Module - P.i.i.m.t.

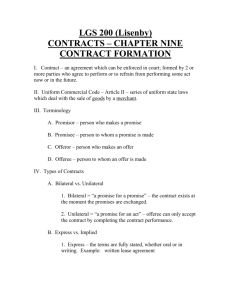

advertisement

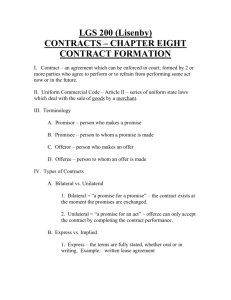

AUL: Business Law , MBA program , by Dr Kayyali Mohamed mullderjob@gmail.com Module: Problems What allocation of interest? • What is the level of risk for A and B in each of the following hypotheticals, assuming A is contributing $100,000, no additional contributions, veto power, no salary; and B is contributing $10,000 plus sweat equity, salary of $5000/mo., no cash contribution, interest for cash, past and future services. Risk and Interest? • a). ALT 1: A is a retired military who is a widower. His contribution is his nest egg. He relies on social security and disability payments, owns 2 apartment buildings. He is 60 years of age and in fair health. Question: A is a retired military who is a widower. His contribution is his nest egg. He relies on social security and disability payments, owns 2 apartment buildings. He is 60 years of age and in fair health. Answer: • Level of risk– Low-moderate • Fixed income; no money to “play with” • Age: old, less time to wait around for profits • Proportion of debt and equity– More debt than equity? • Debt has less risk, greater assurance of repayment • A will want to make a conservative investment • A is retired, probably does not want involvement in business operations Risk and Interest? b) ALT 2: A is a real estate attorney, with a profitable practice from which he receives a salary of $120,000. He has other investments that bring in $10,000 a year, is 32 years of age, and is looking to retire by the time he is 40 years of age. Question: A is a real estate attorney, with a profitable practice from which he receives a salary of $120,000. He has other investments that bring in $10,000 a year, is 32 years of age, and is looking to retire by the time he is 40 years of age. Answer: • Level of risk– High • Income is NOT fixed; financially secure (can afford to risk the money) • Age: middle aged, has time to wait for profits • Proportion of debt and equity – More equity than debt? • Equity has a greater risk, but potential to make much more money • B is an aggressive investor who wants to retire early, wants a greater return on investment • Stock is freely transferable w/ market interest Risk and Interest? c) ALT 3: B is a recent college graduate with $60,000 in school loans. He is single and wants to use the business to create a chain and eventually franchise the store. He receives $2,000/month from a trust. Question: B is a recent college graduate with $60,000 in school loans. He is single and wants to use the business to create a chain and eventually franchise the store. He receives $2,000/month from a trust. Answer: • Level of risk– Medium- High • Low income, but wants to grow big via franchise • Age: young and energy to work hard • Proportion of debt and equity – Equal proportion of debt and equity • B wants to participate in the operation and control of the company, but is not in the position to take a great financial risk Module: Contract Contracts • Definition – A promise that the law will enforce. • Development of Contract Law – Common law once required all contracts to be in writing, with a seal affixed. – Later, some payment was required before a contract could be enforced. – Mutual promises became enforceable in the 1600’s. – By the 1900’s, courts began to consider the fairness of contracts before enforcing them. Types of Contracts (or Agreements) Bilateral vs. Unilateral Executory Valid • vs. Unenforceable Express vs. Implied vs. Executed vs. Voidable vs. Void Bilateral and Unilateral Contracts – Bilateral: both parties make a promise. – Unilateral: one party makes a promise that the other party can accept only by doing something Types of Contracts (cont’d) • Express and Implied Contracts – Express: the two parties explicitly state all important terms of their agreement. – Implied: the words and conduct indicate that the parties intended an agreement. • Executory and Executed Contracts – Executory: when one or more parties has not fulfilled its obligations. – Executed: when all parties have fulfilled their obligations. Types of Contracts (cont’d) • Valid, Unenforceable, Voidable, and Void Agreements – Valid: satisfies the law’s requirements. – Unenforceable: when the parties intend to form a valid bargain but some rule of law prevents enforcement. – Voidable: when the law permits one party to terminate the agreement. – Void: one that neither party can enforce, usually because the purpose is illegal or one of the parties had no legal authority. Sources of Contract Law • • Common Law Uniform Commercial Code – UCC governs the sale of goods. “Goods” means anything moveable, except