Workplace Injury Rehabilitation and Compensation Act 2013

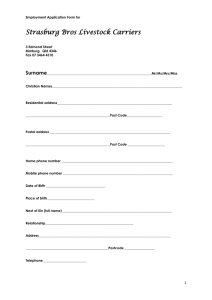

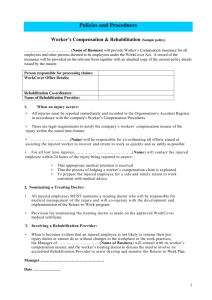

advertisement

Workplace Injury Rehabilitation and

Compensation Act 2013

No. 67 of 2013

TABLE OF PROVISIONS

Section

Page

PART 1—PRELIMINARY

1

Division 1—Introductory

1

1

2

3

4

5

6

7

8

9

Purpose

Commencement

Definitions

Interpretation provisions

Application of this Act to injuries

Claims for compensation

Matters affecting entitlement to compensation

Act binds the Crown

Access to information

Division 2—Principles and Guides

10

11

12

13

14

1

2

3

27

28

29

31

32

33

35

Objectives of Act

Statement of rights and obligations of workers

Statement of rights and obligations of employers

Flow charts

Effect of this Division

35

36

37

37

37

PART 2—WORKPLACE INJURIES

38

Division 1—Injuries

38

15

16

17

18

19

20

21

22

23

24

25

26

Flow chart 1—notice of injury

Notice to be displayed at workplaces

Register of injuries

Notice of injury

Flow chart 2—making a claim

Claim for compensation

Acknowledgement or notice of claim

When claim deemed not to have been made

Guidelines for sections 20, 21 and 22

Prohibition on recovery of certain costs

Medical certificate

Worker who does not have a medical certificate

i

38

39

40

40

43

44

46

47

48

48

48

49

Section

27

28

Page

Medical examinations

Return to work obligations of employers and workers

Division 2—Claims for compensation that may be lodged with

Authority

29

30

31

32

33

34

35

36

Lodging of claims with Authority in certain circumstances

Authority may require further information

Claims against certain employers

Record of employers referred to in section 31

Application of Parts 2, 3 and 5

Recovery by Authority of amount in relation to claim or

contribution

When application may be made to a court

Employer ceasing to exist

Division 3—Entitlement to compensation

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

Entitlement to compensation only if employment connected

with Victoria

Application to sailors

Entitlement to compensation

When no entitlement to compensation

Pre-existing injury or disease

Circumstances in which weekly payments are reduced

because of conviction for drink-driving offence

Circumstances in which weekly payments are reduced

because of conviction for drug-driving offence

No entitlement to compensation where conviction for certain

serious road traffic offences

If conviction or finding of guilt overturned

Out of or in the course of employment

Compensation for workers injured outside Australia

Person not to be compensated twice

Entitlement to damages outside Victoria

Compensation for disease due to employment

Proclaimed diseases

49

51

51

51

52

52

53

54

54

56

56

57

57

59

61

62

65

66

68

69

70

71

73

74

75

77

78

Division 4—Assessment of impairment

79

Subdivision 1—Preliminary

79

52

53

Definitions

Application of this Division to Division 5 of Part 5 and Part 7

Subdivision 2—Assessment in accordance with A.M.A Guides

54

55

56

Assessment of impairment

When and how to make an assessment of impairment

Injury, impairment or symptoms consequential or secondary

to physical injury

ii

79

79

80

80

82

82

Section

Page

Subdivision 3—Industrial deafness

57

58

59

60

61

62

63

82

Compensation for industrial deafness

Excluded deafness

Industrial deafness deemed to occur at constant rate

Assessment of industrial deafness

Further diminution of hearing

Effect of determination for industrial deafness

Assessing degree of impairment of whole person

82

83

83

83

84

86

87

Subdivision 4—Assessment of psychiatric, asthma and infectious

disease impairment

89

64

65

66

67

Psychiatric impairment

Occupational asthma impairment

Infectious occupational diseases

Guidelines referred to in this Subdivision

Subdivision 5—Assessment of spinal impairment

68

Spinal impairment

89

90

90

90

91

91

PART 3—COMPENSATION AND CLAIMS

92

Division 1—Preliminary

92

69

Definitions

92

Division 2—Liability and indemnity

70

71

72

Liability of Authority and employer

Authority to indemnify employer

Employer's excess

Division 3—Claims management—General

73

74

75

76

92

92

93

95

97

Responsibilities of employer

Guidelines

Responsibilities of self-insurers and the Authority

Notice to include statement of right of review

97

102

102

105

Division 4—Claims Management—Employer objection

106

77

78

79

80

81

82

83

84

85

Flow chart 3—employer objection process

Employer may request reasons for decision on a claim

Objection by employer in respect of liability

Objection lodged out of time

Authority may refuse to review a decision to which a

claimed employer has objected

Withdrawal of lodged objection

Request for information and suspension of review

Decision following review

Appeals

iii

106

107

107

108

109

109

110

111

113

Section

86

87

88

89

90

Page

Grounds of appeal

Hearing of appeal by Supreme Court

Costs of worker

Position of worker following decision under section 84

Recovery of payments

Division 5—Liability for payment of compensation

91

92

93

94

95

Application of Division

Liability to pay compensation in respect of an injury arising

out of or in the course of any employment on or after 1 July

2014

Provisions to apply where employer does not meet liabilities

Provisions relating to payment of compensation

Interim payment—weekly payments

114

114

115

115

116

117

117

117

117

118

119

PART 4—RETURN TO WORK

121

Division 1—Preliminary

121

96

97

98

99

100

101

Definitions

Purpose

Application of Part

Obligations of employers and workers

Section 28 and this Part do not derogate from other provisions

Part not to apply in certain circumstances

Division 2—Obligations of employers

102

103

104

105

106

107

108

109

Flow chart 4—return to work obligation of employers

Provide employment

Plan return to work

Consult about the return to work of a worker

Return to work co-ordinator to be appointed

Make return to work information available

Employer to notify Authority of return to work of worker

Host to co-operate with labour hire employer

Division 3—Obligations of workers

110

111

112

113

114

115

126

126

127

128

129

130

133

134

134

136

Flow chart 5—return to work obligation of workers

Participate in planning for return to work

Use occupational rehabilitation services

Participate in assessments

Return to work

Participate in an interview

Division 4—Termination of compensation

116

117

121

123

124

124

124

124

Failure to comply with Division 3

Notification of return to work

iv

136

137

137

137

137

138

139

139

142

Section

Page

Division 5—General provisions

118

119

120

121

122

123

124

125

142

Resolution of return to work issues

Information about the employment obligation period

Authority may give direction

Compliance code

Disallowance of certain compliance code orders

