Level 1 2011 - Mahurangi College

advertisement

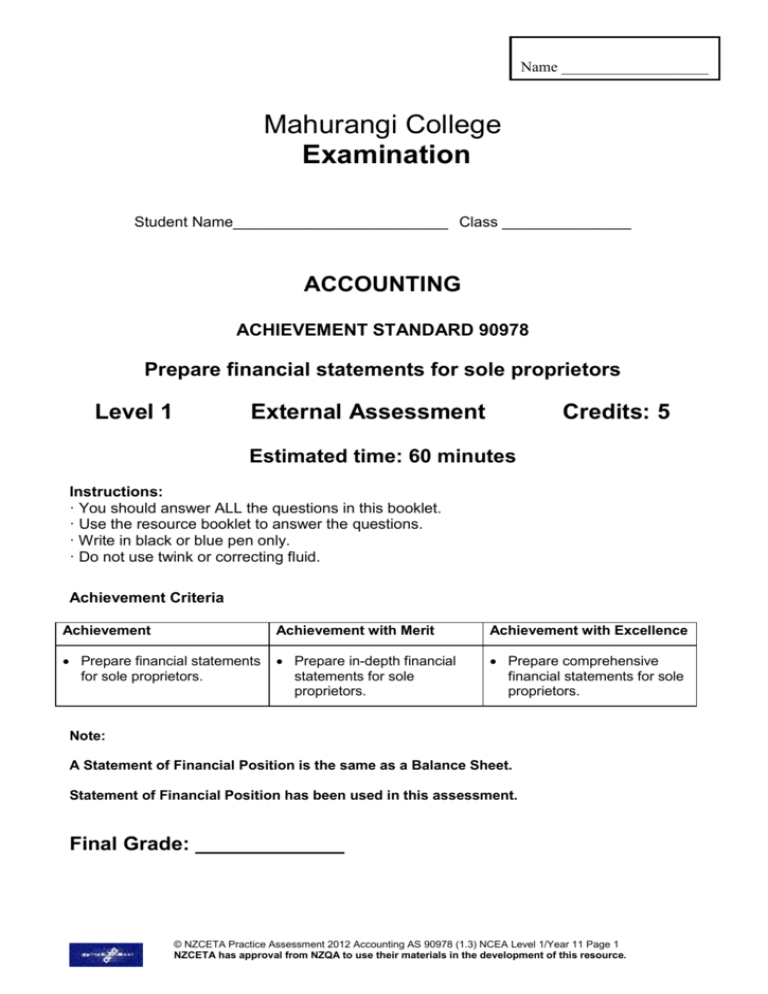

Name ___________________ Mahurangi College Examination Student Name_________________________ Class _______________ ACCOUNTING ACHIEVEMENT STANDARD 90978 Prepare financial statements for sole proprietors Level 1 External Assessment Credits: 5 Estimated time: 60 minutes Instructions: · You should answer ALL the questions in this booklet. · Use the resource booklet to answer the questions. · Write in black or blue pen only. · Do not use twink or correcting fluid. Achievement Criteria Achievement Achievement with Merit Achievement with Excellence Prepare financial statements for sole proprietors. Prepare in-depth financial statements for sole proprietors. Prepare comprehensive financial statements for sole proprietors. Note: A Statement of Financial Position is the same as a Balance Sheet. Statement of Financial Position has been used in this assessment. Final Grade: _____________ © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 1 NZCETA has approval from NZQA to use their materials in the development of this resource. QUESTION ONE: INCOME STATEMENT REFER TO THE RESOURCE BOOKLET Use the Trial Balance and additional information in the Resource to complete the following Income Statement for Ginny’s Florist for the year ended 31 March 2012. Do not use abbreviations. Ginny’s Florist Income Statement for the year ended 31 March 2012 Sales Net Sales Less Cost of Goods Sold Goods available for sale Gross Profit Add Other Income Less Expenses Florist Expenses Administrative Expenses Finance Costs Total expenses Profit/Loss for the year © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 2 NZCETA has approval from NZQA to use their materials in the development of this resource. QUESTION TWO: STATEMENT OF FINANCIAL POSITION. Refer to the Resource Booklet Use the Trial Balance and additional information in the Resource Booklet to answer this question. Prepare a fully classified Statement of Financial Position for Ginny’s Florist as at 31 March 2012. Also, complete the Note to the Statement of Financial Position. Ginny’s Florist Statement of Financial Position as at 31 March 2012 Current Assets Total Current Assets Non-current Assets Property, Plant and Equipment (Note 1) Intangible Assets Total Non-current Assets Total Assets Less Liabilities Current Liabilities Total Current Liabilities Non-current Liabilities Total Liabilities Net Assets Equity Closing Capital Note 1 Property, Plant and Equipment Shop Fittings Building Office Equipment Total Cost Accumulated Depreciation Carrying Amount © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 3 NZCETA has approval from NZQA to use their materials in the development of this resource. QUESTION THREE: CASH BUDGET The following information relates to Ginny’s Florist for the month of August 2012. Complete the Cash Budget on the following page and circle the word “surplus” or “deficit” on the statement , which matches the result. Assume that four weeks equals one month. Ginny’s Florist bank balance on 1 August 2012 is $5,887 in funds. Ginny has estimated the following will occur during August: Cash received for sales 24,678 Invoices to be issued 2,390 Cash paid for purchases 1,377 Invoices on hand for purchases 4,699 Office salaries paid 1.678 Other expenses paid 2,344 Depreciation on shop fittings 200 Commission Received 765 Interest paid on loan 120 Photocopy Paper paid by EFTPOS 65 Received from accounts receivable 723 Ginny’s Drawings (includes fresh flowers $52) 152 Payments to accounts payable 378 Other estimated information relating to August • regular direct debit for electricity, $300. • estimated direct credit from customers for sales $72 You are required to select relevant information to prepare a Cash Budget for the month of August 2012. Use the space provided on the next page. Do not use abbreviations © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 4 NZCETA has approval from NZQA to use their materials in the development of this resource. Ginny’s Florist Cash Budget for August 2012 Estimated Receipts