for money, securities, and certain legal rights. Elements of a Contract • Agreement – offer, and – acceptance • Consideration – There has to be bargaining that leads to an exchange between the parties. • Legality – The contract must be for a lawful purpose. • Capacity – The parties must be adults of sound mind. Meeting of the Minds • The parties can form a contract only if they had a meeting of the minds. – They must understand each other and intend to reach an agreement. – A judge will make an objective assessment of any disagreements about whether a contract was made -- whether or not a reasonable person would conclude that there was an agreement, based on the parties’ conduct. Negotiation Terms JOE Offer Accept or Reject or Counteroffer BOB Accept or Reject or Counteroffer Offer An offer is an act or statement that proposes definite terms and permits the other party to create a contract by accepting those terms. • • Problems with Intent – Invitation to bargain is not an offer. – Price quote is generally not an offer. – An advertisement is generally not an offer. Problems with Definiteness – The term of the offer must be definite. Definiteness/Invitations to Bargain • • • I’ll give a blueberry muffin and a cup of coffee to the first person who shows up next class in class in a full clown suit and makeup. Would you consider showing up in a full clown suit and makeup if I gave you a blueberry muffin and a cup of coffee? I couldn’t take less than $400 for that 1974 Dodge Dart. Termination of Offers • • Termination by Revocation – Effective when the offeree receives it. Firm Offers and Revocability – Common Law Rule • Revocation of a firm offer is effective if the offeree receives it before he accepts. – Option Contract • The offeror may not revoke an offer during the option period. – Sale of Goods • A writing signed by a merchant, offering to hold an offer open, may not be revoked. Termination of Offers (cont’d) • • Termination by Rejection – If an offeree rejects an offer, the rejection immediately terminates the offer. A counteroffer operates as a rejection. Termination by Expiration – When an offer specifies a time limit for acceptance, that period if binding. – If the offer specified no time limit, the offeree has a reasonable period in which to accept. Acceptance • The offeree must say or do something to accept. – In a bilateral contract, the offeree generally must accept by making a promise. – In a unilateral contract, the offeree must accept by performing. • Mirror Image Rule (Common Law) – Requires that acceptance be on precisely the same terms as the offer. Mirror Image Rule 1. 2. 3. 4. 5. Stan offers Eric $6 for Eric’s Carl Yastremski rookie baseball card. Eric answers, “ Throw in a bag of cheesie poofs and you’ve got a deal.” Stan responds, “I’ll do you one better. Let’s meet back here in 20 minutes.” In 20 minutes Stan returns with $6 and Eric’s favorite meal – a chicken nugget happy meal. Eric refuses to give Stan the card, saying he’s having second thoughts. DID STAN AND ERIC HAVE A DEAL? Communication of Acceptance • • and Manner of Acceptance – If an offer demands acceptance in a particular medium or manner, the offeree must follow those requirements. – If the offer does not specify a type of acceptance, the offeree may accept in any reasonable manner and medium. Time of Acceptance: The Mailbox Rule – An accceptance is generally effective upon dispatch, meaning the moment it is out of the offeree’s control. Consideration • Bargaining that leads to an exchange of value between the parties. • Consideration can be anything that someone might want to bargain for. It is the inducement to make the deal, or the thing that is bargained-for. What is the consideration supporting each promise? 1. Stan agrees to pay Eric $6 for Stan’s baseball card; exchange to take place next Tuesday. 2. Professor promises to give a cup of coffee and a blueberry muffin to the first person to come into class in a full clown suit and makeup. 3. I agree to pay you $500 for your lovely painting, “Dogs Playing Poker (on Velvet)”. 4. I promise to pay my son $100 if he does not watch South Park for one year. A Bargain and an Exchange “Bargaining is obligating yourself in order to induce the other side to agree.” • The thing bargained for can be: – another promise or action. – a benefit to the promisor – a promise to do something or a promise to refrain from doing something. Mutuality of Obligations • Illusory Promise – If one party’s promise is conditional, the other party is not bound to the agreement. Promise to pay in return for past favors. Is this consideration? Was it bargained-for? What Type of Contracts ? Insurance What Type of Contracts ? Marriage