March 2010 - Temple University

advertisement

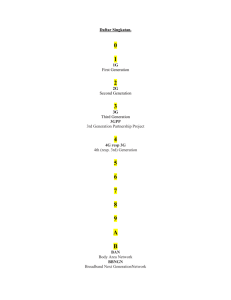

1 Mobile, Web, Cloud And Programming Justin Y. Shi | shi@temple.edu (with credits to Dennis Roberson and Walt Davis) February 17, 2013 2 Moment of Silence for Professor Charles Kapps The Rev. Charles Augustus Kapps, Ph.D. quietly passed away Sunday morning, February 10, 2013. He was at home surrounded by his family. 3 4 Gender of the First Computers • It was female. • This is not well-known. • But, I have the proof: In WWII, woman contributed more to programming than man: Top Secret Roses (http://technicallyphilly.com/2010/09/22/top-secret-rosiesdocumentary-tells-story-of-women-computers-in-wwii) 5 World Changes According to Dave Evans* • 6 devices per living person by 2020. (Mobile) • Zettaflood is Coming: 1.2 Zettabytes unique data in 2011. (Web) • 1/3 of all data will be on the cloud by 2020. * Cisco’s Chief Futurist (this is a job title…) , , , , , 6 BIG – Beyond Mega and Giga The Web is generating BIG numbers Prefix Scientific Notation Kilo Mega Giga Tera Peta Exa Zetta Yotta 103 106 109 1012 1015 1018 1021 1024 English Thousands Millions Billions Trillions Quadrillions Quintillions Sextillions Septillions Decimal 1,000 1,000,000 1,000,000,000 1,000,000,000,000 1,000,000,000,000,000 1,000,000,000,000,000,000 1,000,000,000,000,000,000,000 1,000,000,000,000,000,000,000,000 , , Wireless Trends © Walt Davis 2011 , , , 7 BIG – Beyond Mega and Giga The Web is generating BIG numbers Prefix Scientific Notation Kilo Mega Giga Tera Peta Exa Zetta Yotta 103 106 109 1012 1015 1018 1021 1024 English Thousands Millions Billions Trillions Quadrillions Quintillions Sextillions Septillions Decimal 1,000 1,000,000 1,000,000,000 1,000,000,000,000 1,000,000,000,000,000 1,000,000,000,000,000,000 1,000,000,000,000,000,000,000 1,000,000,000,000,000,000,000,000 , , , , , 8 Refining BIG – Beyond Mega and Giga The Web is redefining BIG numbers Prefix Scientific Notation Kilo Mega Giga Tera Peta Exa Zetta Yotta 103 106 109 1012 1015 1018 1021 1024 English Thousands Millions Billions Trillions Quadrillions Quintillions Sextillions Septillions Decimal 1,000 1,000,000 1,000,000,000 1,000,000,000,000 1,000,000,000,000,000 1,000,000,000,000,000,000 1,000,000,000,000,000,000,000 1,000,000,000,000,000,000,000,000 Est 2020 Traffic = 2 ZettaBytes / Month Data that would fill 1 Billion 1 Terabyte disks 9 WEB OF CLOUDS Amazon Twitter Facebook Google+ Azure YouTube 150M Wireless Trends © Walt Davis 2011 10 April 2011 Base Chart from Twitter – September 2010 11 12 Top 15 Internet Usage Sites 2012 13 What do these mean? • Information expansion • Privacy reduction • Security challenged • And all thanks to: Mobile, Web and Cloud 14 Colorful Clouds • Storage cloud: dropbox, skydrive, googledocs, … • App cloud: Kindle Fire, Netflix, NewYork Times, … • Government cloud: Amazon, google, IBM and Microsoft • HPC cloud? (High Performance Computing) 15 Programming Is the ONLY way you can exercise control over Mobile, Web and Cloud. 16 How to Programming • It is like “giving directions” • Or, like directing traffic • Need to learn multiple languages, just like in the real world. No big deal, right? • Your reward: Devices behave exactly the way you wanted • You are the MASTER. 17 Mobile Programming • So you phone will truly obey you… 18 Web Programming • It is hard to separate from mobile programming (why?) 19 Cloud Programming • So you know exactly how your stuff is saved: SLA 20 Mobile Programming Special Challenges • It can bring time, space, people and things together without effort. • It can move with you anywhere you go. • Immediate privacy and security concerns: • What data do you collect? • Where do you store the data? • How are you going to share the data? • What do you extract? 