Organizational Analysis

advertisement

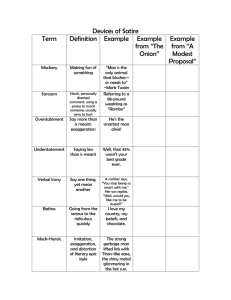

ANALYZING A FIRM’S CAPABILITIES AND RESOURCES Chapter 5 Organizational Analysis Strategic management is about creating and sustaining competitive advantage. Competitive advantage can be understood in the relationship of three constructs: Use value-subjective valuation of a product; “worth” Exchange value-objective price at the time of exchange Consumer surplus-net value a customer derives from a purchase Think of “buyer’s remorse” as negative consumer surplus Competitive Advantage Use Value Consumer Surplus This area represents the value created in each profitable sale and consists of both profit for the firm and surplus for the customer. Exchange Value Profit Total Cost To the Firm This area represents the firm’s total costs in presenting the product or service for sale. To create new value, the firm must cover its total costs. Organizational Analysis When a customer chooses to purchase from Firm A rather than Firm B, the following are true: There was some difference in the consumer surplus offered by Firm A and Firm B That difference gives Firm A a competitive advantage over Firm B That competitive advantage can be attributed to Firm A’s capabilities and resources Superior capabilities and resources Greater consumer surplus Competitive advantage This is a simplified statement of the resource based view used in conducting the organizational side of strategic analysis. Organizational Analysis The Resource-Based View (RBV) Firms are constantly seeking to gain advantage and to translate that advantage into earnings. Firms must appear more attractive than other options in the eyes of customers at the moment that customers decide to purchase. To do this, firms make deliberate decisions about the procurement, development, and deployment of assets and resources used to produce advantage. Organizational Analysis The RBV holds that competitive advantage emerges from resources and capabilities that meet four criteria: Value Rarity Inimitability Non-substitutability Organizational Analysis Two types of resources Tangible resources—physical resources that can be readily seen, touched, and/or quantified Plant, property, and equipment, cash, etc. Intangible resources—non-physical resources that can be difficult to quantify or be seen Patents, trademarks, “secret family recipes”, etc. Capabilities—what organizations can do based on what resources they possess New product development, customer service, etc. Dynamic capabilities—a unique ability to create new capabilities; ability to “update” capabilities Organizational Analysis Value Valuable resources are resources that consumers desire or resources that give a firm an ability to produce products and services that consumers want. A good location for a retail outlet A good credit rating A key technology Valuable resources can be both tangible and intangible. Organizational Analysis Rarity Consider three coffee shops in a two-block area of the same downtown. Each offers a slightly different location, a slightly different atmosphere; each has different personnel, different history, different reputation, and a historically different clientele. For different segments of the market, each offers a uniquely different combination of products and services, a rare bundle of resources. What specifically are these rare resources? The answer lies in the eyes of any customer who would value any one of these stores over the others. Organizational Analysis Inimitability Advantage from valuable and rare resources will diminish if imitated by competitors. Diffusion of key capabilities can undermine competitive advantage. Outsourcing can yield benefits. However, while the savings from outsourcing are appealing, it is important to consider the long term implications for imitability and rarity. Organizational Analysis Inimitability Is Sam’s Cola an effective imitation of Coca-Cola? It depends upon who you ask; for consumers who see little difference in the use value of different sodas, Sam’s Cola is an effective imitation. Understanding what is or is not an effective imitation means understanding the nature of the value that the product or service provides. Organizational Analysis Non-Substitutability Imitating a valuable and rare resource can be difficult. Thus, it can makes sense to substitute it with some equivalent resource. The ability to substitute the value generating function of a resource reduces its value and its ability to sustain competitive advantage. Resources, Capabilities, and Competitive Advantage Sustainable competitive advantage emerges from resources that are: Valuable Valuable resources are used by firms to create products and services that customers find desirable. They allow firms to exploit opportunities and to respond to threats Rare Resources that are rare are held by just a very few. As such, when valuable resources are also rare, they are likely to be in great demand Inimitable Inimitability simply means difficult, costly, or impossible to imitate or develop. Resources that are inimitable are not likely to lose their value through diffusion NonSubstitutable Resources that have no obvious or direct equivalents are difficult or costly to substitute Learning from Harley-Davidson What was the cause of Harley-Davidson’s decline and how did the company recover? How would you quantify the power of the Harley- Davidson brand? What do you think are Harley-Davidson’s distinctive competencies? Organizational Analysis The Value Chain A tool for decomposing the value generating activities of an organization. Term reflects that at each step, the product or service becomes more valuable The value chain is based on a simple but powerful idea, that the value customers see and the value that leads to profits result from a series of distinct but interconnected activities. The Value Chain Firm Infrastructure Human Resource Management Information Technology Physical Plant & Maintenance Inbound Logistics Operations Outbound Marketing Logistics & Sales The Value Chain Primary Activities: actions that are directly involved in creating and distributing goods and services (creating value!) Inbound Logistics—the arrival of raw materials Operations—the actual production process Outbound Logistics—the movement of finished products to customers Marketing & Sales—work to attract customers and convince them to make purchases Service—the extent to which a firm provides assistance to their customers The Value Chain Support Activities: structures that provide underlying support primary activities Firm Infrastructure—how the firm is organized (structure) Human Resource Management—involves the recruitment, training, and compensation of employees Technology—use of computerization and telecommunications to support activities Procurement—process of negotiating for and purchasing raw materials The Marketing Mix The marketing mix (a.k.a.