Introductory Economics Study Guide

advertisement

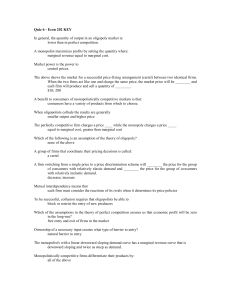

*: Fill in the gap question **: Multiple choice question ***: Either multiple choice or fill in the gap question Red marked questions: are more likely to be exam questions CHAPTER 1 . INTRODUCTION TO ECONOMICS 1. ___Economics_____ is the study of how _____individuals____ and ___societies_____ choose to use the ___scarce_____ resources that nature and previous generations have provided. * 2. Three fundamental concepts of economics are ____Opportunity cost_____ ,____Marginalism______, and _____Efficient markets________ * 3. _____Opportunity cost_____ is the best ____alternative______ that we forgo, or give up, when we make a ____choice___ or a ___decision_____. * 4. When a firm decides whether to produce additional output, it considers only the ____marginal_____ cost , not the ___sunk____ cost. * 5. ___Sunk______ costs are costs that cannot be avoided, regardless of what is done in the future and depending on____ past decisions______ * 6. An _____efficient market_______ is one in which profit opportunities are eliminated almost instantaneously. * 7. There is no free lunch! ____Profit opportunities_____ are rare because, at any one time, there are many people searching for them. * 8. The study of economics teaches us a ____way of thinking___ and helps us to make ___decisions____* 9. Another reason for studying economics is to understand ____society____ and ___global affairs____ better. * 10. ___Microeconomics____ is the branch of economics that examines the behavior of ____individual decision-making units_____—that is, ____business firms_____ and ____households_____. * 11. _____Footballers’ wages____ and the _____price of oil____, for example, are both ___microeconomic____ issues ** 12. ____Macroeconomics______ is the branch of economics that examines the behavior of economic ____aggregates____— income, output, employment, and so on—on a ___national___ scale. * 13. ___Gross domestic product____, the_____ aggregate price level______ and ___unemployment_____, for example, are all ____macroeconomic____ issues ** 14. ___Positive____ economics is an approach to economics that seeks to understand bevaiour and the operation of systems without ____making judgements_____ e.g If tax is imposed on tobacco, the price of the cigarettes will rise *** 15. ___Normative___ economics is an approach that anaylzes outcomes of economic behaviour, evaluates them as good or bad and may prescribe courses of action.e.g Tax should be imposed on tobacco in order to discourage smoking.*** 16. To isolate the impact of one single factor, we use the device of ___ceteris paribus____, or ___all else equal_____ e.g If gasoline prices rise by 10 percent, how much less driving will there be, assuming no simultaneous change in the income, population, laws and all other remain constant * 17. There are four criteria used for judging economic outcomes: ____efficiency____, ___equity____, ___growth____ and ___stability______.** 18. An ____efficient____ economy is one that produces what people want at the least possible cost * 19. ____Equity(fairness)_____ implies a more equal distribution of income and whealth* 20. ____Economic growth____ is an increase in the total output of an economy.* 21. ___Economic stability___ is the condition in which national output is growing steadily, with low ___inflation___ and full ___employment___*** CHAPTER 2. SCARCITY AND CHOICE 1. Three basic questions must be answered in order to understand an economic system: ** a)What gets produced? b)How is it produced? c)Who gets what is produced? 2. ___Capital____ refers to the things that are themselves produced and then used to produce other goods and services.e.g __factory____, ___equipment____ *** 3. The basic resources that are available to a society are __factors of production____: * a)Land b)Labor c)Capital 4. __Consumer__ goods are goods produced for present consumption. e.g __Food__, __clothes__ *** 5. The___ production possibility frontier_______ is a graph that shows all of the combinations of goods and services that can be produced if all of society’s ____resources____ are used ___efficiently_____. * 6. The production possibility frontier shows the principles of ___limited choice___, ___oppotunity cost____, ___inefficiency___, ___scarcity____ and the ___gains from trade____ ** 7. The slope of the ppf curve is also called the ___marginal rate of transformation_____.* 8. The negative slope of the production possibility frontier curve reflects the law of ____increasing opportunity cost___. As we increase the production of one good, we sacrifice progressively more of the other. * 9. Rich countries devote more resources to ___capital production___ than poor countries.* 10. As more resources flow into ___capital production____, the rate of __economic growth___ in rich countries increases. * 11. __Economic systems ____are the basic arrangements made by societies to solve the economic problem. They include: *** a)Command economies b)Free market economies 12. 13. 14. 15. 16. 17. c)Mixed systems In a ___command___economy, a central government either directly or indirectly sets output targets, incomes, and prices. * In a ____free market___ economy, individuals and firms pursue their own self-interests without any central direction or regulation. * In a free market economy you can not make profit, unless the consumers want the product you are selling. This logic leads to the notion of ____consumer sovereignty_____* A __market___ is the institution through which buyers and sellers interact and engage in exchange.* The basic coordinating mechanism in a free market system is __price___.*** Since markets are not perfect, governments intervene and often play a major role in the economy. These type of economic systems are called ___mixed____economies. Some of the goals of government are to: ** Minimize market ___inefficiencies____ Provide ___public___ goods Redistribute ___income___ Stabilize the ___macroeconomy___ by Promoting low levels of ___unemployment____ Promoting low levels of ___inflation____ CHAPTER 3-DEMAND;SUPPLY EQUILIBRIUM 1. A__ firm__ is an organization that transforms resources (inputs) into products (outputs). * 2. ___Households____ are the consuming units in an economy.* 3. The____ circular flow of economic activity______ shows how firms and households interact in input and output markets. * 4. ___ Output markets___ are the markets in which __goods___ and ___services___ are exchanged.* 5. ___Input markets_____ are the markets in which resources—labor, capital, and land—used to produce products, are exchanged.