March Presentation 1

advertisement

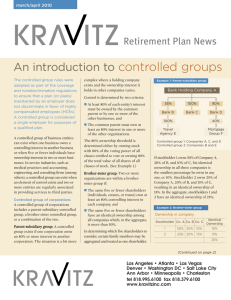

Adventures in Retirement Plan Design Compliance and Administration Considerations Presented By Kelly Marie Hurd, ERPA, CPC Senior Retirement Plan Consultant Caveats & Disclaimers THE VIEWS EXPRESSED BY THE SPEAKERS ARE THEIR OWN AND DO NOT NECESSARILY REPRESENT THE VIEWS OF ANY PERSON, LIVING OR DEAD, REAL OR FICTITIOUS, MALE OR FEMALE, RELIGIOUS OR ATHEIST…YOU GET THE POINT. NO PEOPLE OR ANIMALS WERE HARMED IN THE MAKING OF THIS PRESENTATION. THE CONTENT OF THIS PRESENTATION IS GENERAL IN NATURE AND IS FOR INFORMATIONAL PURPOSES ONLY. IT SHOULD NOT BE USED AS A SUBSTITUTE FOR SPECIFIC TAX, LEGAL AND/OR FINANCIAL ADVICE THAT CONSIDERS ALL RELEVANT FACTS AND CIRCUMSTANCES. Overview Legal/ Accounting Design Consulting Document Compliance /Gov’t Reporting Investments Recordkeeping www.dwcconsultants.com/services/plancomponents.php Slide | 3 Agenda Retirement plan goals Plan design options ◉ Safe harbor ◉ Automatic enrollment Compliance considerations ◉ Required testing ◉ Related companies Plan corrections Slide | 4 Retirement Plan Goals Retirement Plan Goals What are you trying to accomplish with the plan? ◉ Provide a maximum benefit to the owner(s) of the company ◉ Maximize the contributions to the company executives ◉ Implement a plan in order to secure a government contract ◉ Provide generous benefits to all employees to attract and retain talent Slide | 6 HCEs & Nondiscrimination Nondiscrimination testing to ensure Highly Compensated Employee (“HCE”) benefits not disproportionate to Non-HCE (“NHCE”) benefits Must meet one of two tests to be HCE ◉ 5% owner test ◉ Compensation test Employees not meeting one of these tests are NHCE www.dwcconsultants.com/knowledge_center/Key-HCE.php Slide | 7 Benefiting Employees If the retirement plan is not for the benefit of all employees, define the target group ◉ Who do you want to benefit from the retirement plan? ◉ Can you exclude certain classifications of employees from benefiting under the plan? Determine your maximum and minimum funding goals Regulations are structured with testing that requires plans to provide a minimum benefit to qualified employees Slide | 8 Worker Classification Defining Employee Exclusions Permitted based on valid job classification ◉ Title or job function ◉ Location or division ◉ Hourly or salaried Not permitted if indirectly based on service ◉ Temporary ◉ Seasonal ◉ Normally scheduled to work less than… IRS Quality Assurance Bulletin, FY-2006, No. 3 Slide | 10 Other Than Full Time Temps Seasonal employees Per diem employees Interns Students Etc. All of these are still employees! “An Rose Employee By Any Other Name”, PRECISION Magazine, 2014 edition, page 5. Slide | 11 Plan Design Plan Design Should be customized to fit the employer’s goals Factor to consider ◉ Employee turnover ◉ Consistency of cash flow ◉ Flexibility ◉ Complexity ◉ Tax ramifications Stay tuned… Slide | 13 Plan Design Retirement plans offer a plethora of design options ◉ Safe harbor designs ◉ Pro-rata vs. integrated allocations ◉ New comparability Slide | 14 Comparison of Methods Annual Compensation Per Capita Pro Rata Permitted Disparity New Comparability Owner #1 $255,000 $20,750 $51,000 $51,000 $51,000 Owner #2 $255,000 $20,750 $51,000 $51,000 $51,000 Manager #1 $ 80,000 $20,750 $16,000 $13,440 $ 5,200 Manager #2 $ 50,000 $20,750 $10,000 $8,400 $ 3,250 Manager #3 $ 45,000 $20,750 $9,000 $7,560 $ 2,925 Staff #1 $ 40,000 $20,750 $8,000 $6,720 $ 2,600 Staff #2 $ 30,000 $20,750 $6,000 $5,040 $ 1,950 Staff #3 $ 30,000 $20,750 $6,000 $5,040 $ 1,950 Staff #4 $ 23,000 $20,750 $4,600 $3,864 $ 1,495 Staff #5 $ 22,000 $20,750 $4,400 $3,696 $ 1,430 $830,000 $207,500 $166,000 $155,760 $122,800 61% 20.0% 61% 65% 83% www.dwcconsultants.com/knowledge_center/ProfitSharing.php Slide | 15 Safe Harbor 401(k) Plans Plan design that provides for automatic passage of ADP test Minimum employer contribution required Participant notice required 30 – 90 days prior to start of each plan year Two “traditional” options Two automatic enrollment options “The Not-So-Safe-Harbor 401(k) Plan”, PRECISION Magainze, 2013 edition, page 12 Slide | 16 Safe Harbor 401(k) Plans - Traditional Matching contribution ◉ 100% of the first 3% of deferrals, plus ◉ 50% of the next 2% of deferrals Base contribution ◉ 3% of compensation Immediate vesting required Slide | 17 Safe Harbor 401(k) Plans – Auto Enrollment Deferrals ◉ Minimum 3% during initial period ◉ Auto increase by 1% per year up to 6% ◉ Maximum is 10% Matching contribution ◉ 100% of the first 1% of deferrals, plus ◉ 50% of the next 5% of deferrals Base contribution ◉ 3% of compensation Maximum vesting = 2 year cliff Slide | 18 Safe Harbor & New Comparability Annual Compensation 401(k) Deferrals SH Base (3%) New Comp (10.14%/1.38%) Total ER Alloc. Total Allocation Owner #1 $255,000 $23,000 $7,650 $25,850 $33,500 $56,500 Owner #2 $255,000 $17,500 $7,650 $25,850 $33,500 $51,000 Manager #1 $ 80,000 $ 4,000 $2,400 $ 1,104 $ 3,504 $ 7,504 Manager #2 $ 50,000 $ 1,000 $1,500 $ 690 $ 2,190 $ 3,190 Manager #3 $ 45,000 $ 0 $1,350 $ 621 $ 1,971 $ 1,971 Staff #1 $ 40,000 $ 0 $1,200 $ 552 $ 1,752 $ 1,752 Staff #2 $ 30,000 $ 0 $ 900 $ 414 $ 1,314 $ 1,314 Staff #3 $ 30,000 $ 0 $ 900 $ 414 $ 1,314 $ 1,314 Staff #4 $ 23,000 $ 0 $ 690 $ 317 $ 1,007 $ 1,007 Staff #5 $ 22,000 $ 1,000 $ 660 $ 304 $ 964 $ 1,964 $830,000 $46,500 $24,900 $56,116 $81,016 $127,516 61% 87% 61% 92% 83% 84% Slide | 19 I Love Rock N Roll, Inc. Let’s review a typical California safe harbor plan. Plan consistently fails ADP test ◉ ◉ Is Safe Harbor 401(k) the best option? HCE ADP = 10% NHCE ADP = 4% Slide | 20 I Love Rock N Roll, Inc. Failed ADP test ◉ HCE ADP = 10% ◉ NHCE ADP = 4% Correction ◉ Increase NHCEs to an average of 8%, or ◉ Decrease HCEs to an average of 6%, or ◉ Combination of the two, or ◉ Safe harbor plan Slide | 21 Non-HCE Group Annual Compensation Mick 401(k) Deferrals ADP SH NEC (3%) SH Match (Basic) Targeted QNEC $100,000 $10,000 10.00% $3,000 $4,000 $ 0 Steven 90,000 10,000 11.11% 2,700 3,600 0 Ringo 80,000 0 0.00% 2,400 0 0 Iggy 70,000 5,000 7.14% 2,100 2,800 0 Beck 50,000 1,500 3.00% 1,500 1,500 0 Jimi 50,000 5,000 10.00% 1,500 2,000 3,125 (6.25%) Lana 40,000 0 0.00% 1,200 0 2,500 (6.25%) Meghan 40,000 400 1.00% 1,200 400 2,500 (6.25%) Bono 40,000 0 0.00% 1,200 0 2,500 (6.25%) Beyonce 20,000 350 1.75% 600 350 1,300 (6.25%) Kanye 15,000 0 0.00% 450 0 1,875 (12.5%) $595,000 $32,250 $17,850 $14,650 $13,800 Slide | 22 I Love Rock N Roll, Inc. Failed ADP test ◉ HCE ADP = 10% ◉ NHCE ADP = 4% Options ◉ Pro rata QNEC = $595,000 x 4% = $23,800 ◉ Safe Harbor NEC = $17,850 ◉ Safe Harbor Match = $14,650 ◉ Targeted QNEC = $13,800 eba.benefitnews.com/news/the-unconventional-401k-2736440-1.html (requires free registration) Slide | 23 Automatic Enrollment Testing ABC Company – Considering Auto Enrollment ◉ 8 HCEs 100% participation Average deferral of 6.53% ◉ 395 NHCEs 57% participation Average deferral of 2.52% ◉ Auto enrollment 