Effect of compliance codes

Effect of compliance with compliance codes

Functions of Authority in respect of compliance codes

Division 6—Return to Work Inspectorate

126

127

Appointment of inspectors

Identity cards

138

139

140

141

142

143

144

145

Interpretation

Inspectors subject to Authority's directions

Power to enter

Announcement on entry

Report to be given about entry

General powers on entry

Powers in relation to obtaining information

Return of seized things

Power to issue Return to Work improvement notice

Directions or conditions in a Return to Work improvement

notice

Variation or cancellation of Return to Work improvement

notice

Issue of Return to Work improvement notice

Formal irregularity or defect in Return to Work improvement

notice

Proceedings for offence not affected by Return to Work

improvement notice

Persons must assist inspector

Other assistance in exercising powers

Inspector may take affidavits and statutory declarations

Inspector may copy documents

Division 8—Offences

146

147

148

147

147

147

Division 7—Functions and powers of inspectors

128

129

130

131

132

133

134

135

136

137

142

143

144

144

145

146

146

146

148

148

148

148

148

149

150

150

151

152

154

154

154

156

156

157

157

158

158

158

Offences in relation to inspections

Protection of inspectors

Offence to impersonate inspector

v

158

159

159

Section

Page

Division 9—Review of decisions

149

150

151

159

Which decisions are reviewable

Internal review

Review by VCAT

159

160

162

PART 5—BENEFITS

163

Division 1—Preliminary

163

152

153

154

155

156

157

158

159

Definitions

Definition—pre-injury average weekly earnings

Definition applying to pre-injury average weekly earnings—

relevant period

Definition applying to pre-injury average weekly earnings—

ordinary earnings

Definition applying to pre-injury average weekly earnings

and current weekly earnings—base rate of pay

Definitions applying to pre-injury average weekly earnings—

earnings enhancement and enhancement period

Definition applying to pre-injury average weekly earnings

and current weekly earnings—ordinary hours of work

Twice the State average weekly earnings

163

165

167

169

170

171

172

173

Division 2—Weekly payments

174

Subdivision 1—General

174

160

161

162

163

164

165

166

167

Compensation in weekly payments [s. 93]

Weekly payments in first entitlement period

Weekly payments in second entitlement period

Weekly payments after the second entitlement period

Compensation for incapacity arising from surgery after

second entitlement period

Continuation of weekly payments after second entitlement

period

Entitlement under section 165 not affected by certain

circumstances

Certificates of capacity for work

Subdivision 2—Superannuation contributions

168

Compensation in the form of superannuation contributions

Subdivision 3—Compensation after retirement

169

170

171

Injury after retirement

Compensation for incapacity arising after retirement age

Compensation after retirement

vi

174

175

175

176

177

180

182

182

184

184

188

188

188

190

Section

Page

Subdivision 4—Effect of certain pensions on weekly payments

172

173

Effect of disability or other pensions and lump sums on

weekly payments

Notification of entitlement to certain payments

Subdivision 5—Provisions relating to the payment of

compensation

174

175

176

177

178

179

Regard not to be had to certain contracts etc.

Absence from Australia

Further provisions concerning compensation

Sentences of imprisonment

Time for payment

Payment of weekly payments

Division 3—Alteration or termination of weekly payments and

superannuation contributions

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

Application of Division

Application by worker to alter amount of weekly payments

Authority or self-insurer may terminate or alter weekly

payments

Grounds for alteration or termination of weekly payments

Grounds for alteration or termination of superannuation

contributions

Where worker's weekly payments are reduced

Termination or alteration of weekly payments under certain

provisions

When termination of compensation in the form of

superannuation contributions has effect

Notices

When a required period of notice must be given

Reduction of weekly payments after the first entitlement

period

Termination of weekly payments after expiry of second

entitlement period

Notice of reduction of weekly payments

Outstanding weekly payments

Outstanding superannuation contributions

Division 4—Claims for compensation for non-economic loss

195

196

197

198

199

200

Flow chart 6—impairment benefits process

Definitions

Claims for compensation under Division 5

Division 5 claim cannot be made unless all proceedings

under section 328(2)(b) have been determined

Initiation of claim by Authority or self-insurer

Authority may suspend a claim

vii

190

190

193

195

195

195

196

197

197

198

200

200

200

201

201

203

203

205

206

207

207

209

210

211

212

214

216

216

217

218

219

219

219

Section

201

202

203

204

205

206

207

208

209

Page

Authority or self-insurer to accept or reject claim

No proceedings by worker in relation to rejection of

liability without certificate of Conciliation Officer

Assessment of impairment

Written statement of injuries

Worker to advise Authority or self-insurer of worker's

acceptance or dispute of decision as to liability under

section 201(1)

Variation by court or by agreement of decision under

section 201(1)(a)

Reference of dispute under section 205(3)(a) or 206(3)(a) to

Medical Panel

No appeal from certain determinations and opinions

Minister may give directions

Division 5—Compensation for non-economic loss

210

211

220

222

222

223

224

225

227

229

229

230

Definitions

Compensation for non-economic loss—permanent

impairment

Compensation for non-economic loss—permanent

psychiatric impairment

Compensation for non-economic loss—industrial deafness

in respect of further injury

Compensation for non-economic loss-—loss of foetus

Injuries by gradual process other than industrial deafness

Effect of payment of compensation under this Division

Limits on compensation

Compensation not payable after death of worker

Compensation not to exceed relevant maximum

Payment of compensation as lump sum

No Disadvantage—Compensation Table

230

Division 6—Rehabilitation services prior to acceptance of claim

241

212

213

214

215

216

217

218

219

220

221

222

Authority or self-insurer may pay for rehabilitation service

Division 7—Compensation for medical and like services

223

224

225

226

227

228

229

230

231

Definitions

Liability of Authority and self-insurer

Where services provided by employer

To whom compensation under this Division is to be paid

Certain actions etc. not permitted

Medical and like services outside Australia

Compensation not payable for certain accommodation etc.

