Tutorial 7 Chapter 10: Macroeconomic equilibrium in the short run

advertisement

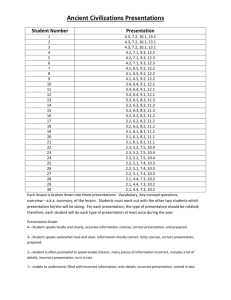

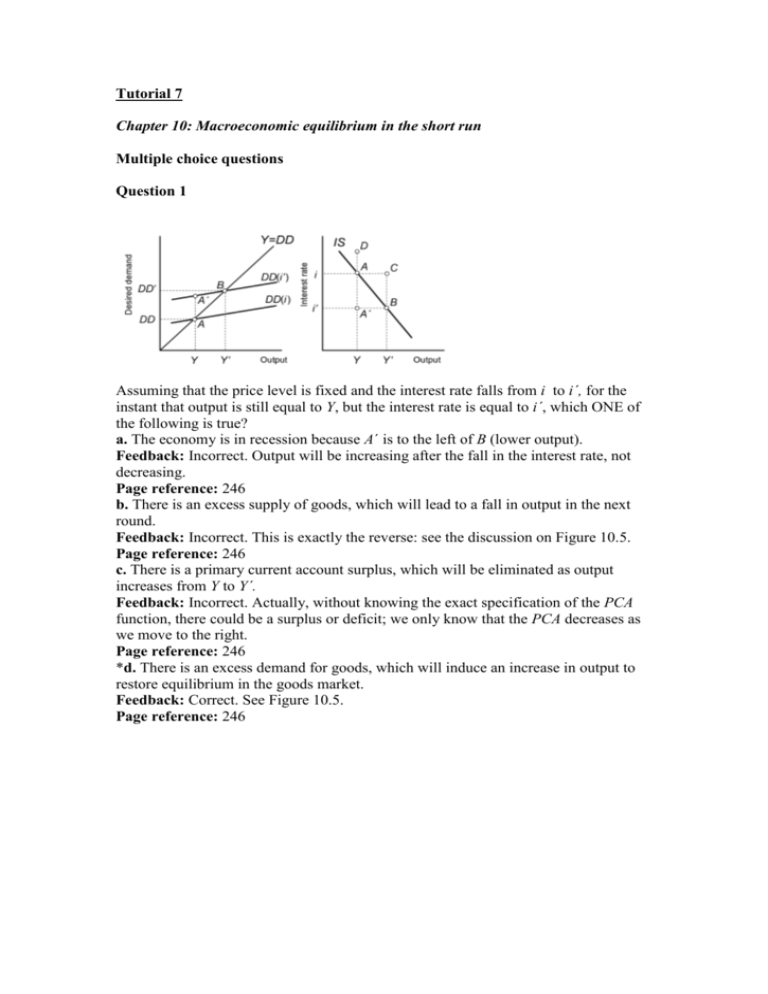

Tutorial 7 Chapter 10: Macroeconomic equilibrium in the short run Multiple choice questions Question 1 Assuming that the price level is fixed and the interest rate falls from i to i´, for the instant that output is still equal to Y, but the interest rate is equal to i´, which ONE of the following is true? a. The economy is in recession because A´ is to the left of B (lower output). Feedback: Incorrect. Output will be increasing after the fall in the interest rate, not decreasing. Page reference: 246 b. There is an excess supply of goods, which will lead to a fall in output in the next round. Feedback: Incorrect. This is exactly the reverse: see the discussion on Figure 10.5. Page reference: 246 c. There is a primary current account surplus, which will be eliminated as output increases from Y to Y´. Feedback: Incorrect. Actually, without knowing the exact specification of the PCA function, there could be a surplus or deficit; we only know that the PCA decreases as we move to the right. Page reference: 246 *d. There is an excess demand for goods, which will induce an increase in output to restore equilibrium in the goods market. Feedback: Correct. See Figure 10.5. Page reference: 246 Question 2 Assume that goods and money markets are in equilibrium such that the IS and TR curves intersect. An exogenous decrease in Tobin’s q shifts the IS curve to the [(A)_____]. In the new equilibrium, the interest rate is [(B)_____] and output is [(C)______]. *a. (A) left; (B) lower; (C) lower Feedback: Correct. See Figure 10.13, panel (a). Page reference: 257 b. (A) right; (B) higher; (C) higher Feedback: Incorrect. See Figure 10.13, panel (a). Page reference: 257 c. (A) left; (B) lower; (C) higher Feedback: Incorrect. See Figure 10.13, panel (a). Page reference: 257 d. (A) right; (B) lower; (C) higher Feedback: Incorrect. See Figure 10.13, panel (a). Page reference: 257 Question 3 Which ONE of the following factors does NOT contribute to a dampening of the multiplier process in the goods market? a. Saving. Feedback: Incorrect. This is a leakage from disposable income. Page reference: 243 *b. Investment. Feedback: Correct. Notice that in the specification of the investment function, only interest rates matter. Page reference: 243 c. Taxes. Feedback: Incorrect. This wedge between gross and net of taxes income reduces consumer spending on goods and services. Page reference: 243 d. Imports. Feedback: Incorrect. This is domestic spending that leaks out of the domestic economy to purchase foreign-produced goods. Page reference: 243 Question 4 The IS curve is the set of real GDP levels and interest rates compatible with [(A) ________], given [(B) _______]. a. (A) goods market equilibrium; (B) real money supply Feedback: Incorrect. The real money supply does not enter directly any of the demand components, only indirectly through the interest rate, which is being accounted for. Page reference: 246 b. (A) trend economic growth; (B) the price level Feedback: Incorrect. We are interested in the short-run deviations of output from trend. Page reference: 246 c. (A) goods market equilibrium; (B) the velocity of money 2 Feedback: Incorrect. The velocity of money has to do with the demand for money, which is related to the TR/LM curves. Page reference: 246 *d. (A) goods market equilibrium; (B) the price level Feedback: Correct. See Figure 10.5. Page reference: 246 Question 5 Which ONE of the following events would NOT shift the IS curve? a. A change in the real exchange rate. Feedback: Incorrect. This changes the net exports component of aggregate desired demand. Page reference: 240 b. A change in real income in the rest of the world. Feedback: Incorrect. The