4% of pay 0% opt-out rate Slide | 24 Automatic Enrollment Testing XYZ Company – Already Has Auto Enrollment ◉ 51 HCEs 94.1% participation Average deferral of 6.59% ◉ 128 NHCEs 94.5% participation Average deferral of 3.61% ◉ Auto enrollment 48 new NHCEs enrolled at 3% of pay 0% opt-out rate NHCE average deferral of 3.55% Slide | 25 Automatic Enrollment Comfortable Retirement 30-year old participant, earning $50,000/year with annual COLAs of 3% ◉ Replacement ratio = 69% Retirement age = 65 Average annual investment return of 8% Default deferral of 3% of pay ◉ Runs out of money by age 70 Escalating default deferral from 3% to 6% of pay ◉ Runs out of money by age 78 www.plansponsor.com/print.aspx?id=6442513744 Slide | 26 Compliance Considerations Compliance Considerations Nondiscrimination testing ◉ Minimum coverage ◉ Top heavy ◉ ADP/ACP (we covered by loving Rock and Roll) ◉ Compensation ratio ◉ Other Key employees vs. HCEs/NHCEs www.dwcconsultants.com/knowledge_center/NDT-Overview.php Slide | 28 Compliance Considerations Applicable limits ◉ Plan and participant level limits ◉ Plan year and calendar year Related companies ◉ Controlled groups ◉ Affiliated service groups Slide | 29 Applicable Limits Limit Code Section 2015 2014 2013 Compensation 401(a)(17) $265,000 $260,000 $255,000 Elective Deferrals [401(k)] 402(g)(1) $18,000 $17,500 $17,500 414(v)(2)(B)(i) $6,000 $5,500 $5,500 408(p)(2)(E) $12,500 $12,000 $12,000 414(v)(2)(B)(ii) $3,000 $2,500 $2,500 Annual Additions – DC Plan 415(c)(1)(A) $53,000 $52,000 $51,000 Annual Additions – DB Plan 415(b)(1)(A) $210,000 $210,000 $205,000 HCE – Compensation Test 414(q)(1)(B) $120,000 $115,000 $115,000 Key Employee – Officer Comp 416(i)(1)(A)(i) $170,000 $170,000 $165,000 Key Employee – 1% Owner Comp 416(i)(1)(A)(iii) $150,000 $150,000 $150,000 N/A $118,500 $117,000 $113,700 Catch-Up Contributions [401(k)] Elective Deferrals [SIMPLE] Catch-Up Contributions [SIMPLE] Social Security Wage Base www.dwcconsultants.com/knowledge_center/contributionlimitations.php Slide | 30 Related Companies Implications Plan document ◉ Only “lead” employer ◉ Adoption by other employers Crediting service for eligibility and vesting ◉ Required for related employers ◉ Optional for unrelated employers Nondiscrimination testing ◉ Aggregation generally required for related employers ◉ Separate testing for unrelated employers Application of limits ◉ Annual additions limit Slide | 32 Attribution One person or entity is deemed to own what another person or entity owns Three different definitions ◉ IRC §267(c) Prohibited transactions ◉ IRC §318 Highly compensated employees and key employees Disqualified persons in S-Corp ESOPs Affiliated service groups ◉ IRC §1563 Controlled groups www.dwcconsultants.com/knowledge_center/OwnerAttribution.php Slide | 33 Types of Controlled Groups Parent/subsidiary Brother/sister Combined “Related Companies: Who Is In Control?”, PRECISION Magazine, 2013 edition, page 3 Slide | 34 Parent/Subsidiary Group One business owns at least 80% of one or more other businesses ◉ For purposes of combined annual additions limit, threshold is greater than 50% Single parent may own multiple subsidiaries Group may include several tiers ◉ Parent owns subsidiary ◉ Subsidiary owns other subsidiaries Slide | 35 Parent/Subsidiary Group Example ◉ Company A owns the following: 100% of company B 80% of company C 50% of company D ◉ Parent/subsidiary group consists of A, B and C but not D Example ◉ Same as above and C owns 40% of D ◉ A (50%) + C (40%) = 90%, so D is now part of the controlled group Slide | 36 Brother/Sister Group Five or fewer owners satisfy both of the following: ◉ Common ownership of at least 80%, and ◉ Identical ownership of more than 50% Slide | 37 Example 3-Hour Tour Island Resort Identical Gilligan 40% 30% 30% Ginger 20% 40% 20% Mary Anne 35% 15% 15% Thurston 5% 0% 0% Professor 0% 15% 0% Common 95% 85% 65% Owner Brother/sister group includes 3-Hour Tour and Island Resort ◉ 85% common ownership ◉ 65% identical ownership Slide | 38 Types of Affiliated Service Groups A-org B-org Management www.dwcconsultants.com/knowledge_center/AffiliatedSvcGroup.php Slide | 39 A-Org Consists of an A-Organization and a First Service Organization (“FSO”) ◉ A-Organization Has ownership interest in FSO, and Regularly performs services for FSO, or Regularly associated with FSO in performing services to a third party ◉ FSO Any type of entity If corporation, must be professional services corporation Determined based on operation, not form Slide | 40 A-Org Both A-Org and FSO must be service organizations ◉ Capital is not a material income producing factor ◉ Banks are never service organizations ◉ These are always service organizations Health Law Engineering and architecture Accounting and consulting Actuarial science and insurance Performing arts Slide | 41 Example Law firm ◉ Firm is a partnership ◉ Each attorney has his/her own PC ◉ PCs, rather than individual attorneys, are partners in law firm ◉ A-Org affiliated service group PCs are A-Orgs Law firm is FSO Slide | 42 Example Medical practice ◉ Doctor owns PC ◉ Doctor has ownership in imaging center ◉ Doctor refers patients from PC to imaging center for x-rays ◉ A-Org affiliated service group PC is A-Org Imaging center is FSO Slide | 43 B-Org Consists of a B-Organization and an FSO ◉ FSO Same definition as in A-Org group ◉ B-Organization Derives a significant portion of its business from FSO, and Provides services to FSO historically performed by employees, and Owned at least 10% by HCEs of FSO ◉ Significance Less than 5% is never significant 10% or more is always significant Everything else is facts and circumstances Slide | 44 Example Central Billing Office (“CBO”) ◉ Five ENT practices are equal owners of CBO ◉ Each ENT practice has two equal owners ◉ CBO derives 20% of its business from each practice Slide | 45 Example Flintstone’s ENT Fred (50%) Barney (50%) [FSO] Simpson’s ENT Bart (50%) Milhouse (50%) [FSO] Jetson’s ENT Astro (50%) Jane (50%) [FSO] Central Billing Office [B-Org] Scooby’s ENT Daphne (50%) Velma (50%) [FSO] HB ENT Hanna (50%) Barbera (50%) [FSO] Slide | 46 Management Groups Consists of a management organization (“MO”) and recipient organization (“RO”) MO’s principal business is to provide management functions for RO No common ownership required Slide | 47 Correcting Plan Errors IRS Top 10 List 1. Failure to timely adopt amendments required by tax law changes. ◉ Full plan restatement due by April 30, 2016, maybe earlier for safe harbor 401(k) plans. www.dwcconsultants.com/knowledge_center/RestatePPA.php 2. Failure to follow the plan’s definition of compensation when determining benefits. 3. Failure to include eligible employees or exclude ineligible ones. Slide | 49 IRS Top 10 List 4. Failure to follow rules related to participant loans. 5. Failure to follow rules related to in-service withdrawals. 6. Failure to satisfy rules related to required minimum distributions at age 70 ½. 7. Failure to satisfy rules related to eligibility to sponsor certain types of plans. 