next slide) 12 Keep these records permanently: The single-sheet Leave Summaries Invoices of “big-ticket” items (ex.copier) Inventory records (additions, disposals) Certain Civil Rights records (ask Ag HR) Shred SSNs, sensitive info 13 “Pink” (County) Sheets Due to District Office by 15th …District to Ext. Finance by 30th …Ext. Finance completes audit of county-paid travel by 15th (45-day turnaround) 14 Completed Bank Reconciliations Due to District Office before the 10th working day after the bank statement date CED is responsible for effecting Reconciliation should be done by someone other than person who maintains the checkbook 15 Soil Test Price: $10 $9 for cost of test; $1 for postage The postage portion collected “stays” in your Agency Account (you are using your District postage allocation on your postage machine to mail samples). 16 The soils postage in your Agency Account may be transferred periodically to your M&O category for… putting additional postage on your meter (by sending Agency check & ‘request to increase’ allocation to your District office) Making M&O type expenditures for your office (no food) 17 What Questions or Concerns Do You Have in Your Office/County? 18 Call ahead. There is probably a prescribed way already of how to handle. Resources for Agency Account Activity: Your District Director Extension Finance: ▪ Steve Bonds (405) 744-5514 ▪ Barbara Krajacic (405) 744-9700 ▪ Suzanne McNatt (405) 744-9697 19