Occupational rehabilitation services

Modification of cars and homes

viii

232

234

235

237

237

238

239

240

240

240

240

241

242

242

244

246

246

247

248

249

250

252

Section

232

233

Page

Duration of compensation under this Division

Termination of payment for professional services obtained

fraudulently

Division 8—Compensation for death of worker

234

235

236

237

238

239

240

241

242

243

Definitions

How compensation for death of worker determined

Dependants

Dependent children and partners and partially dependent

partner

Certain compensation payable to trustee

Interest payable [s. 92A(12)]

Reimbursement of expenses incurred by non-dependent

family members of a deceased worker

Weekly pensions for dependants of worker who dies

Payment of weekly pensions

Provisional payments

255

256

257

257

259

259

261

262

262

263

265

270

271

Division 9—Voluntary settlements

274

Subdivision 1—Settlements in specific circumstances

274

244

245

246

To whom this Subdivision applies

Right to apply for settlement

Amount of settlement

Subdivision 2—Other settlements

247

248

249

250

277

Application of this Subdivision

Right to apply for settlement

Amount of settlement

Order in Council concerning settlements

Subdivision 3—Application procedure

251

252

253

254

255

256

257

258

259

260

261

262

263

274

275

275

Expression of interest must first be given

Authority or self-insurer must respond to expression of

interest

Application for settlement

Time limit for making applications

Authority or self-insurer must respond to application

Time limit on response to offer

Payment and nature of settlement amounts

Adjustment of settlement amount offers

Worker may withdraw application at any time

Circumstances in which offer may be withdrawn or

settlement avoided

Preclusion of further claims

Authority or self-insurer may extend or waive time limits

Minister may give directions

ix

277

277

277

277

278

278

279

280

280

281

281

281

282

284

284

285

286

286

Section

Page

PART 6—DISPUTE RESOLUTION

289

Division 1—Jurisdiction

289

264

265

266

267

268

269

270

271

272

273

274

275

276

277

278

279

Jurisdiction—general

Jurisdiction under Workers Compensation Act 1958

Jurisdiction of Magistrates' Court

Application of this Act to the Magistrates' Court

Certain evidence given in a conciliation inadmissible in

certain proceedings

Evidence relating to worker's claim

Protection of information given to Medical Panel

Admissibility of certificates of Medical Panel

Certain persons not compelled to give evidence

Certain proceedings referred for conciliation

Medical questions

Court may state a question regarding factual issues before

referring a medical question to a Medical Panel

Court to give copies of documents to parties

Copies of Medical Panel's opinion

Costs

Costs liability of legal practitioner

Division 2—Disputes and conciliation

280

281

282

283

284

285

286

287

288

289

290

291

292

293

294

295

296

297

Flow chart 7—dispute resolution process if a worker

disagrees with a decision

Definitions

Lodging of disputes

Power of Senior Conciliation Officer to allow lodging of

dispute

Conciliation officer may seek opinion of a Medical Panel

on medical question

Referral of medical question relating to section 165 of this

Act or section 93CD of the Accident Compensation

Act 1985

Production and disclosure of information

Representation by legal practitioner

Information from provider of medical service or other service

Costs of reports by registered health practitioners

Conciliation without conference

Power to request or release documents etc.

Offence to make false or misleading statement

Duty of Conciliation Officers

Powers of Conciliation Officers

Offence not to comply with direction

Outcome certificates to be issued

Conciliation Officer may give directions about payment of

compensation

x

289

290

291

291

291

292

292

293

293

293

294

296

297

297

297

300

303

303

304

304

305

305

305

306

306

306

307

307

308

308

308

309

310

310

311

Section

298

299

300

301

Page

Genuine disputes about liability for compensation referred

to in section 297(1) and (2)

