Responsible Managers Procedures

advertisement

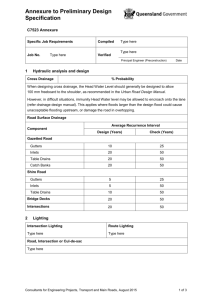

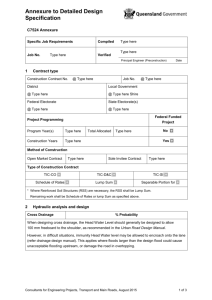

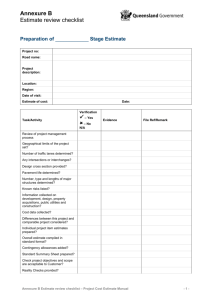

[Company Logo] Responsible Managers Procedures [Date] [Author] [Company Name] [AFSL] Contents 1. Overview .............................................................................................................................. 3 2. To whom does this Procedure apply?................................................................................... 4 3. Laws, Regulations and Industry Standards relevant to this Procedure ................................. 4 4. Background Checking .......................................................................................................... 4 5. Competency analysis ........................................................................................................... 5 6. How do RMs perform their obligations? ................................................................................ 6 7. Summary of Attachments ..................................................................................................... 7 Responsible Managers - Procedures | June 2014 Page | 2 1. Overview As an Australian Financial Services (AFS) Licence holder (No.xxxxxx), Company X Pty Ltd has an obligation under section 912A(1)(e) of the Corporations Act 2001 (Cth) (Corporations Act) to maintain the competence required to provide the financial services covered by its AFS Licence. This obligation is referred to as the ‘organisational competence’ obligation. Responsible Managers (RMs) are senior managers responsible for ensuring that the Company meets its organisational competency obligations. The persons nominated and appointed as RMs, must not only satisfy the requisite knowledge and skill requirements, but also be of good fame and character, and have direct responsibility for significant day-today decisions in those areas of the business for which they are responsible. Our aim is to ensure that the sum total of our RMs’ knowledge, skills and experience covers the entire range of financial services and products provided under our AFS License. Accordingly, we have developed these Procedures to ensure we have in place a clearly defined process to: Adequately identify the appropriate number of RMs needed to run the business efficiently and effectively; Ensure our RMs not only have the appropriate knowledge and skills, but are of good fame and character; Ensure we have appropriate initial and ongoing training arrangements in place for our RMs; and Identify other staff within the Company with the capability of taking on the role of RM in the future, as and when the need arises. RMs are effectively ‘gatekeepers’ of the specific sections of the business for which they are responsible. Specifically, our RMs are charged with the responsibility of ensuring compliance with: The Company’s AFS Licence conditions; and All relevant laws, regulations, industry standards and codes, including our codes of conduct and/or policies. Responsible Managers - Procedures | June 2014 Page | 3 2. To whom does this Procedure apply? This Procedure applies to each duly appointed RM. The Board expects full compliance with this Procedure by all duly appointed RMs. 3. Laws, Regulations and Industry Standards relevant to this Procedure This Procedure has been written to ensure that the duly appointed RMs comply with all relevant laws, regulations and Industry Standards, including, without limitation: Corporations Act 2001 (Cth) and Corporations Regulations 2001; National Consumer Credit Protection Act 2009 (Cth) and National Consumer Credit Protection Regulations; ASIC Regulatory Guide 105; ASIC Regulatory Guide 146; Financial Services Council (FSC) Standard No 1: Code of Ethics & Code of Conduct; and The Financial Planning Association CPD Policy Guide for Licensees. 4. Background Checking Prior to nominating any new RMs, certain checks must be undertaken. The purpose of this requirement is to ensure that the nominated RMs are of good fame and character, and have the requisite knowledge, experience and/or qualifications for their role within our business. The following pre-requisites must be satisfied before any potential new RM’s application will be submitted to ASIC: A full background check must be undertaken. This includes: A criminal history check; A bankruptcy check; and A minimum of two business reference checks; Verification of all completed education; Confirmation of employment in the financial services industry for a minimum period of three years; and Verification of identity. Responsible Managers - Procedures | June 2014 Page | 4 5. Competency analysis We will only nominate RMs who: (a) Are directly responsible for significant day-to-day decisions about the ongoing provision of financial services and