Estimated Payments Surplus/Deficit of cash Plus opening bank balance Equals closing bank balance © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 5 NZCETA has approval from NZQA to use their materials in the development of this resource. ACCOUNTING ACHIEVEMENT STANDARD 90978 Prepare financial statements for sole proprietors RESOURCE BOOKLET Ginny is the owner of Ginny’s Florist a retail store that makes and sells floral displays and accessories. Ginny’s friend Amber makes a variety of table decorations. Amber keeps a display of these in Ginny’s shop and in return pays Ginny a commission on each of her sales. Ginny’s Florist Trial Balance as at 31 March 2012 Accounts Receivable Advertising Bank Building Drawings Freight inwards Goodwill Inventory Purchases Insurance Interest on loan Interest on Mortgage Office expenses Office equipment Office wages Rates Electricity Sales Returns Shop Fittings Shop Wages 3,746 2,450 1757 228,000 2,580 654 10,000 6,432 43,590 1,234 750 2,400 15,647 26,000 5,988 2,395 6,640 230 30,000 38,478 Accounts Payable Accumulated Depreciation - building Accumulated Depreciation – office equipment Accumulated Depreciation – shop fittings Capital Commission Received Loan (5% due 2018) Sales Mortgage GST Payable $428,971 1 2 3 4 5 6 7 8 9 Adjustments: Inventory on hand 31 March 2012 is $7,250. Interest of $250 is owing on the loan. Invoices issued to customers for bouquets for $644 including GST have not been recorded. Depreciation on the building is 5% straight line. Shop fittings have a residual value of $2,000 and a useful life of 14 years. Depreciation on the office equipment is 10% straight line. Insurance of $230 has been paid in advance. Shop wages of $150 are owing. Electricity is allocated at the rate of 20% office and 80% shop. © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 6 NZCETA has approval from NZQA to use their materials in the development of this resource. 1,456 79,800 10,400 8,000 39,304 7,699 20,000 174,569 86,000 1,743 $428,971 Assessment Schedule: Achievement Standard 90978 (1.3) Ginny’s Florist Assessment Criteria Achievement Merit Excellence Prepare financial statements for sole proprietors means preparing correctly classified financial statements /extracts. Prepare in-depth financial statements for sole proprietors means preparing correctly classified financial statements / extracts, including balance day adjustments where the figure is provided; distinguishing cash and non-cash transactions for the cash budget. Prepare comprehensive financial statements for sole proprietors means preparing correctly classified financial statements /extracts with no foreign items, including balance day adjustments where the figure is provided and where it requires a calculation; distinguishing cash and noncash transactions for the cash budget. © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 7 NZCETA has approval from NZQA to use their materials in the development of this resource. QUESTION ONE: INCOME STATEMENT Ginny’s Florist Income Statement for the year ended 31 March 2012 175,129 E 230 V 174,899 Sales Less Sales Returns Net Sales Less Cost of Goods Sold Opening inventory Add Purchases Add Freight inwards Goods available for sale Less Closing inventory Cost of goods sold Gross Profit Plus Other Income Commission Received Less Expenses Florist Expenses Advertising Shop Electricity Shop Wages Depreciation – Shop Fittings Administrative Expenses Insurance Office Electricity Depreciation – Building Depreciation – Office Equipment Office Wages Rates Office Expenses Finance Costs Interest on Loan Interest on Mortgage V V V V 6,432 43,590 654 50,676 7,250 43,426 131,473 M 7,699 V 139.172 2,450 5,312 38,628 2,000 1,004 1,328 11,400 2,600 5,988 2,395 15,647 1,000 2,400 48,390 V E* M E 40,362 M E* M M V V V 3,400 M V Total Expenses 92,152 Profit/Loss for the year 47,020 V* V for correct stem and correct figure correctly classified, no abbreviations M for the correct stem and correct figure, correctly classified (award V if number incorrect but still correctly classified and correct stem). Correct process for Gross