Critical Thinking Project for ELS session 2010

advertisement

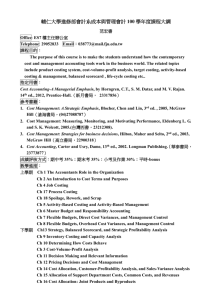

Is Standard Costing Right for Us? A Critical Thinking Model Applied to Cost Accounting (300-level) Amy Fredin, St. Cloud State University Attention 2010 AAA Annual Meeting Attendees: Are you tired of formulaic textbook writing assignments? Do you want to simulate the messy information used in real decision making? You can use this model to do just that – and help students master the topic of standard costing*. Details of this project include: Purpose: To determine whether students understand how and when a standard costing system can be beneficial for a company, and when a less sophisticated system may be more appropriate. Student groups must act as a consulting team and prepare a written recommendation to the company’s management team specifying which costing system they would recommend and why. Unique Aspect: Students must weed through additional information provided (some of which adds important context; some of which is biased and/or irrelevant) in order to cite appropriate evidence in support of their recommendation. Data: I have assigned this project in multiple Cost Accounting sections spanning two semesters; the data indicates that the majority of students reached a high level of understanding in relation to project objectives. Further, student feedback has been very positive for this project – both in terms of learning and enjoyment. ___________________________________________________________________________________ Project information included here: Project Overview…………………………………………………………………….. Page 1 Project Requirements (as provided to students)……………………… Pages 2-4 Outline of Source Documents duplicated here...…………………….. Page 5 Source Documents (as provided to students)…….……………………. Pages 6-10 Main Issues of the case……………………………………………………………. Page 11 ___________________________________________________________________________________ Note: All project information, including the solution to the journal entry portion of the project as well as data from past semesters is available in electronic form from the author. Comments are also welcome in regards to any component of this project! *This same project model could be used to simulate real world decision making within any topic of accounting or other discipline, for that matter. 1 Critical Thinking Project For Cost Accounting Spring Semester 2010 Project Title: What costing system should we use? Scenario: ChillOut Corporation produces custom frozen food orders (by the case) for group homes where patients/clients have special dietary requirements. ChillOut needs to determine which type of costing system it is going to use for the upcoming fiscal year, which starts next week. The company is currently shut down for the Christmas/New Year holiday. Your consulting firm has been hired by ChillOut to assess the alternative costing options and to make a written recommendation to ChillOut’s management team and board of directors. Project Requirements (to be completed in groups of 2 to 4 people) (30 points) Prepare journal entries to account for the specific transactions noted during the month of December; prepare them independently for each of the following costing systems: (round to the nearest cent when necessary) o Actual costing o Normal costing o Standard costing Determine ending balances in the following accounts for each costing system listed above: o Direct materials o Work in process o Finished goods o Cost of goods sold Prepare a written report of your assessment of the company’s costing alternatives as well as your recommendation as to which costing system the company should use in the next and/or future calendar year(s). Your boss, one of the partners at your consulting firm, will be the initial recipient of the report. He or she will look it over and provide you with feedback regarding the criteria established (see rubric ). Once your boss is satisfied with the quality of your work, the report will be presented to ChillOut Corp’s management team and board of directors. (Naturally, you would like to impress your boss with the quality of your work the first time through.) o Just to be clear: For purposes of grading, you will only have one shot at this project Your boss is limiting your research in this project to the following sources (in addition to your textbook) 1) Memo from ChillOut CEO. Available on D2L. 2) Excerpts from a variety of companies’ management teams. Available on D2L. 3) Article: Problems of obtaining information for standards and budgets. Available on D2L. 4) Direct Cost Variance Trend Chart from past 2 years. Available on D2L. 5) Article: Is standard costing obsolete? Available on D2L. 6) Link to the IMA Statement of Ethical Professional Practice: www.imanet.org/about_ethics.asp Your boss will be evaluating the written report/recommendation portion of the project according to the following criteria (see rubric, attached, for further details): 1) Recognizing the relevance/flaws of various documents 2) Recognizing the value of each costing method, and potentially even considering other alternatives not provided 3) Recommendation is based on appropriate evidence, rather than opinion 4) Ideas are presented as part of an organized and logically cohesive argument 5) Proper business writing is utilized (organization, expression, & mechanics) 2 Specific Information for the company, ChillOut Corporation, follows. During the month of December, ChillOut produced 1,250 cases of food and incurred the following actual costs: Variable Overhead (all utility costs, paid in cash) Fixed Overhead (mgmt salaries, $10,000, paid in cash; Depreciation on PP&E, $10,000) Labor costs (6000 direct-labor hours, paid in cash) Material costs (22,500 pounds purchased on credit) $ 10,000 20,000 103,500 43,875 Standard cost and annual budget information were as follows: Standard costs per case Direct labor (5 hours at $18/hr) Direct material (20 pounds at $2/lb) Variable Overhead (5 hours at $1.50/hr) Fixed Overhead (5 hours at $3/hr) Total $ 90.00 40.00 7.50 15.00 $ 152.50 Annual budget information Variable Overhead Fixed Overhead Planned activity level $120,000 $240,000 80,000 direct-labor hours All units produced in the month of December were completed. There were no beginning inventories of DM, WIP, or FG as of December 1. 