products provided under our Licence (b) Possess the relevant knowledge and skills in respect of those financial services and products covered by the Licence (c) Meet one of the five options designed to demonstrate appropriate knowledge and skills as listed below. (See ASIC Regulatory Guide 105 for details). Option Knowledge component (qualifications training, etc.) Skills component (experience) Option 1 Meet widely adopted and relevant industry standard or relevant standard set by APRA Three years relevant experience over past five years Option 2 Be individually assessed by an authorised assessor as having relevant knowledge equivalent to a diploma Five years relevant experience over past eight years Option 3 Hold a university degree in a relevant discipline and complete a relevant short industry course Three years relevant experience over past five years Option 4 Hold a relevant industry – or productspecific qualification equivalent to a diploma or higher Three years relevant experience over past five years Option 5 If not relying on Options 1 – 4, The Company is required to provide a written submission that demonstrates to ASIC that the nominated RM has appropriate knowledge and skills for their role. In determining the knowledge and skill requirements for each RM, the following issues will be taken into consideration: (a) The sections/areas of the business each RM is responsible for; (b) The RM’s qualifications, skills and experience; (c) Any other credentials the RM may have. Such credentials may include, for example: (d) Details of any relevant industry associations, memberships or affiliations; and/or Skills or knowledge recognised by an industry association or relevant regulatory body such as the Financial Services Council and/or the Financial Planning Association of Australia; and Any other material which may be used to support the nominated RM’s application, including, for example, positive client feedback, and /or other relevant performance measures. Responsible Managers - Procedures | June 2014 Page | 5 To qualify under the standards set by ASIC, potential new RMs will be assessed on the basis of their: Qualifications and skills; Experience with, and knowledge of the section of the business they are responsible for; Understanding of our obligations under the AFS Licence, and also of all relevant laws, regulations, standards, codes and policies which impact on the financial services, Being able to demonstrate good fame and character. 6. How do RMs perform their obligations? See Process Map attached as Annexure A for overview of the obligations of our RMs. RMs should be copied in on all key reports relating to, or impacting on, their specific area of responsibility within the Company. For example, the RM responsible for the management of breach identification and reporting would be required to: (a) Review the breach and incident reports and registers to identify significant and/or systemic recurring or systemic incidents; (b) Review reported breaches of the Corporations Act and the AFS Licence conditions to identify significant and/any systemic or recurring incidents. Responsible Managers - Procedures | June 2014 Page | 6 7. Summary of Attachments Annexure A Process Map – Responsible Manager Procedure (attached) Annexure B Appointment of Responsible Manager Procedure Annexure C Appointment of Responsible Manager Form Annexure D Ongoing Assessment of a Responsible Manager Procedure Annexure E Responsible Manager Assessment Plan Report Annexure F Good Fame and Character Assessment Annexure G Register of Responsible Managers Annexure H Responsible Manager Training Plan Annexure I Personal Statement Annexure J Organisational Competence Annexure K Procedure to Notify ASIC: Amend Details of a Responsible Manager Annexure L Procedure to Notify ASIC: Adding or Removing a Responsible Manager Responsible Managers - Procedures | June 2014 Page | 7 ANNEXURE A Process Map – Responsible Manager Procedure ANNEXURE B Appointment of Responsible Manager Procedure RESOURCES REQUIRED 1. Resume/CV of nominated Responsible Manager; 2. Original academic transcripts or certified copies; 3. Criminal History Check/ Police Check (not more than 12 months old); 4. Bankruptcy Check (not more than 12 months old); 5. Two pro-forma business references; 6. A signed personal statement; and 7. ASIC Register of Banned & Disqualified Persons check. PROCEDURE Using the required resources, complete the Appointment of Responsible Manager Form. Provided all sections are adequately addressed, approval to be given. If there are any shortfalls then a plan to address these should be implemented prior to approval being provided. Once the approval has been granted the relevant details should be transposed to the Register of Responsible Managers Form. The Resume / CV provided must provide full details of: Qualifications; Membership