Grandparents Raising Grandchildren (GRG)

advertisement

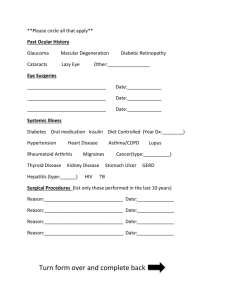

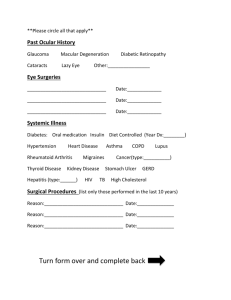

Grandparents Raising Grandchildren (GRG) An Individual Training Course for the GRG Program 1 Grandparents Raising Grandchildren (GRG) Georgia has a growing population of grandparents who, for a variety of reasons, are assuming the role of caretaker for their grandchildren. DFCS believes that when parents are unable to care for their children, it is preferable for their children to live with suitable family members rather than be placed with strangers. 2 Grandparents Raising Grandchildren (GRG) Grandparents are often at a time in their lives when their incomes are no longer growing. In fact, their income may be barely enough for them to get by. So, when grandparents take on the unexpected responsibility of raising a child, a personal financial crisis may ensue. 3 Grandparents Raising Grandchildren (GRG) In order to assist the growing population of grandparents who are raising their own grandchildren, DFCS, the Division of Aging Services (DAS) and the Office of Child Support Services (OCSS) are collaborating and exploring ways in we can help strengthen families headed by grandparents. As a result, a number of enhanced services will now be made available to grandparents who are raising their grandchildren. 4 DAS and Grandparents Raising Grandchildren Grandparents can call Local Area Agencies on Aging (AAAs) throughout the state to find out about services that are available through DAS and partner agencies. In the Atlanta Metro area, specialized workers, called Navigators, will be available to help grandparents access DAS services. 5 OCSS and Grandparents Raising Grandchildren OCSS will give priority status to referrals for cases involving grandparents raising their grandchildren. For cases in which the absent parent is currently paying child support, OCSS will immediately redirect those payments to the grandparent. For cases in which neither absent parent is paying child support, OCSS will work closely with the grandparent in order to obtain an order of child support as soon as possible. 6 DFCS and Grandparents Raising Grandchildren As part of our ongoing efforts to maintain and strengthen families, DFCS will provide direct support needed by grandparents who are raising their grandchildren. This support will include both cash assistance payments, paid through the Office of Family Independence (OFI), and specialized child care services provided through the Childcare and Parents Services (CAPS) program. 7 There will be multiple points of entry into a seamless system of services we will provide to grandparents raising their grandchildren. Point Of Entry Office of Child Support Services (OCSS) Identification of Needs Referral Agencies OCSS Child Support Medical Support August 1, 2006 August 1, 2006 GRANDPARENT Division of Family and Children Services (DFCS) GRANDPARENT August 1, 2006 Division of Aging Services (DAS) August 1, 2006 DFCS TANF, FS, Child Care, Energy Assistance, etc. August 1, 2006 DAS Kinship Care, Support Groups, Legal Advice, etc. August 1, 2006 GRANDPARENT Division of Mental Health (DMH) April 2007 Division of Mental Health (DMH) February 2007 GRANDPARENT Division of Public Health (DPH) February 2007 GRANDPARENT Division of Public Health (DPH) February 2007 GRG Cash Assistance – Who’s Eligible? To be eligible for GRG cash assistance, the following criteria must be met: the grandparent is the caretaker of his/her own grandchild the grandparent is 60 years of age and older, or the grandparent is disabled, the household is not participating in an existing foster care program nor receiving foster care per diems, the household’s income is less than 160% of the federal poverty level (FPL), and the AU applies for and receives TANF for the grandchild. 9 How is a household defined? Whose income is counted? For the purpose of determining financial eligibility, “household” is defined as including the grandparent, the grandparent’s spouse and the grandchild for whom assistance is requested. It is only income of household members, as defined in the paragraph above, that counts toward the income limit. Income that belongs to other persons living in the home is NOT counted for the purpose of determining eligibility for GRG cash assistance payments. 10 How can we know if a grandparent is disabled? In order to receive GRG assistance, a grandparent who is less than 60 years old must be disabled. If the grandparent receives either SSI or RSDI disability payments, we consider him to be disabled for GRG purposes. An award letter from the Social Security Administration is required for verification. 11 What kind of cash assistance is available? Two types of GRG cash assistance are available: GRG Emergency/Crisis Intervention Services Payment (CRISP), and GRG Monthly Subsidy Payment (MSP). 