Heart of the South West Forestry Enterprise Action Plan. 2015-2020

advertisement

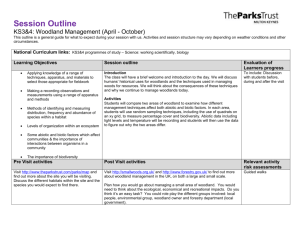

The HoTSW Forestry Enterprise Action Plan A Business Case for the Growth and Development Of the Forestry and Woodland Sector - Heart of the South West Local Enterprise Partnership Area Prepared by The Silvanus Trust and Laura Jones Associates (Contact: jane.hart@silvanus.org.uk; 07974 715379) On behalf of: HoTSW Forestry Task and Finish Group Forestry Commission, Devon County Council, Confor, Tamar Valley Area of Outstanding National Beauty (AONB), North Devon Biosphere Reserve, FWAG South West, The Silvanus Trust and Exmoor National Park. & HoTSW Local Nature Partnership The above members, plus: Blackdown Hills AONB, Climate Positive, Crops4energy, Devon Hedge Group, Devon Wildlife Trust, East Devon AONB, Natural England, RegenSW, South Hams District Council, South West Energy Centre, Torbay Council, Trees and Land CIC. Acknowledgements Thanks to RegenSW for off gas-grid and un-managed woodland maps and Forestry Commission, Timber Strategies, Martin Glynn Consultants, Devon County Council and South West Energy Centre for further data and discussion. 1 Contents 1. Introduction ....................................................................................................................... 3 2. Our aspirations for the HoTSW LEP area ........................................................................... 4 3. The sector – Opportunities for growth .............................................................................. 5 3.1 How woodlands contribute to the HoTSW LEP area .................................................. 5 3.2 The woodland resource............................................................................................... 7 Figure 1: Comparison of hardwood production between harvesting scenarios over 50-year forecast ...................................................................................................................................... 8 3.3 The hedgerow resource .............................................................................................. 9 3.4 Supply chain ................................................................................................................ 9 Table 1: Wood chain businesses relevant to HoTSW area ........................................................ 9 3.5 Processing – the ‘Timber’ economy .......................................................................... 11 3.6 Key contribution to a low carbon economy .............................................................. 12 Figure 2: High, medium and low density off gas-grid properties and under-utilised woodland in the HoTSW area ................................................................................................................... 14 3.7 Recreation, health and education – the ‘Non-Timber’ economy ............................. 15 3.8 Jobs within the forestry and woodland sector ......................................................... 15 3.9 Gross Value Added .................................................................................................... 16 4. Growth opportunities contributing to HoTSW LEP priority areas ................................... 17 5. Delivery and costs ............................................................................................................ 23 6. Deliverables...................................................................................................................... 24 7. Best practice and linkages ............................................................................................... 26 8. A non-funded scenario..................................................................................................... 27 2 1. Introduction The Heart of the South West (HoTSW) Forestry Enterprise Action Plan is a coordinated sector approach to capture expanding market opportunities for wood and wood related products. Rural employment, apprenticeships, low carbon timber and renewable fuel will be delivered through growth in the sector, whilst also releasing resources from local woodland and hedgerows. Collaboration and sustainability will be cross-cutting themes integral to all areas of development, embedding connectivity and best practice. Throughout 2015-20 facilitated investment, supply chain and market developments, specialist business support, and training – all focused on specific development opportunities - will enable the woodland sector1 to increase productivity, reach new markets and improve the skills base. HoTSW Local Enterprise Partnership (LEP) priorities will be met through: Securing the Capital: increasing forest, woodland and hedgerow management and developing the resource for the future The Supply Chain: developing the wood chain, including woodfuel SME A Skilled and Competitiveness: Qualified Workforce: enabling enterprise, innovation and, reaching new markets creating rural jobs, apprenticeships, maintaining and increasing knowledge and skill levels Collaboration & Sustainability Woodlands and the businesses they support, either directly or indirectly, are economically important to the HoTSW LEP area. Similarly the woodland of the area are highly significant in environmental and landscape terms and the importance of the environmental Distinctive Assets to economic prosperity now and in the future is recognised within the HoTSW LEP’s strategy. Woodlands have been noted as providing significant ecosystems services across all the ecosystem services categories (provisioning, regulating and cultural). 1 The woodland sector is wide – encompassing larger forest areas and estates to smaller woodlands, copses and, in its widest sense, the hedgerows of the South West with their strong biodiversity and cultural associations. 