* 6. In the ____ labor ___ market , households supply human power in order to earn __wages___ paid by the firms *** 7. In the __capital___ market, households supply their ___savings___, for __interest___*** 8. In the ___land___ market, households supply real property in exchange for ___rent____. *** 9. A household’s decision about the quantity of a particular output to demand depends on: ** a)The price of the product in question. b)The income available to the household. c) The household’s amount of accumulated __wealth___. d)The prices of other products (substitutes and complements) available to the household. e)The household’s tastes and preferences. f)The household’s expectations about future income, wealth, and prices. 10. ___Quantity demanded_____ is the amount (number of units) of a product that a household would buy in a given time period if it could buy all it wanted at the current market price. * 11. ___Income____ is the sum of all households wages, salaries, profits, interest payments, rents, and other forms of earnings in a given period of time. It is a __flow__ measure.* 12. ___Wealth___, is the total value of what a household owns minus what it owes. It is a ___stock___ measure.* 13. ___Normal____ goods are goods for which demand goes up when income is higher and for which demand goes down when income is __lower__. For example: __car__, __refrigerator__, __jewel___ *** 14. ___Inferior____goods are goods for which demand falls when income ___rises___. e.g __matchbox__, __bread__ *** 15. ___Substitutes____ are goods that can serve as replacements for one another; when the price of one___ increases___, demand for the other __goes up___.*** 16. Complements are goods that “go together”; a ___decrease___ in the price of one results in an ___increase___ in demand for the other, and vice versa.*** 17. __A higher price___ causes lower ____quantity demanded____ and a move along the demand curve DA. ** 18. Change in ___income___, ____preferences___, or ____prices_____ of other goods or services leads to ___Change in demand___ ** 19. Supply decisions depend on __profit potential___. * 20. __Profit____ is the difference between revenues and costs.* 21.___Quantity supplied____ represents the number of units of a product that a firm would be willing and able to offer for sale at a particular price during a given time period.* 22. Assuming that its objective is to maximize profits, a firm’s decision about what quantity of product depends on: The _____ price of the good or service____, ____the cost___ of producing the good_____, which in turn depends on: ______The price of required inputs____ (labor, capital, and land), ___the technologies ____that can be used to produce the product, and ____the prices of related products___. *** 23. __ Market equilibrium___ is the condition that exists when quantity supplied and quantity demanded are equal. * 24. ___Shortage____, is the condition that exists when quantity demanded exceeds quantity supplied at the current price.* 25. When quantity demanded exceeds quantity supplied, ___price____ tends to rise until equilibrium is restored. * 26. __Surplus____, is the condition that exists when quantity supplied exceeds quantity demanded at the current price.* 27. ___Higher demand____ leads to higher equilibrium price and higher equilibrium quantity. *** 28. ___Higher supply _____leads to lower equilibrium price and higher equilibrium quantity.*** 29. ___Lower demand____ leads to lower price and lower quantity exchanged.*** 30. __Lower supply_____ leads to higher price and lower quantity exchanged.*** CHAPTER 4-MARKET PRICE AND ELASTICITY 1. ____Price rationing____ means when a shortage exists in a free market, the price of the good will rise until quantity supplied equals quantity demanded.*** 2. A ___price ceiling_____ is a maximum price that sellers may charge for a good, usually set by government.* 3. __Queuing____ is a nonprice rationing system that uses waiting in line as a means of distributing goods and services.*** 4. ____Favored customers ____are those who receive special treatment from dealers during situations when there is excess demand.*** 5. ____Ration coupons_______ are tickets or coupons that entitle individuals to purchase a certain amount of a given product per month.*** 6. A___ black market_____ is a market in which illegal trading takes place at marketdetermined prices.*** 7. A ___price floor____ is a minimum price below which exchange is not permitted. 8. The most common example of a price floor is the ____minimum wage___, which is a floor set under the price of labor. * 9. The result of setting a price floor will be ____excess supply____, or higher quantity supplied than quantity demanded. * 10. __Consumer surplus_____ is the difference between the maximum amount a person is willing to pay for a good and its current market price.* 11. ___Producer surplus_____ is the difference between the maximum amount a producer is willing to accept to supply a good and its current market price.* 12. __Price elasticity of demand____ measures how responsive consumers are to changes in the price of a product.* 13. Unlike the value of the slope of ___demand___, the value of ___elasticity___ is a useful measure of ___responsiveness____.* 14. When demand does not respond at all to a change in price, demand is___ perfectly inelastic____.*** 15. Demand is ____perfectly elastic______ when quantity demanded drops to zero at the slightest increase in price.*** 16. Demand is __unit elastic___ when change in quantity demanded is equal to change in price *** 17. Price elasticity of demand decreases as we move ____downward_____ along a straight line demand curve.* 18. When demand is ___inelastic___, price and total revenues are ___directly___ related. Price increases generate ___higher ___revenues_____. *** 19. When demand is ___elastic____, price and total revenues are ___indirectly____ related. Price increases generate____ lower revenues_____.*** 20. The determinants of the elasticity of demand are availability of ___substitutes____, importance of the item in the ___budget____and ____time dimension__ _ ** 21. _____Income elasticity of demand____measures the responsiveness of demand to changes in income. *** 22. ___Cross-price elasticity of demand____ is a measure of the response of the quantity of one good demanded to a change in the price of another good. *** 23. __Elasticity of supply____ is a measure of the response of quantity of a good supplied to a change in price of that good. Likely to be positive in ___output___ markets. *** 24. ___Elasticity of labor supply___ is a measure of the response of labor supplied to a change in the price of labor.*** CHAPTER 5-HOUSEHOLDBEHAVİOUR AND CONSUMER CHOICE 1. A key assumption in the study of household and firm behavior is that all input and output markets are___ perfectly competitive____. 2. We also assume in a perfect competition that households and firms possess ____all the information____ they need to make market choices.* 3. ___Perfect knowledge___ is the assumption that firms have all available information concerning ___wage rates___, ____capital costs____, and ____output prices____.