Salary, Classifications and Allowances

advertisement

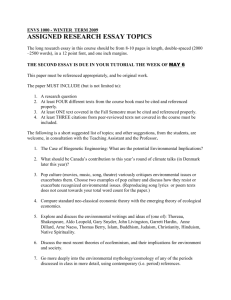

COMPARISON OF TERMS AND CONDITIONS (where there are differences) Summary of Provisions Subject No FaHCSIA EA DoHA EA DEEWR EA DIAC INNOVATION EA PM&C EA DRALGAS DSS EA Salary, Temporary Performance, Classifications 1 Salary advancement 1 September each year. 1 August each year. 15 August each year. 1 July each year. 1 July each year. 1 July each year. 14 September each year. 1 September each year 2 Salary Advancement TPA/Higher Duties 1 September each year Payment Date: Anniversary 1 increment when: Worked for a continuous period of 12 months, or for a period of 12 months within a 24 month period 3 Temporary performance Payment Date: First full pay period after 1 August each year. 1 increment when: Worked an aggregate period of at least 3 months between 1 July and 30 June. ‘Strong & Effective’ or higher rating Satisfactory assessment at the higher level where performance plan not required Acting for 2 weeks or more, unless exceptional circumstances apply. Where HDA periods have been at different levels, progression will occur to the HDA level closest to the substantive level unless the person has acted for three months or more at the higher classification Acting for a continuous period of more than 5 working days. Payment Date: 15 August 1 increment when: Continuous TPL at the same classification and pay point from 1 April to 15 August ‘Mostly Achieves’ rating or higher Eligible where there is a break of three weeks or less in TPL between 30 June and 15 August Acting for 5 consecutive days or more, unless exceptional circumstances apply. Payment Date: Beginning of first full pay period after 1 July each year. 1 increment when: ‘Effective’ or higher rating Not referenced in EA Payment date: Anniversary 1 increment: After 12 months acting in the job. Worked an aggregate period of at least 3 continuous months in the previous performance cycle ending 30 June Acting for 2 weeks or more. Payment Date: 14 September Ongoing employees 1 increment when on current pay point for 3 months Rated satisfactory or better May advance two pay points in recognition of high level performance Acting for 4 weeks or more. Acting for 15 consecutive days or more. Acting for 10 consecutive working days inclusive of public holidays Worked for a continuous period of 12 months, or for a period of 12 months within a 24 month period Performance Agreement in place Satisfactory performance or higher Temporary performance increment retained if break no longer than 24 months Acting for 2 weeks or more, unless exceptional circumstances apply Hours of Work 4 Hours of work 7 hours 30 minutes per day. 7 hours 30 minutes per day. 7 hours 30 minutes per day. 7 hours 30 minutes per day. 7 hours 30 minutes per day. 7 hours 36 minutes per day. 7 hours 30 minutes per day. 7 hours 30 minutes per day. 5 Christmas and Easter closedowns Christmas - 12:30pm on the last working day before Christmas Day and re-open the first working day following the first day of January(i.e. three and half days leave without deduction). Christmas - COB on the last working day before Christmas Day, to the New Year's Day public holiday (i.e. three days leave without deduction). Where a manager and an EL agree that additional work is necessary, they should discuss so that agreement on TOIL and its timing Where a manager and an EL agree that additional work is necessary, they should discuss so that agreement on TOIL and its timing 6 TOIL Christmas 12:30pm on the last working day before Christmas Day to the New Year's Day public holiday (i.e. three and half days leave without deduction). Easter - 3.00pm on Easter Thursday (i.e. two hours leave without deduction). Where a manager and an EL agree that additional work is necessary, they should discuss so that agreement on Christmas - 3:00pm on the last working day before Christmas Day to the New Year's Day public holiday (i.e. three days 2 hours leave without deduction). Easter - 3.00pm on Easter Thursday (i.e. two hours leave without deduction). Where a manager and an EL agree that additional work is necessary, they should discuss time off in lieu so that agreement on TOIL Christmas – Employees may choose to use