Unit 3 Recording Transations in T

advertisement

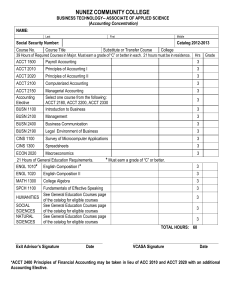

Unit 3 Recording Transactions in T- Accounts From Unit 2: Cash Acct Rec Equipment Building Acct Pay Bank Loan Capital From Unit 2: Information from balance sheet- Cash 1000 Acct Rec 500 Equipment Building 2000 40000 Acct Pay 2500 Bank Loan 20000 Capital 21000 There must be at least two entries (dual entry accounting) to keep the balance sheet balanced. Sept 21 Cash Acct Rec Equipment Building Acct Pay Bank Loan Capital 1000 +200 500 -200 2000 40000 2500 20000 21000 1200 300 2000 40000 2500 20000 21000 Asset and Liability transaction: Cash Acct Rec Equipment Building Acct Pay Bank Loan Capital 500 -200 2000 40000 2500 20000 21000 Sept 21 1000 +200 300 2000 40000 2500 -500 20000 21000 Sept 23 1200 -500 700 300 2000 40000 2000 20000 21000 What was this transaction? Cash Acct Rec 500 -200 2000 40000 2500 20000 21000 Sept 21 1000 +200 300 2000 40000 2500 -500 20000 21000 Sept 23 1200 -500 700 300 2000 40000 2000 20000 21000 Sept 24 Equipment Building +3000 Acct Pay Bank Loan +3000 Capital Unit 3: T-Accounts To more easily reflect the changes that transactions create, we will learn the concept of T-Accounts. • Essentially each item in the balance sheet becomes its own separate account. • We describe each side of the “T” as a Debit or a Credit. T-Accounts may look something like this: Note: Assets balances all always Debits and grow on Debit side Liabilities and Capital always Credits and grow on Debit side! T- Account Transactions: Cash $500 Sept 20 $300 $800 Balance $600 Acct Rec $400 $300 Sept20 $200 Sept 24 Balance $100 Bank Loan $5000 Sept 24 $200 Balance $4800