125 units remained unsold as of December 31, however. Units (or cases) are sold for $225 each. Specific journal entries to account for: Purchase of DM Transfer of 20,000 pounds of DM into production Payment for DL Incur OH costs Transfer/allocate OH costs into production Transfer completed units to FG Sale of units on credit Account for any OH variances (the company does this on a monthly basis) Close out any variances (and/or any under- or over-applied OH) using the most accurate approach you can, given the information provided (the company does this on a monthly basis) 3 Rubric for Costing System Project Skill/Criteria Recognize the relevance/flaws of various documents Not there yet Does not identify relevant documents or flaws/biases in any of the documents; Does not correctly interpret documents Recognize the value of each costing method (possibly consider other alternatives not provided) Does not understand or adequately acknowledge the advantages and drawbacks of any of the methods Recommendation is based on evidence, rather than opinion No position is stated as to which costing method should be used Ideas are presented as part of an organized & logically cohesive argument Ideas or arguments presented (if there are any) are not logically presented and are fragmented throughout the paper Audience is not considered, discussion rambles and is not focused; any comments related to the documents provided are not cited Proper business writing techniques are utilized (consider audience) Level of Performance Developing Identifies some relevant documents but does not interpret them all correctly; Identifies some of the flaws/biases in the documents Understands and adequately acknowledges some of the advantages and drawbacks of one or more methods A position is stated as to which costing method to use, but is not adequately supported with valid evidence Some ideas and arguments are given, but not all are logically presented and not all are cohesive Audience is somewhat considered and discussion is somewhat concise; some comments related to the documents provided appropriately cite the source Mastery Identifies and correctly interprets the relevant documents; Identifies the flaws/biases in the documents Understands and adequately acknowledges all of the key advantages and drawbacks to each costing method; Considers other methods that may also be appropriate under these circumstances A position is stated as to which costing method to use, and is adequately supported with valid evidence Ideas and arguments are presented logically, and thought processes are focused and cohesive Audience is considered and discussion is concise (including necessary details but leaving out ‘the fluff’); comments related to the documents appropriately cite the source* *For purposes of this project, since your source documents are limited to the ones given, you do not need to create a bibliography page. To cite the sources where you are getting your information, please use parenthetical notation (i.e. the author’s last name(s) and the year the article was published) either at the end of the specific sentence where you used the document’s information, or at the end of a paragraph, if the entire paragraph is discussing content from a given source. If an author’s name is not provided, simply provide the type of source document in parentheses (such as ‘Memo from CEO’, or ‘IMA Ethical Standards’, for example). Citing the sources that you use is considered an important part of this project. Your boss needs to know what information you used from the given set of documents as he or she reviews your work. By citing the sources used, your boss will be able to tell whether you picked up on the key aspects of the project, or not. (FYI: The citations that you make note of in your initial report to your boss will be removed before the final report is presented to ChillOut Corp.) 4 Source Documents attached to this packet include: Memo from CEO Excerpts from a variety of companies’ management teams Article: Problems of obtaining information for standards and budgets Direct Cost Variance Trend Chart from past 2 years Remaining source document (Article: Is Standard Costing Obsolete?) is available from the author. 5 Memo To: Consulting Team From: ChillOut CEO, Dave Buckley Re: Consulting engagement related to selecting a costing method Please let this memo serve as an engagement letter, outlining exactly what it is that we would like to get from you. As part of your consulting effort, we hope that you will assess how a normal, actual, and standard costing system may affect our company’s financial status. After assessing these systems, we also hope that you will be able to make a recommendation as to which costing system would be most beneficial to our company. As background information, I thought it may be important for you to know that we purchased a high-end software package two years ago (we just finished our second year of using this software). This software package has made it possible for us to implement a standard costing system that automatically sends alerts to the responsible department when unfavorable variances occur at a level that we feel is significant; if a variance is favorable, no notice is sent, as we assume all is well. When we made the decision to purchase this software, we planned on getting use from it for at least 4 years (in order to make the investment somewhat costeffective). It would be easy enough for us to scale this standard costing system back (into something more consistent with what we used previously). However, I am just not sure how I would feel about backing away from this