3 2. Our aspirations for the HoTSW LEP area To increase the proportion of industries making use of wood in the HoTSW area, to benefit the productivity of local woodland, businesses and community enterprises, and to replace ‘carbon heavy’ materials in a range of economic sectors with wood, including: construction, low carbon housing, engineered products and wood fuel. A secured resource: For 66% of all woodlands in the HoTSW LEP area to be in management this would mean increasing the management area from 47,000ha (46%) to 67,500ha or by 20,500ha. In economic terms increasing this will create 84 jobs with a related increase in GVA of £1,932,000 (84x£23,0002). A good proportion of this wood is used by local businesses and community enterprises that are made increasingly aware of the opportunities for local sourcing. Woodland owners in The Heart of the South West are aware of the opportunities and future needs and potential for their woodlands; how to take those opportunities, and of the organisations and companies that they might collaborate with. Further woodland creation mitigates the forecasted reduction in commercial timber. Growth across the supply chain: If a further 20,500ha of woodland were to be managed bringing approximately 93,275 tonnes of timber to market annually3 an additional 2384 jobs are created. For the proportion of this wood that is utilised in the non-fuel uses then the carbon is captured for the lifetime of the product. Greater enterprise, innovation and SME competitiveness, reaching new markets: Existing businesses in The Heart of the South West are able to make the most of 2 Roots to Prosperity, ‘A Strategy and Action Plan for the Growth and Development of the Forestry Sector in Northern England’, June 2014. This report uses the Annual Business Survey report figure of £23,066 as the approximate gross added value per employee for the forestry and logging sector. The figures are higher for the processing sector but this figure has been used in this document. 3 Based on an average yield class of 6.5 (assuming average yield class of 14 for conifers which constitute 75% of HoTSW woodlands and yc4 for broadleaves which constitute 25% of woodland area) and a 70% average thinning intensity. 4 Roots to Prosperity, A Strategy and Action Plan for the Growth and Development of the Forestry Sector in Northern England, June 2014 4 innovations (e.g. engineered timber, pyrolysis, technology to maximise production and value adding) within the industry and the market opportunities that arise from the context of the HoTSW area (e.g. housing growth, new or fast developing industries such as biomass renewables, a vibrant and increasingly higher value tourism market), new marketing innovations such as online platforms (e.g. business to business sales in food area – extending to wood), and the increasing branding opportunity eg. Online sales of local brand) and to ‘localise’ relevant national and international innovations. New businesses opportunities are explored and created by new entrants and existing businesses. Community enterprises are supported by the industry to flourish. The area takes best opportunity of the Grown in Britain movement5 mirroring the development of industry led partnership to maximise the use of local wood products. Existing and new businesses maximise the opportunity of computer aided design, use of digital technology etc., in their production, marketing and sales processes. A skilled and qualified workforce: Those working within the sector are continually developing their own skills and those of the industry in its widest sense (e.g. through apprenticeships, business skills, mentoring and keeping abreast of relevant future skills). They have access to the latest information and up to date research in easily accessible formats. 3. The sector – Opportunities for growth 3.1 How woodlands contribute to the HoTSW LEP area Woodlands have for centuries provided goods to the inhabitants of the LEP area and beyond – attested to by the continued presence of the charcoal hearths of the smelting industry in the woods themselves and the presence of oak beams, and of course, fire places in many traditional and new buildings). They continue to contribute in a variety of important ways to the economic well-being of the LEP area including: Through wood products both o traditional (logs, bars, chipwood for reprocessing into chipboard, particle, strand board etc.), and 5 Grown in Britain http://www.growninbritain.org/ 5 o developing (woodfuel and engineered wood products such as glulam beams, finger jointed larger dimension material etc.); o artisan goods (from sculpture to restaurant grade charcoal); Through ‘in-wood’ other activities e.g. recreation (shooting, walking, cycling, cabins, paintballing etc.) and their associated businesses; Through ‘wider ecosystems services’ including o ‘cultural services’ – acting as both a backdrop and a location for tourism, and an opportunity to enhance our well being through enjoying natural, tranquil spaces – a particularly important resource to regional assets, such as the protected landscapes of our National Parks, AONBs and Nature Improvement Area which would benefit from more managed woodland; o Vital ‘regulatory services’ necessary for life (mitigating flood risk, purifying water, providing clean air, maintenance of soil quality and provision of organic materials, storing carbon to reduce the extent of climate change6 etc.). In addition the woodland sector has a number of attributes of relevance to developing its economic potential including: A few larger estates or management units such as the Forestry Commission, Duchy, Crown, Clinton Devon etc., to a very large number of small woodland owners often with very small woodland areas in their ownership, to woodlands on farms when the woodland is usually subsidiary to the main farm business; Geographically dispersed – which creates both a challenge and an opportunity (e.g. for wood as a fuel); A variety of accessibilities – some with excellent within wood infrastructure of roads and loading bays and located near good public road infrastructure to small isolated woodlands with limited or no within woodland infrastructure and accessible by narrow lanes. 6 Realising nature’s value: The Final Report of the Ecosystem Markets Task Force, 2013 6 3.2 The woodland resource Estimates of area of woodlands, standing volumes and timber forecasts are set out below7: Woodland Area (ha) 102,200 Forestry Commission managed woodland 10,700 (10.5%8) (ha) (conifer / broadleaf) (8,100 / 2,600) Private sector woodland area (ha) 91,500 (89.5%) (conifer / broadleaf) (17,500 / 73,900) % of all woodland in some form of active Approx. 