Make An Extra $5000 per month!

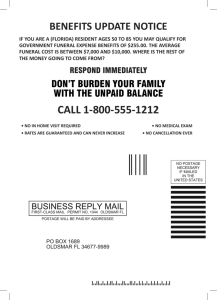

advertisement

WELCOME TO OUR TRAINING SEMINAR Agent Seminar IRREVOCABLE FUNERAL TRUST 5 SECRETS IN MARKETING THE FUNERAL AND ESTATE TRUSTS Speakers: Elder Law Attorney Karl Dovnik, Jr. Michael K. O’Dell – National Sales Office National Sales Office Michael K. O’Dell Attorney Karl Dovnik Speakers OUR GOAL IN THIS SEMINAR You will learn How to Market Our Products Medicaid Overview by Attorney Dovnik - help your clients protect Assets by planning now YOUR SUCCESS IS OUR #1 PRIORITY We are here to partner with you and help your business grow. We are committed to help in anyway and every aspect of your business. YOUR SUCCESS IS OUR #1 PRIORITY! Take good notes You’ll Learn how to sell the funeral and estate trusts . New presentation on the estate trust. Today – New Estate Trust Presentation Michael K. O’Dell National Sales Office You’ll hear what happened to Mildred Today National Known Elder Law Attorney Our Products just make common sense to the senior that is trying to protect their life savings from a nursing home. Remember, 93% of your seniors don’t have long term care insurance Karl Dovnik, Jr. The Funeral and Estate trusts from a legal standpoint are an excellent way to protect assets… A NURSING HOME CAN WIPE-OUT A LIFETIME OF SAVINGS ! 93% OF SENIORS OVER 65, DON’T HAVE NURSING HOME INSURANCE ! Without Planning, Your Clients Could Lose Everything ! LOOK AT THE FACTS ! •AVERAGE COST- $7000.00 –NURSING HOME •50% OF US WILL ENTER A NURSING HOME. •70% OF SINGLES WILL REACH POVERTY WITHIN 33 WEEKS. •7 0UT OF 10 COUPLES WILL HAVE ONE SPOUSE ENTER A NURSING HOME. •A NEW CASE OF DIMENTIA ARISES EVERY 7 SECONDS. The Legal planning that you do today…could determine if your children and grandchildren inherit anything from you. Asset Protection is possible. Advance Planning Can Protect Assets ! Let’s look at the New Medicaid Rules Deficit Reduction Act for 2005 DIVESTMENTS AND GIFTS • EXTENDING THE THREE YEAR TRANSFER RULE ON ASSETS TO A FIVE YEAR RULE. The Old Rule was from the date of transfer, the new rule is from the date of Medicaid Application. Medicaid Eligibility Rules Some states may vary on these Medicaid eligibility rules Single person Assets - $ 2000.00 Life Policy - $1500.00 Car - $ 4500.00 Personal possessions Wedding rings Funeral trust Income - $ 45.00 Spousal Impoverishment Rules for married couples Assets - $50,000 – 109,540.00 Life Policy - $ 1,500.00 Car – Unlimited Value Home - $ 500,000 Equity Personal Possessions Funeral Trust for both spouses Income - $2739.00 Monthly SINCE ONLY $1500.00 IS EXEMPT FOR LIFE INSURANCE…THIS IS AN ISSUE • Medicaid says only a $1500.00 life insurance policy is exempt. • Any policy over that amount in cash values is a countable asset and would have to be spent down for Medicaid Eligibility. • Example: $10,000.00 Policy – (Paid Up) 9,850.00 Cash Value • SOLUTION: 1035 Exchange to Funeral Trust. (Tax Free) – Now it is Protected. Some states may vary on Medicaid Rules, please consult an Elder Law Attorney in your state. Funeral Trust Planning • Dollars put into the Irrevocable Funeral Trust is Exempt. (Client receives fair market value - No Five Year Look-Back • Protected from Creditors, Lawyers, Hospitals, Nursing Homes and Medicaid. • The last trust available without a look-back. • Great Medicaid Planning Tool. • The Financial Planner /Insurance Agent can now assist their clients with this pre-planning trust. Medicaid Rules may vary from state to state. You should consult and elder law attorney in your state. This presentation is for illustrative purposes only. ADVANCE PLANNING SHOULD BE DONE FIVE YEARS IN ADVANCE TO PROTECT ASSETS REVIEW – PLANNING YOU SHOULD RECOMMEND •PLANNING TOOLS •FUNERAL TRUST PLANNING •POWER OF ATTORNEY •HEALTHCARE AND FINANCIAL POA •NETWORKING WITH AN ATTORNEY •KEEP IT SIMPLE…THIS FUNERAL TRUST IS EASY TO SELL…YOU DON’T HAVE TO BE A EXPERT TO SELL THIS PRODUCT! THIS FUNERAL TRUST PLANNING IS JUST COMMON SENSE! FUNERAL TRUST 1. 2. 3. 4. 5. 6. SINGLE PREMIUM LIFE PRODUCT Premiums from $1000 - $15,000 ISSUE AGES 0-99 NO UNDERWRITING – GUARANTEED ISSUED GREAT COMMISSIONS FUNERAL TRUST PROVIDED BY INS. CO. 1. MEDICAID EXEMPT IN MOST STATES 2. 