* 4. In a perfect competition every household must make three basic decisions: ** a)How much of each product, or output, to demand. b)How much labor to supply. c)How much to spend today and how much to save for the future. 5. ___The budget constraint ____separates those combinations of goods and services that are available, given limited income, from those that are not. The available combinations make up the ___opportunity set_____.* 6. __Utility ___is the satisfaction, or reward, a product yields relative to its alternatives. The basis of choice. * 7. __Marginal utility____ is the additional satisfaction gained by the consumption or use of one more unit of something.* 8. ____The law of diminishing marginal utility____ :The ____more_____ of one good consumed in a given period, the ____less ____satisfaction (utility) generated by consuming each ____additional (marginal) unit_____ of the same good. *** 9. Total utility ___increases____ at a decreasing rate, while marginal utility __decreases___. *** 10. Diminishing marginal utility helps to explain why demand ___slopes down____.* 11. Price changes affect households in two ways: __Income___ and ___substitution__ effects * 12. When the price of a product falls, a consumer has more ___purchasing power____ with the same amount of income. When the price of a product falls, that product becomes more attractive relative to potential ___substitutes______. * 13. The __income___ effect of a higher wage means that households can afford to offer less labor. * 14. The __substitution effect__ of a higher wage means that the opportunity cost of __leisure___ is higher. As a result, __more___ labor is supplied.* 15. When the income effect outweighs the substitution effect, the result is a ____“backward-bending”____ labor supply curve. * 16. The___ financial capital market____ is the complex set of institutions in which suppliers of capital (households that save) and the demand for capital (business firms that invest) interact.* 17. An increase in the___ interest rate___ has the income effect : Households will now earn more on all previous savings, so they will ___save___ less. * 18. An increase in the interest rate has the substitution effect : The ___opportunity cost____ of present consumption is now higher; given the law of demand, the household will ___save___ more. * CHAPTER 6-THE PRODUCTION PROCESS_THE BEHAVIOUR OF PROFIT MAXIMIZATION 1. Perfect competition is an industry structure in which there are: __many firms___, each ___small___ relative to the industry, producing virtually ___identical(homogeneous) products____ and in which no firm is large enough to have any control over __prices___. In perfectly competitive industries, new competitors can ___freely enter and exit____ the market.** 2. __Homogeneous___ products are undifferentiated products; products that are identical to, or indistinguishable from, one another. For example: __Steel__ , ___cement___industries *** 3. In a perfect competition, price is determined by the interaction of market ___supply___ and ___demand___. * 4. The perfectly competitive firm faces a ___perfectly elastic demand ___curve for its product. * 5. The three decisions that all firms in a perfect competition must make include: *** a)How much to ___supply___ b) Which ___production technology__ to use c) How much of each ___input___ of demand 6. ___Profit (economic profit)____ is the difference between ___total revenue___ and ___total economic cost___. * 7. ___Total revenue____ is the amount received from the sale of the product: PxQ * 8. The ___short run___ is a period of time for which two conditions hold: *** The firm is operating under a ___fixed scale___ of production, and firms can neither___ enter__ nor __exit___ the industry. 9. The__ long run___ is a period of time for which there are no __fixed factors___ of production. Firms can increase or decrease ___scale___ of operation, and new firms can ___enter__ and existing firms can ___exit___ the industry.*** 10. The fundamental things to know with the objective of ___maximizing profit____ are: __The market price__ of the output , the __technologies__ used for production and the prices of __inputs___*** 11. A ___labor-intensive ____technology relies heavily on human labor instead of capital.* 12. A ___capital-intensive____ technology relies heavily on capital instead of human labor. * 13. ___Marginal product____ is the additional output that can be produced by adding one more unit of a specific input, ceteris paribus.* 14. The law of _____diminishing marginal returns____ states that: When ___additional units of a variable input____ are added to fixed inputs, the marginal product of the variable input ___declines_____. * 15. ___Average product____ is the average amount produced by each unit of a variable factor of production. (Total Product/Total units of labor)* 16. ___Marginal product____ is the slope of the total product function.* 17. When average product is ___maximum___, marginal product equals average product. *** 18. When average product falls, ___marginal product___ is less than ___average___ product____. *** 19. Increases in capital usage lead to increases in the ___productivity___ of labor.* CHAPTER 7- SHORT RUN COSTS 1. ___Fixed ____cost is any cost that does not depend on the firm’s level of output. For example: __social security insurance__ cost,__ rents__, __salaries__ of the employees, __administration__ costs. *** 2. ___Variable____ cost is a cost that depends on the level of production chosen.For example: __labor__ cost, __raw material___ costs, __energy__ costs, __maintenance__ costs *** 3. __Average fixed cost (AFC)____ is the___ total fixed cost (TFC)___ divided by the number of ___units of output (q)____ * 4. Average fixed cost ____declines___ as quantity rises. *** 5. As output increases, total fixed cost ____remains constant____ and average fixed cost ___declines___. *** 6. ___Marginal cost___ is the increase in total cost that results from producing one more unit of output.* 7. Marginal cost reflects changes in ___variable___ costs. * 8. Average variable cost (AVC) is the ___total variable____ cost divided by the number of ___units of output___.* 9. When marginal cost is below average cost, average cost is ___declining___. When marginal cost is above average cost, average cost is __increasing____. Marginal cost intersects average variable cost at ___the minimum point__ of AVC.*** 10. __The total ___cost curve has the same shape as the total variable cost curve; it is simply higher by an amount equal to ___TFC____. *** 11. If MC is below ATC, then ATC will ___decline___ . If MC is above ATC, ATC will __increase____. *** 12. __MC__ intersects the __ATC___ and ___AVC____ curves at their minimum points. *** 13. At any market price, the ____marginal cost____ curve shows the output level that ___maximizes profit_____. * 14. The __marginal cost___ curve of a ___perfectly competitive___ profitmaximizing firm is the firm’s ___short-run supply___ curve. *** CHAPTER 8-LONG RUN COSTS 1. Total economic cost includes a ___normal rate of return___, or the rate that is just sufficient to keep current investors interested in the industry.