46% management % of area with evidence of thinning9 Approx. 20% within private sector woodlands (all species)10. Standing volume (000 m3 obs)11 26,108 Biomass stock (000 odt)12 20,313 Carbon stocks (000t) 10,156 Potential area of increased management 20,5003 (ha) Potential increase in tonnes per annum 93,275 Much of the private sector broadleaved resource is not in active management. The theoretical timber that could be realised on a sustainable basis from this under-managed resource is significant (Figure 113), with the ‘unrestricted’ scenario showing the potential for hardwood timber if management constraints were addressed and under-utilized woodland brought into management. A significant barrier to economic potential is the size of the 7 All figures are taken from the National Forest Inventory provisional estimates for woodlands in the Heart of the South West Local Enterprise Partnership Area, March 2015 8 This compares to 17% of ownership based upon the South West Region (now defunct as a political entity) 9 Used as proxy for management in producing forecast figures and noted as a conservative approach to calculating future volumes 10 This figure allows future estimations based upon current evidence 11 ‘Over bark standing’ measurement – the standard measurement of standing timber 12 Oven dried tonnes 13 National Forest Inventory provisional estimates for woodlands in the Heart of the South West Local Enterprise Partnership Area, March 2015 7 individual woodlands. Figures are not yet available for the LEP but the figures for the South West Region (as was) indicate that 30% of woodlands, by area, are sub 20ha in size with the remaining 70% 20ha or larger. This proportion should reflect the HoTSW LEP woodland scales reasonably well (they are 40% of the region’s woodlands). Figure 1: Comparison of hardwood production between harvesting scenarios over 50-year forecast In addition the local resource needs securing. The availability of commercial timber, both hardwood and softwood, is forecast to steadily reduce in the HoTSW area14 and if not addressed through further woodland creation this could become the single biggest challenge to growth facing the wood processing sector in the future, eroding business confidence and threatening jobs. 14 National Forest Inventory provisional estimates for woodlands in the Heart of the South West Local Enterprise Partnership Area, March 2015 8 3.3 The hedgerow resource With 53,000km15 of the most extensive and intact hedgerow network in the country found within the HoTSW area there is significant potential to establish the management of hedges for woodfuel to drive sustainable landscape management. Only about 40% of hedges in the south west are currently in favourable condition but most are highly accessible and could be managed to produce worthwhile crop of wood fuel whilst enhancing hedgerow contribution to biodiversity and carbon storage. Through coppicing hedgerows and chipping the cut wood energy can be produced at approximately 2-3p/KWh, comparable to oil at about 6p/KWh16. 3.4 Supply chain The ‘wood chain’ reaches across the sector from tree nurseries and planting services to timber production, hauliers, processing (see Table 1), suppliers and retailers, suppliers of forestry related equipment, and includes non-timber activities such as recreational, tourism and education which rely on woodland and forestry (see section 3.6). The wood energy chain also specifically includes a growing number of suppliers/retailers of biomass products and installers of renewable heat installations and retrofit solutions. Table 1: Wood chain businesses17 relevant to HoTSW area Primary processing: Secondary processing Tertiary processing: Sawmills, veneer manufacturers, wood carvers, wood turners, furniture makers, charcoal makers, hedge laying, hurdle makers Saw log- timber construction products, eg, joinery grade timber, structural beams, paper, pulp and board manufacturers, fibre board manufacturers Small round wood - stake (fencing, gate, bar) manufacturers, seasoned logs, kindling, wood chips Residuals - animal bedding, compressed briquettes, pellets New – glulam beams, finger-jointed larger dimension materials Final stage of processing and uses the products of secondary processing to manufacturer products frequently sold to the individual consumer, e.g., furniture and kitchen units production 15 State of Devon’s Nature, 2013 Devon Local Nature Partnership Wood fuel from hedges, Devon County Council, Tamar Valley AONB, The Devon Hedge Group, 2014 17 South West England Woodland & Forestry Strategic Economic Study, Ekogen, Lockhart Garratt, Professor Colin Price, Bangor University, 2009 16 9 Greater collaboration within the supply chain will help to secure and develop new market opportunities. Processing industries could benefit from greater awareness among woodland owners of the requirements of the processing industries and the need for longer term security of wood supplies to enable confident investment in additional wood processing capacity. Supporting existing wood processing businesses to increase the demand for round-wood could also make a significant potential contribution to other parts of the economy such as agriculture and construction18. The local wood chain is currently served by the web-based South West Directory of Woodland Products and Services (http://www.woodland-directory-sw.org.uk) which has the potential to be developed into a more sales-oriented platform, with the facility to distribute order enquiries to listed members. Wood fuel suppliers can currently be registered on the Renewable Heat Incentive Biomass Suppliers list (https://www.gov.uk/find-fuel-supplier) and the National Biofuel Suppliers Database (http://www.woodfueldirectory.org/). Several local forestry initiatives support the wood chain offering expertise, advice and can offer an impartial ‘broker’ service and coordinating services. Additionally, collaborative initiatives, such as the Ward Forester enterprise (wardforester.co.uk) and Dartmoor Woodfuel Cooperative (http://www.dartmoorwoodfuel.co.uk/) operate locally to facilitate groupings of woodland owners and wood users, respectively, to allow economies of scale through grouped woodland management and shortened supply chains. Nationally, the Grown in Britain programme seeks to significantly increase markets for British grown wood products and to establish an ‘assured’ brand through its licensing scheme. A Grown in Britain consortium, led by English Woodlands Timber, has recently been awarded funding by Innovate UK, to explore how hard-wood supply chains could be improved. Regional initiatives work closely with Grown in Britain to source opportunities for the sector locally, Torbay Council is the first Grown in Britain local authority - bringing their 40 woodlands into active management and providing resource for the local processing sector. 