of relevant professional associations; The financial services and financial products provided; Details of previous employer and length of service; The title, role and duties performed; Any authorisation(s) held; The type of client services provided; Any application form for a Criminal History Check can be obtained from the Federal Police website www.afp.gov.au. Bankruptcy check can be applied for from information brokers listed on www.itsa.gov.au. The prescribed business reference format is contained in the AFS Licensing Kit. See www.asic.gov.au >Financial advice & services > Licensing > AFS licensing kit- Part 2 (RG 2 Appendix 1) Responsible Managers - Procedures | June 2014 Page | 2 ANNEXURE C Appointment of Responsible Manager form NAME: ORGANISATIONAL EXPERTISE: 1. Review the detailed CV provided by the prospective Responsible Manager. 2. Original certificates and academic transcripts should be cited as evidence. 3. Compare the prospective Responsible Manager’s knowledge and skills against the financial service authorisation QUALIFICATIONS: ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ EXPERIENCE: ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ (a) Detail Number of years ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ (b) List relevant Industry Memberships / Associations ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ Responsible Managers - Procedures | June 2014 Page | 3 OPTIONS FOR DEMONSTRATING KNOWLEDGE & SKILLS KNOWLEDGE SKILLS/EXPERIENCE OPTION SATISFIED 1 Widely accepted and relevant industry standards At least 3 years’ experience over the past 5 years 2 Individual assessment (or recognition of current competency) by an authorised assessor as having relevant knowledge equivalent to a diploma At least 5 years’ experience over the past 8 years 3 Relevant university degree and relevant short industry course listed on the ASIC training register At least 3 years’ experience over the past 5 years 4 A qualification which is the equivalent of a diploma specifically relevant to the particular industry and/ or product At least 3 years’ experience over the past 5 years 5 Provide a detailed submission to satisfy ASIC that the responsible manager nominated has the necessary skills and experience Experience history over the past 10 years (or thereabouts) GOOD FAME AND CHARACTER ASSESSMENT Instructions: (a) Are copies of all required documents attached? Yes No (b) Are police checks and bankruptcy checks less than 12 months old? Yes No (c) Do business references follow the ASIC pro forma? Yes No (d) Has a criminal history check/police check been completed? Yes No (e) Has a bankruptcy check been completed? Yes No (f) Has the ASIC Register of Banned & Disqualified Persons check been completed? Yes No (g) Have two business references been provided? Yes No (h) Has a personal statement been signed? Yes No Responsible Managers - Procedures | June 2014 Page | 4 Please provide details if necessary: The applicant for the role of responsible manager meets the organizational expertise and good fame and character requirements Yes No Approved by: Signed: Dated: Responsible Managers - Procedures | June 2014 Page | 5 ANNEXURE D Ongoing Assessment of a Responsible Manager Procedure RESOURCES REQUIRED Criminal History Check / Police Check (not more than 12 months old); Bankruptcy Check (not more than 12 months old); A signed Personal Statement; and Details pertaining to training undertaken over the preceding twelve months. ANNUAL PROCEDURE Company to: Consider the results of the above checks in conjunction with the duly completed Responsible Manager Plan Assessment Report; Provided all sections are adequately addressed – approval to be given. If there are any shortfalls then a plan to address these should be implemented prior to approval being provided; and Once approval has been given the details should be transposed to the Register of Responsible Managers Form. This register should be updated every 12 months. NOTE: An application form for a Criminal History Check can be obtained from the Federal Police website www.afp.gov.au A Bankruptcy Check can be applied for from information brokers listed on www.itsa.gov.au Responsible Managers - Procedures | June 2014 Page | 6 ANNEXURE E Annual Responsible Manager Plan Assessment Report NAME: Summary of the responsible managers’ activities / duties: ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ Provide details of relevant training undertaken over the previous twelve months: ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ Note: Copy of training register may be attached Has the training been sufficient to maintain knowledge and skills requirements? Yes No Provide details: ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ Are there any shortfalls that need to be addressed? Yes No If yes, provide details of the shortfalls/’gaps’ as well as the training and/or courses needed to address the identified shortfalls/gaps. ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ Responsible Managers - Procedures | June 2014 Page | 7 Provide details of the specific training objectives for the next twelve months: ____________________________________________________________________________________ ____________________________________________________________________________________ ____________________________________________________________________________________ Assessed by: Signed: Dated: Approved by: Signed: Dated: Responsible Managers - Procedures | June 2014 Page | 8 ANNEXURE F Good Fame and Character Assessment We will conduct good fame and character checks on an annual basis. INSTRUCTIONS: (a) Attach copies of all required documents Yes No (b) Police checks and bankruptcy checks must be less than 12 months old Yes No (c) Personal Statement signed Yes No (d) Criminal History Check / Police Check Yes No (e) Bankruptcy Check Yes No (f) ASIC Register of Banned & Disqualified check Yes No Yes No Provide details if necessary: The Responsible Manager has maintained and updated their expertise and meets the good fame and character requirements Approved by: Signed: Dated: Responsible Managers - Procedures | June 2014 Page | 9 ANNEXURE G Register of Responsible Managers Name of Responsible Manager Date Appointed Key Person Yes/No Responsible Managers - Procedures | June 2014 Alternative Knowledge & Skills Good Fame & Character Check Training Requirements Date Removed Page | 10 ANNEXURE H Sample Responsible Manager Training Plan** NAME OF RESPONSIBLE MANAGER: AREAS OF RESPONSIBILITY: Knowledge Area Requirement Details of Training Comments **Training Plans for RMs will be set, administered and tracked via the KAPLAN Ontrack training system. Responsible Managers - Procedures | June 2014 Page | 11 ANNEXURE I Personal Statement I, declare that during the previous 10 year period that I have not been: 1. refused the right, or been restricted in the right, to carry on any trade, business or profession for which a licence, registration or other authority is required by law; 2. suspended from membership of, or disciplined by, any securities, stock, futures, commodities or other exchange of which I have been a member; 3. refused membership of any securities, stock, futures, commodities or other exchange; 4. removed from membership of, or disciplined by, any professional body; 5. carried on business under any name other than the name or names shown in this application; 6. known by any name or names other than those shown in this Personal Statement; 7. the subject of any findings, judgments or current proceedings, including findings, in relation to fraud, misrepresentation or dishonesty, in any administrative, civil or criminal proceedings in any country; 8. declared bankrupt or insolvent under any administration; 9. engaged in the management of any companies/businesses that have had an external administrator appointed; 10. engaged in the management of any companies/businesses that were declared insolvent; 11. engaged in the management of any companies/businesses that were declared the equivalent of insolvent under the law of an external territory or country other than Australia; 12. engaged in the management of any company that has had an instrument of approval under the Superannuation Industry (Supervision) Act 1993 (Cth) revoked; and 13. engaged in the management of any companies/businesses that have had a Corporations Act 2001 (Cth) (or previous corresponding law) licence or Insurance Agents and Brokers Act 1984 (Cth) registration revoked or suspended. Signed: Dated: ____/____/____ Responsible Managers - Procedures | June 2014 Page | 12 ANNEXURE J Review of the Organisational Competence Date Change to our business For example a change in our AFSL business activities may result in a need to replace a key person or responsible manager, etc. Have we maintained our organisational competence? Reviewed by Board Approval Required (Required action or comments) Responsible Managers - Procedures | June 2014 Page | 13 ANNEXURE K Procedure to notify ASIC: Amend details of a Responsible Manager The Company may be required to amend details of a Responsible Manager from time to time. For example, this may be due to the name of the Responsible Manager changing. The Company must undertake the following in order to amend the details of a Responsible Manager: Upon notification by the Responsible Manager of the request for the change, the Register of Responsible Managers must be amended for record purposes; and The Company is to complete and submit a form FS20 to ASIC within 10 business days from change in details. The relevant sections of Form FS20 must be completed and lodged with ASIC within 10 business days of any change occurring. The