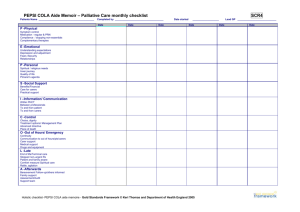

RELOCATION POLICY UPDATES Number of Policies

advertisement

Relocation Policy Innovations Cathy Bauman Runzheimer International June 9, 2011 Runzheimer International Mobile Workforce Business Travel Business Vehicles/Fleet Relocation Virtual Office International Assignments Route Planning & Logistics ● Mobile – 45% ● Concern: Employee Productivity ● Benefit: Employee Satisfaction & Competitive Advantage Benchmark Key Findings • Mobility cost per employee—$7,350 • Business Travel—32% expect spending to increase • Business Vehicles—67% concerned with 24/7 liability with company-provided vehicles • Virtual/Home Office – need to develop policy • Corporate Aircraft—executive use dropped; use by ‘managers of multiple sites’ increased • Relocation—43% expect increase in volume DOMESTIC MOBILITY • What Changes Have You Made to Your Relocation Policy in the Past Year? - 40% None - Remainder Various -- Increased Loss on Sale -- Offered Pre-Decision Counseling -- Reduced Mandatory Marketing Time and Increased Temp Living Assistance RELOCATION POLICY UPDATES Policy Updates 15% 15% 5 Years 2 Years 1 Year 24% 6 Months 39% POLICY TIERS/ADDITIONS • Number of Policies - 3 Policy Tiers – Average • Various Changes: - Increase Loss on Sale - Incentive to Rent - Extending Marketing Time - Extending Temp Living Benefit HOME SALE PROGRAMS Home Sale Programs 54% Guaranteed Buyout 23% BVO 2% BVO & GBO Loss-On-Sale Program 84% Provide Caps - 15% - $50K - 11% - $10K & $30K - 5% - $100K EQUITY ASSISTANCE Negative Equity Assistance 12% No Yes 88% COST OF LIVING ALLOWANCES (COLAs) • Do You Provide a COLA? - Yes – 73%; No – 27% • Do You Provide a COLA for High Cost Locations Only? - Yes – 76%; No – 24% • Do You Provide a COLA for All Transferees? - Yes – 28%; No – 72% • Do You Provide a COLA to Homeowners and Renters? - Homeowners – 92%; Renters – 92% EMPLOYEE LEVEL FOR COLA • What Level of Employee Receives COLA - Transferee – 79% - Executive – 42% - Experienced New Hire – 38% - New Hire – 38% - Other – 25% COLA THRESHOLDS, CAPS & SUBSIDIES • COLA Thresholds - 48% No Threshold - 24% - Threshold = 5% - 12% - Threshold = 10% • COLA Caps - 96% No • Mortgage Subsidy - Yes = 52%; No = 48% - 23% Subsidy Based on COLA LUMP SUM POLICIES • Do You Have a Formalized Lump Sum Policy? - Yes = 82%; No = 18% • Number of Policies - 30% More than 5 Policies - 21% = 2 Policies - 18% = 4, 5 Policies • Temp Living Days – Homeowner - 37% = 30; 28% = 60; 8% = 45 • Temp Living Days – Renter - 51% = 30; 8% = 60 NEW POLICIES/PROGRAMS DEVELOPED • • • • Temporary Living or Renter – 53% Other – 53% Talent Management – 12% Virtual or Home Office Program – 12% GLOBAL/INTERNATIONAL MOBILITY Survey targeted strategic objectives and policy offerings that companies have adopted or are considering adopting in response to today’s mobility environment Two Major Findings: • Companies once again expanding expatriate population • Companies adopting increasing number of mobility policies and compensation approaches, with a continuing trend toward multiple policy types and adoption of lower cost alternative solutions Source: AIRINC EXPATRIATE POPULATIONS INCREASING • 42% of Companies Report Increase in Expatriate Population in 2010 Compared to 26% in 2009 • US and Asia Pacific Companies More Likely to Increase Expatriate Population Numbers at 53% and 50% respectively • Only 38% of European Companies Expect to Increase Their Expatriate Populations in 2011 although 52% report populations to remain stable EXPATRIATE POPULATIONS INCREASING • Expatriate Population Growth Strongest in High Tech, Financial & Professional Services, Manufacturing and Transportation Industries • Companies Report on Average 3-4 Formal Assignment Policies - Most Common: -- Balance Sheet 83% -- Short Term – 73% -- Localization – 45% -- Host Plus 21% -- Commuter 21% GLOBAL/INTERNATIONAL POLICIES • Half of companies are looking to adopt new policies in 2011. -- Most common policy type under consideration is Localization Plus – 28% -- Localization – 26% -- Reduced Balance Sheet – 21% -- Host Plus – 21% -- Commuter – 21% ALTERNATIVE PACKAGES • Decision-Makers Continue to Explore and Implement Los Cost Alternative Packages • 2010 – 15% of Companies Implemented One or More Low Cost Alternative Package • 30% More Considering • 44% Respondents Package in Active Use BALANCE SHEET • Balance Sheet is Still Most Popular Expat Compensation Scheme - 83% Respondents use Balance Sheet - 74% Companies use Balance Sheet Exclusively for Long Term Assignments - 60% Use Balance Sheet as Only Approach to Long Term Assignments - 14% Use Mix of Full and Reduced Balance Sheets. HOST PLUS • Host Plus Used Most by Financial Firms and Companies Headquartered in Asia-Pacific and European Regions • 43% Asia-Pacific • 35% European • 14% U.S. Companies use Host Plus • 45% of Financial Firms Regardless of HQ use Host Plus SENDING & RECEIVING LOCATIONS • Top Sending Countries - U.S. – 80% - U.K. – 71% - Australia – 31% - Canada – 26% - Singapore – 21% • Top Receiving Countries - U.S. – 65% - U.K. – 50% - China – 41% - Singapore – 29% - Hong Kong – 22% TAXES AND IMMIGRATION • Tax and Immigration Top Challenges for Mobility Practitioners • Other Challenges - Designing globally consistent policies - Aligning mobility with talent management THANK YOU QUESTIONS AND ANSWERS Cathy Bauman Runzheimer International ceb@runzheimer.com 262-971-2356