1035 EXCHANGES ACCEPTED GREAT FOR PRE-PLANNING AND CRISIS PLANNING The Irrevocable Funeral Trust • Irrevocable Funeral Trust (IFT) - Funded by a single premium life policy. • Trust strictly specifies money is to be used for funeral expenses. • Life Policy grows @2.00% * • At Death, the trust pays the funeral home directly with excess funds being returned to the estate or family. • Death claim - Agent gathers death certificate/bill from funeral home and fills out claim form for family. The Easiest Sale You’ll ever make • • • • Four ways to fund the IFT Trust 1035 Exchange from Old Life Insurance Policies that have a Face Value of over $1500.00 Cash - Write You a check 10% Free Withdrawal from an Annuity Old Mature savings Bonds 1035 Exchange Sale FUNERAL TRUST Life Insurance Policy Protect This Policy by Tax Free Exchange •Face Amount - $10,000 •Cash Value - $ 9200.00 Medicaid limits in most states - $ 1,500.00 Provides Instant Medicaid Protection The 10% Free Withdrawal To Fund Trust Existing Annuity Policy - $ 200,000.00 Value 10% Free Withdrawal from An annuity to fund funeral trust. ($20,000.00) Use $20,000 to set up (2) Funeral Trusts at $10,000 per spouse. Now this money is Medicaid Exempt! Your Biggest Competition THE FUNERAL HOME REASONS WHY YOUR CLIENT IS BETTER OFF DOING BUSINESS WITH YOU. The Funeral Home might go out of business You might move closer to your children in your old age The Funeral Home may merge with new owners You might retire down in Florida Our Funeral Trust doesn’t specify any particular funeral home. This trust can be used with any funeral home at time of death. WE OFFER FLEXIBILITY! Case Study - #2 • Crisis Case – Client is already in an YOU CAN USE A institution. POWER OF ATTORNEY IF CLIENT IS UNABLE TO SIGN. Example: Age 85 – Female $10,000 remaining in bank acct. Two Choices – Spend $ 8000 on Nursing Home Save $8000 with Funeral Trust FUNERAL COSTS CAN VARY FROM $7000- $12,000 NATIONAL AVERAGE IS $8495.00 PACKAGE YOUR PRODUCTS FUNEAL TRUST FOR IRENE SMITH ABC FINANCIAL SERVICES, INC. 123 MAIN STREET ANYTOWN, USA 00000 800-000-0000 PLANNER – TOM JONES Funeral Trust Products National Guardian Life Learn how to complete an application IT’S EASY AND SIMPLE The Family Estate Trust The Irrevocable Estate Trust •Protect Money from Nursing Home •From $1000 to $50,000 •Money You Want To Pass To Family •You Want Asset Protection •Medicaid Exempt – 60 Month Rule •Trust Avoids Probate •Advance Planning A Must ! •Pass Money to Children or Grand Children Four Questions You must ask your client to sell the Family Estate Trust 1.) Do you have nursing home insurance? Four Questions 2.) Do you have money that is designated to pass to your grandchildren or children? These are funds that may be sitting in a bank CD or Savings Account. It’s money you don’t need to live on or have to live on. It’s money you want to know will get to children or family “NO MATTER WHAT HAPPENS IN THE FUTURE”. 3.) The only concern that you have …is what happens if you enter a nursing home before death. The money you wanted to pass to your children or family could be wiped out by long term care costs. 4.) Are you familiar with the Family Estate Trust? Let me explain the benefits…. Mildred’s Story and what happened •In 2001, Mildred sold her home for approximately $100,000.00 and moved into a senior apartment at the age of 71. She was in good health. •Her income was more than enough for her to pay her bills. She had $2,350 monthly income and the bills amounted to only $1,465 monthly. •She did not have long term care and she was concerned about the nursing home wiping out her grandchildren and children inheritances. •She wanted to leave $50,000 to her children, and she was concerned that a nursing home could wipe out this money before she died. If Mildred would have followed the advice from her financial planner. Today, she would be on Medicaid with a $50,000 Estate Planning Trust to her family. Good Planning Can Protect Assets ! •Her advisor said she should set up an “Estate Trust” with the $50,000 and after 60 months passed, this money would be protected from the nursing home and Medicaid. •For some reason Mildred never completed the trust with her advisor. •In January of 2007, Mildred entered a nursing home after a stroke. (*cost of nursing home was $6950 monthly) •In August of 2009, Mildred applies for Medicaid with only $1900.00 left in the bank. The Estate Trust Can Protect Assets If Mildred would have planned, she could be in the nursing home and still pass $50,000 to her family. Don’t let your clients become like