Revocation of directions of Conciliation Officer

Payments under direction etc. not admission of liability

Costs

Division 3—Medical Panels

302

303

304

305

306

307

308

309

310

311

312

313

317

Function of Medical Panel

Procedures and powers

Reference of medical question

Convenor to convene Medical Panel

When opinion on medical question may not be given

What a Medical Panel may ask a worker to do

Examination by Medical Panel

If worker unreasonably refuses to comply with request

under section 307

Attendance before Medical Panel to be in private

Medical Panel can ask provider of medical service to attend

Medical Panel may request further information

Opinions

Division 4—Determination by courts and recognition of

determinations

314

315

316

317

314

314

315

316

Determination of State with which worker's employment is

connected in proceedings under this Act

Determination of the State with which worker's employment

is connected

Recognition of previous determinations

Determination may be made by consent

317

317

318

318

319

319

319

320

321

322

322

323

324

324

324

325

326

PART 7—ACTIONS AND PROCEEDINGS FOR DAMAGES

327

Division 1—Choice of Law

327

318

319

320

321

322

323

Claims to which this Division applies

The applicable substantive law for work injury damages

claims

What constitutes injury and employment and who is employer

Claim in respect of death included

Meaning of substantive law

Availability of action in another State not relevant

Division 2—Actions for damages

324

325

326

327

328

327

328

329

329

329

331

332

Flow chart 8—common law process

Definitions

Actions for damages

Actions for damages—serious injury

Proceedings under this Division

xi

332

333

338

339

340

Section

329

330

331

332

333

334

335

336

337

338

339

340

341

342

343

344

345

346

347

348

349

350

351

352

353

354

355

356

Page

Medical examination

Authority or self-insurer to respond to application

Response by applicant

Certain material not admissible in proceedings

Conference before proceedings commence

Statutory offer and counter offer

Proceedings for damages for serious injury

Finding on an application does not give rise to issue estoppel

Authority may consent to bringing of proceedings

No further application allowed

Worker not entitled to recover damages for same injury

despite review of degree of impairment

Proceedings—limitations on awards

Jury not to be informed of certain matters

Limitation on damages in respect of pecuniary loss

Judgments, order for damage, settlement or compromise to

be reduced by certain amounts of compensation paid

Costs

Present value of future loss to be qualified

Limitation on award of interest on an amount of damages

When Authority, employer and self-insurer cease to be liable

to pay weekly payments

Determination of serious injury application after death of

worker

Calculation of limitation of actions period within which

proceedings may be commenced

Division not to affect date of accrual of cause of action

Effect of decision on application

Directions

Legal practitioner may recover costs

Legal costs order

Litigated claims legal costs order—workers

Litigated claims legal costs order—Authority and self-insurers

Division 3—Actions by terminally ill workers or workers with

asbestos-related conditions

357

358

Actions by terminally ill workers or workers with asbestos

related conditions

Actions by terminally ill workers continued after death of

worker

Division 4—Administration by a trustee

359

Certain funds to be administered by trustee

xii

342

343

344

344

345

346

346

348

348

349

349

350

351

351

352

352

355

356

356

357

361

362

362

362

363

363

364

366

367

367

369

370

370

Section

Page

Division 5—Conduct of common law proceedings

360

361

362

363

364

365

Definitions

Application of Division

Apportionment of liability

Notice of proceedings

Conduct of defence

Order for apportionment of liability

Division 6—Other actions and rights

366

367

368

369

370

371

Damages under Part III of Wrongs Act 1958

Liability of Transport Accident Commission

Settlement between Transport Accident Commission and

the Authority

Indemnity by third party

Substantive law

Compensation for pain and suffering

370

370

371

371

372

372

374

376

376

377

379

379

382

382

PART 8—SELF-INSURERS

384

Division 1—General

384

372

373

374

Definitions

Student workers

Municipal Association of Victoria as self-insurer

Division 2—Application for approval as self-insurer

375

376

377

378

Determination of eligibility to apply for approval as

self-insurer

Application for approval as self-insurer

Estimated relevant remuneration

Adjustment of application fee

Division 3—Approval as self-insurer

379

380

381

382

383

384

385

386

387

Approval as self-insurer

Terms and conditions of approval

Notice to be given to employer if application refused

Period that approval has effect

Approval of new holding company as self-insurer

Review of approval

Revocation of approval

Cost associated with revocation recoverable from employer

Non-WorkCover employer ceases to be a self-insurer

Division 4—Contributions to WorkCover Authority Fund

388

389

Payment of contribution

Submission of return by self-insurer

xiii

384

385

386

386

386

387

389

390

391

391

393

394

394

395

396

398

400

401

401

401

402

Section

Page

Division 5—Review of contributions by self-insurers

390

Review of contributions

402

402

Division 6—Liability for claims for compensation

403

Subdivision 1—Liability of self-insurer

403

391

392

393

394

Self-insurer's liability to pay compensation

Claims management

Liabilities of self-insurer to be guaranteed

Payments by Authority

Subdivision 2—Election by self-insurer to assume liability for tail

claims

395

396

397

398

399

400

401

402

Movement from scheme insurance to self-insurance

When a self-insurer becomes an eligible subsidiary of a

holding company

When an employer that is a body corporate becomes an

eligible subsidiary of a self-insurer

When a self-insurer becomes an eligible subsidiary of

another self-insurer

Guarantee of liability for tail claims

Requirement for guarantee

Arrangements for payments in respect of liability for tail

claims

Where an eligible subsidiary ceases to be an eligible

subsidiary of a self-insurer

Subdivision 3—Employer that ceases to be self-insurer or

otherwise to be liable for tail claims

403

404

405

406

407

408

409

Employer ceases to be self-insurer

General provisions applying to assessment by an actuary

Initial assessment of liability for tail claims

Annual assessment of tail claims liabilities and adjustment

of payments

Provision of guarantees

Review of final revised assessment at the end of the liability

period

Eligible subsidiary of self-insurer becomes a non-WorkCover

employer

Division 7—Miscellaneous

410

411

412

403

403

404

407

408

408

411

413

415

418

419

420

420

421

421

423

424

425

426

430

431

433

Guidelines

Effect of guidelines

Secrecy provisions

433

434

434

xiv

Section

Page

PART 9—NON-WORKCOVER EMPLOYERS

413

414

415

416

417

418

419

420

421

422

423

424

425

426

427

428

Definitions

Authority retains or assumes liability for tail claims

Actuary to assess tail claims liabilities

Obligation of non-WorkCover employer

Annual assessment of tail claims liabilities

Adjustment of payments as at the end of the third year

Adjustment of payments as at the end of the sixth year

Payments of tail claims

Provision of guarantees

Provision of new guarantee

Recovery under guarantees

Review of final revised assessment at the end of the liability

period

Liability of Authority under this Part

Legal proceedings excluded

Application of Part if non-WorkCover employer ceases to be

a non-WorkCover employer

Failure to comply with a provision of this Part

438

438

440

441

442

442

443

443

444

444

446

446

447

448

448

448

449

PART 10—PREMIUMS AND REGISTRATION OF

EMPLOYERS

450

Division 1—Preliminary

450

429

430

431

432

Application

Liability to pay premium

Groups

Joint and several liability of group members

Division 2—Registration

433

434

435

436

437

438

459

Flow chart 9—registration of employer

Registration of employers

Statutory contract of insurance

Registered employer to notify change of circumstances

Evidence that employer is registered under this Part

Books and accounts to be preserved

Division 3—Rateable remuneration

439

440

441

442

443

444

450

450

451

457

Employer to give estimate of rateable remuneration

Authority may estimate rateable remuneration of employer

Certified statement of rateable remuneration

Employer to give certified statement

Revised estimates of rateable remuneration

Where employer fails to provide accurate information about

rateable remuneration

xv

459

460

461

462

463

463

464

464

464

464

465

465

467

Section

445

446

Page

Worker employed under Transport Accident Commission

program

Superannuation benefits and calculation of premiums

Division 4—Premiums

447

448

449

450

451

452

453

454

455

456

457

458

470

Flow chart 10—Determination of premium process

Premiums order

Authority may give notice of premium

Premium payable where employer not registered for whole

of premium period

Adjustment of premium in certain circumstances

Default penalty

Payment and recovery of penalties

Late payment penalty

Default penalty where failure to provide full and true

disclosure

Application for refund of premium

Premium avoidance schemes

Proceedings not to be brought

Division 5—Premium review

459

460

461

462

463

464

465

466

467

468

469

470

