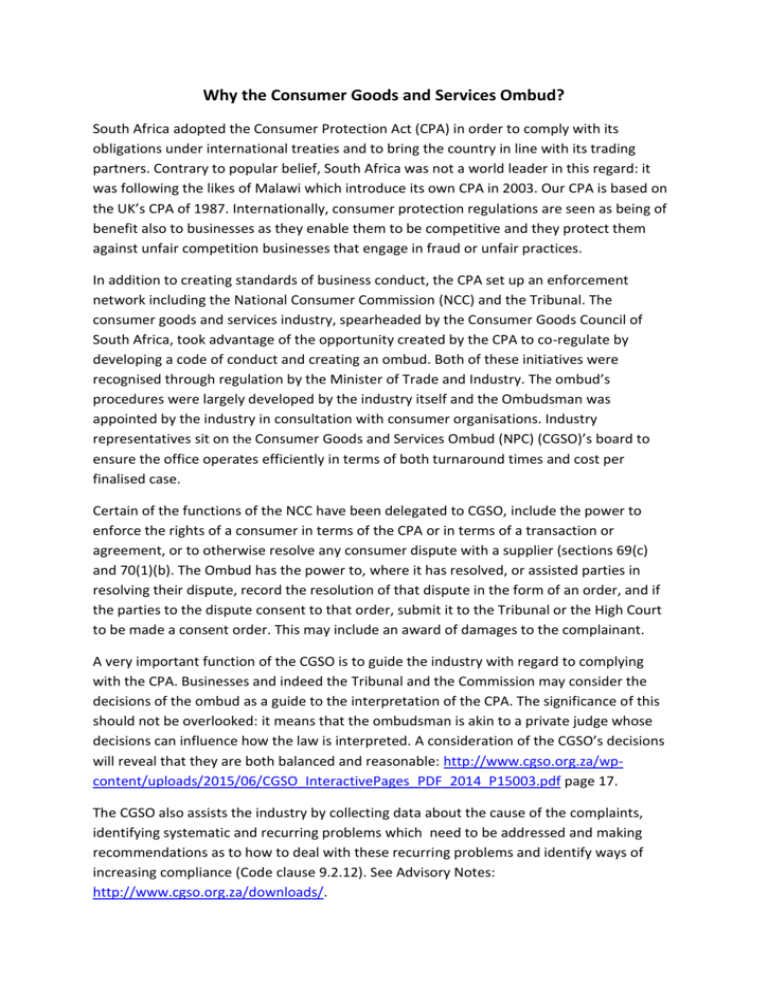

Why the Consumer Goods and services Ombud

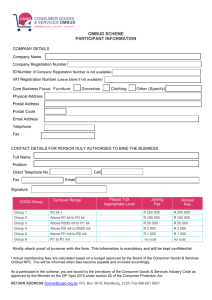

advertisement

Why the Consumer Goods and Services Ombud? South Africa adopted the Consumer Protection Act (CPA) in order to comply with its obligations under international treaties and to bring the country in line with its trading partners. Contrary to popular belief, South Africa was not a world leader in this regard: it was following the likes of Malawi which introduce its own CPA in 2003. Our CPA is based on the UK’s CPA of 1987. Internationally, consumer protection regulations are seen as being of benefit also to businesses as they enable them to be competitive and they protect them against unfair competition businesses that engage in fraud or unfair practices. In addition to creating standards of business conduct, the CPA set up an enforcement network including the National Consumer Commission (NCC) and the Tribunal. The consumer goods and services industry, spearheaded by the Consumer Goods Council of South Africa, took advantage of the opportunity created by the CPA to co-regulate by developing a code of conduct and creating an ombud. Both of these initiatives were recognised through regulation by the Minister of Trade and Industry. The ombud’s procedures were largely developed by the industry itself and the Ombudsman was appointed by the industry in consultation with consumer organisations. Industry representatives sit on the Consumer Goods and Services Ombud (NPC) (CGSO)’s board to ensure the office operates efficiently in terms of both turnaround times and cost per finalised case. Certain of the functions of the NCC have been delegated to CGSO, include the power to enforce the rights of a consumer in terms of the CPA or in terms of a transaction or agreement, or to otherwise resolve any consumer dispute with a supplier (sections 69(c) and 70(1)(b). The Ombud has the power to, where it has resolved, or assisted parties in resolving their dispute, record the resolution of that dispute in the form of an order, and if the parties to the dispute consent to that order, submit it to the Tribunal or the High Court to be made a consent order. This may include an award of damages to the complainant. A very important function of the CGSO is to guide the industry with regard to complying with the CPA. Businesses and indeed the Tribunal and the Commission may consider the decisions of the ombud as a guide to the interpretation of the CPA. The significance of this should not be overlooked: it means that the ombudsman is akin to a private judge whose decisions can influence how the law is interpreted. A consideration of the CGSO’s decisions will reveal that they are both balanced and reasonable: http://www.cgso.org.za/wpcontent/uploads/2015/06/CGSO_InteractivePages_PDF_2014_P15003.pdf page 17. The CGSO also assists the industry by collecting data about the cause of the complaints, identifying systematic and recurring problems which need to be addressed and making recommendations as to how to deal with these recurring problems and identify ways of increasing compliance (Code clause 9.2.12). See Advisory Notes: http://www.cgso.org.za/downloads/. Internationally, the benefits of belonging to an ombud scheme are recognised to include: Providing an independent, impartial, fair, timely, efficient and informal external dispute resolution process that is free to consumers Helping to support improvements in systems and reducing disputes; Helping businesses themselves to resolve disputes with consumers; Resolving any consumer disputes that businesses fail to resolve themselves; and reducing the administrative burden of doing so; Saving in management time. Human error will always happen in the best of companies, and it will often be easier that redress is determined by someone independent; Providing precedents to guide businesses when considering disputes; Helping to clarify the law; Briefing management on issues or ‘hotspots’ of which they ought to be aware, and the possible implications of those issues; Informing consumers of their responsibilities (http://cgso.org.za/dl/Consumer%20obligations%20v1%20linked.pdf); Relieving businesses of the aggravation of dealing with consumers who unreasonably refuse to take no for an answer; Resolving dispute regarding liability in the supply chain; Focusing on the restoration of the business relationship rather than taking punitive action against a business (no compliance notices/ fines); Saving litigation costs and reducing the risk of reputational damage. Additional benefits: Gaining public trust; Keeping disputes out of the public domain; Free product testing where disputes arise (budget permitting); Workshops/ training on Code and CPA; Case studies/ advisory notes/ benchmarking.