most efficient way to complete and lodge Form FS20 is online via the portal. Alternatively, download and print a paper copy of Form FS20, This material can then be lodged by mail or in person. It is the responsibility of the Company to undertake this procedure. Methods of lodging Form FS20 (a) Lodging by mail Mail Form FS20 to: Australian Securities & Investments Commission FS Licensing, Regulation Directorate GPO Box 9827 Melbourne VIC 3001 (b) Lodging in person Deliver Form FS20 to the nearest ASIC Service Centre. Lodgement Fees There is no fee if Form FS20 is lodged within 10 business days. A late fee applies after 10 business days. See ASIC website for details. The fee can be paid by phone, mail or in person. Licensees lodging electronically will be able to print an invoice showing any fee payable. Responsible Managers - Procedures | June 2014 Page | 14 ANNEXURE L Procedure to notify ASIC: Adding or removing a Responsible Manager The Company has an ongoing obligation to formally notify ASIC when changes any of its Responsible Managers. This means we must tell ASIC when it adds or removes any of its Responsible Managers. For example, we may need to add or remove a responsible manager if: The business changes (e.g. it expands to cover new services or products, or the roles of people within the business change); or A Responsible Manager leaves our business or is no longer involved in significant day-to-day decisions about our business. Where the outgoing Responsible Manager is named on the AFS licence as a key person, the Company must apply to vary the key person conditions on its AFS licence. Adding a Responsible Manager The Company may be required to add a Responsible Manager from time to time. The relevant sections of Form FS20 must be lodged with ASIC within 10 business days of any change occurring. The most efficient way to complete and lodge Form FS20 is online via the portal. Alternatively, download and print a paper copy of Form FS20. This material can then be lodged by mail or in person. When adding a Responsible Manager, the following core proofs must be lodged in support of Form FS20: (a) Statement of Personal Information, including certified copies of relevant qualification certificates; (b) Certified copy of a Criminal History check; (c) Certified copy of a Bankruptcy check; (d) Certified copy of two business references; and (e) Submission on Responsible Manager’s Competence (for Option 5 only). (See page 8 of this Procedure for details). These proofs are explained in detail in Section E of Part 2 of the AFS Licensing Kit (“RG 2”). Importantly, ASIC needs to receive these core proofs within 20 business days of submitting Form FS20 online. If ASIC do not receive them all within this time frame, our online form will be rejected at the prelodgement stage. Accordingly, the Company must undertake the following in order to add a Responsible Manager: The Register of Responsible Managers must be amended to add the Responsible Manager for record purposes; Responsible Managers - Procedures | June 2014 Page | 15 Form FS20 must be completed and submitted to ASIC within 10 business days from the actual change in details and submit the respective core proofs within 20 business days of submitting Form FS20 online; and A review of the organisational competence must be undertaken. Removing a Responsible Manager The Company may be required to remove a Responsible Manager from time to time, for example when a Responsible Manager resigns. The relevant sections of Form FS20 must be completed and lodged with ASIC within 10 business days of any change occurring. The most efficient way to complete and lodge Form FS20 is online via the Licensee portal. Alternatively, download and print a paper copy of Form FS20. This material can then be lodged by mail or in person. The Company must undertake the following in order to remove a Responsible Manager: The Register of Responsible Managers must be amended to remove the Responsible Manager for record purposes; You must complete and submit a Form FS20 to ASIC within 10 business days from change in details; and A review of the organisational competence must be undertaken. It is the responsibility of the Company to undertake this procedure. Method of lodging Form FS20 and other documents (a) Lodging by mail Mail Form FS20 to: Australian Securities & Investments Commission FS Licensing, Regulation Directorate GPO Box 9827 Melbourne VIC 3001 (b) Lodging in person Deliver Form FS20 to your local ASIC service Centre. Lodgement Fees There is no fee if Form FS20 is lodged within 10 business days. A late fee applies after 10 business days. See ASIC website for details. The fee can be paid by phone, mail or in person. Licensees lodging electronically will be able to print an invoice showing any fee payable. Responsible Managers - Procedures | June 2014 Page | 16