471

472

473

474

475

476

477

467

468

470

471

472

472

473

473

474

475

475

476

477

478

479

Flow chart 11—premium review process

Definitions

Employer may apply for review of a reviewable amount

under this Division

Time for making, and form of, application for review

Application for review made out of time

Authority may decline application for review

Withdrawal of application for review

Time period for review

Request for information and suspension of review

Determination of review

Payments following review of reviewable amount

Interest payable following review of reviewable amount

Deemed determinations of the Authority

Review of premium by Authority at its discretion

Adjustment of premium after review

Application of adjustment powers under section 473

Recovery of increased premium

Refund of premium may be offset

Exercise of review and adjustment powers

xvi

479

480

481

481

482

482

483

483

484

485

486

487

488

488

489

489

490

490

490

Section

Page

Division 6—Review by VCAT and appeal to Supreme Court

478

479

480

481

482

483

484

485

486

487

Right of review and appeal

Request for further and better particulars

Payment of fee or filing fee before review or appeal

Authority to lodge material

Grounds of review

Onus on review or appeal

Review by VCAT

Supreme Court appeals

Authority to give effect to decision on review

If no appeal from a decision or order

Division 7—Recovery of premium or penalty

488

489

Recovery of premium or penalty

Evidence

Division 8—Reviews by Minister

490

491

491

492

492

492

493

493

494

494

494

495

495

495

496

497

Review of setting of premiums

497

PART 11—THE VICTORIAN WORKCOVER AUTHORITY

499

Division 1—Constitution

499

491

492

493

494

495

496

497

498

499

500

501

The Authority

Objectives of the Authority

Functions of the Authority

Powers of the Authority

Accountability of the Authority

Guidelines, forms and advisory practice notes

Power to give advice on compliance

Chief Executive Officer

Officers and employees

Delegation

Authorised agents

Division 2—Board of Management

502

503

504

505

506

507

508

509

510

511

Establishment of Board

Constitution of Board

Execution of documents

Judicial notice of signatures

Directors generally

Acting Directors

Vacancy, resignation and termination

Chairperson

Meetings of the Board

Pecuniary interests of Directors

xvii

499

499

500

504

506

506

507

507

508

509

510

512

512

512

512

513

513

513

515

515

517

518

Section

Page

Division 3—WorkCover Advisory Committee

512

WorkCover Advisory Committee

Division 4—Financial matters

513

514

515

516

517

518

519

519

521

WorkCover Authority Fund

Borrowing powers

Repayment of capital

Dividends

Budget

Operating and financial report

521

524

524

525

525

525

PART 12—OTHER BODIES

526

Division 1—Accident Compensation Conciliation Service

526

519

520

521

522

523

524

525

526

527

528

529

530

531

532

533

534

535

536

Conciliation Service

Constitution of the Conciliation Service

Function

Powers

Appointment of Senior Conciliation Officer and

Conciliation Officers

Acting Senior Conciliation Officer

Engagement of Conciliation Officers and staff

Protection against liability for Conciliation Officers

Functions of the Senior Conciliation Officer

Minister may make guidelines

Senior Conciliation Officer may give directions

Data to be collected by the Senior Conciliation Officer

Vacancy and resignation

Senior Conciliation Officer may advise removal or

suspension from office

Removal from office by Governor in Council

Conciliation Service budget

Authority to fund the Service

Signature

Division 2—Medical Panels

537

538

539

540

541

526

526

526

526

527

527

528

529

529

530

530

530

531

532

532

533

534

534

534

Establishment and constitution

Term, resignation and termination

Advisory functions

Validity of acts or decisions

Protection for Convenor and members of a Medical Panel

xviii

534

536

537

537

538

Section

Page

PART 13—GENERAL

539

Division 1—Indexation

539

542

543

544

545

546

547

Indexation—weekly payments

Indexation of weekly pensions for dependants of a worker

who dies

Indexation of certain amounts—according to average

weekly earnings

Indexation of certain amounts—consumer price index

Indexation—no reduction

Indexation—rounding

Division 2—Agreements

548

549

550

551

Reciprocal agreements—compensation

Reciprocal agreements—premiums or other amounts

Reciprocal agreements—relevant services

Incentive agreements to improve employer performance

Power to obtain information and evidence

Powers of inspection

Offences

Access to police records

Court to provide certificate of conviction

VicRoads may disclose information to Authority

Issue of search warrants

563

564

565

566

567

547

548

549

550

551

553

554

555

556

556

557

557

Division 5—Prohibited conduct relating to touting for claims

559

560

561

562

542

543

546

547

551

Division 4—Issue of search warrants

558

540

547

Division 3—Access to information

552

553

554

555

556

557

539

Definitions

Prohibited conduct by agents

Offence of engaging in prohibited conduct

Consequences of prohibited conduct for recovery of fees by

agents

Consequences of prohibited conduct for legal practitioners

Legal practitioner and agents can be requested to certify as

to prohibited conduct

Power to restrict or ban recovery of costs by agents who

engage in prohibited conduct

Power to restrict or ban agents who engage in prohibited

conduct

Duty of claimants to comply with requests for information

about agents and legal practitioners

xix

561

561

562

564

564

565

566

568

569

570

Section

Page

Division 6—Regulation of providers of professional services

568

569

570

571

572

573

574

Suspension of payments for services

Effect of disqualifying offence

Conduct of service providers

Findings of relevant bodies

Notice to be given before determination made

Authority may publish list of providers subject to

disciplinary action

Victorian Civil and Administrative Tribunal

Division 7—Discriminatory conduct

575

576

577

578

579

580

Offence to engage in discriminatory conduct

Order for damages or reinstatement

Procedure if prosecution is not brought under section 575

Civil proceedings relating to discriminatory conduct

Effect of orders on other orders under section 575, 576 or 578

Claims under section 576 or 578

570

570

573

574

578

579

580

580

582

582

584

586

588

591

592

Division 8—Offences

592

Subdivision 1—Fraud, bribery and false information

592

581

582

583

584

585

586

587

Fraud

Bribery

False or misleading information

False or misleading statements

False information

Investigations

Indemnity

Subdivision 2—Other offences

588

589

598

Unauthorised use of information

Obstructing officers

Division 9—Miscellaneous

590

591

592

593

594

595

596

597

598

599

600

592

593

594

595

596

597

597

598

598

598

Certificate

State taxation officer

Signature

Service of documents by the Authority

Service of documents on the Authority

Secrecy provisions

Liability of premium adviser

Protection against self-incrimination

Legal professional privilege and client legal privilege not

affected

Refunding money to the Authority etc.

Imputing conduct of bodies corporate

xx

598

599

599

599

600

601

603

604

605

605

606

Section

601

602

603

604

605

Page

Criminal liability of officers of bodies corporate—failure

to exercise due diligence

Responsible agency for the Crown

Proceedings against successors to public bodies

Undertakings

Adverse publicity orders

Division 10—Prosecutions

606

607

608

615

Institution of prosecutions under Part 4

Return to work—procedure if prosecution is not brought

Institution of prosecutions

Division 11—Directions and Guidelines

609

610

611

612

Directions given by the Minister

Directions given for the purposes of Part 4

Guidelines made by the Minister

Guidelines made by the Authority

Division 12—The Authority and the IBAC

613

614

615

616

Mandatory notification of corrupt conduct to IBAC

Consultation prior to notification

Communication of information to the IBAC

Authority not to prejudice investigations of the IBAC

Division 13—Section 85 provisions

617

618

619

Supreme Court—limitation of jurisdiction—conferral of

exclusive jurisdiction

Supreme Court—limitation of jurisdiction—no proceedings

Proceedings

618

618

619

619

620

620

620

621

621

621

622

622

622

623

Regulations

Transitional regulations

623

624

Division 15—Savings, Repeal and Transitionals

622

623

615

615

616

622

Division 14—Regulations

620

621

607

610

611

612

613

Re-enacted provisions of Accident Compensation Act 1985

Repeal of Accident Compensation (WorkCover Insurance)

Act 1993

625

625

637

PART 14—AMENDMENTS AND REPEALS

639

Division 1—Accident Compensation Act 1985

639

624

625

626

Amendment of Part I

Section 5 substituted—Definitions

5

Definitions

Amendment of sections 5, 5A, 5AB, 5AE, 8(5) and 68

xxi

639

640

640

641

Section

627

628

629

630

631

632

633

634

635

636

637

638

639

640

641

642

643

644

Page

Repeal of sections 5C, 5D and 5E, Division 3 of Part I and

Parts II and III

Part IV

Amendment of section 92B

Further amendment of Part IV

Sections 100 to 100C substituted

100

Indexation—weekly payments

100A Indexation of weekly pensions for dependants of a

worker who dies

100B Indexation of certain amounts—according to average

weekly earnings

100C Indexation of certain amounts—consumer price index

Dollar amounts as at 1 July 2013—benefits

Dollar amounts as at 1 July 2013—payment, contributions etc.