21 Respect the Numbers… Look where the World is going… 23 Wireless Broadband Network Trends • Internet and Applications Growth • Wire-line and Wireless Traffic Growth • Wireless Growth – Smart Phones and Beyond • So What? 24 The Mobile Programming Pyramid • It’s fun. • It’s useful. • It makes money for you. • It challenges your creativity. • It helps solving people’s problems. • It gives you something to brag about. • It has more potentials than desktop and servers. • It is growing. • It’s cool. 25 Wireless Trends © Walt Davis 2011 Mobile Broadband Overtook Fixed Broadband in 2008 Millions Fixed & Mobile Broadband Subscribers 800 688 Mobile BB subscribers 700 Fixed BB subs 600 500 429 400 276 282 300 200 100 153 99 7 30 344 473 403 210 154 71 2003 2004 2005 2006 2007 2008 Source: ITU World Telecommunication/ICT Indicators Database – March, 2010. 2009 26 Telecom markets on the move Growth in ICTs, 1998-2009 Source: ITU World Telecommunication/ICT Indicators Database – March, 2010 27 Wireless Trends © Walt Davis 2011 Growth of Mobile-only Internet Users 900 Number of Users, Millions 800 700 600 Middle East & Africa Central & Estern Europe 500 Japan Western Europe 400 North Amercia Latin America 300 Asia 200 100 0 2010 2011 2012 Year 2013 2014 2015 28 Wireless Trends © Walt Davis 2011 Growth Projections for Global Internet Traffic Monthly Traffic in PetaBytes 45,000.00 40,000.00 35,000.00 30,000.00 File Sharing Internet Video to PC 25,000.00 Internet Video to TV Web / Data 20,000.00 Video Calling Online Gaming 15,000.00 VoIP 10,000.00 5,000.00 0.00 2009 2010 2011 Source: Cisco Visual Networking Index, 2010 2012 Year 2013 2014 Wireless Trends © Walt Davis 2011 29 Growth Projections for Global Internet Traffic Monthly Traffic in PetaBytes 45,000.00 40,000.00 35,000.00 30,000.00 25,000.00 20,000.00 15,000.00 10,000.00 The total of all forms of video File Sharing (Video to TV, Video to PC, and Internet Video to PC Video calling) is projected Internet Video to TV Web / Data to account for over Video Calling Online Gaming 90% of global consumer traffic VoIP by 2014 5,000.00 0.00 2009 2010 2011 Source: Cisco Visual Networking Index, 2010 2012 Year 2013 2014 Wireless Trends © Walt Davis 2011 30 Wireless Broadband Network Trends • Internet and Applications Growth • Wire-line and Wireless Traffic Growth • Wireless Growth – Smart Phones and Beyond • So What? Wireless Trends © Walt Davis 2011 31 Cellular Subscriber Growth is Slowing Source: ITU World Telecommunication/ICT Facts and Figures – October 20, 2010 Wireless Trends © Walt Davis 2011 Smart Phones – The Growth Product for Mobile Wireless Trends © Walt Davis 2011 33 Projected Smartphone Growth Mobile Internet will be 10x Desktop Internet Computing Growth Drivers Over Time Mobile Internet 100,000 Desktop Internet 10,000 1,000 PC 100 10 1B+ Units / Users Minicomputer 10B+ Units ??? 100MM+ Units Mainframe 10MM+ Units 1 1MM+ Units 1960 Stand-Alone Wired Seamless/Cloud 1970 1980 1990 2000 Web 3.0: Social Networking 2010 2020 Source: Morgan Stanley 34 34 Wireless Trends © Walt Davis 2011 35 Growth of Digital Content in the Clouds iTunes Downloads by Months Following Launch Songs 10 Billions of Units Total iTunes Down Loads 12 8 Apps 6 4 2 0 1 12 23 34 45 Months Following Introduction Source: Apple Reports 56 67 36 Smart Phone Market Shares 2012 Second quarter of 2012, by operating system. • Android (Google Inc.) — 104.8 million units, 68.1 percent share (46.9 a year earlier) • iOS (Apple Inc.'s iPhone) — 26.0 million units, 16.9 percent share (18.8 percent a year earlier) • BlackBerry (Research in Motion Ltd.) — 7.4 million units, 4.8 percent share (11.5 percent a year earlier) • Symbian (mostly used by Nokia Corp.) — 6.8 million units, 4.4 percent share (16.9 percent a year earlier) • Windows (Microsoft Corp.) — 5.4 million units, 3.5 percent share (2.3 percent a year earlier) • Linux — 3.5 million units, 2.3 percent share (3.0 percent a year earlier) • Others — 0.1 million units, 0.1 percent share (0.5 percent a year earlier) Source: IDC. 37 Mobile Connections By Region 457M 530M 410M 530M 2.6B 552M 467M Total Global Revenue: $906 billion (2010) Source: Mobile Voice and Data Forecast Pack: 2010–15 © OVUM 2010 38 Wireless Trends © Walt Davis 2011 Evolution of Mobile Technology High Speed Video-OnDemand Capability Bandwidth Spectrum Video Conference Push-to-talk (PTT) Customized Infotainment SMS Speech only Late 1970s- 80s 1G Analog Network Voice mail Caller ID Multimedia Messaging Conference Calling Web Browsing Speech (digital) Early 1990s 2G GSM Speech, Voice mail, SMS Late 1990s 2.5G GPRS, EDGE Video-OnDemand Video Conference Streaming Music Streaming Music Streaming Music 3D Gaming 3D Gaming 3D Gaming Faster Web Browsing Faster Web Browsing Faster Web Browsing Full motion Video Speech, Voice Mail, SMS, Web Browsing, MMS, PTT Full motion Video Speech, Voice Mail, SMS, Web Browsing, MMS, PTT Full motion Video Speech, Voice Mail, SMS, Web Browsing, MMS, PTT 2000s 3G 3.5G UMTS, WCDMA, EVDO Rev B, HSDPA, CDMA 2000 DVB/DAB Increasing array of products with greater demand for speed 4G WiMax, LTE Wireless Trends © Walt Davis 2011 39 Improvement in Bits per Hertz Spectral Efficiency 40 Wireless Data Growth at AT&T 5000% growth over 12 quarters! 268% CAGR Postpaid Subscribers with Integrated Devices ? Source:” Leveraging Standards to Serve Growing Customer Needs” presentation by Hank Kafka,Vice President, Architecture, AT&T Wireless Trends © Walt Davis 2011 41 Wireless Data Growth at AT&T Customers in Millions AT&T Cellular Customers 120 100 80 70.1 77.0 85.1 95.5 60 40 20 0 2007 2008 2009 2010 • From 1Q2008 until 4Q2009, there was a 30.3% shift in the number of AT&T customers with Integrated Devices – primarily iPhones • During this same period, 18.5 million new customers were added, and the data traffic increased by a factor of 13.5 iPhone users generated ~36X more traffic than non-integrated devices 42 Growth of Mobile Data Traffic 43 Future Bandwidth Requirements FCC conclusions from “Mobile Broadband: the Benefits of Additional Spectrum”, October 2010: It is likely that mobile data demand will exhaust spectrum resources in the next five years; A spectrum deficit approaching 300 MHz is likely by 2014 A narrowly circumscribed estimation of the economic benefit from releasing additional spectrum … is likely to exceed $100 billion Source: Rysavy Research, February 2010 44 Wireless Broadband Network Trends • Internet and Applications Growth • Wire-line and Wireless Traffic Growth • Wireless Growth – Smart Phones and Beyond • So What? 45 Obvious • Facebook and Twitter are rapidly replacing email and texting as the primary means of electronic communications. • From a business opportunity perspective, Social Network focused software built to run with an Android end-user device for the Asian market seems like an obvious winner! • Similarly, investments in companies with Internet / Smart Phone based Social Networking applications should be (or at least were) great investments and job opportunities. 46 Less Obvious • Smart Phones and Tablets are rapidly replacing Laptops and Deskside Computers as the primary means of access to the Internet. Need to focus on these platforms. • The world is becoming more transparent. You can run, but not hide. •Mobile devices must rely on the web that must rely on the cloud for sustainable operations. 47 Even Less Obvious • The vast amount of saved information offers enormous opportunities to better understand the dynamics of political, economic and technological trends. •Big data applications are a really important opportunity given the data that is being generated and shared • Unintended consequence (information security) is a huge issue. Need for Computer Scientists to work with other disciplines to meet the new opportunities. 