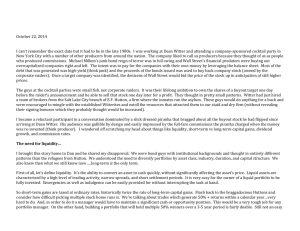

Portfolio Performance % P/L July

advertisement

AUGUST 2014 AUGUST 2014 FPI PREMIER SAVINGS PLAN INVESTMENT OBJECTIVE Amici International Corporation aims to achieve long-term Capital Growth by investing in a diversified portfolio including emerging markets, commodities, resources, energy, precious metals and other high growth opportunities. Composition and Performance of Portfolio 1 Month Investec Global Strategic Equities DWS Global AgriBusiness CGWM Select Global Opportunity Vanguard US 500 Stock Index Invesco Global Technology Schroder US Smaller Companies Invesco Global Healthcare Invesco US Structured Equity JPM USD Liquidity 3 Months 6 Months YTD -2.50% 1.34% 6.39% 5.04% -3.87% -3.59% 4.30% 1.22% -2.34% -0.77% -0.33% 0.33% -1.69% 2.93% 7.23% 5.04% -2.91% 4.76% 0.49% 2.07% -3.77% 1.54% 1.31% -1.59% -1.86% 5.33% 2.73% 6.13% -3.98% 0.33% 4.24% 0.12% -0.11% -0.34% -0.68% -0.79% AUGUST 2014 Portfolio Performance % P/L July MARKET REVIEW JULY Volatility returned to markets in July as a number of factors contributed to market instability. These included geopolitics, sanctions against Russia and shocks to the Portuguese banking system. However, the overriding influence remains central bank policy. Ultra loose monetary policy has reduced market volatility and explains why markets were unresponsive to the increase in geopolitical tensions earlier in July. However, as expectations change for rising interest rates, volatility has crept back in. By the end of July volatility had risen to its highest level since April, while the yield on high yield bonds surged as fears rose over market liquidity should interest rates start to increase. Developed markets sold off in the last week of July erasing earlier gains. The MSCI World index fell by 0.8% over the month, while global bond markets were also lower, with the Barclays Global Aggregate Index falling close to 1%. In comparison, emerging market equities gained 3.1% as sentiment towards China improved. The US economy rebounded in the second quarter, expanding by 4% on an annualised basis as we had predicted. The underlying trend in economic growth is seemingly robust. The release of revised historical data showed the economy had fared better than first thought, with an upward revision to 2013 numbers. Rising business and consumer surveys suggest that the current momentum could continue throughout the rest of the year. Meanwhile, stronger company fundamentals should support US equity markets. With 81% of the S&P 500 by market capitalisation having reported earnings (at the time of writing), nearly 70% of companies have beaten analyst earnings expectations. We expect some sort of recovery in markets before more volatility in the fall. The MSCI Pacific Index returned 0.1% in the week to 1 August. In Japan, Industrial output for June fell at the fastest rate since 2011, leading to concerns over the ability of the government’s Abenomics programme to end deflation and restore growth. AUGUST 2014 PORTFOLIO REVIEW. We had been expecting some sort of correction to strong equity gains earlier this year, and we did indeed get a modest correction the last week of July resulting in weak performance for the Funds in the portfolio. However, as of this writing, markets have clawed back their losses and are pushing higher. Rather than trying to second-guess the markets, we stick to our strategy of being modestly positive on risk assets, and overweight equities vs. bonds, while aiming to run lower levels of portfolio risk. PORTFOLIO CHANGES None FUND FEATURES AND PORTFOLIO OUTLOOK Investec Global Strategic Equities The Fund aims to provide long-term capital growth primarily through investment in equities of listed companies from around the world. Stocks fell sharply in the last week of July, amid further uncertainty over the timing of the first US interest rate increase. Concern over Russian sanctions, Argentina’s sovereign default and the European financial sector also hit sentiment, with the S&P 500 falling 2.7% and the Dow Jones down 2.8%. This was largely predicted and we think equities will rebound but turbulence will remain. Hold Investec Global Strategic Equities Performance Cumulative Performance to 25/07/2014 1 month Growth % -2.50% 3 months 1.34% 6 months 6.39% YTD 5.04% DWS Global Agribusiness Invests globally in companies that are either in the agricultural sector or profit from this sector. Volatility finally hit the markets and there was a general fall in equities across the board. Speculation over US interest rates intensified as economic data strengthened and growth momentum appears to have carried through into the third quarter so we expect the fund to recover in line with overall market trends. Importantly, the long term fundamentals remain in place.