either annual leave or flex credits to cover the close down period. Day after boxing day to be a public holiday. No reference to TOIL The Secretary may authorise payment of an executive extended commitment allowance of $11,500 Christmas - COB on the last working day before Christmas Day, to the New Year's Day public holiday (i.e. three days leave without deduction). No specific reference Christmas - COB on the last working day before Christmas Day, to the New Year's Day public holiday (i.e. three days leave without deduction). Not hour for hour Fair and reasonable time off Included in individual performance agreement as agreed with manager Christmas – 12.30pm on the last working day before Christmas, resuming the first working day after New Year’s Day (i.e. three and half days without leave deduction). Easter – 3.00pm on Easter Thursday (i.e. two hours without leave deduction). The Secretary may grant a period of paid TOIL to EL who work hours that are in addition to those reasonable extra/additional hours. 1 Summary of Provisions Subject No FaHCSIA EA DoHA EA TOIL and its timing can be reached prior to the working of additional hours. and its timing can be reached prior to the working of additional hours. Also hour for hour for extra travel time. See EA for detail. . 7 Flextime Available to APS6 and equiv) and below Maximum flex credit to be carried from one settlement period to another is 37 hours 30 minutes. Maximum flex debit to be carried from one settlement period to another is 22 hours 30 minutes. Employees can use up to 5 consecutive days of flex leave. In exceptional circumstances, an employee who has a positive flex balance in excess of 37.5 hours may have the balance in excess of 37.5 hours paid out at ordinary time rates. DEEWR EA Plan to reduce flex to be agreed exceeding 20 hours in settlement period Flex credits exceeding 30 hours may be cashed out managers approval Flex credits in excess of 37.50 hours can be cashed out automatically Maximum flex debit is 10 hours in settlement period DIAC can be reached prior to the working of additional hours. INNOVATION EA PM&C EA pa to an EL and equivalent subject to conditions outlined in EA Maximum flex credit to be carried from one settlement period to another is 37 hours 30 minutes. Maximum flex debit to be carried from one settlement period to another is 22 hours 30 minutes Option to cash out flextime credits in excess of 37.5 hours at the ordinary time rate Provision to also convert excess credit to annual leave. Maximum flex debit is 10 hours in settlement period Positive flex balance in excess of 20 hours in settlement period may be paid out DRALGAS Agreed unused TOIL up to a maximum amount of 37 hours and 30 minutes can be carried over from month to month. Available to APS6 and equiv) and below Maximum flex credit to be carried from one settlement period to another is 37 hours 30 minutes. Maximum flex debit to be carried from one settlement period to another is 37 hours 30 minutes. If debit of 7.5 hours over a four week period must bring to positive before being able to access further flex leave. Available to APS6 and equiv) and below Maximum flex credit to be carried from one settlement period to another is 37 hours 30 minutes. Maximum flex debit to be carried from one settlement period to another is 22 hours 30 minutes. Employees can use up to 5 consecutive days of flex leave. In exceptional circumstances, an employee who has a positive flex balance in excess of 37.5 hours at the end of a settlement period may have the balance in excess of 22.5 hours paid out at the single hourly rate. can be reached prior to the working of additional hours. Maximum flex debit from one settlement period to the next is 10 hours Maximum Flextime credit from one settlement period to the next is 1 standard working week a flextime absence may be taken in part or full days up to a maximum of five consecutive days maximum of 38 hours as a flextime credit carried into the next settlement period maximum of 7 hours 36 minutes flextime debit carried into next settlement period positive flex balance in excess of 38 hours, balance may be carried over to the next settlement period but must reduce the excess to 38 hours within 4 weeks. DSS EA Leave 9 Cash out of annual leave Employees may cash out annual leave. 