Retail Highlights – November 2014

advertisement

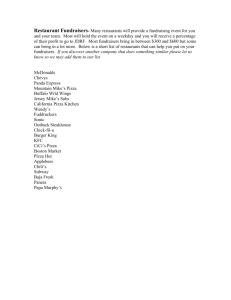

Retail Highlights – November 2014 Contents Nilgiris Goes for a New Future Under Biyanis Papa John’s Acquires Pizza Corner Amazon.com is Set to Acquire Fashion e-tailer Jabong Nilgiris Goes for a New Future Under Biyanis Future Consumer Enterprises Limited the food and FMCG arm of Kishore Biyani's Future Group acquired the Nilgiris convenience store chain. Nilgiris, an iconic brand with origins dating back to 1905 and a household name in South India, operates a franchisee operated convenience store chain with 140 stores in key urban centers in the four southern states of Kerala, Karnataka, Andhra Pradesh and Tamil Nadu. This acquisition by FCEL will lead to geographical expansion of the convenience store network in Southern India, as presently FCEL’s existing footprint is primarily concentrated in North and Western India. Future Group with an investment of over Rs 110 crores, is setting up a food park spread across 110 acres in Tumkur, near Bengaluru, India. Products developed at the food park will be retailed through Future Group’s retail formats such as Big Bazaar, Food Bazaar, Foodhall, KB’s Fairprice, Big Apple and Aadhaar as well as through other modern retailers. Over the past two years, the Future group has also made acquisitions to increase its footprint and product line. In September 2012, Future Consumer Enterprise then known as Future Ventures India Ltd had acquired 100% equity share capital in Express Retail Services Pvt. Ltd, which runs Big Apple, for Rs.61.35 crore, strengthening its footprint in North India. Earlier in January 2014, the company had acquired 35% stake in Sarjena Foods, the seller of bakery products under the name Baker Street. Papa John’s Acquires Pizza Corner Om Pizza & Eats Pvt Ltd, the Indian master franchisee of global pizza chain Papa John’s, has acquired bigger local rival and the arguably the third-largest pizza chain in India, Pizza Corner, for an undisclosed amount. The Indian Pizza market is currently dominated by Domino's followed by Pizza Hut. It is believed the terms of the transaction includes a stock deal which would give Global Franchise Architects (GFA), the current owner of Pizza Corner, a stake in Om Pizza. Papa John’s will convert the existing Pizza Corner stores to Papa John’s branded restaurants through Q1 2015. Papa John’s, the world’s third-largest pizza delivery company, currently has 15 operating restaurants across India through its master franchisee Om Pizza. The acquisition cum merger brings a phenomenal opportunity to meet growing demands by combining Papa John’s world class pedigree with Pizza Corner’s local expertise and would make it a strong player especially in south and Western India said John Schnatter, founder and CEO of Papa John’s. Om Pizza, a firm backed by PE firm TVS Capital, is majority owned by Avan Projects, owned by the Mittal family (which sold Ispat to JSW a few years ago). Avan is led by Atulya Mittal and is focused on capitalising on the consumption-driven growth story in India. Founded by serial entrepreneur Fred Mouawad, GFA is a Geneva-based group that builds, operates and franchises a select portfolio of specialty food service brands. Pizza Corner was its first brand in India launched way back in 1996 - and its other portfolio in the country consists of Donut Baker, Cream and Fudge and Coffee World. Currently GFA has 120 stores across its four brands in India, around half of the over 250 stores in six countries globally. 1|Page November-30-2014 Amazon.com is Set to Acquire Fashion e-tailer Jabong According to reports E-commerce giant Amazon.com, has completed its first level of talks to acquire Rocket Internet-backed lifestyle e-tailer Jabong.com in a deal worth a little over $1 billion, upon completion this could be the biggest acquisition in the history of the Indian e-commerce space. However right now it is not comprehensible how the deal would be structured as Jabong is an inventory-based e-tailer. The Indian government which allowed up to 51 % foreign direct investment in multi-brand retail trading however has ensured that multi-brand e-commerce companies with FDI will not be permitted to operate. With some meticulous structuring, Amazon can seal this deal because only recently Flipkart bought Myntra. Flipkart-Myntra deal, pegged at around $340 million, remains to date the biggest M&A in the e-com sector in India. Flipkart, founded by ex-Amazon employees has given Amazon a run for its money. Jabong acquisition is more of a counter move for Amazon to up its fashion line. It is very likely that post acquisition Amazon may keep Jabong as a separate asset, very much on the lines of Amazon's acquisition of Zappos in 2009. However, the Jabong deal would attract intense regulatory scrutiny given the market muscle of Amazon. Besides Rocket Internet, Swedish investment firm Kinnevik and UK's development financial institution CDC are major shareholders. Kinnevik owns 25 per cent stake in Jabong. The structuring of the transaction would also be interesting as the fashion portal is being merged into a global network of Rocket Internet-backed sites such as Dafiti, Lamoda, Namshi and Zalora under a firm called Big Foot Retail. Big Foot Retail itself is said to be worth around $2.5 billion as of September 30, 2014, as per disclosure made by Kinnevik recently based on its 34 per cent effective ownership of the global platform. Jabong, which is one of the two top lifestyle e-tailers in India along with Flipkart owned Myntra, reported gross merchandise value (GMV) of over Rs 509 crore from 3.197 million orders in the January-June 2014 period. This marked a three-fold rise over the previous year.If it maintains the same growth through the rest of the year it may end with GMV of over Rs 1,000 crore for the year ending March 31, 2015. Accepted fair valuation in speciality e-com in unlisted space internationally is pegged at 3.5x sales, which would value Jabong at around Rs 3,500 crore. Jabong could be looking to drive a hard bargain given the strategic play of Amazon in India and significance of the deal to win in the high stakes game in the country. Earlier in October, Amazon's founder and CEO Jeff Bezos during his India visit committed to invest $2 billion in its Indian operations, a day after Flipkart announced a $1-billion funding. Bezos said he was happy with his company's run on India since it sold goods worth $1 billion a year. "If there is an opportunity to invest more, we will," he said. Jabong was founded by Arun Chandra Mohan, Praveen Sinha and Lakshmi Potluri in 2012. Later, Mukul Bafana and Manu Jain (now head of Chinese phone maker Xia). Jabong and Amazon's India team have refused to comment about the deal. 2|Page November-30-2014