Federalism and Supreme Court Decisions

advertisement

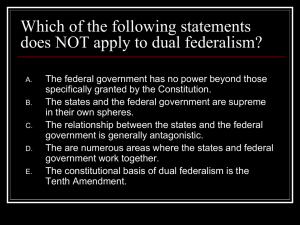

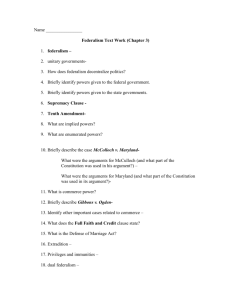

FEDERALISM (S) AND SUPREME COURT DECISIONS Dr. East 11/2015 WHAT HAPPENED NOV. 4? • State-wide elections for the VA General Assembly (the Legislative Branch of VA) and city and county elections – VA gen. assembly: composed of bicameral body 100 member House of Delegates, serving 2 year terms, and 40 VA Senators, serving 4 year terms • Voter turnout is usually incredibly low for a mid-term, off-year election with no Federal seats at stake • https://vote.arlingtonva.us/elections/elected-officials/ • https://solutions.virginia.gov/GovOrgChart/OrgChart2013.pdf KEY SEATS FOR VA SENATE 2015 NOT MUCH CHANGED IN VA HOUSE LOCAL GENERAL ELECTIONS ALWAYS FIRST TUES. IN NOV. SAMPLE BALLOT FOR GENERAL ELECTION IN ARLINGTON SAMPLE BALLOT FOR LOCAL ELECTIONS Lines in Blue are Arlington Voting Precincts and Red indicate VA State Congressional Districts BACK TO FEDERALISM • What was the definition of federalism? – Ans. = system of government where power is divided/shared/distributed between central gov. (Feds, national gov.) and states’ governments (regional govs.) • Did the Constitution say anything about local governments? – NO – State gov. and each states’ constitution explain how to create and govern local areas like Arlington …state constitutions allowed by 10th Amendment • Power is divided, so is taxing and spending (gotta pay for gov. somehow; gotta spend money for public good) – Gov. not supposed to make a profit (unlike businesses) – Spending also called budget appropriations – Taxing also called revenue creation DEPENDING UPON WHERE YOU LIVE, YOUR LIFE MAY BE REGULATED BY 6 LEVELS OF GOV. (2012 COUNTS) Special Districts (like zoning, water 38,266 use, flood prone, etc.) 35,879 Cities and Towns Individual School 12,880 Districts 3,031 Counties 50 States 1 Federal Gov. 90,107 Total Gov. • • Each of these places may tax you too (generate revenue) so that they can pay for things 2013 Arling. Co Taxes = 2013 VA State Taxes = 2013 VA Inc. Taxes = 2013 VA Prop. Taxes = 2013 US Revenue Tax = $901,222,812 $19,186,853,000 $11,672,861,000 $33,188,000 $2,780,000,000,000 Source: http://factfinder2.census.gov/faces/tableservices/jsf/pages/productview.xhtml?src=bkmk http://factfinder2.census.gov/faces/tableservices/jsf/pages/productview.xhtml?src=bkmk POWER SHARING MUST BE DETERMINED IN A FEDERALIST SYSTEM • The Supreme Court and ideas of representatives from political parties have determined how federalism has been applied in American government(s) • 1803 – Marbury V. Madison – resolved the question of whether or not the Supreme Court had the right to apply judicial review to the laws of states and actions of the other Federal branches of Government (since these activities of the court were not directly/ explicitly written into the Constitution) • They asserted that the Supremacy Clause of the Constitution gave them the right to do this. • Judicial Review = the process in which the Supreme Court can rule on whether or not a law or government action is allowed by the Constitution. TIME CHANGES INTERPRETATIONS OF FEDERALISM • Court Decisions under Chief Justice John Marshall (1801-1835) affirmed Federal Supremacy and created a broad interpretation of National over State Power – McCulloch v. Maryland (1819) • Issues: – 1) Can Congress establish a federal bank? – 2) Could state of Maryland or any state tax a federal bank? • Decisions: – 1) Constitution enumerates Congress’ power to borrow and coin money, it also has power to make all laws that are necessary and proper to achieve functions of government; thus it has implied power to create a bank; – 2) NO to state taxes of federal operations (like banks) …such taxes would violate the supremacy clause • Lasting effect: necessary and proper clause “stretched” to allow gov. to create social welfare programs, national parks, regulate environment etc. – Gibbons v. Ogden (1824) • Issues: Conflict between steamboat operators in states of New Jersey and New York for control of shipping and trade in lower Hudson River. – 1) States wanted fed. gov. to interpret commerce clause narrowly to regulate only trade in specific products, not manage overall commercial activity, – 2) Feds wanted broader and more general control over commercial activity between states so that it could settle disputes between states, etc. • Decisions: – 1) no state has monopoly power over trade as that would interfere with interstate commerce – 2) Feds had power to control trade in general for public good of all • Lasting Effect: – Used to justify fed. regulation of many things, – Highways, stock markets, etc. – Helped decide in favor of Gov. regulation in Wickard v Filbourn and the agriculture planting limits DUAL FEDERALISM (FROM ABOUT 1835 – 1930) • Later courts often interpreted Federalism in a more balanced manner for states • Chief Justice Roger B. Taney’s court (Marshall’s successor, 18351863) promoted Dual Federalism (nicknamed Layer Cake Federalism) – Definition: the belief that having separate, yet equally powerful levels