10 Personal leave – General 20 days credit per year. 8 days per year without a medical certificate. Maximum of 3 consecutive days without a medical certificate. 11 Compassionate Deducted from Not Referenced in EA. Employees may cash out annual leave. Employees may cash out annual leave. Employees may cash out annual leave. Not Referenced in EA. Employees may cash out annual leave. May cash out down to 20 days 18 days credit per year. 10 days per year without a medical certificate. Maximum of 3 consecutive days without a medical certificate. Personal leave half pay not less than 2 days. 18 days credit per year. Maximum of 3 consecutive days without a medical certificate. 18 days credit per year. 5 days per year without a medical certificate. Personal leave can be taken at half pay. 18 days credit every 12 months. 10 days per year without a medical certificate. Maximum of 3 consecutive days without a medical certificate. 18 days credit per year. Maximum of 3 consecutive days without a medical certificate. 18 days credit per year. 5 days per year without a medical certificate. 10 days on engagement, and then 8 days in the first year of employment 18 days credit per year 8 days without a medical certificate Maximum of 3 consecutive days without a medical certificate In addition to In addition to In addition to In addition to In addition to In addition to personal In addition to Personal 2 Summary of Provisions Subject No FaHCSIA EA Leave 14 Supporting Partner Leave 15 Cultural and Ceremonial Leave personal leave Personal illness or injury that poses a serious threat to their life – 3 days paid leave - Death – at least 3days. 4 weeks leave full pay. Can be taken at half pay. 3 days paid and/or 2 months unpaid. DoHA EA personal leave credit of 18 days. Personal illness or injury that poses a serious threat to their life – 2 days paid leave -Death - 3 days. 4 weeks leave full pay. Can be taken at half pay. 3 months unpaid. DEEWR EA NAIDOC Week Leave One day’s paid leave to attend NAIDOC week activities. 17 Purchased 8 weeks, min of 1 day. 18 Extended Purchased Leave Not Referenced in EA 19 Sabbatical Leave Self-fund an extended period of leave (12 months) – 4 year work period and one year sabbatical at 80% of salary Miscellaneous Leave (moving house) 1 days paid leave per calendar year. Volunteering Leave 4 days with pay and a reasonable amount of leave without pay. 20 2 weeks leave full pay (4 weeks half pay). 16 personal leave. Personal illness or injury that poses a serious threat to their life – 3 days paid leave -Death –3 days DIAC personal leave. Personal illness or injury that poses a serious threat to their life – 2 days paid leave - Death -at least 2days. 4 weeks leave full pay. Can be taken a half pay INNOVATION EA personal leave. Personal illness or injury that poses a serious threat to their life – 2 days paid leave - Death - 2 days 2 weeks leave full pay. PM&C EA leave. Personal illness or injury that poses a serious threat to their life – 3 days paid leave -Death – 3 days leave credit 3 days paid leave: 20 days on full pay 4 weeks leave full pay. Can be taken at half pay. Not Referenced in EA 3 days paid Cultural Leave for Aboriginal and Torres Strait Islander employees Personal illness or injury that poses a serious threat to life Death One day’s paid leave to attend NAIDOC week activities. 5 days paid (including Cultural and Ceremonial leave). See miscellaneous and cultural leave Up to 5 days paid Rolled into Cultural Leave 5 days paid (including NAIDOC week leave). DSS EA Cultural leave – 2 days pa (ATSI staff can use for NAIDOC events as well). Ceremonial leave – 20 days unpaid for ATSI employees. See miscellaneous and cultural leave Ceremonial leave - 10 days unpaid over a two year period. personal leave. Personal illness or injury that poses a serious threat to their life – 3 days paid leave -Death – 3 days 2 weeks leave full pay. Up to 3 additional weeks from personal/carer’s leave credits. 2 days paid leave to attend NAIDOC week activities or other cultural or ceremonial events. 3 months unpaid. DRALGAS 2 days paid leave to attend NAIDOC week activities. 6 weeks, generally taken in multiple days. 8 weeks. 8 weeks. 