* 2. __Breaking even____ is a situation in which a firm earns exactly a normal rate of return.*** 3. ___Operating profit (or loss)____ equals ___total revenue minus total variable cost (TR – TVC)____. *** 4. If revenues are smaller than variable costs, the firm suffers operating losses that push total losses above fixed costs. In this case, the firm can minimize its losses by ___shutting down____. *** 5. The shut-down point is the lowest point on the ___average variable___ cost curve.*** 6. The ___short-run supply___ curve of a competitive firm is the part of its marginal cost curve that lies ___above___ its average variable cost curve. * 7. In the short-run, firms have to decide ___how much to produce____ in the current scale of plant. In the long-run, firms have to choose among many ___potential scales___ of plant. * 8. Increasing returns to scale, refers to an increase in a firm’s scale of production, which leads to lower ___average costs___ per unit produced. * 9. The long run average cost curve of a firm exhibiting ___economies of scale___ is ___downward___-sloping.* 10. __Constant returns to scale___ refers to an increase in a firm’s scale of production, which has no effect on __average costs___ per unit produced.* 11. ___Decreasing returns to scale_____, refers to an increase in a firm’s scale of production, which leads to __higher __ Average costs per unit produced.* 12. The ___optimal ___ scale of plant is the scale that __minimizes ___average cost. * 13. Firms __expand___ in the long-run when ___increasing returns to scale___ are available. * 14. In the long run, equilibrium price (P*) is equal to___ long-run average___ cost, ___short-run marginal___ cost, and __short-run average___ cost. __Profits___ are driven to zero. *** CHAPTER 9- General Equilibrium and the Efficiency of Perfect Competition 1. _ Partial____ equilibrium analysis is the process of examining the equilibrium conditions in individual markets and for households and firms separately.* 2. ____General____ equilibrium is the condition that exists when all markets in an economy are in simultaneous equilibrium.* 3. To examine the move from partial to general equilibrium analysis we will consider the impact of: a major ___technological advance____, and a shift in ___consumer preferences____. * 4. A significant technological change in a single industry affects many markets: a) Households face a different structure of ___prices____ and must adjust their ___consumption____ of many products. b) ___Labor___ and ___capital___ markets are reallocated. * 5._____ Pareto efficiency___, is a condition in which no change is possible that will make some members of society better off without making some other members of society worse off. * 6.In a perfect competition society will produce the efficient mix of output if all firms equate __price___ and ___marginal cost___.*** 7. ___Market failure___ occurs when resources are misallocated, or allocated inefficiently. * 8. ___Imperfect competition____ is an industry in which single firms have some control over price and competition. * 9. __Monopoly ___is an industry composed of only one firm that produces a product for which there are no close ___substitutes___ and in which significant ___barriers____ exist to prevent new firms from entering the industry. *** 10. In all ___imperfectly competitive____ industries, __output___ is lower—the product is underproduced—and ___price___ is higher than it would be under perfect competition. *** 11. An __externality ___is a cost or benefit resulting from some activity or transaction that is imposed on parties outside the activity or transaction. for example: ___ air pollution__ and ___traffic congestion____, ___building a natural park___, *** 12. The study of externalities is a major concern of ___environmental___ economics.* 13. ___Marginal social___ cost is the total cost to society of producing an additional unit of a good or service. * 14. Marginal social cost is equal to the sum of the __marginal__ costs of producing the product and the correctly measured ___damage__ cost involved in the process of production* 15. Five approaches have been taken to solving the problem of externalities: a) government imposed ___taxes__ and __subsidies__ b) private ___bargaining___ and negotiation c) __legal rules___ and procedures d) __sale of rights__ to impose externalities e) direct ___government__ regulation such as __imprisonment___ and __fines__ ** CHAPTER 10- MONOPOLY 1. _ Market power__ is the imperfectly competitive firm’s ability to raise price without losing all demand for its product. * 2. A __pure monopoly ___is an industry with a single firm that produces a product for which there are no close __substitutes___ and in which significant barriers to entry prevent other firms from entering the industry to compete for profits. Examples: ___electricity__ and __natural gas___ industries *** 3. __Government franchises__,__patents__ , __Economies of scale__ and ___Ownership of a scarce factor of production___ are the significant barriers which prevent new firms to enter the market in a monopoly. ** 4. In a monopoly, the __market demand___ curve is the demand curve facing ___the firm__, and total quantity supplied in the market is what __the firm decides to produce___. * 5. At every level of output except one unit, a monopolist’s __marginal revenue___ is below price. *** 6. In a monopoly, __total revenue___ is maximum when ___marginal revenue___ equals zero. *** 7. A monopoly firm has no ___supply___ curve that is independent of the __demand__ curve for its product. *** ∆𝑷 8. In a monopoly MR=___ P__ + ___Q x ∆𝑸 ____ * 9. In a monopoly P= __ 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 𝑴𝑪 𝟏− 𝟏 |𝑬𝑷 | ___ * In a monopoly entry to the market is ___blocked____* Charging different prices to different buyers is called ___ price discrimination____.* The monopolistic firm can not price __discriminate____ * ___Collusion___ is the act of working with other producers in an effort to limit competition and increase joint profits. * Monopoly leads to an inefficient ____mix of output____. That is , price is __above____ marginal cost, which leads to an ___underproduction___ from the society’s point of view. * A __trust___ is an arrangement in which shareholders of independent firms agree to give up their stock in exchange for the certificates that entitle them to a share of their common profits. Common examples are ___minery___ and __oil___ industries * The major difference between a cartel and trust is that the trustees lose their ___legal and economic_ independence____ ; while the cartel group members do not.