Amendment of sections 101, 102 and 103

Amendment of sections 104B to 118

New section 123B substituted

123B Prohibition on recovery of certain costs

Amendment of sections 124, 125 and 125A

Further amendment of Part IV

Parts V, VIA, VIIA and VIIB

Part VIII

Part IX, section 313 substituted

313

Section 93CD

Part IX, new section 352A inserted

352A Retrospective operation of certain instruments of

delegation

Part IX, new section 368A inserted

368A Section 91(3AAA)

Savings and Transitional

Division 15—Workplace Injury Rehabilitation and

Compensation Act 2013

643

643

645

646

651

651

652

655

657

660

663

664

665

667

667

667

668

668

668

669

669

669

669

670

670

671

671

391

Workplace Injury Rehabilitation and

Compensation Act 2013

Repeal of spent provisions

Schedules

671

671

671

Division 2—Accident Compensation (WorkCover Insurance)

Act 1993

672

645

646

647

Amendment of section 87 of Accident Compensation

(WorkCover Insurance) Act 1993

87

Part 2A (Premium review)

Division 3—Amendment of other Acts

648

649

Workers Compensation Act 1958

Amendment of Acts specified in Schedule 9

xxii

672

672

672

672

673

Section

Page

Division 4—Repeal of Part 14 and Schedule 9

650

Repeal of Part 14 and Schedule 9

__________________

673

673

SCHEDULES

674

SCHEDULE 1—Further Interpretative Provisions

674

PART 1—PERSONS DEEMED TO BE WORKERS OR

EMPLOYERS

674

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

Students etc. deemed to be workers and their deemed

employers

Declared training programs

Persons attending certain employment programs deemed to

be workers

Co-operatives—deemed workers and employers

Door to door sellers

Timber contractors

Drivers carrying passengers for reward

Owner drivers carrying goods for reward

Contractors

Remuneration and contractual arrangements

Claims to be made against principal

Share farmers

Religious bodies and organisations

Persons employed in the public sector

Municipal Councillors

Places of pick-up

Sporting contestants

Riders and drivers in certain races

Outworkers

PART 2—REMUNERATION

20

21

22

23

24

677

677

678

679

680

681

682

684

685

686

687

688

689

689

690

691

692

695

Definition of remuneration

Remuneration—value of remuneration comprising fringe

benefits

Remuneration—motor vehicle allowance

Remuneration—accommodation allowance

Rateable remuneration

PART 3—OTHER INTERPRETATION PROVISIONS

25

26

27

674

676

Significant contributing factor

Member of a family

Superannuation benefit

xxiii

695

698

699

700

701

702

702

702

703

Section

Page

SCHEDULE 2—Pre-injury Average Weekly Earnings

705

SCHEDULE 3—Modification to Degrees of Impairment for the

Purposes of Division 5 of Part 5

710

SCHEDULE 4—No Disadvantage—Compensation Table

712

SCHEDULE 5—Table to be used to Determine Settlement

Amounts under Section 246

716

SCHEDULE 6—Self-insurers—Pre-application Eligibility Fee

717

1

Pre-application eligibility fee

SCHEDULE 7—Application Fee for Approval as Self-insurer

1

2

3

Application fee

Assessment remuneration

Fee limit

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

718

718

718

719

SCHEDULE 8—Persons to Whom Document may be Produced

or Information Communicated or Divulged

1

717

The Secretary to the Department of State Development,

Business and Innovation.

The Secretary to the Department of Environment and

Primary Industries.

The Secretary to the Department of Transport, Planning and

Local Infrastructure.

The Secretary to the Department of Treasury and Finance.

The Coroners Court.

The Public Advocate.

The Commissioner of State Revenue.

The Transport Accident Commission.

A person who has responsibility for the administration of a

welfare, benefit or compensation scheme of a State or

Territory or the Commonwealth.

A corresponding authority.

A Department or public entity within the meaning of the

Public Administration Act 2004.

The National Occupational Health and Safety Commission.

The Australian Bureau of Statistics.

The Board or committee of management (by whatever name

called) of a statutory superannuation scheme within the

meaning of the Superannuation (Portability) Act 1989.

Any special commission (within the meaning of the Evidence

(Commissions) Act 1982) where—

A person, committee or body approved by the Governor in

Council.

A committee of the Parliament.

xxiv

721

721

721

721

721

721

721

721

721

721

721

721

721

721

721

722

722

722

Section

18

19

20

21

22

23

Page

CPA Australia.

A National Board within the meaning of the Health

Practitioner Regulation National Law.

Legal Services Board.

Legal Services Commissioner.

Victorian Bar Inc..

CoINVEST Limited A.C.N. 078 0040985 or its successors.

SCHEDULE 9—Consequential Amendments

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

Asbestos Diseases Compensation Act 2008

Children, Youth and Families Act 2005

Civil Procedure Act 2010

Conservation, Forests and Lands Act 1987

Constitution Act 1975

Corrections Act 1986

Country Fire Authority Act 1958

County Court Act 1958

Credit Act 1984

Criminal Procedure Act 2009

Dangerous Goods Act 1985

Duties Act 2000

Education and Training Reform Act 2006

Emergency Management Act 1986

Emergency Services Superannuation Act 1986

Equipment (Public Safety) Act 1994

Evidence Act 2008

Evidence (Miscellaneous Provisions) Act 1958

Independent Broad-based Anti-corruption Commission

Act 2011

Juries Act 2000

Limitation of Actions Act 1958

Local Government Act 1989

Long Service Leave Act 1992

Magistrates' Court Act 1989

Occupational Health and Safety Act 2004

Ombudsman Act 1973

Owner Drivers and Forestry Contractors Act 2005

Police Assistance Compensation Act 1968

Police Regulation Act 1958

Radiation Act 2005

Road Safety Act 1986

Transport Accident Act 1986

xxv

722

722

722

722

722

722

723

723

723

723

724

725

725

726

727

727

727

727

728

728

730

731

731

732

732

732

733

734

734

734

735

735

738

738

739

739

740

740

740

Section

33

Page

Victorian Civil and Administrative Tribunal Act 1998

742

PART 24—WORKPLACE INJURY REHABILITATION

AND COMPENSATION ACT 2013

742

104

34

35

36

Tribunal may request information about a

determination

105

Compulsory conference in WorkCover proceedings

Victorian Managed Insurance Authority Act 1996

Victoria State Emergency Service Act 2005

Wrongs Act 1958

28LZL Operation of Panel provisions of the Workplace

Injury Rehabilitation and Compensation Act 2013

═══════════════

ENDNOTES

742

743

743

743

745

746

748

xxvi

Victoria

Workplace Injury Rehabilitation and

Compensation Act 2013†

No. 67 of 2013

[Assented to 12 November 2013]

The Parliament of Victoria enacts:

PART 1—PRELIMINARY

Division 1—Introductory

1 Purpose

The purpose of this Act is to—

(a) simplify the provisions applying to the

rehabilitation of injured workers and

compensation in relation to injuries or deaths

arising out of accidents and diseases in the

workplace on or after 1 July 2014; and

1

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

s. 2

Part 1—Preliminary

(b) streamline the provisions of the Accident

Compensation Act 1985 which continue to

apply in respect of injuries or deaths arising

out of accidents and diseases in the

workplace before 1 July 2014; and

(c) provide a single gateway for claims for

compensation whether under this Act or the

Accident Compensation Act 1985; and

(d) provide for the registration of employers and

the payment of WorkCover premiums; and

(e) repeal the Accident Compensation

(WorkCover Insurance) Act 1993; and

(f) make consequential amendments to the

Accident Compensation Act 1985, the

Workers Compensation Act 1958 and

certain other Acts.