—4 P’s) provides important insights into how to leverage resources and capabilities into goods and services people will buy Product—the good(s)/service(s) a firm sells Price—the price at which goods/services are offered Place—the location of offerings or distribution channels Promotion—the communication s used to market a product (e.g., advertising, public relations, other forms of direct or indirect sales) The marketing mix is critical to a firm’s survival and competitive advantage Competitive Profile Analysis Competitive Profile Analysis Combines value chain analysis ,with the VRIN criteria and the outputs from the environmental analysis. Based upon the environmental analysis and the mission and goals of the firm, an ideal value chain is developed. That ideal profile provides the benchmark against which the current value chain is evaluated. The gap between the ideal and the current guides the development of new strategy. Competitive Profile Analysis CPA for textbook industry Function/ Resources Value Rareness Inimitability Substitutability Rating High Very High Very High Modest 9 Operations Modest Low Low Modest 5 Outbound Logistics Modest Low Low Modest 4 Sales & Marketing Modest High Modest Low 8 Service Modest Modest Modest Low 6 Firm Infrastructure High Modest Modest Low 5 HR Management High Modest Modest Low 8 Very High Low Low Modest 5 Low Low Low High 3 Inbound Logistics Technology Physical/Plant Constraints Analysis A constraints analysis helps identify root causes of problems that restrict an ideal outcome Simple process 1. Identify problems that you believe restrict the outcome 2. Draw causal arrows from one problem to another if you believe that they are causal 3. The problems that have no arrows pointing at them are root causes and should be dealt with first Constraints Analysis Cause A Cause D Cause B Problem Cause C Cause E Cause F Cause G Final Thoughts & Caveats The Fallacy of the Better Mousetrap Better mousetrap fallacy – “if a man can write a better book, preach a better sermon, or make a better mousetrap than his neighbor, though he builds his house in the woods, the world will make a beaten path to his door.” While an appealing idea, research in the field of entrepreneurship underscores the reality that a better mousetrap, a better invention, a better technology, a better product, or a better service will not necessarily make a better or more profitable business. Final Thoughts & Caveats The Fallacy of the Better Mousetrap Successes reflect timely interactions between the products and services that customers find attractive and a host of contextual circumstances that make those products and services valuable and difficult for other firms to imitate. Success = Good timing + Desirable product + Strong customer interaction + Favorable contextual factors + Error (Luck) Even a truly better mousetrap might be ignored if it is never noticed by the market or if it is improperly marketed to consumers who do not have mouse problems! Final Thoughts & Caveats The Challenge of a Sustainable Advantage Things change and resources that are valuable and rare today may be less so tomorrow, while resources that have no value today could be very valuable in the future. Sustained competitive advantage is built upon resources that are valuable, rare, inimitable and non-substitutable. However, over time, few resources retain their value and few will remain highly rare if they are highly valued. Final Thoughts & Caveats The Challenge of Sustainable Advantage So, is any competitive advantage truly sustainable? The answer is that it is all a matter of perspective. Sustaining an advantage, even for a short time, is still an important achievement as it allows a firm to reap greater profits and to realize greater returns. At the same time, no competitive advantage is sustainable indefinitely. Temporary advantage research suggests firms are better off concatenating short-term advantages into a sustainable path Final Thoughts & Caveats Ambiguity and Social Complexity The relationship between competitive advantage and the resources that enable it is complex and difficult to discern, embedded in human interactions, historical endowments, and networks of tacit knowledge. The process of gathering resources and creating from them competitive advantage is an imperfect one and cannot be reduced to a simple and generalizable formula. Final Thoughts & Caveats Ambiguity and Social Complexity Social complexity simply means beyond the ability of most to understand or influence. Competitive advantage is socially complex: It is typically embedded in bundles of resources that connect to one another and to the people and operations of a firm in complex ways. As a result, competitive advantage is rarely attributable to any single, solitary resource or ability. Final Thoughts & Caveats Ambiguity and Social Complexity Causal ambiguity exists when the connections between a firm’s resources and its competitive advantage are not well understood. So, it is difficult to know which resources produce which outcomes. As a result, the process of resource acquisition and development becomes much more imprecise, uncertain, and expensive. Three Final Caveats Ambiguity and Social Complexity Thus… Competitive advantage is not a commodity that can be bought and sold. Rather, it must be crafted, cultivated, and maintained. “Firms cannot purchase sustained competitive advantage on open markets” – Barney (1986)