foreigners’ imports are our exports. Their demand for our goods depends on the level of their national income. Page reference: 240 *c. A change in the interest rate. Feedback: Correct. Aggregate desired demand is the sum of desired demands by households, firms, governments, and the rest of the world. Equilibrium in the goods market requires that Y = DD. The IS curve is all combinations of Y and i, holding all of the other variables in (10.9) constant, such that DD = Y. Page reference: 240 d. A change in tax payments to the government. Feedback: Incorrect. Household disposable income changes when taxes are changed, so that household desired demand for consumption goods would, indeed, change. Page reference: 240 Question 6 Under the Keynesian assumption, the Taylor rule is simplified to a relationship between [(A)___________] and [(B) _____________]. a. (A) output gap; (B) the deviation of unemployment from its equilibrium level Feedback: Incorrect. This is Okun’s law! Page reference: 251 *b. (A) output gap; (B) the interest rate set by the central bank Feedback: Correct. The Keynesian assumption of sticky prices means that, in the very short run, inflation is negligible, so the general Taylor rule boils down to the expression (10.11). Page reference: 251 c. (A) inflation gap; (B) the deviation of unemployment from its equilibrium level Feedback: Incorrect. Note that this is not quite an adjusted Phillips curve (coming attraction), since the benchmark is the inflation target of the central bank, rather than the underlying rate of inflation. Page reference: 251 d. (A) inflation gap; (B) the interest rate set by the central bank Feedback: Incorrect. This could be considered the neoclassical mirror image of the Keynesian assumption of an economy at equilibrium unemployment continuously with variation in inflation rates. NB. This does not reflect short-run macroeconomic reality. Page reference: 251 3 Question 7 If the central bank [(A)_____] its target (neutral) interest rate, the TR schedule shifts downwards and to the right. This is an example of [(B)_____]. a. (A) increases; (B) expansionary monetary policy Feedback: Incorrect. A reduction in the target rate leads to a reduction of the nominal interest rate via the Taylor rule which stimulates investment and thus output. See the discussion of Figure 10.11. Page reference: 254 *b. (A) reduces; (B) expansionary monetary policy Feedback: Correct. See the discussion of Figure 10.11. Page reference: 254 c. (A) increases; (B) contractionary monetary policy Feedback: Incorrect. A reduction in the target rate leads to a reduction of the nominal interest rate via the Taylor rule which stimulates investment and thus output. See the discussion of Figure 10.11. Page reference: 254 d. (A) reduces; (B) contractionary monetary policy Feedback: Incorrect. A reduction in the target rate leads to a reduction of the nominal interest rate via the Taylor rule which stimulates investment and thus output. See the discussion of Figure 10.11. Page reference: 254 Question 8 Assuming that both the price level and interest rate remain unchanged, according to this Keynesian characterization of the goods market, what exactly is the economic meaning of the length of the segment BC? a. Government demand for final goods and services. Feedback: Incorrect. See Figure 10.3. Page reference: 240 b. The non-income-dependent components of demand. Feedback: Incorrect. See Figure 10.3. Page reference: 240 c. Excess demand for goods at the existing price level. Feedback: Incorrect. See Figure 10.3. Page reference: 240 *d. The quantity of produced, but unsold, final goods and services. Feedback: Correct. See Figure 10.3. Page reference: 240 4 Open question: Exercise 1 from the book. Extra question: Exercise 9 from the book The starting point is the intersection of the IS and TR curve in point A. 5