48 Computer Science Challenges • Wireless mobile devices are less reliable. How can we • • • • program them to provide reliable services? Mobile programming platforms evolve very fast. How to teach new technologies in Universities? Cloud devices are cheaper. Auction-based cloud devices are the cheapest. How can we program using auction-based resources for reliable service delivery? Supercomputers are awesome but too expensive. Can we build supercomputer in the cloud? What about auction-based supercomputers? 49 Are you ready for the challenges? 50 What Your Fellow Students Did… • CIS1025: Web Programming for non-programmers • CIS2305: Mobile Programming Technologies • Apps and Maps Studios at Temple University • Growshare.net: Google API Competition runner up (42 in the world) http://growshare.net • Campus Safety App: 51 Questions? Contact: Dr. Justin Y. Shi | shi@temple.edu Thank you! 52 Wireless Trends © Walt Davis 2011 Backup Slides 53 Wireless Trends © Walt Davis 2011 54 Wireless Communications Trends • Wireless Growth – SmartPhones and Beyond • Wire-line and Wireless Traffic Growth • 3G and 4G Technology – Approaching the Limits on Spectral Efficiency • Capacity – the BIG Issue 55 Wireless Trends © Walt Davis 2011 Spectrum Holdings of Top U.S. Cellular Carriers Spectrum Bandwidth in MHz* 0 20 40 60 80 100 120 140 Clearwire 140 AT&T 100 Verizon 91 LightSquared 59 T-Mobile 53 Sprint Nextel 50 MetroPCS Wireless 21 Leap Wireless 20 * Bandwidth in Top 100 U.S. Metropolitan Markets Source: FCC Data and Wall Street Journal, April 4, 2011 Total = 534 MHz 160 Wireless Trends © Walt Davis 2011 56 Future Traffic? • AT&T’s experience has shown that Cisco’s forecast for Cellular Data growth may be too conservative! • Gartner has projected a 38% GAGR for Smartphones through 2015. Taken together with Cisco’s projection for 92% GAGR for cellular data traffic, increased usage by customers will drive a 54% increase. Wireless Trends © Walt Davis 2011 57 [Source: Credit Suisse, May 2010] Wireless Trends © Walt Davis 2011 58 Traffic Multiplying Effect of High-end Devices Wireless Trends © Walt Davis 2011 59 Spectral Efficiency is Close to Shannon’s Limit Limits with MIMO Shannon’s Limit Source: “Digital Dividend: Potentials and Limitations of Mobile Broadband Access”, Helge Iliders and Peter Vary, Institute of Communication Systems and Data Processing , RWTH Aachen University, Germany, Published in Breitbandversorgung in Deutschland • 17. — 18. Marz 2010 in Berlin Paper 24 Wireless Trends © Walt Davis 2011 60 Spectral Efficiency is Close to Shannon’s Limit Limits with MIMO Shannon’s Limit Significant increases in Cellular Capacity will have to come from additional spectrum, and from spectrum re-use - i.e., pico-cells. Source: “Digital Dividend: Potentials and Limitations of Mobile Broadband Access”, Helge Iliders and Peter Vary, Institute of Communication Systems and Data Processing , RWTH Aachen University, Germany, Published in Breitbandversorgung in Deutschland • 17. — 18. Marz 2010 in Berlin Paper 24 Wireless Trends © Walt Davis 2011 61 Micro-Cellular Evolution Car phones Cell phones Smartphones Universal Personal Communicator Technology requires large # of low cost sites Capacity is key Capacity Limited Traffic/User LTE/WiMAX UMTS/HSPA GSM Economics favors small # of macro sites Capacity is not an issue Coverage Limited AMPS 4G Digital OFDM 3G Digital CDMA 2G Digital TDM Thin macro cell overlays Dense micro cell under lays DAS for large buildings 1G Analog Microcells for outdoor; DAS & Pico for enterprise; femto for residential Larger # macro cells; Indoor coverage w/ more power; Some micro in dense urban cover only Small # large macro cells outdoor User Density 62 Wireless Trends © Walt Davis 2011 • • • AMPS GSM Size of Cell Site • Spectral efficiency of cellular has improved 20x But – users have grown 15x – usage has grown 4x – users have moved from voice to requiring high speed data – 200x bandwidth increase A single cell site that supports 150,000 pops in AMPS will only support 1500 pops in 4G Maximum cell sizes in urban areas will shrink from 5 miles to a 300 yd radius in 4G Micros and Picos will predominate 1G Analog UMTS/ HSPA LTE/ WiMAX 2G Digital TDM 3G Digital CDMA Micro • Macro Decreasing Macro Cell Coverage Effectiveness Low High Demand for Capacity 4G Digital OFDM 63 Wireless Trends © Walt Davis 2011 Wireless Technology Positioning Mobility / Range Vehicle High Speed Vehicular Rural Walk Vehicular Urban GSM GPRS 3G/WCDMA Pedestrian Indoor Personal Area HSDPA EDGE Nomadic Fixed urban Fixed FlashOFDM (802.20) IEEE 802.16e DECT WLAN (IEEE 802.11x) bluetooth 0.1 1 IEEE 802.16a,d 10 User data rate 100 Mbps Source: Stand und zukünftige attraktive Arbeitsgebiete für den Lehrstuhl für Kommunikationsnetze - Prof. Dr.-Ing. Bernhard Walke 63 Wireless Trends © Walt Davis 2011 64 Mobile Data Growth is Similar to Fixed Internet Growth Source: Cisco VNI Mobile, 2011 Wireless Trends © Walt Davis 2011 65 Wireless Communications Trends • Wireless Growth – SmartPhones and Beyond • Wire-line and Wireless Traffic Growth • 3G and 4G Technology – Approaching the Limits on Spectral Efficiency • Capacity – the BIG Issue Wireless Trends © Walt Davis 2011 66 Impact of Internet Traffic Growth “At current growth rates, Internet traffic will increase by a factor of 1000 or three orders of magnitude in roughly 20 years. It will be challenging for transmission and routing / switching systems to keep pace with this level of growth without requiring prohibitively large increases in network cost and power consumption.” “MEETING THE BANDWIDTH DEMAND CHALLENGE:TECHNOLOGIES AND NETWORK ARCHITECTURAL OPTIONS” IEEE Communications Magazine • January 2010 Editorial Wireless Trends © Walt Davis 2011 67 Wireless Communications Trends • Wireless Growth – SmartPhones and Beyond • Wire-line and Wireless Traffic Growth • 3G and 4G Technology – Approaching the Limits on Spectral Efficiency • Capacity – the BIG Issue Wireless Trends © Walt Davis 2011 68 Mobile Revenue By Region $59B $203B $203B $52B $267B $54B $68B Total Global Revenue: $906 billion (2010) Source: Mobile Voice and Data Forecast Pack: 2010–15 © OVUM 2010 Wireless Trends © Walt Davis 2011 69 Growth of social networking services - Twitter International Telecommunication Union – March 2010 Wireless Trends © Walt Davis 2011 Number of Internet Users 10000 Worldwide 1000 Millions Number of Users 12% CAGR U.S. 100 10 1 Year Source: International Telecommunications Union 70 71 Wireless Trends © Walt Davis 2011 Growth of Mobile-only Internet Users Global Users Number of Users, Millions 1,000 100 Slope = 35X in 10 Years 143% per Year 10 1 2010 2011 2012 2013 Year 2014 2015 72 Wireless Trends © Walt Davis 2011 Strong growth in 3G telephony 7'000 Millions Global Mobile BB Subscribers Mobile BB subscribers 3G % mobile 800 700 600 500 400 300 200 100 - 15 11 8 5.6 3.2 0.5 1.7 16 14 12 10 8 6 4 2 0 Mobile subscribers (total & 3G) 2007-2014 6'000 3G 5'000 4'000 3'413 Other 5'024 4'587 5'567 5'842 6'179 6'456 3'909 3'000 2'000 1'000 2003 2004 2005 2006 2007 2008 2009 0 2007 2008 2009 2010 2011 2012 2013 5 bn total cellular subscribers, 1 bn mobile broadband subscribers in 2010. 6.5 bn total cellular mobile subscribers, of which 43% 3G in 2014. Source: ITU (left); Morgan Stanley International Telecommunication Union – March 2010 2014 73 Wireless Trends © Walt Davis 2011 3G Growth by Region Global growth in IMT-2000 countries, 2000-2009 130 140 Europe nb countries 120 109 CIS 100 Asia-Pacific 80 Arab States 89 70 Americas 60 Africa 43 40 30 20 0 0 1 2 9 21 38 36 21 17 33 14 24 9 22 19 12 9 4 42 14 9 18 26 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Source: ITU World Telecommunication Regulatory Database March 2010