18 Opportunities to Add Value to South West Home Grown Timber, John Clegg Consulting Ltd, 2012 10 3.5 Processing – the ‘Timber’ economy The processing sector employs approximately 14,000 people regionally when primary, secondary and tertiary activities are included, with a further 5,953 estimated to be dependent on the sector when employment multiplier effects are taken into account19. Larger sawmills within the HoTSW area include Norbord, Brookridge Timber, West Country Timber Supplies and Minehead Sawmills. Wood products directed at the construction market from existing processing businesses are likely to be the most commercially viable for processing more of the potentially available round-wood20. With 27,370 house build starts in the first quarter of 2013 in England21 and 25% of new-builds in the UK being timber framed there are considerable opportunities to increase market share within housing developments22. Investment in the manufacture of niche or engineered building products is also considered financially viable within the South West region, particularly if vertically integrated into such as design and build construction and supported by technical expertise23. These may include small, but growing markets in such as: kiln-dried products suitable for internal joinery and structural work; finger-jointed and laminated products using sawed and glued wood. Secondary processor Buckland Timber in Crediton is a leading producer in glued laminated timber for a range of joinery products, including large span structural beams. In addition to large dimension high quality timber, lower grade locally sourced round-wood is converted by sawmills and wood fuel processing businesses. Norbord, a South Molton based major panel-board producer, provides an important local market for regionally grown timber in terms of the high quantity of small round-wood it buys annual (approximately 25,000 tonnes per annum24). 19 South West England Woodland & Forestry Strategic Economic Study, Ekogen, Lockhart Garratt, Professor Colin Price, Bangor University, 2009 20 Opportunities to Add Value to South West Home Grown Timber, John Clegg Consulting Ltd, 2012 21 National Government Statistics: House Building, March 2013 22 Investing in the timber processing industries of the south west, Woodland Renaissance Partnership, 2013 23 Opportunities to Add Value to South West Home Grown Timber, John Clegg Consulting Ltd, 2012 24 As above 11 Competing for this round-wood is a growing wood energy market with strong demand for firewood and woodchip aligned with the market growth for woodfuel boiler installations for both domestic and community properties. In some instances hardwood logs are worth more as firewood then in the saw log market25. Small scale processors are numerous and scattered across the area, but larger operators include Okehampton based Forest Fuels and Dunster Biomass Heating, Taunton. The pellet market is also growing rapidly, but most pellets are currently imported into the area. 3.6 Key contribution to a low carbon economy The sector has a key role to play in the transition to a low carbon economy – developments in low carbon housing will provide opportunities for use of timber in new forms of engineered composite products26, allowing locally procured timber to be sold as ‘climatefriendly’ and renewable solutions in the built environment. The carbon contained in timber construction materials remains stored for the duration of the product’s lifetime and these products have the lowest energy consumption and carbon dioxide emissions of any standard building material. Building a house with wood rather than brick reduces carbon emissions by 10tonnes of carbon and that replacing 1 tonne of brick or concrete with the same volume of timber can save up to 1 tonne of carbon dioxide emissions27. Additionally, the resulting potential increase in local sustainable woodland management and investment in new woodland will enhance the longer term resource with its positive impact on climate regulation, via carbon storage – the sequestration of tonnes of carbon dioxide. Wood not suitable for timber uses can supply renewable energy and provides an alternative to fossil fuels. With shortened supply chains local buildings can be economically heated with such as woodchip, biomass pellets and seasoned firewood, sourced from local woods and hedgerows, processed nearby, minimising transportation. There is great potential for wood energy from under-managed woodland to address fuel poverty and the challenge of decarbonising heating systems in the widespread off gas-grid properties (currently 83,000 homes in Devon). Community buildings and business units could also benefit – there are 25 Somerset Woodfuel Resource Study, FWAG South West, 2010 Investing in the timber processing industries of the south-west, 2013, Woodland Renaissance Partnership 27 Roots to Prosperity, ‘A Strategy and Action Plan for the Growth and Development of the Forestry Sector in Northern England’, June 2014 26 12 currently 6328 schools in the county receiving oil and/or liquefied petroleum gas (LPG) deliveries, which could be encouraged to switch to a lower carbon source of heating whilst supporting the local economy. Many communities are actively pursuing community owned renewable energy schemes, which keep the economic benefits of energy local, rather than enabling leakage to the large energy