* The ___Antirust Division ____(of the Department of Justice) is one of two federal agencies empowered to act against those in violation of antitrust laws.* ___Consent decrees ___are formal agreements on remedies between all the parties to an antitrust case that must be approved by the courts. * 1995, Turkey put into force the law of ___ protection of fair competition___ against the violation through the formation of ___cartels and ___trusts___ * CHAPTER 11-MONOPOLISTIC COMPETITION AND OLIGOPOLY 1. A _______monopolistically competitive_____ industry has the following characteristics: A __large___ number of firms No __barriers to entry__ Product ___differentiation___ ** 2. Examples for a monopolistic competition are ___textile___ and __automobile___ industries *** 3. ___Product differentiation___ is a strategy used in a monopolistic competition and accomplished by producing products that have distinct positive identities in consumers’ minds in order to achieve ___market power___. This action is often carried out through ___advertising____ and provision of __trademarking___ . 4. The demand curve faced by a ___monopolistic competitor____ is likely to be less elastic than the demand curve faced by a____ perfectly competitive____ firm, but more elastic than the demand curve faced by a ___monopoly___. * 5. In the short-run, a monopolistically competitive firm will produce up to the point where ___MR = MC____; but the ___profits___ are not guaranteed. * 6. As new firms enter a monopolistically competitive industry, the demand curves of existing firms shift to the___ left____, pushing ___MR___ with them. * 7. For a monopolistically competitive firm, in the long run, ___economic profits___ are eliminated. This occurs for a firm when its demand curve is just tangent to its ___average cost____ curve. * 8. In a monopolistic competition, price is __above___ marginal cost. * 9. In a monopolistic competition, ____average total cost____ is not minimized. The typical firm will not realize all the ___economies of scale____ available. Smaller and smaller market share results in ___excess capacity____ * 10. An ___oligopoly____ is a form of industry (market) structure characterized by ___a few dominant firms___. Products may be ___homogeneous___ or ___differentiated_____.** 11. A group of firms that gets together and makes price and output decisions to maximize joint profits is called a ___cartel____. * 12. The___ Cournot model____ is a model of a ____two-firm industry (duopoly)____ in which a series of output-adjustment decisions leads to a final level of output between the output that would prevail if the market were organized competitively and the output that would be set by a ___monopoly___. * 13. The ___kinked demand curve____ model is a model of ___oligopoly___ in which the following assumption has been made: Competitive firms will follow if a single firm cuts price but will not follow if a single firm raises price.* 14. ___Price leadership___ is a form of __oligopoly___ in which one dominant firm sets prices and all the smaller firms in the industry follow its pricing policy. *** 15. The ___quantity demanded___ in an oligopoly industry is split between the dominant firm and the group of smaller firms. This division of output is determined by the amount of ___market power____ of the dominant firm. * 16. In an __oligopoly___, the dominant firm has an incentive to push smaller firms out of the industry in order to establish a ___monopoly___. *** 17. In an oligopoly, the practice of a large, powerful firm driving smaller firms out of the market by temporarily selling at an artificially low price is called __predatory pricing____.* 18. __Game theory___ analyzes ___oligopolistic___ behavior as a complex series of strategic moves and reactive countermoves among rival firms. * 19. In game theory, when all players are playing their best strategy given what their competitors are doing, the result is called ___Nash equilibrium___.* 20. In game theory ,the ___dominant___ strategy , is the strategy that is best no matter what the opposition does. * 21. When uncertainty and risk are introduced, the game changes. A __maximin strategy ___is a strategy chosen to maximize the minimum gain that can be earned.* 22. The strategy to respond in a way that lets your competitors know you will follow their lead is called ___tit-for-tat ___strategy. If one leads and the competitor follows, both will be better off.* 23. Game theory has been used to help understand many phenomena – from the provision of _____local public goods and services____ to ___nuclear war____. * 24. A market is ___perfectly contestable_____ if entry to it and exit from it are costless. * 25. In contestable markets, even large oligopolistic firms end up behaving like___ perfectly competitive___ firms. Prices are pushed to___ long-run average cost___ by competition, and positive profits do not persist. * 26. The only necessary condition of oligopoly is that___ firms are large enough____ to have some control over price. ** 27. Oligopolies, or concentrated industries, are likely to be inefficient for the following reasons: a. Profit-maximizing oligopolists are likely to price ___above marginal cost___. b. __Strategic behavior___ can force firms into deadlocks that waste resources. c. ___Product differentiation and advertising___ may pose a real danger of waste and inefficiency. ** CHAPTER 12-INTRODUCTION TO MACROECONOMICS 1. Microeconomists generally conclude that markets ___work well___. Macroeconomists, however, observe that some important prices often seem ___ sticky.____ * 2. ___Sticky ___prices are prices that do not always adjust rapidly to maintain the equality between quantity supplied and quantity demanded. * 3. ___Classical economists___ applied microeconomic models, or “market clearing” models, to economy-wide problems. However, these models failed to explain the prolonged existence of high ___unemployment___ during the Great Depression.* 4. Much of macroeconomics has roots in Keynes’s work. According to Keynes, it is not prices and wages that determine the level of employment, as classical models had suggested, but instead the level of ___aggregate demand___ for goods and services. * 5. __Fine-tuning__ is the phrase used by Walter Heller to refer to the government’s role in regulating ___inflation___ and __unemployment__. * 6. __Stagflation__ occurs when the overall price level rises rapidly (__inflation___) during periods of recession or high and persistent unemployment (__stagnation__). *** 7. Three of the major concerns of macroeconomics are: ___Inflation__, ___output growth___ and ___unemployment___ *** 8. __Hyperinflation___ means a period of __very rapid increases__ in the overall price level.*** 9. ___Deflation___ means a __decrease___ in the overall price level.