-3.87% for the month. Hold. DWS Global Agribusiness Performance AUGUST 2014 Cumulative Performance to 25/07/2014 Growth % 1 month 3 months 6 months YTD -3.87% -3.59% 4.30% 1.22% CGWM Select Global Opportunities Designed for those investors seeking a consistent total return from a combination of capital growth and income with the prospect of moderate growth over the longer-term. The fund holds multiple asset classes to achieve its goal. Select Global opportunities fund followed the market dip at the end of July as markets pulled back. We expect the fund to rebound as economic data still seems reasonably strong although the turbulence of geo political events can easily upset things. Hold CGWM Select Global Opportunities performance Cumulative Performance to 25/07/2014 Growth % 1 month 3 months 6 months YTD -2.34% -0.77% -0.33% 0.33% Vanguard US 500 Stock Index The fund seeks to track the performance of the Standard & Poor’s (”S&P”) 500 Index, In the US, the S&P 500 posted a negative return for July. Macroeconomic data largely confirmed the ongoing improvement in the US economy, particularly in the labour market, although this in turn raised concerns that US interest rates could rise sooner than expected, making markets nervous. Combined with ongoing Political events, equities sold off at the end of July resulting in an overall negative performance. Hold Vanguard US 500 Performance AUGUST 2014 Cumulative Performance to 25/07/2014 Growth % 1 month 3 months 6 months YTD -1.69% 2.93% 7.23% 5.04% Invesco Global Technology The objective of this Fund is to achieve long term capital growth by investing in technology companies throughout the world. The tech sector underwent a steep decline in July. The sector has had a good run and some of these prices may have become over inflated. -2.91% for July but we expect prices to rebound. Hold Invesco Global Technology Performance Cumulative Performance to 25/07/2014 Growth % 1 month 3 months 6 months YTD -2.91% 4.76% 0.49% 2.07% Schroder US smaller companies AUGUST 2014 The fund's investment objective is to achieve capital appreciation through investment in US smaller companies. Following another week of elevated volatility for the broad market, analysts seem unsure if we are positioned for a prolonged market pullback. Small cap stocks have performed particularly well over the last year but unfortunately, they seem to suffer more than most when volatility increases. -3.77% for the last month. Hold Schroder US smaller companies performance Cumulative Performance to 25/07/2014 Growth % 1 month 3 months 6 months YTD -3.77% 1.54% 1.31% -1.59% Invesco Global Healthcare The aim of the fund is to achieve capital growth by investing in healthcare companies throughout the world. Biotech Stocks took a hit as a-Risk Off sentiment hit the market. We expect the market trend to stay intact but expect a choppy summer. The sell-off late in July seemed to hit most healthcare/ biotech stocks. Hold Invesco Global Healthcare performance Cumulative Performance to 25/07/2014 Growth % 1 month 3 months 6 months YTD -1.86% 5.33% 2.73% 6.13% AUGUST 2014 Invesco US Structured Equity Aim: achieve long term capital appreciation by investing in a diversified portfolio of large cap equities. A sharp decline on the final trading day of the month pushed large-cap indexes to a loss for July, while small- and mid-cap shares seemed to suffer more. Performance was -3.98 % for the month but we expect the trend to reverse. Be prepared for rebound but volatility will never be far away. Hold. Invesco US Structured Equity performance Cumulative Performance to 25/07/2014 Growth % 1 month 3 months 6 months YTD -3.98% 0.33% 4.24% 0.12% JPM USD Liquidity The fund seeks to achieve a return in line with prevailing money market rates whilst aiming to preserve capital consistent with such rates and to maintain a high degree of liquidity. Cumulative Performance to 25/07/2014 Growth % 1 month 3 months 6 months YTD -0.11% -0.34% -0.68% -0.79% OUTLOOK Markets ended July with risk assets selling off. Over the past 3-4 weeks, there has been a rotating pullback in several asset classes, headed by U.S. high yield, European periphery bond spreads and commodity prices. In contrast, the U.S. dollar has risen by 2.8% since early May. There are a number of explanations for this period of turbulence, with none of them being totally convincing in isolation. The first is that expectations for Fed tightening have been brought forward, in response to relatively robust U.S. data. The second is that there have been growing concerns about the Eurozone, as reflected in poor data at the end of July. Finally, geopolitical risk has risen with the escalating tension in Ukraine and Gaza. However, no one explanation accounts for moves in markets that we have seen recently, with equities and bond yields falling, European equities and peripheral bonds underperforming global stocks, and commodities falling—rather than rising, as would be expected. AUGUST 2014 We think that the markets are undergoing a “liquidity” shock; and analysis suggests that monetary conditions began tightening from May 2013 onwards and volatility shocks should therefore be expected. Global Growth Chart Overall, we think the U.S. market will continue its bullish trend; we believe it to be fairly valued or slightly over-valued, and expect at worst a 10 percent correction. A larger correction would likely be caused by rising interest rates, and the current slow growth argues against higher rates near-term. We remain sceptical of the strength of Eurozone financial institutions, and therefore have a negative outlook with regards to European growth prospects.