companies. The proximity of under-utilised woodland to the potential market of off gas-grid properties within the HoTSW area is demonstrated in Figure 2. Properties are located across the area with red ‘hot-spots’ of high density off gas-grid housing, such as small regional towns, providing focused markets for wood fuel from nearby woodland. ‘White’ regions include such as Exmoor and Dartmoor with comparatively very low numbers of housing but still contain many off gas-grid properties that would benefit from a local alternative to oil and LPG. 28 DCC correspondence, June 2015 13 Figure 2: High, medium and low density off gas-grid properties and under-utilised woodland in the HoTSW area 14 3.7 Recreation, health and education – the ‘Non-Timber’ economy The area holds several popular hubs offering forest based recreational activities (mountain bike trails, high rope challenges) including Haldon Forest, Neroche Forest and Tavistock Woodlands Estates with many other woodland providing high value green spaces for localised health promoting activities such as walking, cycling, horse-riding. Activities within woodland are also often connected to other economic sectors, such as refreshment facilities, bike hire and pony-trekking outlets. The 1SW cycling route established a critical mass of off-road cycling in the region and the draft final report for this project showed that usage on trails “far exceeded” expectations, and revenues generated at the hubs were “healthy and showed reduced seasonality” compared to other tourist offers. Recreational field sports also form a close economic relationship with woodland in the HoTSW area, particularly in such as Exmoor National Park. The value of shooting activity in the woodlands of Greater Exmoor is of significant value with a recent study29 noting that £4million, as measured by Gross Value Added, is retained in the Exmoor area local economy. Local woodland hold many other assets to be recognised - they are rich in archaeology such as charcoal hearths and iron age hill forts, and cultural resources and benefit rural enterprises offering survival skills, rural craft, foraging, etc. The Natural Environment White Paper30 calls for every child in England to be given the opportunity to experience and learn about the natural environment. There are approximately 125 forest education practitioners in Devon31, with several others in Somerset and all reliant on woodland to provide socially inclusive and income generating educational and family focused activities. 3.8 Jobs within the forestry and woodland sector Accurate estimates for jobs supported directly or indirectly by the woodland sector are, by virtue of the industry32 difficult to come by. A recent study for an area in SW Scotland 29 PACEC, The Role of Game Shooting in Exmoor, 2012 on behalf of the National Park Authority and in association with the Greater Exmoor Shoots Association and other partners 30 ‘The Natural Choice: securing the value of nature’ (DEFRA, 2011) 31 Membership data of the Devon Forest Education Network, 2015 32 High proportion of self-employment sole-traders and a workforce that is mobile geographically and by season. In addition jobs that arise from woodland sector such as woodfuel businesses are not separately. 15 quoted a figure of 1 job per 242ha of actively managed woodland33 (based on a 40 year rotation). In a 2014 study34 a figure of 8.9 FTE jobs for every 1000ha of woodland in management was used. An earlier study relating to the South West Region 35 noted a figure of 6.12 FTE in primary processing per 1000ha of all woodland (managed and undermanaged). Accurate extrapolation is not possible for a variety of reasons. However, if a figure of 1 job per 242ha of newly actively managed woodland were to be used to indicate an effect, then an increase in woodland management of 20,500ha might lead to an additional 84 FTE. In addition if the figures from the Roots to Prosperity report 10 are used then for every additional 10,000tonnes of material processed in an area might increase jobs by 25.5 FTE, leading to an indicative (due to variable nature of contexts) total of 238 jobs from a potential increase of 93,275 tonnes per annum in the HoTSW area. These are jobs that can help to transform areas of rural deprivation - the potential of strengthened wood fuel supply chains meeting energy needs of nearby off gas-grid properties will, in particular, offer rural employment and create job opportunities where opportunities are few36. The sector is also keen to provide rewarding apprenticeship opportunities where there are predicted skills shortages in future resource management and processing37. 3.9 Gross Value Added The total Gross Value Added (GVA) of woodlands is not directly available for the HoTSW area but a number of reports are relevant. The South West Regional Study by Ekogen et al38 noted a GVA of the processing sector of £404m with a further £121m generated through indirect and induced economic effects. It also noted a GVA per head of £35,200 (across the 33 Eskdalemuir A comparison of forestry and hill farming; productivity and economic impact, Feb 2014, SAC Consulting 34 Roots to Prosperity, A Strategy and Action Plan for the Growth and Development of the Forestry Sector in Northern England, June 2014 35 South West England Woodland & Forestry Strategic Economic Study, April 2009 36 Heart of the South West Local Enterprise, ‘Strategic Economic Plan Final Submission’ 31st March 2014 p7 37 Forestry Skills Action Plan, Forestry Commission, 2011 38 Ekogen in association with Lockhart Garratt and Professor Colin Price, ‘South West England Woodland & Forestry, Strategic Economic Study.’ April 2009 16 sector), however, only part of this processing sector is based in the HoTSW area. A more recent report39 noted a GVA of just over £23,000 per employee in forest management using this figure we can calculate an estimated GVA figure of £1,932,000 by increasing the woodland area in management (84 jobs created x £23,000 per job40). 