investment before the four years is up. Additional background information related to employee incentives may also be helpful for you as you complete your analysis. Our employees help to set the quantity/usage and cost standards for their respective areas. They are awarded bonuses if their respective department has favorable variances for two consecutive quarters. As you can see from the variance trend chart, this incentive program has been very successful. Despite the favorable cost variances that have occurred in the past, you should know that our sales have dropped from prior years. We feel that this is much more a reflection of touch economic times for everyone than it is a reflection of our customers’ satisfaction with our products. Still, because we again are forecasting a drop in sales going into next year, we must continue to focus on keeping our costs down. Our cost accountant/analyst, who has been working full-time for us since the implementation of our new software system, has even offered to cut back her hours for purposes of company cost savings (and for personal reasons, as well). We cannot operate our current system without a full-time employee in this position, though. As a final note, I thought that you may want to know that our company is looking to establish a long-term relationship with a consulting firm (to help us assess other areas of our company’s performance, namely our sales, operations and personnel activities). If we, the management team, find your work to be of high quality, it is likely that we will look no further for another firm to engage in these additional projects. Thank you for your efforts in assessing these costing systems. I look forward to reviewing your recommendations with the entire management team. 6 Excerpts from three companies’ management teams Best Foods, a subsidiary of Unilever (2008 McGraw Hill ‘Managerial Accounting’ textbook): “At Best Foods, standard costs are set at attainable levels… We designate variances as controllable or uncontrollable. Plant managers are held accountable for the controllable variances.” Parker Hannifin Corporation’s Brass Products Division (2008 McGraw Hill ‘Managerial Accounting’ textbook): Parker Hannifin’s Brass Products Division, a world-class manufacturer of brass fittings, valves, and tubing, is a standard-costing success story. “Parker Brass uses its standard-costing system and variance analyses as important business tools to target problem areas so it can develop solutions for continuous improvement. Variances are reported for each product line, and if any production variance exceeds 5 percent of product-line sales, the product-line manager is required to provide an explanation. Also required is a plan to correct the problems underlying any unfavorable variances. Variance reports, which are generated within one day of the completion of a job order, are distributed to managers and production schedulers. A variance database is kept, which can be assessed by product-line managers, to provide variance data by part number, by job-order number, or by dollar amount.” From the perspective of Parker Brass’s management, the division has modified its standard costing system to provide disaggregated and timely cost information to enable timely corrective action in a rapidly changing business environment. “Many people have condemned standard costing, saying it is irrelevant to the current just-in-time, fast-paced business environment. Yet surveys consistently show that most industrial companies in the U.S. and abroad still use it. Apparently, these companies have successfully adapted their standard-costing system to their particular business environments.” Cost Management Systems in Germany (2008 McGraw Hill ‘Managerial Accounting’ textbook): Throughout the world, flexible budgeting is found in cost management systems as a means of controlling overhead costs. In Germany, for example, grenzplankostenrechnung (or “flexible standard costing”) exhibits many of the features illustrated in this chapter. Under the German approach, “each cost center distinguishes between variable costs (e.g., energy) and fixed costs (e.g., a manager’s salary).” The number of machine hours is a common activity measure. “For purposes of cost planning and control, companies budget each cost center’s expenses and then distribute the expenses each month of the budget year. The budgeted costs are standards for efficient resource consumption…” The cost and performance information “allows for effective discussions about productivity improvement” among department managers, management accountants, and plant managers. Among the companies using the flexible standard costing system is Stihl, a well-known German manufacturer of chain saws and other landscaping equipment. 7 Problems of Obtaining Information for Standards and Budgets (From Chapter 14, ‘Advanced Management Accounting’ textbook, 3rd edition) Standards and budgets occupy a prominent place in the literature of cost accounting, management control, and organization theory. Standard-setting and budgeting activities are so pervasive in management teaching and practice that we tend to accept them without considering the fundamental forces that make these activities desirable. In an ideal world of certainty, costless information, and observability, and unbounded computational capacity, a central decision maker can make globally optimal decisions and can direct subordinates (local managers) to implement centrally determined plans. In this setting, there would seem to be little role for budgets. In the real world, however, local managers are given considerable decision-making authority. Profitsharing incentive contracts may be instituted to motivate the managers to make decisions that are in the firm’s best interest, as described above (and in Ch13). But, as we have seen, simple profit-sharing contracts introduce uncertainty into the managers’ compensation functions, and managers may take actions (such as lowering output levels) to