2 Commencement

(1) This Act, other than sections 626, 628(1), (2), (3)

and (4), 629, 630(1), (2), (4), (5), (6), (10) and

(11), 631, 632, 633, 637(4), 641, 642, 643

and 647, comes into operation on 1 July 2014.

(2) Section 626 (except subsection (7)) and sections

628(2), (3) and (4), 629, 630(1), (2), (4), (5), (10)

and (11), 631, 632, 633, 637(4) and 642 come into

operation on the day after the day on which this

Act receives the Royal Assent.

(3) Sections 628(1) and 641 are deemed to have come

into operation on 5 April 2010.

(4) Sections 626(7), 630(3) and 647 are deemed to

have come into operation on 1 July 2010.

(5) Section 643 is deemed to have come into

operation on 1 November 2010.

(6) Section 630(6) is deemed to have come into

operation on 1 July 2012.

2

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

Part 1—Preliminary

3 Definitions

In this Act—

accounting records has the same meaning as it

has in section 3 of the Financial

Management Act 1994;

A.M.A Guides means the American Medical

Association's Guides to the Evaluation of

Permanent Impairment (Fourth Edition)

(other than Chapter 15) as modified by this

Act and the regulations;

ambulance service means the conveying of a

worker by any reasonable means—

(a) for the purpose of receiving medical or

hospital services; or

(b) to the worker's place of residence after

receiving medical or hospital services;

applicable prescribed percentage, in relation to

the amount paid or payable to a class of

worker, means the percentage of

remuneration prescribed by the regulations

as not being attributable to the performance

of work by a worker of that class;

apprentice, except in clause 17 of Schedule 1,

means an apprentice within the meaning of

the Education and Training Reform Act

2006;

authorised agent means a person appointed by the

Authority under section 501 as an authorised

agent;

Authority means the Victorian WorkCover

Authority continued in existence by

section 491(1);

Board means the Board of Management of the

Authority;

3

s. 3

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

Part 1—Preliminary

s. 3

books includes any document;

Note

See the definition of document in section 38 of the

Interpretation of Legislation Act 1984.

Conciliation Officer means—

(a) the Senior Conciliation Officer; and

(b) a Conciliation Officer holding office

under section 523(2);

Conciliation Service means the Accident

Compensation Conciliation Service

continued in existence under section 519;

Convenor means the Convenor of Medical Panels

appointed under section 537;

corresponding Authority means a Government

department or a statutory authority of the

Commonwealth Government, or of the

Government of another State or of a

Territory, that is responsible for

administering a law corresponding to this

Act, the Occupational Health and Safety

Act 2004, the Dangerous Goods Act 1985

or the Equipment (Public Safety) Act 1994;

corrupt conduct has the meaning given in

section 4 of the Independent Broad-based

Anti-corruption Commission Act 2011;

current weekly earnings has the meaning given

by section 152;

current work capacity, in relation to a worker,

means a present inability arising from an

injury such that the worker is not able to

return to his or her pre-injury employment

but is able to return to work in suitable

employment;

4

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

Part 1—Preliminary

declared training program means a training

program in respect of which a declaration

under clause 2 of Schedule 1 is in force;

dependant means a person who—

(a) at the time of the death of a worker was

wholly, mainly or partly dependent on

the earnings of the worker; or

(b) would, but for the incapacity of a

worker due to an injury, have been

wholly, mainly or partly dependent on

the earnings of the worker;

disease includes—

(a) any physical or mental ailment,

disorder, defect or morbid condition

whether of sudden or gradual

development; and

(b) the aggravation, acceleration,

exacerbation or recurrence of any

pre-existing disease;

domestic partner of a person, means—

(a) a person who is in a registered domestic

relationship within the meaning of the

Relationships Act 2008 with the

person; or

(b) a person to whom the person is not

married but with whom the person is

living as a couple on a genuine

domestic basis (irrespective of gender),

taking into account all the

circumstances of their relationship,

including any one or more of the

matters referred to in section 35(2) of

the Relationships Act 2008 as may be

relevant in a particular case;

5

s. 3

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

s. 3

Part 1—Preliminary

drive includes to be in control, or in charge, of a

motor vehicle;

eligible subsidiary has the meaning given by

section 372;

employer includes—

(a) a person—

(i) for whom a worker works; or

(ii) with whom a worker agrees to

perform work—

at the person's direction, instruction or

request, whether under a contract of

employment (whether express, implied,

oral or in writing) or otherwise; and

(b) a person who is deemed to be an

employer under this Act; and

(c) if the services of a worker are

temporarily lent or let on hire to

another person by, or with the consent

of, the person with whom the worker

has entered into a contract of

employment or apprenticeship or

otherwise, the last mentioned person,

while the worker is working for that

other person; and

(d) the legal personal representative of an

employer who is dead;

employer superannuation contribution means

any contribution made by an employer in

respect of a worker to any scheme or fund

for the payment of superannuation,

retirement or death benefits including a

contribution made by an employer on behalf

of the worker under a salary sacrifice

agreement or arrangement but excluding—

6

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

Part 1—Preliminary

(a) any contribution in respect of a worker

that is not made for the purposes of

avoiding a liability on an employer

under the Superannuation Guarantee

(Administration) Act 1992 of the

Commonwealth; and

(b) any contribution in respect of a worker

which is not made for the purposes of

discharging an obligation on an

employer under—

(i) an industrial award; or

(ii) a public sector superannuation

scheme, agreement or

arrangement; or

(iii) any other Commonwealth or State

law relating to superannuation;

and

(c) any contribution, made by an employer

in respect of a worker under a salary

sacrifice agreement or arrangement, of

a kind or class specified by the Minister

by an Order published in the

Government Gazette;

exemption limit, in relation to a financial year,

means the amount prescribed in the

premiums order in respect of that financial

year for the purposes of clause 20(3)(d) of

Schedule 1;

first entitlement period has the meaning given by

section 152;

fringe benefit has the same meaning as in the

Fringe Benefits Tax Assessment Act 1986 of

the Commonwealth but does not include

anything that is prescribed by the regulations

not to be a fringe benefit for the purposes of

this definition;