4. Growth opportunities contributing to HoTSW LEP priority areas Sector growth will be delivered through facilitated investment, supply chain and market developments, specialist business support, and training – focused on the following development opportunities: 39 Ibid Roots to Prosperity, 2014 Roots to Prosperity, ‘A Strategy and Action Plan for the Growth and Development of the Forestry Sector in Northern England’, June 2014. This report uses the Annual Business Survey report figure of £23,066 as the approximate gross added value per employee for the forestry and logging sector. The figures are higher for the processing sector but this figure has been used in this document. 40 17 HoTSW LEP Securing the Capital: The Supply Chain: further Enterprise, innovation and SME Maintaining and increasing the Priorities Increasing forest, woodland developing the wood chain competitiveness, new markets skills of this rural sector, and hedgerow management including woodfuel including apprenticeships and assuring/developing the resource for the future Capitalising on our distinctive assets – > Increasing woodland management and local wood use to create higher value growth and better jobs (transformational opportunities, strengthening research, development and innovation and environmental assets) 41 42 > modelling undermanaged woodland against ground slope and access to target woodland with best chance to become managed and produce timber41 > Investment in new woodland to enhance longer term resource including plantings around new developments; new woodland plantings etc. (e.g. businesses investing in woodland creation project to enhance environment around towns– low carbon building aspirations, shade in > Strengthen links between the woodland, wood products and biomass fuel sectors and the first class research regional facilities such as Exeter and Plymouth Universities as well as national and international institutions (Building Research Establishment, Forest Research) to maximise opportunity and applicability to market; -Ensure that research finding are disseminated in readily accessible formats > Development of high value > Engaging the sector in markets for local wood products specialist marketing training to with local narratives relating to enable the effective use of brand (e.g. Exmoor hedgerow locality narrative charcoal, local restaurant charcoal); green oak build and utilising local wood products within local building; wood fuel > Developing the marketing narrative of locality and sustainability and using digital media to enhance consumer understanding (e.g. YouTube promotion of local sourcing, processing, crafting ,etc)42 Bringing local success from experience of ‘Marches Undermanaged Woodland Ground Truthing Survey’, Heartwoods, June 2014 Example of YouTube narrative highlighting the power of local consumption choices https://www.youtube.com/watch?t=325&v=BZl6NdhQFoI 18 towns) > Further use of the existing Maximising Productivity and Employment Across the whole economy and to benefit all sectors woodland infrastructure to build on successful ventures such as mountain biking 1SW and developing markets such as glamping etc. Explore opportunities utilising outdoor space both in the UK and in other countries, e.g. longer distance horse-riding, running > Increase investment in appropriate equipment to capture value, e.g. small scale harvesting and processing equipment; chippers for higher quality fuel chip; charcoal burning > Support for collaboration to meet needs from pest and diseases, improve climate resilience and develop opportunities, e.g. shared woodfuel storage > Explore feasibility of newer > Establishing easily accessible manufacturing techniques in small scale local businesses e.g. kiln-drying, finger-jointing, glulam, composite products and up-to-date skills for wood fuel specification installation and maintenance > Ensuring that woodland and > Continue provision of > Processing businesses to work with woodland owners and contractors to develop long term supply contracts when planning significant additional wood processing capacity specialist business advice to sector such as was undertaken through the South West Timber Business Development Programme (2013-14)43 wood-using businesses and community enterprises can access the necessary technical and business skills to maximise their productivity and growth > Ensure that businesses and community enterprises have access to skilled operatives, including through apprenticeships 43 Forestry Commission’s £100,000 South West Timber Business Development Programme 2013-14 – specialist technical services, consultancy, advice and training to businesses with potential to increase the value of the regional forestry and timber industry 19 Creating conditions for growth: infrastructure and services that underpin growth (transport, broadband and mobile connectivity, skills infrastructure) Cross cutting aims: Environmental 44 > Invest in ‘in-wood’ infrastructure of loading bays and roading to ensure woodland can be managed > Explore feasibility of business and community enterprise opportunities of all scales from construction and renewable energy to hedgerow charcoal; > Supporting the developing charcoal production in smaller woodfuel market, e.g broadleaved woodlands, etc. appropriate harvesting and in Allowing reduced wood processing equipment, transportation costs and equipment enhancing the enhanced value locally use of sawmill residues as value adding produce – such > Investment in wood fuel hubs as pellets (e.g. for drying material) developing economies of scale > Ensuring green and securing long term supply infrastructure investment to contracts create attractive work and living spaces and mitigate the warming climate, e.g. tree planting in new housing development - A recent report by Greenleaf Cumbria notes that £1 investment in green infrastructure directly creates £2.30 of GVA, with a further £6.90 of wider economic benefits44. Contributing to longer term > Recognising, valuing and resilience and social inclusion increasing the ecosystem through: services that woodland > Update and maintain an > Enabling cross supply chain industry led woodland services and woodland products directory. Ensure online platform and links to similar platforms (such as food and drink) where appropriate forums for discussion, exploration of opportunities, dissemination of research, collaboration, etc > Maximising use of the developing brands including Exmoor, Dartmoor, Blackdown Hills, Tamar Valley, Devon and Somerset Brands with support of Grown in Britain initiative and events that allow consumers of wood to understand the opportunity of locally produced and processed wood in all its forms Enabling collaborative approaches to managing small woodlands including: >Training – improving workforce skills across the sector from advice to resource producers to business management skills in processing enterprises and contractor skills > Providing support for micro and small businesses to take on new entrants and Roots to Prosperity, ‘A Strategy and Action Plan for the Growth and Development of the Forestry Sector in Northern England’, June 2014. 