Market mechanism

advertisement

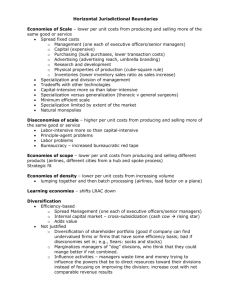

CHAPTER 7: CORPORATE STRATEGY Team 4: Peter Hogue, Breann Flores, Cameron Lloyd, Matthew Hord, Jonathon Jordan Corporate Strategy vs. Business Strategy Business Strategy is concerned with how a firm competes Corporate Strategy is concerned with where a firm Competes Range of product/market activities the firm undertakes Product Scope– How specialized the firm is in terms of the range of products it supplies. E.g. Coca-Cola, Gap, SAP Vertical Scope– The range of vertically linked activities the firm encompasses. E.g. Exxon, Nike Geographical Scope– The geographical spread of activities for the firm. Tesco Bank: from Food to Finance A New Image New store formats: Tesco Extra, Tesco Express The Tesco “Clubcard” Online shopping Tesco Financial Services Economies of scope Economies of scale- reduction of the average costs that result from increase in the output of a single product Economies of scope- is when a resource across multiple activities uses less of that resource than when the activities are performed independently Tangible vs. non tangible resources Economies of Scope cont. Brand extension- exploiting a strong brand across additional products Economies of scope can be exploited by selling or licensing the use of the resource or capability to another company Ex: Pepsi selling and distributing Starbucks Frappuccino's Transaction costs • Market mechanism- where individuals and firms, guided by market prices, make independent decisions to buy and sell goods and services Administrative mechanism- where decisions concerning production and resource allocation are made by higher authorities' figures Examples: search costs, cost of negotiating and drawing up a contract, the cost of monitoring the other party’s side of the contract The scope of the firm: specialization vs. integration Single integrated- Vertical scope, product scope and geographical scope Several specialized firms-it has an administrative interface between each vertical level Diversification Refers to the expansion of an existing firm into another product line or field of oporation Two types Horizontal Vertical Benefits and Costs Growth Risk reduction Value creation Internal creation External creation When Does Diversification Create Value? Attractiveness test Cost-of-entry test Better-off test Vertical Integration Vertical integration refers to a firm’s ownership of vertically related activities Indicated by the ratio of a firm’s value added to its sales revenue. Vertical integration can be: Backward: the firm acquires control over production of its inputs Forward: the firm acquires control of activities previously undertaken by its customers Full or partial Benefits and Costs In the 20th century, vertical integration was viewed as beneficial. That opinion has changed over the past 25 years Outsourcing enhances flexibility and allows firms to concentrate on their ‘core competencies’ One benefit is vertical integration results in cost savings from the physical integration of processes One cost is that it can restrict a firm’s ability to benefit from scale economies and can reduce flexibility and increase risk. Technical Economies from the Physical Integration of Processes Analysis of the benefits of vertical integration has emphasized the technical economies of vertical integration Cost savings that arise from the physical integration of processes Transaction Costs in Vertical Exchanges When a single supplier negotiates with a single buyer, there is no market price It depends on relative bargaining power Moving from a competitive market to one with individual buyers and sellers in bilateral relationship causes efficiencies of the market system to be lost. The Incentive Problem High-Powered incentives: A market interface exists between buyer and seller, profit incentives ensure the buyer is motivated to secure the best deal & the seller is motivated to be efficient to retain the buyer. Internal supplier-customer relationships are subject to low-powered incentives To create stronger incentives, companies can open internal divisions to external competition Flexibility May be disadvantageous in responding to new product development that require new combinations of technical capabilities. When system-wide flexibility is needed, it may allow for speed and coordination in adjusting through the vertical chain. Compounding Risk Vertical integration represents a compounding risk because problems at one stage of production threaten all other stages. GM strike in 1998 24 US assembly plants halted Designing Vertical Relationships Arms-length and spot contracts involve no resource commitment beyond the deal Vertical integration involves a substantial investment Franchises and long term contracts are formalized by complex written agreements Spot contracts may require little documentation but are bound by common law Collaborative agreements between buyers and sellers are informal Different types of Vertical Relationships Long term contracts Vendor partnerships Franchising Joint Ventures Agency Agreements Long-term Contracts A series of transactions over a period of time and a specify the terms of sales and responsibilities of each party Franchising A contractual agreement between the owner of a business system and trademark that permits the franchisee to produce and market the franchisers product or service in a specified area. Managing Corporate Portfolio When opportunities are presented that create value through vertical integration or diversification managers have to decide whether or not to pursue the option and if so how to manage this. Portfolio planning helps answer all those question. GE/McKinsey Matrix The attractiveness axis combines market size, market growth, market profitability, cyclicality, inflation recovery, and international potential Business unit competitive advantage axis combines market share, technology, manufacturing, distribution, marketing, and cost BCG’s Groxth-Share Matrix Uses industry attractiveness and competitive position to compare the strategic positions of different business The simplest of the portfolio planner Four quadrants- Question Marks, Dogs, Cash Cows, and Stars Ashridge Portfolio Display Based upon Goold, Campbell and Alexanders parenting framework Looks not just at the characteristics of a business but the characteristics of its parent company Looks at styles of management More difficult to use then the other two types of portfolio planning but is more realistic Questions?