Profit. E correctly calculated figure, correctly classified and correct stem (award V if number incorrect but still correctly classified and correct stem) E* boths parts needed for 1 E and correctly calculated and correctly classified. (award V if number incorrect but still correctly classified and correct stem). V for the whole amount under florist expenses. V* for the correct process including correctly labelled Profit or Loss. © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 8 NZCETA has approval from NZQA to use their materials in the development of this resource. Question one N1 N2 3V/M/E 5V/M/E A3 7V/M/E A4 19V/M/E M5 20V/M/E including 3 M/E M6 11 V/M/E including 4 S/C plus 1P Max 2 F Max 1 F E7 13 V/M/E including 3 E and 3 M plus 1P No F E8 15 V/M/E Including 3 E and 4 M plus 1P No F © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 9 NZCETA has approval from NZQA to use their materials in the development of this resource. QUESTION TWO: STATEMENT OF FINANCIAL POSITION Ginny’s Florist Statement of Financial Position as at 31 March 2012 Current Assets Accounts Receivable Bank Prepayments Inventory Total Current Assets Non-current Assets Property, Plant and Equipment (Note) Intangible Assets Goodwill Total Non-current Assets Total Assets Less Liabilities Current Liabilities Accounts payable GST Payable Accrued expenses Total Current Liabilities Non-current Liabilities Loan ( 5% due 2018) Mortgage Total Liabilities Net Assets Equity Opening Capital Add Profit for the year E V M V 4,390 1,757 230 7,250 13,627 169,800 Vf 10,000 V 179,800 193,427 V E M 1,456 1,827 400 3,683 20,000 86,000 109,683 83,744 39,304 47,020 86,324 2,580 83,744 Less Drawings Closing Capital Cost V Accumulated Depreciation V Carrying Amount V V V 106,000 Shop Fittings 30,000 E10,000 20,000 V Vf V V* Building Office Equipment 228,000 26,000 V M 91,200 M13,000 136,800 13,000 Vf V correct stem (no abbreviations) and figure, correctly classified Vf for transferring PPE total from table or transferring profit from Question One V* for correct process M correct figure, correctly classified and correct stem (award V if number incorrect but still correctly classified and correct stem) E correctly calculated figure, correctly classified and correct stem (award V if number incorrect but still correctly classified and correct stem) F foreign item © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 10 NZCETA has approval from NZQA to use their materials in the development of this resource. Question Two N1 N2 8V/M/E 10 V/M/E A3 12V/M/E A4 14V/M/E M5 16 V/M/E including 4 M/E Max 2 F M6 17V/M/E including 5 M/E plus 1 V* No F E7 20 V/M/E including 6 M/E plus 1 V* No F E8 21V/M/E Including 7M/E plus 1 V* No F © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 11 NZCETA has approval from NZQA to use their materials in the development of this resource. QUESTION THREE: CASH BUDGET Ginny’s Florist Cash Budget for the month ended 31st August 2012 Estimated Receipts Sales Commission Received Cash from Accounts Receivable Total estimated receipts M V V 24,750 765 723 26,238 Estimated Payments Purchases Office Salaries Office Expenses Drawings Interest on Loan Electricity Payments to Accounts Payable Stationery Total estimated payments Surplus of cash Plus opening bank balance Equals closing bank balance V V V M V M V M 1,377 1,678 2,344 100 120 300 378 65 6,362 19,876 5,887 25,763 V* Notes: V for correct stem and correct figure correctly classified V* correct processing over all three areas (net increase, bank balance at the beginning and bank balance at the end) M for correct stem and correct figure correctly classified (award V for incorrect figure) F Foreign item Accept direct credit from customers for sales $72 added into Accounts Receivable or sales. Question Three N1 N2 3 V/M 4 V/M A3 6 V/M Max 3 F A4 7 V/M Max 2 F M5 8 V/M Max 2 F M6 9 V/M E7 10 V/M E8 12 V/M plus V* plus V* plus V* Max 1 F No F No F © NZCETA Practice Assessment 2012 Accounting AS 90978 (1.3) NCEA Level 1/Year 11 Page 12 NZCETA has approval from NZQA to use their materials in the development of this resource.