8. Failure to pass the ADP and/or ACP test. Slide | 50 IRS Top 10 List 8. Failure to pass the ADP and/or ACP test. 9. Failure to provide the top-heavy minimum benefit to non-key employees. 10. Failure to cap benefits at the annual additions limit. www.irs.gov/Retirement-Plans/EP-Examination-Process-Guide---Section-2---Compliance-Monitoring-Procedures---Top-Ten-Issues--Voluntary-Correction Slide | 51 To Correct Or Not To Correct? Admitting You Have A Problem Is The First Step! Confess your sins? Go forward and sin no more? I’m an atheist? Slide | 52 To Correct Or Not To Correct? Impact on participants and beneficiaries Impact on plan administration Likelihood of discovery Statute of limitations Personal liability of plan fiduciaries Slide | 53 Correction Programs DOL (DFVC & VFC) ◉ Specific errors ◉ Specific methods ◉ No self-correction “Accidents Will Happen”, PRECISION Magazine, 2014 edition, page 14 IRS (EPCRS) ◉ Almost any error ◉ Pre-approved methods or “roll your own” ◉ Self-correction permitted sometimes Slide | 54 Questions Page | 55 Kelly Marie Hurd, ERPA, CPC Senior Retirement Plan Consultant 651.204.2600 ext. 117 www.linkedin.com/in/kellymariehurd Kelly.Hurd@DWCConsultants.com www.DWCconsultants.com A PPENDIX About DWC ERISA Consultants, LLC Established in 1999 National ERISA consulting firm Locations in multiple states Over 700 clients nationwide Consulting & compliance services for defined contribution and defined benefit plans are our only service lines No E&O claims since company inception Slide | 57 Expertise & Leadership Our Team… ◉ Consultants average more than 10 years of experience ◉ Partners average over 20 years of experience ◉ Registered with the IRS as return preparers, subject to strict ethical standards ◉ Hold active industry leadership roles IRS Advisory Committee on Tax Exempt & Government Entities ASPPA Board of Directors and Executive Committee ASPPA Government Affairs Committee Co-editor-in-chief of The Journal of Pension Benefits Professor of Benefits/Compensation – Carlson School of Management Author of the Defined Contribution Handbook Slide | 58 Custom Solutions Every member of the DWC team is encouraged to think beyond the conventional wisdom and put themselves in their clients' shoes. Since the IRS and Department of Labor are involved, following regulations is of critical importance, but the strategy for doing so must be considered in the context of the day-to-day business environment and each client’s objectives. Slide | 59 Professional Development Mandatory professional credentialing program ◉ All consultants must complete the exams toward the Enrolled Retirement Plan Agent (“ERPA”) credential within 3 years of hire. Allows consultants to represent clients before the IRS In-house training on technical developments and process improvements Required CPE and participation in industry conferences and events ◉ Each employee has an annual budget for expenses related to CPE. Slide | 60 Compliance Advantage Rigorous internal review standards ◉ All deliverables are reviewed by a senior team member ◉ Comprehensive internal controls, including electronic audit trail, to ensure quality and accuracy Industry-leading service-delivery ◉ Generally respond to all communications within 1 business day ◉ Delivery commitments based on receipt of requested information rather than government deadlines ◉ Fast turnaround times as compared to industry standards Plan sponsor reports ◉ Easy to read ◉ Include action items, executive summary, and detailed sections Compliance portal ◉ Plan sponsor reports and government forms stored by type and/or year ◉ Year-end plan sponsor data submission is secure and easy to complete ◉ Dynamic tracking and routing of all tasks and client deliverables Slide | 61 Relationship-Based Service DWC’s service model is straight-forward. We assign a consultant, team leader and partner to each plan. DWC adheres to a strict peer-review policy, so all work is reviewed prior to delivery to our clients. Our structure provides hightouch, accurate service to our clients while maintaining costeffective pricing. At DWC, we dig deeper to understand each client’s unique financial and operational needs. With decades of experience, critical thinking and exceptional service, DWC combines strategic solutions with flawless execution. Slide | 62 Cost-Effective Pricing DWC does not accept revenue sharing from any third parties. Our fee model is and has always been to charge a reasonable fee for the services we actually provide for each plan. We do not offer “allinclusive” pricing, because such pricing models typically result in many plans subsidizing extra services that only a few plans actually require. This is a significant reason why industry surveys continually show our fees to be below the 50th percentile for the premium service-level that we provide. We fully disclose our fees in an easy-to-understand format, and we always have, even long before “fee disclosure” became a requirement or even an industry buzzword. Slide | 63 Client Reports: First Impression Sales: Plan Design Projection Report ◉ Customized cost-benefit analysis of several design options ◉ Delivered within 2 business days of receipt of census Hired: Welcome Package ◉ DWC team introduction ◉ Roles and responsibilities (both initial and ongoing) ◉ Service standards ◉ Delivered within 5 business days Slide | 64 Client Reports: Plan Document Collaborative process ◉ DWC: prepares Summary of Plan Provisions (SoPP) comparing current provisions to proposed new document, including recommendations ◉ Client/DWC/Advisor: conference call to review SoPP, discuss and update as needed ◉ DWC: finalizes and delivers signature-ready plan document package Plan document and adopting resolution Summary Plan Description and plan FAQ QDRO policy and loan policy (as applicable) Plan Administrator’s guide and sample forms ◉ DWC: follows up to ensure timely execution of documents Slide | 65 Client Reports: Year End Prep Report Delivered 6 to 8 weeks prior to year-end ◉ Includes required annual notices ◉ Requests information needed to complete testing, contribution calculation and government reporting, as applicable Census (several options for secure, encrypted submission) Annual questionnaire (completed online) ◉ Client checklist as a reminder of their key tasks ◉ Reminder of key compliance deadlines and our service commitment Client phone call to review report and process Slide | 66 Client Reports: Annual ERISA Compliance Review The AECR is delivered annually and includes action items, executive summary and the following items: Plan eligibility review Coverage test ADP/ACP test Top heavy determination Contribution limit review Compensation ratio test Company contribution calculation Required minimum distributions Participant loan review Proactive plan design review Related company review Form 5500 and 8955-SSA In the event of an IRS or DOL audit, our AECR makes the process much less stressful. Slide | 67