20 Sustainability and Social Inclusion provides, including physical and mental health benefits, and raising awareness amongst businesses and local communities, creating local mechanisms for business investment in such infrastructure and environmental goods – such as ‘1% for your planet’, low carbon home off-site investments, planning gain > Explore opportunities for enabling and encouraging use of wood by community enterprises (as fuel or products) e.g. through community shares / social enterprises / crowd funding etc. thereby capturing value of engaging with the natural environment > Utilise woodland, hedge planting and individual and group plantings to mitigate > Developing the woodfuel > further develop and share district-heating potential in new and existing developments and enabling wood fuel to contribute to the heating of off gas-grid homes > Explore the potential of under-managed hedgerows to provide heating in off gas-grid areas building upon work from existing programmes and sharing toolkits45 that have been developed > Link with community enterprises for management activities and investment in wood fuel hubs opportunities toolkits for wood fuel from hedgerows and on farm sources > extending ‘Ward Forester’ grouped woodland harvesting and product marketing approach; co-operative opportunities e.g. Dartmoor Woodfuel Co-operative > Ensuring the benefits and opportunities of modern woodfuel heating are conveyed to the public and planners for both new and retrofitting46 e.g. ensuring consideration of district heating is considered part of the planning requirement on new development in HoTSW area as they are in some planning areas (e.g. Cranbrook in East Devon) > Capturing an increased proportion of timber used within anticipated new housing (e.g. 50,000 homes in HoTSW 2014-19) apprenticeships - enabling business expansion and craftsmanship, existing knowledge to be built upon and handed on Overcoming ‘peripherality’ through: > Linking researchers and woodland owners through webinars > Provision of workshops and ‘demonstration woodlands’ for woodland owners to increase awareness of: - woodland potential - need to increase woodland’s ‘climate readiness’ -resilience to pests and diseases > Maintain and extend an up to date set of case studies of woodfuel installations (across the range) including ones using wood from their own or local 45 E.g. Cordiale toolkit http://www.tamarvalley.org.uk/projects/cordiale-woodfuel/ SW Energy Centre Report on Devon Woodfuel Potential, July 2014. The report notes that lack of a developed independent trade body to promote the many benefits of woodfuel systems including financial returns (see para 28.1). Also SW Regen ‘Ready for Retrofit Supply Chain Study’ October 2014 identified lack of customer awareness of retrofit opportunities as a barrier to growth. The report notes that micro-renewable heat measures – for example heat pumps and small biomass boilers represent 36% of the annual £1100m annual turnover in the domestic retrofit market. 46 21 the risks of local flooding engaging with private and public sector to maximise benefits of trees planted properties > Develop a series of sector champions or ‘friends’ who are happy to host visits or discuss successes with potential referrals (widely used in other sectors) > Build links with tourism and related sectors to explore opportunities for local wood use and promotion – e.g. locally produced charcoal in restaurants and campsites 22 5. Delivery and costs With strategic support from the Forestry Commission, Confor (Confederation of Forest Industries) and Devon and Somerset County Councils, The HoTSW Forestry Task and Finish Group and Local Nature Partnership will agree an Accountable Body to manage the Plan and ensure deliverables are met. The delivery team will consist of a Programme Manager, Sector Coordinator, and a number of contracted specialist advisors (equivalent to three fulltime) with appropriate expertise in managing the resource, opening up markets, and providing sector specific business and technical support. The Plan will be delivered across the whole HoTSW region with specific areas of opportunities and established networks, such as the North Devon Biosphere Reserve, National Parks, AONBs and Nature Improvement Area, acting as pilots to model the benefits of initiatives, such as concentrated growth in wood fuel supply to service new district heating systems to housing development in Barnstaple. A limited revenue cost of £850,000 is required to deliver this coordinated Plan and produce a target £5 million investment in the sector: Expenditure: Cost activity staff resource Project Manager Sector Coordinator Advisor Advisor Advisor Mileage and expenses Training (incl venue, refreshments, etc) Marketing - products Marketing - brand developments FTE 0.5 1 1 1 1 4.5 £ annual years cost employed 25000 32000 28000 28000 28000 9000 £ total cost 5 5 5 5 5 5 125,000 160,000 140,000 140,000 140,000 45,000 30,000 40,000 30,000 850,000 It is hoped the Plan will benefit, in part, from the £1 million fund for LEP supported forestry schemes announced in the Chancellor’s March 2015 Budget. Additional funding will be levered from the Countryside Stewardship scheme (for resource and primary processing 23 investments), Rural and Urban Community Energy Funds (stimulating local energy markets through community-owned renewable energy schemes), National Apprenticeship Service (apprenticeship core training), the LEADER programme (small scale local productivity), and Horizon 2020 (research activities). Private investment will match this commitment, both from the sector itself and through creating mechanisms amongst other local businesses and communities for ‘green’ investment in woodland infrastructure and environmental goods, such as ‘1% for your planet’ schemes. Private investment will also be encouraged by supporting community enterprises to crowd-fund share capital to own biomass boilers providing heat to local buildings. These schemes generate income through Government tariffs and the sale of heat that can be used to provide a community fund for delivering other local priorities. They also reinvigorate communities by bringing people together with a common purpose and capture the social value of engagement with the natural environment. 