10 weeks. 8 weeks. 8 weeks. One election per calendar year of up to 8 weeks, minimum of 1 day Employees with 3 years continuous employment may be granted up to 6 months leave following a further 2 years of continuous employment Not Referenced in EA Not Referenced in EA Not Referenced in EA Not Referenced in EA Not Referenced in EA Self-fund an extended period of leave (6 months) – 3 years continuous following a further 2 years of continuous employment leave paid at salary based on money paid in Not Referenced in EA Not Referenced in EA Self-fund an extended period of leave (12 months) – 4 year work period and one year sabbatical at 80% of salary Not Referenced in EA Not Referenced in EA Not Referenced in EA Self-fund an extended period of leave (12 months) – 4 year work period and one year sabbatical at salary based on money paid in Reasonable miscellaneous leave with pay, for moving house Miscellaneous leave with pay, for short term volunteer purposes Paid personal leave for moving house Paid personal leave for moving house Not referred to in EA Not referred to in EA Not referred to in EA Removed from EA 2 days with pay and a reasonable amount of leave without pay. Not specified Not specified 1 day with pay and a reasonable amount of leave without pay. Up to 5 days paid 2 days with pay and a reasonable amount of leave without pay. Balancing Work and Family Life 3 Summary of Provisions Subject No FaHCSIA EA DoHA EA DEEWR EA DIAC INNOVATION EA PM&C EA DRALGAS DSS EA 21 Family Care rooms Yes Yes N/A Yes Yes Yes Not Referenced in EA Not referenced in EA Provided for in policy 22 Work/Life Balance Information and Referral Service Yes Not Referenced in EA Not Referenced in EA Not Referenced in EA Not Referenced in EA Not Referenced in EA Not Referenced in EA Removed from EA $23.20 pf. First aid officers $14pw. Fire wardens, HCO or HSR $9.50pw. $26 pf. HSR - $22.00 pf Fire Warden - $22pf First Aid Standard A $22 pf; First Aid Standard B $25 pf; First Aid Standard C $30 pf. First aid - $28pf Fire wardens $28pf HSR $25 pf. $25 per fortnight First Aid - $31.85pf Fire Wardens - $ 26.50pf HSRs – $ 31.85pf HCOs - $31.85pf Not Referenced in EA Not Referenced in EA Access to flu shots Not referenced in EA Provided for in policy Healthy and Safe Workplace 23 Workplace Contact Officer Allowance Annually Not Referenced in EA HSR, HCO or Emergency Control Volunteer $333 pa ($12.77pf). First Aid– level 2 $537 pa ($20.59pf); First Aid - level 3 $659 pa ($25.26pf); additional allowance of $512 pa ($19.63pf) for coordinators. Not Referenced in EA Yes full details available in EA. Not referenced in EA Not referenced in EA Not referenced in EA Not referenced in EA Not referenced in EA Not referenced in EA Provided for in policy $275 per week. Pro rata for less than a week. $50 per day for restricted on a weekend roster. Min of 3 hours OT if recalled to duty. Min of 1 hour OT if not recalled to the workplace. Mon to Sat- Time and a half Sun- Double time Pub Hol - Double time (single time during rostered hours) Minimum payment of 4 hrs where not continuous with ordinary hours 9% of hourly rate. Min of 3 hours OT if recalled to duty. Min of 1 hour OT if not recalled to the workplace. $39 per day. Min of 3 hours OT if recalled to duty. Min of 1 hour OT if not recalled to the workplace. 10% of salary and allowances. Min of 2 hours OT if recalled to duty. Min of 1 hour OT if not recalled to the workplace. $350 per week. Pro rata for less than a week. Min of 2 hours OT if recalled to duty. Min of 1 hour OT if not recalled to the workplace. 7.5% Mon to Fri, 10% Sat and Sun, 15% pub Hol of hourly rate of salary. $45 per week day $55 for weekends, public holidays and closedown days Min of 3 hours OT if recalled to duty. Min of 1 hour OT if required to perform duty but not recalled to the workplace. Mon to Sat- Time and a half for first 3 hoursDouble time thereafter Sun- Double time Pub Hol - Double time and a half (time and a half during rostered hours) Mon to Fri per hour - APS 1-3 $47.27 - APS 4-6 $61.90 Annual allowance of $17,000 20% of employees annual salary 24 Vaccinations Annually 25 Screen Based Eyesight Testing and Reimbursement Not referenced in EA. Allowances and Reimbursements 26 Restriction 27 Overtime 