12 What is the CRISP? The GRG Crisis Intervention Services Payment (CRISP) is a one-time only cash payment equal to up to 3 times the maximum TANF cash assistance grant amount for that AU size. The CRISP may be received more than once if a grandchild moves into the home of a grandparent who has previously received a CRISP for another grandchild, and if the AU is otherwise eligible for the CRISP. 13 What is the CRISP? (cont.) The CRISP provides cash assistance to grandparents who need help in paying the cost of emergency expenses, such as unanticipated and sudden increases in shelter or utility costs, or new expenses incurred to pay for school supplies, furniture or even the legal expenses associated with gaining formal custody of a child. 14 How do we define an emergency? If the grandparent who is applying for assistance believes that her household is experiencing an emergency, and she meets the other GRG eligibility criteria, then she may receive the GRG CRISP. 15 How can we know if an emergency exists? To verify that an emergency exists, merely accept your client’s statement unless you have reason to question what your client claims. If questionable, you may use one of the following sources of verification: 1. lease agreement 2. utility bills/cut off notices 3. legal fees associated with the process of gaining custody of the grandchild. 16 How do we verify the amount of an emergency expense? We can accept the client’s statement about whether an emergency exists, but we must verify the actual cost of eliminating the identified emergency. Verify an expense that the grandparent has already paid with a receipt. Verify an anticipated expense, e.g., for a new bed, by a statement from a retailer. The item to be purchased, and the dollar amount, must be specified. 17 How do we compute the amount of a CRISP? The CRISP is paid in increments of the maximum TANF grant amount for one month, two months or three months, depending on what you have verified the dollar amount of the emergency expense to be. For example, if an AU is eligible for the CRISP, the AU verifies an emergency expense of $300, and the maximum TANF grant amount for the AU size is $235, the AU will be eligible to receive a CRISP of $470. This amount is equivalent to the maximum TANF grant amount for two months, which would be paid to the AU because the maximum grant amount for one month is less than the verified emergency expense. 18 Can a grandparent apply for the CRISP at any time? The CRISP is intended to help alleviate a crisis or emergency, not to pay for a family’s ongoing needs. However, an emergency can occur at any time, so the grandparent can come to us at any time and apply for the CRISP. 19 For what should the CRISP be used? Although the purpose of the CRISP is to help an eligible AU pay for expenses incurred as a direct result of a grandchild moving into the home, it is not our responsibility to monitor how the CRISP money is spent. 20 For what should the CRISP be used? (cont.) Examples of emergency needs may include a rent deposit because the grandparent must move into a larger apartment a utilities deposit because of the need to move into a larger apartment a one-time rent and/or utility assistance for a family at immediate risk of eviction or shut off of utilities incurring other unanticipated expenses, such as the purchase of furniture or school supplies. 21 Paying the CRISP should be the last, not the first option If an AU meets the eligibility criteria for receipt of the CRISP, but its emergency can be resolved using assistance from other sources, the grandparent must seek assistance from those other sources. Only when there has been an attempt to access all other potential sources of assistance can the CRISP be approved. There can be no duplication of cash assistance or other services provided to the AU. 22 What is the MSP? The GRG Monthly Subsidy Payment (MSP) is a cash payment of $50.00 per child, per month. The payment is ongoing, and eligibility for this payment does not require that an emergency expense has been incurred. However, in order to receive the MSP, the grandparent must receive TANF cash assistance for her grandchild. 23 Requirements for receipt of the MSP In order to qualify for a GRG MSP, a grandparent must meet the basic GRG eligibility criteria (refer back to the 9th slide). In addition, the grandparent must receive TANF cash assistance for the grandchild for whom the GRG MSP is requested. The grandparent cannot be included in the TANF AU, even if she may be potentially eligible to receive TANF. 24 Guidelines for Using MSP The basic needs for which GRG MSP may be used may include: shelter expenses (e.g., rent, mortgage and utilities) child care expenses clothing bedding, furniture or other supplies needed in order for the grandchild to move in legal expenses directly related to the grandparent’s efforts to gain custody of the grandchild other miscellaneous costs associated with the grandparent gaining custody of the grandchild. DFCS will not monitor how GRG cash assistance is spent. 