Mildred. Help them plan now while they are healthy to protect assets. Estate Planning – Estate Planning Trust Worksheet Protecting Assets for our family by using the “Estate Trust” Name of client - _____________________________age - ____ Spouse - _________________________age-____ Address - ___________________________City - _________________State_____Zip -___________ Telephone - _________________________ _____Our Goals are to plan in advance with the “Estate Trust” to protect funds from the nursing home and Medicaid. We realize by planning 60 months in advance with the estate trust, these funds will be exempt in this irrevocable trust. _____ These are funds that we definitely want to pass to our children, grandchildren or charity. _____ These are funds that we don’t need to live on or depend on for income. _____ We don’t have long term care insurance. We are concern what would happen if we entered a nursing home. _____We understand that this trust is an irrevocable trust designated to pass these funds probate free to our named beneficiaries. Our Goals planning with the “Family Estate Trust” $ ________ (each) to our grandchildren $____________ - Church $________ (each) to our children. $____________ - Charity $ _________ - other This is the same life application as the funeral trust Existing Clients You already have relationship Do an Annual Review with Each of your customers. The best target age is from 60-90. •Help Your clients up date their accounts at bank with P.O.D. •Review their estate planning and financial documents •CD holders that have CD’s coming due. •Passbook Savings customers •SELL THE FUNERAL TRUST CONCEPT TO THEM. Annual review letter Every town has a SENIOR CENTER SENIOR CENTERS ARE ALWAYS LOOKING FOR SPEAKERS AT THEIR LUNCHEONS. ESPECIALLY ON SENIOR ISSUES There are probably 20 Senior Centers within 30 miles of your office. Almost every town has a senior center. They usually meet weekly for a luncheon. Go to each senior center and introduce yourself as a speaker that they might like to have at their up coming meetings. NEVER SELL PRODUCT WHEN YOU SPEAK…TALK CONCEPTS ONLY! Celebrity Seminars Travel Nationally CELEBRITY SEMINARS THINK OUTSIDE THE BOX LOOK-A-LIKE – SOUND A LIKE WITH YOUR MARKETING WHEN WAS THE LAST TIME YOU HAD THIS MANY PEOPLE CELEBRITY LOOK A LIKE FINANCIAL – SOUND ASEMINAR? LIKE SEMINARS ATTEND YOUR We Specialize in Financial Planning Seminars SENIORS LOVE OUR “LAS VEGAS” SHOW NATIONALLY KNOWN CELEBRITY SEMINARS Admission ticket SPEAKER – Attorney Karl Dovnik, Jr. 15th Annual Estate Planning Expo ADMISSION TICKET DELCO ESTATE PLANNING SERVICES, LLC October 11th , 2007 – 12:30 P.M. “Howard Johnson Conference Center” Wausau, Wisconsin FREE ENTERTAINMENT AFTER SEMINAR 12:30 P.M – 4 P.M – ESTATE PLANNING COURSE ARRIVE EARLY FOR BEST SEATING…THIS SEMINAR IS FREE…BUT YOU NEED THIS TICKET FOR ADMISSION After the invitation is sent, the seniors call into our 800 number To confirm seating. On this number we ask them to leave their Name, address, city, and the number of people that will be Attending…We then send this ticket to them a week or more in Advance…They won’t forget…ticket is used for admission. Boost Your Income with The Funeral Trust and Estate Trust During the last 3 weeks I made more than I could believe. GREAT Product! CALL DELCO BROKERAGE SERVICES WRITE (3) CASES PER MONTH with Funeal Trust AND EARN HUGE COMMISSIONS A CASE BEING HUSBAND AND WIFE AT $10,000 PREMIUM EACH = $20,000 PER CASE X 3 CASES = $ 60,000.00 60,000 x 12% = $ 7200.00 COMMISSION (BASE ON AGE 72) Write two Estate Trust s @ $50,000 = $100,000 premium Commission base on age 72 = $ 12,000.00 Approximately Total Commission for Month = $19,200.00 START SELLING THE FUNERAL TRUSTS INCREASE YOUR MONTHLY INCOME BY $7800.00 • • Direct Mailers Annual Review Letter Get Excited and start marketing to your existing clients. Huge Opportunity to make an EXTRA 7K MONTHLY OR MORE! START WRITING BUSINESS TODAY! Contract today With us to get on next training webinar Delco Brokerage Services, a division of Delco Estate Planning Services, LLC disclaims and implied or actual warranties as to the accuracy of this material or any liability with respects to it. Not intended for public distribution. This is not intended to be legal advice. Medicaid rules vary from state to state. Please consult an elder law attorney for exact rules pertaining funeral trusts in your state.