*** 10. __Aggregate output___ is the total quantity of goods and services produced in an economy in a given period. * 11. A __recession___ is a period during which aggregate output __declines__. *** 12. A prolonged and deep recession becomes a ___depression___. *** 13. The existence of ___unemployment___ seems to imply that the aggregate labor market is not in equilibrium. * 14. There are three kinds of policy that the government has used to influence the macroeconomy: ___ fiscal policy____ , __monetary policy_____ and __growth or supply side___ policies *** 15. ___Fiscal___ policy refers to government policies concerning ___taxes__ and ___spending___.* 16. ___Monetary policy___ consists of tools used by the__ Federal Reserve___ to control the quantity of money in the economy.* 17. ___Growth___ policies are government policies that focus on stimulating ___aggregate supply___ instead of aggregate demand. * 18. In macroeconomics there are 4 decision making units: __firms__, __households__, __government___ and __rest of the world__ *** 19. The ___circular flow diagram___ shows the___ income___ received and ___payments___ made by each sector of the economy. * 20. ___Transfer payments___ are payments made by the government to people who do not supply goods, services, or labor in exchange for these payments. They include __ Social Security__ benefits, __veterans’__ benefits, and __welfare__ payments. * 21. In the __money market__—sometimes called the financial market—households purchase __stocks___ and __bonds__ from firms. * 22. ___Treasury bonds__ and __bills___ are promissory notes issued by the federal government when it ___borrows___ money.* 23. __Corporate bonds__ are promissory notes issued by corporations when they __borrow__ money.* 24. __Shares of stock___ are financial instruments that give to the holder a share in the firm’s ownership and therefore the right to share in the firm’s profits.* 25. ___Dividends___ are the portion of a corporation’s profits that the firm pays out each period to its shareholders.* 26. __Aggregate___ demand is the total demand for goods and services in an economy.* 27. __Aggregate supply___ is the total supply of goods and services in an economy.* 28. An ___expansion___, is the period in the business cycle from a trough up to a peak, during which output and employment ___rise___. *** 29. A ___contraction, recession___, is the period in the business cycle from a peak down to a trough, during which output and employment __fall___.*** CHAPTER 13-MEASURING NATIONAL OUTPUT 1. __Gross domestic product ___is the total market value of all final goods and services produced within a given period by factors of production located within a country.* 2. ___Value added__ is the difference between the value of goods as they leave a stage of production and the cost of the goods as they entered that stage. * 3. In calculating ___GDP___, we can either sum up the value added at each stage of production, or we can take the value of final sales. * 4. __Gross national product____ is the total market value of all final goods and services produced within a given period by factors of production owned by a country’s citizens, regardless of where the output is produced. * 5. In calculating GDP there are two methods used: __expenditure__ and __income___ approach * 6. Expenditure categories: ___Personal consumption__ , __Gross private domestic investment__, __government consumption__ and __net exports___ *** 7. Personal consumption expenditures (C) are expenditures by consumers on the following: __durable_ _goods , __nondurable__ goods and __services___ *** 8. ___Nondurable__ goods are goods that are used up fairly quickly, such as __food__ and __clothing__. *** 9. __Durable___ goods are goods that last a relatively long time, such as __cars__ and __household appliances__.*** 10. ___Gross private domestic investment__ includes the purchase of new housing, plants, equipment, and inventory by the private sector.* 11. __Nonresidential investment ___includes expenditures by firms for __machines__, __tools__, plants, and so on.* 12. ___Residential investment ___includes expenditures by households and firms on new ___houses __and ___apartment buildings___.* 13. ___Inventories___ are the goods that firms produce now but intend to sell later. * 14. GDP is not the market value of total sales during a period—it is the market value of __total production___. * 15. The relationship between total production and total sales is: GDP= total sales + __change in inventories__ * 16. __Gross investment___ is the total value of all newly produced capital goods (plant, equipment, housing, and inventory) produced in a given period. * 17. ___Depreciation___ is the amount by which an asset’s value falls in a given period.* 18. ___Net investment___ equals gross investment minus depreciation.*** 19. __Exports (EX_)__ are sales to foreigners of Turkey-produced goods and services.* 20. __Imports (IM) __are Turkey’s purchases of goods and services from abroad. * 21. __Net exports (EX – IM)___ is the difference between exports and imports.* 22. __National___ income is the total income earned by the factors of production owned by a country’s citizens.* 23. __Gross national product(GNP)__ = GDP + ___receipts of factor income__ from rest of the world – __ payments of factor income__ to the rest of the world * 24. __Net national product(NNP)___ = GNP - __depreciation__ * 25. ___National income__(NI) = NNP − __ indirect taxes__ + ___subsidies__ * 26. __Personal income___(PI) = National income − __ corporate profits__ − __social insurance _payments__ + __dividends__+ __transfer payments__ * 27. ___ Disposablepersonal income(Yd)__ = Personal income − __Taxes___ * 28. ___Personal saving__ is the amount of disposable income that is left after total personal spending in a given period.* 29. ___Nominal___ GDP includes all the components of GDP valued at their current prices.* 30. The GDP deflator is one measure of the___ overall price level___. * 31. Overall price increases can be sensitive to the choice of the base year. For this reason, using __fixedprice weights___ to compute __real GDP___ has some problems. * 32. The use of fixed-price weights to estimate real GDP leads to problems because it ignores: __Structural changes___ in the economy ;___ supply shifts___, which cause large decreases in price and the___ substitution effect___ of price increases. ** 33. Limitations to the GDP are : 1)If society is better off, a decrease in __crime__ is not reflected in GDP, 2) An increase in __leisure__ is an increase in social welfare but it is not counted in GDP ; 3) __household__ activities are not counted in GDP; 4) ___underground economy__ in which transactions take place and in which income is generated that is unreported and therefore not counted in GDP. *** 34. __ Gross national income (GNI)___ is the GNP converted into dollars using an average of currency exchange rates over several years adjusted for rates of inflation. It is used to make __international comparisons___ of output. * 35. GNI divided by population equals ___gross national income per capita___.