25 Can an AU receive the CRISP and the MSP? Some AUs may qualify for both the CRISP and the MSP. If an AU is eligible for both forms of cash assistance, it can receive them simultaneously. Of course the CRISP, intended to resolve an emergency, is a one-time-only payment, while the MSP is paid on an ongoing basis. 26 What happens if the grandchild moves out? If the grandchild leaves the custody of the grandparent who is receiving GRG cash payments, the eligible grandparent must notify DFCS within 10 days of the departure from the home of the grandchild. A failure to report the departure of the grandchild within 10 days may result in an overpayment. The grandparent will have to repay the GRG MSP (and any TANF or FS overpayment) if an extra payment is received as a consequence of not reporting the child’s departure within 10 days. 27 GRG Relationship Requirements A child must be living in the home with a grandparent who receives the GRG cash assistance on the child’s behalf. Relationship is established by one of the following: 1. birth 2. ceremonial or common-law marriage 3. legal adoption, or 4. legal guardianship. 28 GRG Relationship Requirements (cont.) The following relationships also meet the relationship requirement: grandparent (up to great-great-great) spouse of a grandparent even if the marriage was terminated by death or divorce, unless the grandchild was born after the termination of the marriage. 29 GRG Relationship Requirements (cont.) The relationship of the child to the grandparent is traced by recording the names and relationships of all direct and intermediate relatives. Paternity must be established if the application is made by the paternal grandparent. If you need to do this in order to determine eligibility for GRG payments, follow TANF policy for establishing paternity. 30 Verifying Relationship Verification of relationship may not be available if the child lives with parent of the putative father and the putative father's whereabouts are unknown. You will need to make a decision based on all available information regarding the child's relationship to the grandparent who applies for assistance. Document the case record thoroughly. If the relationship of the child’s grandparent to the child’s father is questionable, verification of the relationship can be obtained using a variety of documents. Please refer to Section 1210 of the TANF policy manual for additional information. 31 How is GRG cash assistance counted in the TANF budget? GRG cash assistance, whether it is a CRISP or an MSP, is not counted in the TANF budget. GRG cash assistance is paid to an eligible AU in addition to, not instead of, any TANF cash assistance for which the AU may be eligible. 32 How is GRG cash assistance counted in a Medicaid budget? GRG cash assistance, whether it is a CRISP or an MSP, is disregarded in Medicaid budgets. 33 How is GRG cash assistance counted in a FS budget? The GRG CRISP is treated as a resource in a FS case. Remember that the resources of a TANF AU are disregarded for FS purposes. The GRG MSP is counted as unearned income in the FS budget. Be sure the AU knows that receipt of the GRG MSP could cause its FS benefits to decrease. 34 How to process an application for GRG cash assistance 1. If an application is made for the GRG MSP, first process a TANF application. 2. Complete form 354 (required for Form 351). 3. Complete Form 351, the GRG worksheet, in order to establish the AU’s eligibility for the GRG CRISP and/or MSP. 4. Document your findings in the case record and on SUCCESS. 35 How to process an application for GRG cash assistance (cont.) 5. Complete Form 281 in order to issue either the CRISP or MSP. The original copy of the completed form is sent to Fiscal Services, which will issue the payment. 6. Complete Form 282 in order to notify the AU of 1) its approval for receipt of GRG cash assistance, 2) the denial of its application, or 3) the termination of the MSP. 7. Complete Form 713G as needed in order to make referrals and share information with other staff who are responsible for providing other services and/or assistance to the family. 36 GRG forms Form 281 (payment authorization form): http://www.odis.dhr.state.ga.us/3000_fam/3390_tanf/CHAPTERS/For ms%20-%20Masters/Form%20281%20-%20MT%2013-%20082006.doc Form 282 (disposition notification form): http://www.odis.dhr.state.ga.us/3000_fam/3390_tanf/CHAPTERS/For ms%20-%20Masters/Form%20282%20-MT%2013-%2008-2006.doc Form 351 (GRG worksheet): http://www.odis.dhr.state.ga.us/3000_fam/3390_tanf/CHAPTERS/For ms%20-%20Masters/Form%20351-%20MT%2013-08-2006.doc 37 Policy References For additional information and the latest policy updates, please check the following link: http://www.odis.dhr.state.ga.us/3000_fam/3390_ tanf/TANF.htm Select MAN 3390 and go to Section 1210. 38 Thank you for your efforts in helping Georgia’s families to be strong and healthy!