6. Deliverables Throughout 2015-2020 the following targeted outputs and outcomes will be achieved: Outputs Facilitated private investment (e.g. small scale harvesting and processing equipment, chippers for higher quality fuel chip, loading bays, roading, value adding and enhanced productivity equipment, marketing, skills and business developments) Facilitated public investment (as above) Jobs (FTE) Apprenticeship placements Facilitated supply chain collaborations (joint ventures, community enterprises, wood fuel hubs, cooperative management solution and routes to market) Sector marketing products (online platforms, case studies, promotion via digital media, development of sector ‘champions’) Strengthened links with research establishments – findings disseminated in accessible format Existing and new enterprises receiving specialist and technical support to maximise opportunities from: Target £3.5 million £1.5 million 200 50 10 10 2 100 24 computer aided design, use of digital technology innovations, e.g. engineered timber, pyrolysis, technology to maximise production and value adding developing markets e.g. growth in housing, renewable energy, higher value tourism products new marketing innovations, e.g. online sales platforms local and wood products branding opportunities other new business and market opportunities 25 Individuals receiving skills, training and knowledge transfer provision (study tours, forums, webinars, demonstration events, business skills, specialist marketing training, mentoring, woodland owners advised on opportunities and future needs) Outcomes Gross Value Added to economy Timber brought to market annually Woodland into management Hedges in favourable condition Renewable energy sourced New woodland created annually, including green infrastructure 150 £4,600,00047 93,275 tonnes 20,500ha 750km 186,500 MWHrs 20ha 7. Best practice and linkages The Plan will link closely with opportunities for primary production and processing through the Rural Development Programme’s Countryside Stewardship scheme including Woodland Capital Grants, the Countryside Productivity Scheme, and the Farming Advisory Framework, in addition to small grants via LEADER funding. Activities will complement, not duplicate, grants and assistance provided via Countryside Stewardship. Local activities will closely associate with the Grown in Britain programme, adding value at a local level through opportunities for affiliated local branding and supply chain networks. The Plan will support the Ward Forester enterprise – developing small woodland economics and improving market opportunities via combined harvesting - incorporating its services to avoid duplication. The Plan will additionally collaborate with the following schemes currently pending funding support: South Devon AONB Woodfuel project - mapping the woodland/hedgerow resource, farm audits and woodfuel workshops, local supply woodfuel hubs, community engagement; Tamar Valley AONB woodfuel supply chain development feasibility studies – evaluating the catchment in terms of timber, access routes, and landscape implementations; 47 200 jobs multiplied by £23,000 per job 26 Organic Research Centre SustainFARM (partners in Romania and Poland) - integrated food and non-food systems to develop climate-resilient agro-ecosystems, adding value to wood and ‘waste’; The Plunkett Foundation’s support-based programme for fledgling social enterprises establishing community woodland management ventures. The programme also links with and builds upon the: Forestry Commission’s £50,000 Forestry Business Support service 2014-15 delivered nationally by the Forest Advisory Consortium England – preparing enterprises to take advantage of opportunities via the Rural Development Programme; Forestry Commission’s £100,000 South West Timber Business Development Programme 2013-14 – specialist technical services, consultancy, advice and training to businesses with potential to increase the value of the regional forestry and timber industry; FOREST Intelligent Energy Europe’s on-line best practice, guidance, and training tools; Cordiale Interreg IVa project’s good practice guidance for hedge management for wood fuel, case studies, biomass boiler installations, and toolkits to assess biomass volume; North Devon Biosphere Reserve’s Forest Policy Framework and Woodland Enterprise Zone development; The Devon Community Energy Accelerator project, which in partnership with RegenSW is investing £100k in supporting the community energy sector through bespoke training and start-up grants for community enterprises progressing towards Rural and Urban Community Energy Fund applications; North Devon and South Devon Catchment Management Partnerships; Devon Local Nature Partnership’s Natural Devon’s Prospectus 2014; Partnership initiatives within neighbouring LEPs. 8. A non-funded scenario If the requested funding is not received it is unlikely that a significant number of the planned outputs and outcomes would happen. An amount of private investment would be made but 27 resources would not be maximised and opportunities for growth with associated rural jobs, training opportunities and renewable products missed. With less local timber and woodfuel available for local markets, imports are likely to fill the niche with associated increased carbon emissions and costs and reduced local employment. 28