of government (State and Fed.) is the best arrangement – Generally courts that believed this argued for a strict interpretation of Constitution and did not favor stretching the necessary and proper clause, they strictly upheld rights of states per 10th amendment and the reserved powers • Ex. Dred Scott v. Sandford (1857) – court declared that Congress did not have authority to make slavery illegal in western territories • Ex. Plessy v. Ferguson (1896) – upheld separate but equal laws in states (this despite amendments like 13th, 14th, and 15th after Civil War) COOPERATIVE FEDERALISM (BEGINS AROUND 1930) • 16th Amendment (1913) = allows Feds. to keep taxes (revenues) it collects for things it needs rather than returning all of this income to states (can now run Federal programs all across country) • Bank failure and Great Depression ushers in large numbers of federal programs in the New Deal package (FDR’s creation of all the alphabet agencies, FBI, FHA, Labor Relations agencies, etc.) – Courts initially found these programs illegal and unconstitutional – by 1937, FDR pushed his will through courts and courts were again applying a very broad interpretation of the interstate commerce clause and they were allowing government programs to operate if they affected commerce in any way. • Now federal, state, and local governments are intertwined … nicknamed Marble Cake Federalism • Became an era where Feds and States influenced each other with fiscal (money) revenue sharing programs • 1st instances of this was categorical grants, – Def. = grants used and planned with cooperation of states – Categorical grants give money to states for specific purposes and require states to provide some matching funds and can only be used for specific reasons or purposes (under lots of fed restrictions) – Monies used here often started urban job programs, head start programs, urban redevelopment and housing programs etc. – Used often in 1960s and 70s, still around NEW FEDERALISM (REAGAN CHANGES AFTER 1980) • Pres. Regan (Republican), wanted to retrieve power from Feds back to states • Era lasted until 9/11 • Era of devolution (called Devolution Revolution) – return of monetary and administrative power back to states • New grants of monies to states were called Block Grants – Block grant = money given to states with fewer restrictions, meaning states could use it for what they needed, not what Feds. thought they needed • Under Pres. Clinton (Democrat) – congressional Republicans (elected under a “Contract with America platform” were able to pass the … – Unfunded Mandates Reform Act: this act prevented Congress from passing laws on federally required programs without debate on how to fund them or providing monies back to states to pay for them. • Mandates = requirements that direct states to comply with federal laws; unfunded mandates were requirements that made no allowances for the costs stats would incur – Ex. TANF (Temporary Assistance to Needy Families) program which replaced the Aid to Families with Dependent Children (AFDC) … this returned power to administer such funded programs to the states (away from Fed. gov.) FEDERALISM UNDER BUSH AND OBAMA • Looks like power is swinging back to Feds but kind of unclear yet: – Ex. No Child Left Behind (Bush) and regulation of public school education with federal monies granted to states for adopting common core standards (Race to the Top, Obama)… both are examples of Fiscal federalism – Gonzales v. Raich: Supreme Court upheld Fed power to prosecute med. Marijuana arrests in states that had legalized medical marijuana – Gonzales v. Carhart: Supreme Court said Congress has right to ban some abortion procedures – Also, Supreme Court recently declared the Federal Defense of Marriage Act (DOMA) unconstitutional…this act withheld fed. benefits for same-sex partners of federal employees • This was one step away from making states’ laws banning same-sex marriages illegal and they did that this year in June 2015 – Supreme Court recently refused to consider state appeals that would have prevented same-sex marriages in various states – Obamacare, Affordable Care Act, under constant judicial and Congressional review – 2001 – Congress Passed Patriot Act – allowed more government surveillance of populace in age of terrorism (idea was that some infringement on personal rights to privacy was necessary for good of all public) CONCLUSION: ADVANTAGES AND DISADVANTAGES TO FEDERALISM Advantages • Political Activity is Easily mobilized given the specific localized nature of most governments • Interest groups cannot take over • Diversity of policies and laws allow for political experimentation • Different policies in different states make more sense than uniform laws Disadvantages • Pol. Activity can be confusing • Small but motivated interest groups and/or political parties can block the will of the majority for an extended time – Ex. problem with divided government between Congress and President • Different policies in different states create inequality • Different policies even for driving age, pot possession, and speed limits creates confusion and inequality