28 Departmental Liaison 7.5% Mon to Fri, 10% Sat and Sun, 15% pub Hol of hourly rate of salary. Min of 3 hours OT if recalled to duty. Min of 1 hour OT if not recalled to the workplace. Mon to Sat - Time and a half for first 3 hours - Double time thereafter Sun- Double time Pub Hol- Double time and a half (time and a half during rostered hours) Annual allowance of $20,174 Mon to Sat - Time and a half for first 3 hours- Double time thereafter Sun- Double time Pub Hol- Double time and a half (time and a half during rostered hours) Annual allowance of $20,401 Mon to Sat- Time and a half for first 3 hoursDouble time thereafter Sun- Double time Pub Hol- Double time and a half (time and a half during rostered hours) Annual allowance of $17,245 Monday to Saturday time and a half Sunday double time Sat, Sun, Pub Hol 1st Hour - APS 1-3 $73.15 - APS 4-6 $86.66 subsequent hours - APS 1-3 $47.27 - APS 4-6 $61.90 Annual allowance of $18,000 Annual allowance of $23,339 Mon to Sat - Time and a half for first 3 hours - Double time thereafter Sun- Double time Pub Hol- Double time and a half (time and a half during rostered hours) Annual allowance of $20,174 4 Summary of Provisions Subject No FaHCSIA EA 29 Community Language CLA 1 $980 pa CLA 2 $1,966 pa 30 Professional Membership $750 pa Up to $42 pa for other relevant associations 31 Health Allowance Not Referenced in EA 32 School Holiday Assistance Not Referenced in EA 33 Financial Assistance Not Referenced in EA 35 Impact of Building Work Secretary will approve the amount of allowance from $8 to $3 per day. Formula for rate calculation and quantum descriptors are in EA. 36 Relocation permanent 37 Excess Travelling Time (ETT) DoHA EA DEEWR EA INNOVATION EA PM&C EA DRALGAS DSS EA Rate 1 $647 pa Rate 2 $1,293 pa $1,700 pa Rate 1 $894 pa Rate 2 $1,789 pa Not Referenced in EA $1,600 pa Not Referenced in EA CLA 1 $980 pa CLA 2 $1,966 pa Not Referenced in EA The department will pay for professional association membership costs Not Referenced in EA $500 pa Reimburse membership and accreditation fees for memberships of professional bodies that relate to employee’s work $750 pa Up to $42 pa for other relevant associations Grandfathered $2000 allowances for CNOs Meet reasonable costs to maintain mandatory quals as required by the dept. Allowance of $2,000 pa paid to C’wealth Nurses Not Referenced in EA APS 1-3 $500 APS 4-6 $200 Not Referenced in EA $200 reimbursed each financial year. Not Referenced in EA Not Referenced in EA Removed from EA Not Referenced in EA Not Referenced in EA $26 pd or $13 ½ day, per primary school age child Not Referenced in EA Not Referenced in EA Removed from EA Reimbursement up to $500 for financial advice, staff aged 54 and over. Reimburse $18 per child up a max of $180 pw per family. All carers who work for the Department must be at work. Not Referenced in EA Not Referenced in EA Not Referenced in EA Not Referenced in EA Not Referenced in EA Removed from EA Allowance may be payable as determined by the Secretary. Rate and period of payment to be determined according to the circumstances and in consultation with Staff and their representatives. $10 per day (If miscellaneous leave with pay or working from home arrangements have failed to redress employee's working conditions) Allowance may be payable as determined by the Secretary The Secretary will determine the amount and conditions on which a disruption allowance may be paid. Allowance may be payable as determined by the Secretary Not Referenced in EA Not Referenced in EA Removed from EA Employer initiated may negotiate a package up to $48,000 for reasonable expenses Employee initiated may negotiate a package of up to $14,000 payable by the gaining area. Disturbance Allowance An employee may be entitled to assistance with relocation expenses. Details are in the relocation assistance guideline. An employee may be entitled to assistance with relocation expenses Employer initiated -up to $40,000 for reasonable expenses Employee initiatedreimbursement of up to $10,000 to $20,000 for reasonable expenses Not Referenced in EA Employer initiated reimbursement of all reasonable costs associated with relocation. A non-acquitable taxable one-off lump sum payment to cover miscellaneous