AOF

Entrepreneurship

Unit 3, Lesson 9

Accounting Basics

Copyright © 2009–2012 National Academy Foundation. All rights reserved.

Accounting is important in today’s world

• Accounting is an integral part of

running a business.

• Accounting helps entrepreneurs

make decisions about every

facet of a business.

• Accounting can show

operational strengths and

weaknesses, thus allowing

entrepreneurs to make changes

that make the company more

profitable.

The accounting cycle is a series of steps

1. Collect and analyze source documents

2. List each transaction chronologically in the general

journal

3. Post to the general ledger

4. Prepare a trial balance

5. Prepare financial statements

6. Make post-closing journal entries

7. Create a post-closing trial balance

The general journal lists transactions by date

• A general journal contains

a chronological listing of a

business’s financial

transactions.

• Journalizing is the process

of recording financial

transactions into a

journal.

• Before entering a

transaction into the

journal, you must decide

which accounts will be

affected.

Why would you want to

organize financial

transactions in the order

in which they occurred?

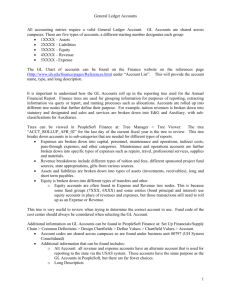

The general ledger lists transactions by account

• A general ledger keeps specific

account information together

and tracks individual account

balances.

• The information from the

journal is transferred to the

respective account in the

general ledger in chronological

order.

Why would it be helpful

to track the financial

information from specific

accounts?

A trial balance helps you make sure you’ve entered

everything correctly in the general ledger

• A trial balance lists account

names and their balances on a

specific date.

• It proves the general ledger is in

balance.

• You can detect errors by

preparing a trial balance.

• The sum of all debits must equal

the sum of all credits.

What are some types of errors that can be made

during the accounting cycle?

The income statement shows revenues and expenses for a

specific time period

• By listing aggregated

revenues and expenses, you

can identify anything

unexpected or out of

balance.

• By subtracting expenses

from revenues, you can see

how much you made (or

lost) during the time period

you’re reporting.

• Information from the income

statement is used in other

financial statements.

The statement of changes in owner’s equity (SCOE) shows

the company’s worth at the end of the accounting period

• The SCOE is usually

prepared after the

income statement and

before the balance

sheet.

• The SCOE reports the

change in capital from

the beginning to the end

of a time period.

• Capital can be increased

or decreased during

each accounting cycle.

Domingo’s Dance Studio

Statement of Changes in Owner’s Equity

For the Month Ended February 28, 2009

Beginning Capital Balance, February 1, 2009

Add: Investments by Owner

Subtotal

Less: Withdrawals by Owner

Net Loss

Total Decrease in Capital

Ending Capital, February 28, 2009

0.00

2,000.00

2,000.00

1,000.00

-270.00

1,270.00

730.00

What are the benefits of

reinvesting a company’s

net income back into the

company?

The balance sheet reports a company’s assets, liabilities, and

shareholder equity

Performance reports help control expenses and plan for the

future

Performance reports

serve to:

• Analyze differences

between projected

and actual sales,

costs, and

expenses

• Identify significant

and/or unfavorable

differences needing

corrective actions

Cooper's Kites

Performance Report

For Year Ended December 31, 2013

Projected

Actual

Increase/(Decrease)

Amount

Percentage

Operating Revenue

Net Sales

Cost of Merchandise Sold

Gross Profit on Operations

Operating Expenses

Selling Expenses

Advertising Expense

Supplies Expense--Sales

Total Selling Expenses

Administrative Expenses

Depr. Expense--Office Equipment

Depr. Expense--Computer System

Insurance Expense

Payroll Taxes Expense

Rent Expense

Salary Expense--Administrative

Supplies Expense--Administrative

Uncollectible Accounts Expense

Utilities Expense

Total Administrative Expenses

Total Operating Expenses

Income from Operations

Other Revenue and Expenses

Interest Revenue

Net Income before Federal Income Tax

Federal Income Tax Expense

Net Income after Federal Income Tax

Units of Item Sold

$50,000

25,500

$62,847

32,062

$12,847

6,562

25.69%

25.73%

24,500

30,785

6,285

25.65%

1,325

576

1,901

1,880

748

2,628

555

172

727

41.89%

29.86%

38.24%

714

1,000

1,720

2,850

1,200

9,500

435

112

869

18,400

20,301

714

1,000

1,720

2,660

1,200

9,500

565

159

927

18,445

21,073

0

0

0

-190

0

0

130

47

58

45

772

0.00%

0.00%

0.00%

-6.67%

0.00%

0.00%

29.89%

41.96%

6.67%

0.24%

3.80%

4,199

9,712

5,513

131.29%

26

4,225

634

38

9,750

1,463

12

5,525

829

46.15%

130.77%

130.76%

3,591

1000

8,287

1248

4,696

248

130.77%

24.80%