computational finance programme

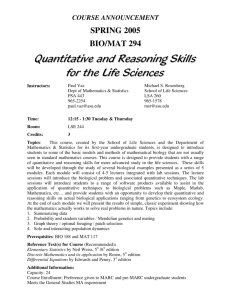

advertisement

Opportunities in Quantitative Finance A/P Ng Kah Hwa, PhD (Columbia) Director, Quantitative Finance Programme Director, Centre for Financial Engineering 12 March 2005 Slide 1 Introduction and Background • In 1973 Black and Scholes developed the option pricing models based on advanced mathematics • Today the financial practice has become very quantitative • Sophisticated mathematical models are used to support investment decisions, to develop and price new financial products or to manage risk 12 March 2005 Slide 2 What is Quantitative Finance ? Multidisciplinary programme that combines Mathematics, Finance and Computing with a practical orientation that is designed for high-caliber students who wish to become professionals in the finance industry. Covers the following areas • • • • • Mathematical Theory and Tools Statistical Methods Computing Theory and Techniques Financial Theory and Principles Core Financial Product Knowledge Plays an increasingly important role in the financial services industry and the economy. 12 March 2005 Slide 3 Examples Risk Management • Banks in the course of their business take on risk ? • How do we measure the risk that the bank is exposed to ? • How do we hedge and mange the risk? 12 March 2005 Slide 4 Examples (continued) Tools • Linear Algebra and Calculus • Advanced probability and statistics • Time Series Analysis • Simulation Methodologies 12 March 2005 Slide 5 Examples Derivatives Trading Pricing and Hedging of Complex Derivatives Tools • Advanced Stochastic Processes • Numerical solutions to partial differential equations 12 March 2005 Slide 6 Career Opportunities Potential Employers • Banks • Investment Companies • Securities Firms • Insurance Companies • Multinationals Increase in demand for graduates with high level of quantitative and analytical skills 12 March 2005 Slide 7 Career Opportunities Jobs • Financial Product Development and pricing (Structured Deposits, Derivatives etc.) • Risk Management • Investment decision making and fund management • Wealth Management 12 March 2005 Slide 8 Skills Required for Quantitative Analysts/Risk Managers • Basic Quantitative Skills - Mathematics (Linear Algebra, Calculus) - Probability - Statistics • Computer programming - Excel, VBA, C/C++, SAS • Knowledge of Derivatives and Fixed Income 12 March 2005 Slide 9 Objective To equip graduates for the finance industry with: • Technical knowledge and skills in quantitative finance and risk management • Strong quantitative modeling skills • Analytical mind This programme is uniquely positioned to meet the increasing demand for graduates with quantitative modeling and risk management skills. 12 March 2005 Slide 10 Introduction Key features: • Multi-disciplinary • • curriculum integrating mathematical methods and statistical tools, computing techniques with applications to finance Use of quantitative tools with state-of-the-art financial systems in the computing laboratory Projects with financial engineering applications Current programme committee: • A/P Ng Kah Hwa (Programme Director) • A/P Tan Hwee Huat (Deputy Director) 12 March 2005 Slide 11 The Honours-Track programme Students are only admitted to QF Major after two semesters of studies in the Science Faculty. Students admitted to QF major are placed in the honours track leading to a B.Sc (Hons) degree upon completing the course work requirement (given later). A student may, however, for various reasons, opt to exit earlier with a B.Sc upon completing the corresponding course work requirement (given next slide). Typically, a student will require 3 and 4 years to complete the requirement for B.Sc and B.Sc (Hons) respectively. A shorter timeframe is possible for some. 12 March 2005 Slide 12 Coursework Requirement for B.Sc. Satisfy University requirements for B.Sc. Satisfy Faculty requirements for B.Sc. Pass a total of 70 MCs at level 1000 to 3000 to satisfy the Major requirements Essential Modules include: • • • • • • • • • • • • • CS1101 Programming Methodology CS1102 Data Structures and Algorithms CF3101 Investment Instruments: Theory and Computation FNA1002 Financial Accounting FNA2004 Finance MA2222 Basic Financial Mathematics MA3245 Financial Mathematics I MA1101R Linear Algebra I MA1102R Calculus MA1104 Advanced Calculus I MA2213 Numerical Analysis I or CZ2105 Numerical Methods for Scientific Computing I MA2101 Linear Algebra II or MA2215 Linear Programming or ST2132 Mathematical Statistics ST2131 Probability 12 March 2005 Slide 13 Coursework Requirement for B.Sc. (continued) Elective Modules include: • CF3201 Basic Derivatives and Bonds • CS3230 Design & Analysis of Algorithm • FNA3101 Corporate Finance • FNA3103 Financial Markets • FNA3117 Bank Management • FNA3118 Financial Risk Management • MA3220 Ordinary Different Equations or MA3264 • • Modeling via Ordinary Differential Equations MA3236 Nonlinear Programming ST3131 Regression Analysis 12 March 2005 Slide 14 Additional Requirements for B.Sc (Hons) (continued) Essential modules include:• • • • CF4100 Honors Project CF4102 Financial Trading and Modeling CF4103 Financial Time Series: Theory and Computation MA4257 Financial Mathematics II • CZ4105 Numerical Methods for Partial Differential Equations or MA4255 Numerical Partial Differential Equations FE5103 Equity Products and Exotics FNA4111 Research Methods in Finance FNA4112 Seminars in Finance MA4253 Mathematical Programming MA4264 Game Theory MA4265 Stochastic Analysis in Financial Mathematics MA4267 Discrete Time Finance ST4231 Computer Intensive Statistical Methods ST4233 Linear Models Elective modules include:• • • • • • • • • 12 March 2005 Slide 15 Professional Certification Professional Risk Manager (PRM) Certification Designed for those:• Seeking professional certification in risk management • Looking to develop their skills • Looking for skills assessment of potential employees CFA Certification CFA Cross-over with PRM 12 March 2005 Slide 16 Admission Requirements Students are only admitted to QF Major after two semesters of studies in the Science Faculty. To be considered for admission, a student must :• achieve a CAP of at least 3.5; • complete his/her first 2 semesters including the group of four qualifying modules: 1)CS1101 (Programming Methodology) 2)MA1102R (Calculus) 3)MA1101R (Linear Algebra) 4)ST2131/MA2216 (Probability) • the group average point (GAP) for the qualifying modules must be at least 3.5. 12 March 2005 Slide 17 How to Apply At the end of semester 2, and after obtaining the examination results, interested students should e-mail Ms Au Kasie at matauk@nus.edu.sg to request for an application form OR Collect the application form from the Department of Mathematics General Office, S14-03-07. Send in the hard copy of the application form together with a copy of your NUS academic results to Ms Au Kasie by the application deadline. Students are encouraged to submit their application as early as possible to facilitate the processing of their application. For more information, please go to http://www.math.nus.edu.sg 12 March 2005 Slide 18 12 March 2005 Slide 19