expenditure. Employee initiated -to be agreed between the employee, manager and a Corporate Division representative at the time of assignment of duties. Payment at single time Mon – Sat and time and half Sun & Pub Holidays for time necessarily spent in travel or on duty (exclusive of overtime Not Referenced in EA Not Referenced in EA Employer initiated -Up to $40,000 for reasonable expenses Employee initiated -Reimbursement of up to $10,000 to $20,000 for reasonable expenses Disturbance Allowance Employer initiated or in the interests of the department Reimbursement of reasonable relocation costs. Assistance package to be negotiated. Self-initiated transfer nil Disturbance Allowance Not Referenced in EA Payment at single time Mon – Sat and time and half Sun & Pub Holidays. Time off in lieu may be DIAC Employer initiated reimbursement of reasonable relocation costs Not Referenced in EA - Removed from EA 5 Summary of Provisions Subject No FaHCSIA EA DoHA EA DEEWR EA DIAC granted on an hour for hour basis for Permanent or temporary moves initiated by FaHCSIA for additional time in excess of usual travel time spent travelling to and from home and previous work place 38 Excess Fares 39 Loss or damage to personal effects 40 Tropical and Temperate Clothing Allowance INNOVATION EA - DSS EA Not Referenced in EA Not Referenced in EA Removed from EA Reimbursement of reasonable expenses to cover the loss or damage subject to minimum value of $20. Reimbursement where damage occurred in the course of the employee’s work. Not Referenced in EA Up to Comcover excess per incident for loss or damage to clothing or personal effects. Not Referenced in EA Not Referenced in EA Not Referenced in EA Removed from EA First 21 days at temporary location allowance for accommodation, meals and incidentals. $60 for part day TA. Travel charge card or other Government credit card to pay for accommodation, meals and incidental expenses. Travel charge card or other Government credit card to pay for accommodation, meals and incidental expenses Travel charge card or other Government credit card to pay for accommodation for first 21 days at temporary location. Allowance for meals and incidentals No part day TA. Not Referenced in EA Not Referenced in EA Reimbursement of excess travel fares for temp duty at a place other than employee’s usual place of work: Not Referenced in EA Reimbursement of reasonable costs. Where a substantial amount is involved, a formula is specified. Not Referenced in EA Reimbursement of reasonable expenses associated with the loss or damage on production of receipts. Up to $100 for the reasonable costs of clothing over a three year period. Employees travelling for periods of at least 7 days and no longer than 6 months are eligible to apply. Reimbursement of reasonable costs of clothing bought for the trip. Manager will have regard to the prevailing climate conditions at both locations and the frequency and length of travel of the Staff member. Not Referenced in EA Not Referenced in EA First 21 days at temporary location allowance for accommodation, meals and incidentals No part day TA. First 21 days at temporary location allowance for accommodation, meals and incidentals. $44 for part day TA. First 21 days at temporary location allowance for accommodation, meals and incidentals. $40 for part day TA. First 21 days at temporary location allowance for accommodation, meals and incidentals. Part day TA $51 pd. DRALGAS duty) in excess of their usual hours of duty for the day time necessarily elapsing between time of departure from home and commencement of duty at usual place of work, and the time necessarily elapsing between time of ceasing duty at usual place of work and arrival at home.. Reimbursement of excess travel fares for temp duty at a place other than employee’s usual place of work: calculated from office based site for home based work employees limited to 3 months Up to Comcover excess per incident for loss or damage to clothing or personal effects. PM&C EA Travelling on Business 41 Travelling Allowance 42 Relocation – temporary (travel in excess Reasonable accommodation costs where there Living Away From Home Allowance package to meet Paid on the basis of reasonable actual expenses or an The Secretary may determine a rate of allowance based on a Entitled to reasonable amount expended on accommodation, Not Referenced in EA Not Referenced in EA The Secretary will negotiate payment of reasonable costs 6 Summary of Provisions Subject No FaHCSIA EA of 3 weeks) are ongoing accommodation costs at the pretransfer locality. Pantry Allowance of $400 Reunion fares if dependants remain in pre transfer locality, 1 fare every 3 months. 