7

s. 3

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

s. 3

Part 1—Preliminary

full-time worker means a worker who is

employed for at least the normal number of

hours fixed in any industrial award

applicable to the worker or, if there is no

applicable award, the prescribed number of

hours;

heart attack injury means an injury to the heart,

or any blood vessel supplying or associated

with the heart, that consists of, is caused by,

results in or is associated with any of the

following—

(a) any heart attack;

(b) any myocardial infarction;

(c) any myocardial ischaemia;

(d) any angina, whether unstable or

otherwise;

(e) any fibrillation, whether atrial,

ventricular or otherwise;

(f) any arrhythmia of the heart;

(g) any tachycardia, whether ventricular,

supra ventricular or otherwise;

(h) any harm or damage to such a blood

vessel or to any associated plaque;

(i) any impairment, disturbance or

alteration of blood, or blood circulation,

within such a blood vessel;

(j) any occlusion of such a blood vessel,

whether the occlusion is total or partial;

(k) any rupture of such a blood vessel,

including any rupture of an aneurism of

such a blood vessel;

(l) any haemorrhage from such a blood

vessel;

8

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

Part 1—Preliminary

(m) any aortic dissection;

(n) any consequential physical harm or

damage, including harm or damage to

the brain;

(o) any consequential mental harm or

damage;

hospital means—

(a) a public hospital, denominational

hospital, private hospital or public

health service within the meaning of the

Health Services Act 1988; or

(b) a day procedure centre within the

meaning of the Health Services Act

1988; or

(c) an approved mental health service

within the meaning of the Mental

Health Act 1986; or

(d) a hospital within the meaning of a law

of another State or of a Territory; or

(e) a place within Australia declared by

Order of the Governor in Council to be

a hospital for the purposes of this Act;

or

(f) a place outside Australia approved by

the Authority as a hospital for the

purposes of this Act;

hospital service includes—

(a) maintenance, attendance and treatment

in a hospital; and

(b) the provision by a hospital of—

(i) medical attendance and treatment;

and

(ii) nursing attendance; and

9

s. 3

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

s. 3

Part 1—Preliminary

(iii) medicines, medical, surgical and

other curative materials,

appliances or apparatus; and

(iv) any other usual or necessary

services provided by a hospital

with respect to the treatment of an

injury or disease of a worker;

IBAC means the Independent Broad-based Anticorruption Commission established under

section 12 of the Independent Broad-based

Anti-corruption Commission Act 2011;

IBAC personnel has the same meaning as it has in

the Victorian Inspectorate Act 2011;

incapacity includes—

(a) a disfigurement that is sufficient to

affect the earning capacity of a worker

or a worker's opportunities for

employment; and

(b) in relation to industrial deafness,

inability to engage in the worker's own

or other suitable employment because

of an immediate and substantial risk of

increasing the industrial deafness to a

level of material disability;

industrial award means—

(a) a fair work instrument (other than an

FWA order) within the meaning of the

Fair Work Act 2009 of the

Commonwealth; or

(b) a transitional instrument within the

meaning of the Fair Work (Transitional

Provisions and Consequential

Amendments) Act 2009 of the

Commonwealth;

10

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

Part 1—Preliminary

industrial deafness means any condition of

deafness caused by—

(a) exposure; or

(b) continued exposure; or

(c) periods of continued exposure—

to industrial noise;

injury means any physical or mental injury and,

without limiting the generality of that

definition, includes—

(a) industrial deafness; and

(b) a disease contracted by a worker in the

course of the worker's employment

(whether at, or away from, the place of

employment); and

(c) a recurrence, aggravation, acceleration,

exacerbation or deterioration of any

pre-existing injury or disease;

interest at the prescribed rate means interest at

the rate fixed for the time being under

section 2 of the Penalty Interest Rates Act

1983;

legal practitioner means an Australian legal

practitioner within the meaning of the Legal

Profession Act 2004;

Medical Panel means a Medical Panel constituted

under Division 2 of Part 12;

medical practitioner means—

(a) a person registered under the Health

Practitioner Regulation National Law to

practise in the medical profession

(other than as a student); and

11

s. 3

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

s. 3

Part 1—Preliminary

(b) in relation to anything done for the

purposes of this Act—

(i) in a place within Australia but

outside Victoria, a medical

practitioner who is lawfully

qualified in that place to do that

thing; and

(ii) in a place outside Australia, a

medical practitioner who is

lawfully qualified in that place to

do that thing and who is approved

for the purposes of this Act by the

Authority or a self-insurer;

medical question means any of the following—

(a) a question as to the nature of a worker's

medical condition relevant to an injury

or alleged injury;

(b) a question as to the existence, extent or

permanency of any incapacity of a

worker for work or suitable

employment and the question whether a

worker is partially or totally

incapacitated;

(c) a question as to whether a worker has a

current work capacity or has no current

work capacity and what employment

would or would not constitute suitable

employment;

(d) a question as to whether a worker, on a

particular date or during a particular

period, had no current work capacity

and, if not, what employment would, or

would not, have constituted suitable

employment on that date or during that

period;

12

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

Part 1—Preliminary

(e) a question as to whether a worker has

no current work capacity and is likely

to continue indefinitely to have no

current work capacity;

(f) a question as to whether a worker has a

current work capacity and, because of

the injury, is, and is likely to continue

indefinitely, to be incapable of

undertaking—

(i) further or additional employment

or work; or

(ii) further or additional employment

or work that would increase the

worker's current weekly

earnings—

and, if not so incapable, what further or

additional employment or work the

worker is capable of undertaking;

(g) a question as to the medical, personal

and household or occupational

rehabilitation service provided, or to be

provided, to a worker for an injury,

including a question as to the adequacy,

appropriateness or frequency of that

service;

(h) a question whether a worker's

employment was in fact, or could

possibly have been—

(i) a significant contributing factor;

or

(ii) a contributing factor—

to an injury or alleged injury, or to a

similar injury;

13

s. 3

Workplace Injury Rehabilitation and Compensation Act 2013

No. 67 of 2013

s. 3

Part 1—Preliminary

(i) a question as to the extent to which any

physical or mental condition, including

any impairment, results or resulted

from or was or is, materially

contributed to by the injury;

(j) a question as to the level of impairment

of a worker, including—

(i) a question of the degree of

impairment of a worker assessed

in accordance with Division 4 of

Part 2 of this Act or section 91 of

the Accident Compensation Act

1985;

(ii) a question as to whether or not

that impairment is permanent;

(k) a question as to the amount of the total

percentage referred to in section

61(2)(b) of this Act or section 89(3)(b)

of the Accident Compensation Act

1985;

(l) a question as to whether a worker has

an injury which is a total loss

mentioned in the Table in Schedule 4 of