* CHAPTER 14-UNEMPLOYMENT,INFLATION,CPI 1. The ___labor force___ is the number of employed plus unemployed.* 2. ___Frictional___ unemployment is the portion of unemployment that is due to the normal working of the labor market; used to denote short-run job/skill matching problems.*** 3. ___Structural___ unemployment is the portion of unemployment that is due to changes in the structure of the economy that result in a significant loss of jobs in certain industries.*** 4. ___Cyclical___ unemployment is the increase in unemployment that occurs during recessions and depressions.*** 5. The___ natural rate___ of unemployment is the unemployment that occurs as a normal part of the functioning of the economy. Sometimes taken as the sum of ___frictional___ unemployment and __structural___ unemployment.*** 6. A __recession___ is roughly a period in which ___real GDP___ declines for at least two consecutive quarters. * 7. Recessions may help to reduce ___inflation__ and lead to a decrease in the demand for __imports__, which improves a nation’s ___balance of payments___ *** 8. ____Price indexes___ are used to measure overall price levels. * 9. The ___consumer price index___ (CPI) is a measuring tool used for the calculation of price changes and computed each month by the Bureau of Labor Statistics using a bundle that is meant to represent the “__market basket___” purchased monthly by the typical urban consumer.* 10. The consumer price index (CPI) is the most popular __fixed-weight___ price index. * 11. ___Producer price indexes___ (PPIs), measure price changes for products at all stages in the production process. The three main categories are: ___finished__ goods, __intermediate__ products and __raw materials___ *** 12. Inflation changes the __distribution__ of income and also increase the __input prices___. * 13. __Unanticipated ___ inflation is an inflation that takes people by surprise.* 14. Inflation that is higher than expected benefits ___debtors___; inflation that is lower than expected benefits __creditors__. * 15. The real interest rate is the difference between the interest rate on a loan and the __inflation rate___. * 16. The opportunity cost of ___holding cash___ is high during inflations. * 17. Inflation creates __administrative___ costs and inefficiencies. * CHAPTER 15- MONEY AND HOW TO SUPPLY MONEY 1. Two major schools decidedly against government intervention developed: ___monetarism___ and ___new classical___ economics. * 2. __Velocity of money___ is the number of times a dollar bill changes hands, on average, during a year; the ratio of___ nominal GDP___ to the ___stock___ of money.* 3. Nominal income (GDP) is equal to ___real output (income)___ (Y) x the ____overall price level___ (P) * 4. ___Quantity___ theory of money is the theory based on the identity ___M x V P x Y _____and the assumption that the __velocity of money ___(V) is constant . *** 5. Inflation is always a ___monetary___ phenomenon. If the __money supply___ does not change, the price level will not change. * 6. The view that changes in the money supply affect only the price level, without a change in the level of output, is called the “___strict monetarist___” view. * 7. Money is anything that is generally accepted as a ___medium of exchange___. Its properties can be described as 1) ___store of value___ which means an asset that can be used to transport purchasing power from one time period to another , 2) ___liquidity___ which shows that it is portable and readily accepted and easily exchanged for goods , 3) __unit of account___ that provides a consistent way of quoting prices.*** 8. ___Required reserve ratio___ is the percentage of its total deposits that a bank must keep as reserves at the Federal Reserve. * 9. An increase in bank reserves leads to a greater than one-for-one increase in the money supply. Economists call the relationship between the final change in deposits and the change in reserves that caused this change the __ money multiplier____. * 𝟏 10. Money multiplier = 𝑹𝒆𝒒𝒖𝒊𝒓𝒆𝒅 𝒓𝒆𝒔𝒆𝒓𝒗𝒆 𝒓𝒂𝒕𝒊𝒐 * 11. In the accounts of a central bank, __deposits__ (on the liability side) = __reserves__ + loans (on the asset side) * 12. __Central Bank___ has several functions: clearing ___interbank payments___ , providing ___funds_ for banks in __trouble___ and to control the ___money supply___ , and accounting the receivables and payables of the government ** 13. If the central bank wants to increase the supply of money, it creates more __reserves___, thereby freeing banks to create additional deposits by making more __loans___. * 14. Three tools are available to the central bank for changing the __money supply__: (1) changing the ___required reserve ratio___; (2) changing the ___discount rate___; and (3) engaging in __open market___ operations. ** 15. __Decreases___ in the required reserve ratio allow banks to have more deposits with the existing volume of reserves. As banks create more deposits by making loans, the supply of money (currency + deposits) ___increases___. * 16. If the central bank wants to restrict the supply of money, it can __raise___ the required reserve ratio, in which case banks will find that they have insufficient reserves and must therefore __reduce___ their deposits by “calling in” some of their loans. The result is a ___decrease___ in the money supply.* 17. ___Discount rate__ is the interest rate that banks pay to the central bank to borrow from it. * 18. The___ higher___ the discount rate, the __higher__ the cost of borrowing, and the __less___ borrowing banks will want to do. * 19. ___Open market operations___ is a tool used to expand or contract the amount of reserves in the system (purchase and sale of government’s ___securities___) and thus the __money supply__.* 20. The __Treasury Department___ is responsible for collecting __taxes___ and paying the federal government’s ___bills___. * 21. An open market ___ purchase___ of securities by the Fed results in an ___increase___ in reserves and an __increase___ in the supply of money by an amount equal to the___ money multiplier ___times the change in reserves. * 22. An open market __sale ___of securities by the Fed results in a __decrease___ in reserves and a __decrease___ in the supply of money by an amount equal to the __money multiplier___ times the change in reserves.* 23. The government can not control certain aspects of the economy related to fiscal policy. For example: The government can control ___tax rates__ but not ___tax revenue___. * 24. Tax revenue depends on ___household income___ and the size of ___corporate profits___*. 25. Government ___spending___ depends on government decisions and the state of the economy.