8 trips per year; or 4 where travel involves extended travel time and connecting flights to or from SA, WA, TAS, NT; or a single international flight annually 43 Airline Club Membership DoHA EA reasonable costs to be agreed based Not Referenced in EA DEEWR EA DIAC agreed alternative package of assistance reimbursement of reasonable costs, 8 trips or more per year over a 12 month period Commuted Remote Localities Allowance Regular and ongoing travel. INNOVATION EA PM&C EA DRALGAS DSS EA meals and incidentals Not Referenced in EA Membership may be paid for or purchased at PM&C’s discounted corporate rate Not Referenced in EA Not Referenced in EA Removed from EA In policy - Airline club membership is provided to employees who are likely to be travelling regularly by air on DSS business. Regular trips are as per former FaHCSIA EA. Where a DSS employee has paid for a personal airline club membership and later meets the above requirements, DSS may reimburse the employee for some or all of the cost of that membership. Remote Locality Assistance 44 Remote Locality Assistance Allowance, Leave fares and Additional Annual Leave Remote Locality Assistance Allowance amount payable depends on location. Leave fares and additional paid leave. May have access to remote locality conditions as negotiated with the Manager. $450 payable for financial/career advice. DEEWR includes ability to have 1 month discussion and 1 month consideration period paid out. $1200 payable for financial/career Commuted Remote Localities Allowance Not Referenced in EA Remote Locality Assistance Allowance amount payable depends on location. Leave fares and additional paid leave. $500 payable for financial/career advice Retirement, Redeployment and Retrenchment 45 Voluntary redundancy $500 payable for financial/career advice. $640 payable for financial/career advice. $600 payable for financial/career advice. $500 payable for financial/career advice. $750 payable for financial advice. 7 Summary of Provisions Subject No FaHCSIA EA DoHA EA DEEWR EA DIAC INNOVATION EA PM&C EA DRALGAS DSS EA advice. 46 Involuntary redundancy 13 months (20 or more years of service or over 45). 56 weeks (20 or more years of service or over 45). 13 months (20 or more years of service or over 45). 13 months (20 or more years of service or over 45). 6 months (20 or more years of service or over 45). 7 months for other employees 30 weeks for other employees 7 months for other employees 7 months for other employees 7 months for other employees Level 1 – recognised as an approved student; paid study leave Reimbursement up to $3000 per calendar year. Reimbursement up to $1200 per annum. Up to 8 hours study leave per week Reimbursement of $793 for first approved subject in a semester, and up to $566 per semester for each additional subject. Up to 8 hours study leave per week 7 months. 56 weeks (20 or more years of service or over 45). 13 months (20 or more years of service or over 45). 30 weeks for other employees 7 months for other employees No specifics in EA refers to policy Reimbursement up to $1500 per semester to a maximum of $3000 per academic or calendar year Up to 5 hours study leave per week, 10 hours for Aboriginal and Torres Strait Islander employees and those with disabilities and up to 3 hours travel time Performance and Capability 47 Study Assistance Reimbursement up to $1400 per semester to a maximum of $2800 per academic or calendar year. Up to 5 hours study leave per week Level 2 – Level 1 support; reimbursement of a percentage of total study costs Level 3 – 100% financial support for the costs of the study. Up to 5 hours study leave per week Reimbursement of $2376 for undertaking Legal Workshop. Up to 7:30 hours study leave per week Reimbursement up to $7000 per calendar year. Up to 6 hours study leave per week 8