compensate for this uncertainty. Such risk-avoiding behavior is not generally desirable for the firm as a whole or for its shareholders. We must attempt to design the most efficient contracts to balance the conflicts between managers and owners. Using Information for Rewards and Control – The Moral Hazard Problem Conflicts can arise in even simple situations. Consider a salesperson who is asked by the sales manager to provide an estimate of expected sales in the upcoming period. The sales manager will use the estimate to plan production and marketing efforts and as the basis for the compensation plan. More specifically, the salesperson is paid a base salary and a commission on sales in excess of a target amount. The sales manager will use the estimate of sales potential to set the target level of sales that the salesperson must attain before commissions are paid. In this situation, almost all salespersons tend to understate the assessed sales potential. The problem is not limited to sales. A production manager may understate the potential output from an assembly line so that, if something goes wrong, she will still have a good chance of attaining the production quota. The misrepresentation of private information occurs because of two critical conditions: (1) the subordinate has information, by virtue of specialization, that the superior requires for planning purposes; and (2) the information is used both for planning and for control purposes. These problems are another example of the moral hazard problem; in this case, the manager (or subordinate) is motivated by the structure of the control or evaluation system to misrepresent private information. The condition for this moral hazard situation arises whenever the manager’s information or actions are not directly observable by the manager’s superiors. Moral hazard is not necessarily the consequence of a poorly designed control system. In fact, because of the specialization sought by decentralization, and the need for specialist information in control, moral hazard is almost guaranteed in a decentralized firm that attempts to assess individual contributions to the firm. Moral Hazard and Information Impactedness The existence of moral hazard creates the information impactedness situation, described earlier, whenever available, valuable information does not flow as required in the firm. As another example of information impactedness, consider a situation in which a manager knows that she has made a bad decision but refuses to correct the situation because doing so would make the bad decision obvious to all. On the other hand, leaving the existing decision unchanged may cause damage to the firm but not harm the manager’s reputation (or compensation), because no one else will recognize that a bad decision has been made. 8 Information impactedness arises when local managers possess valuable, perhaps unique, information about their local environment but do not convey it truthfully. We are not suggesting that managers are evil or indifferent to the overall performance of the firm. We are suggesting that when managers are evaluated and promoted on the basis of comparisons of their performance with a standard, we should not expect managers to act contrary to their own self-interest when asked to provide information on the appropriate level of the standard. Their self-interest may cause them to strategically manipulate their information and intentions. Because of inherent uncertainty and the costliness of observation, owners will rarely be able to detect whether an unexpected outcome was due to the prior misrepresentation of information or an unusually good or bad outcome. Information impactedness problems can be mitigated by basing rewards on companywide rather than individual performance. In this way, managers have more motivation to share information and cooperate. But, when managerial rewards are based on overall rather than individual performance, managers will not capture the gains from their individual efforts, information acquisition, and decision making. As a consequence, they will reduce their efforts along those dimensions – the practice of free-riding (described in Ch13). Many firms base rewards on individual performance. Apparently, the motivational benefits provided by measuring and rewarding individual behavior outweigh the potential costs of information impactedness and risk-avoidance behavior. 9 ChillOut Corporation Direct Cost Variances for past 2 yr period Dollar Amount of Variance (All are positive thus far) (All positive amounts represent Favorable Variances) 1800 1600 1400 1200 1000 800 600 400 200 0 DM Price & Effic. Var (combined) DL Price & Effic. Var (combined) 10 ‘Main Issues’ that groups should address in their written reports (I do not expect every group to hit all of these issues, but I do expect each group to cover most of them) Is the company’s incentive plan really working well? Are there other ways to set standards (other than how this company is setting them), if a standard system is best for this company? Is the previous investment in the software package a relevant cost for this decision? Would switching to a simpler costing system be very expensive? What benefit(s) are the users of the current system really getting? Is continued use this way worth keeping a full-time analyst on staff? Are there other benefits the company could get out of its current system to justify the accountant’s salary? (i.e. are there other types of variances they could evaluate?) Is the economy the only reasonable explanation for this company’s decreased sales? (what about decreased quality, given its consistently favorable variances over the past two years; what about SP being a bit too high, given the higher standard cost per unit as compared to the actual or normal cost per unit) Is it relevant that other companies have found a standard costing system to be useful? Are there other ways to allocate indirect costs? Would they be appropriate for this company? 11