* 26. __Disposable, or after-tax income ___(Yd ) equals total income minus __taxes___. * 27. A government’s ____budget deficit____ is the difference between what it spends (G) and what it collects in taxes (T) in a given period: * 28. If Government spendings exceeds Taxes , the government must borrow from the public to finance the __deficit___. It does so by selling ___Treasury bonds and bills____.* 29. In equilibrium, __aggregate output (income)___ (Y) equals planned ___aggregate expenditure___ (AE), and leakages ___(S + T)___ must equal planned injections ___(I + G)___. * 𝟏 30. Government spending multiplier = 𝑴𝑷𝑺 * 31. The ___aggregate consumption___ function is now a function of disposable, or after-tax, income.* 32. A tax cut increases ___disposable income___, and leads to added ___consumption spending___.* 33. The multiplier for a change in taxes is smaller than the multiplier for a change in ___government spending___. * 34. ∆𝐘 = − ∆𝐓 𝐱 𝐌𝐏𝐂 𝐌𝐏𝐒 * 𝑴𝑷𝑪 35. 𝐓𝐚𝐱 𝐦𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫 = − 𝑴𝑷𝑺 * 36. The ___balanced-budget multiplier ___is the ratio of change in the equilibrium level of output to a change in government spending where the change in government spending is balanced by a change in taxes so as not to create any deficit. * 37. The difference between the federal government’s receipts and its expenditures is the federal ___surplus ___ (+) or ___deficit ___(-). * 38. ___Automatic stabilizers____ are revenue and expenditure items in the federal budget that automatically change with the state of the economy in such a way as to stabilize __GDP___. * 39. ___Fiscal drag ___is the negative effect on the economy that occurs when average tax rates increase because taxpayers have moved into higher income brackets during an expansion. * 40. The ___full-employment ___budget is what the federal budget would be if the economy were producing at a full-employment level of output. * 41. The ___cyclical___ deficit is the deficit that occurs because of a downturn in the business cycle.* 42. The___ structural ___deficit is the deficit that remains at full employment.* CHAPTER 16-MONEY DEMAND , MONETARY POLICY 1. ___Interest___ is the fee that borrowers pay to lenders for the use of their funds.* 2. There are three reasons for demanding for money: ___transaction___ motive, __speculation___ motive and __precautionary__ motive *** 3. __Nonsynchronization of income and spending __ is the mismatch between the timing of money inflow to the household and the timing of money outflow for household expenses.* 4. __Transaction__ motive is the main reason that people hold money—to buy things.* 5. __Speculation__ motive: Investors may wish to hold __bonds___ when interest rates are __high__ with the hope of selling them when interest rates __ fall__.* 6. ___Precautionary__ motive means holding the money due to the need of a self protection against uncertainties and risks which may arise through a sudden disease, natural disaster or an emergency situation * 7. The total quantity of money demanded in the economy is the sum of the demand for checking account___ balances__ and __cash___ by both households and firms. * 8. An __ increase__ in Aggregate Output (Income) (Y) Will Shift the Money Demand Curve to the ___right___ * 9. A decrease in __income___ means a decrease in the number of___ transactions__ and a __lower___ demand for money * 10. The amount of money needed by firms and households to facilitate their day-to-day transactions also depends on the __average TL__ amount of each transaction. In turn, this depends on __prices___, * 11. __Decreases__ in the price level shift the money demand curve to the___ left___.* 12. The __interest rate__ has negative effect on the demand curve of money and causes it sloping downward. ** 13. The __volume of transactions__ has positive effect and shifts the money demand curve to the __right__** 14. __Aggregate output __has positive effect on the demand curve of money, it shifts the money demand curve to the ___ right___** 15. __Price level__ has positive effect on the money demand, the demand curve shifts to the right** 16. An increase in Y (national income) shifts the money demand curve to the ___right__.*** 17. A decrease in Y(national income) shifts the money demand curve to the ___left___.*** 18. An increase in the price level is like an increase in Y in that both events increase the demand for money. The result is an increase in the equilibrium ___interest rate____. *** 19. A decrease in the price level leads to a __decrease___ in the equilibrium interest rate.*** CHAPTER 17-MONETARY AND FISCAL POLICY 1. When the interest rate __falls___, planned investment ___rises___.* 2. When the interest rate __rises__, planned investment ___ falls___. * 3. When the interest rate rises, planned investment __falls___ .This leads to a decrease in planned __aggregate expenditure ___ . As a result, equilibrium __output(income)__ lowers.*** 4. When the interest rate falls, planned investment __rises___ .This leads to an increase in planned __aggregate expenditure ___ . As a result, equilibrium __output(income)__ increases.*** 5. ___Expansionary fiscal___ policy is an increase in ___government spending___ or a reduction in __net taxes___ aimed at increasing ___aggregate output (income) (Y)____.*** 6. ___Expansionary monetary___ policy is an increase in the ___money supply___ aimed at increasing __aggregate output (income) (Y)__. *** 7. ___Crowding-out effect ___ is the tendency for increases in government spending to cause reductions in __private investment___ *** 8. __Interest sensitivity____ of planned investment is the responsiveness of planned investment spending to changes in the interest rate.*** 9. ___Contractionary fiscal___ policy is a decrease in __government spending___ or an increase in___ net taxes___ aimed at decreasing ____aggregate output (income) (Y)____.*** 10. The determinants of planned investment are ___ interest rate___ , ___Expectations___ of future sales ,___Capital___ utilization rates , ____Relative capital and labor___ costs ** CHAPTER 18-INTERNATIONAL TRADE 1. When a country exports more than it imports, it runs a ___trade surplus___.* 2. A ___trade deficit____ is the situation when a country imports more than it exports.* 3. David Ricardo’s theory of ___comparative advantage___, states that ___specialization___ and ___free trade___ will benefit all trading partners (real wages will rise), even those that may be absolutely less efficient producers.* 4. A country enjoys an ___absolute advantage___ over another country in the production of a product when it uses fewer resources to produce that product than the other country does.* 5. A country enjoys a ___comparative advantage___ in the production of a good when that good can be produced at a lower cost in terms of other goods.* 6. When countries ___specialize____ in producing the goods in which they have a comparative advantage, they maximize their combined ___output ___and allocate their resources more efficiently.* 7. The ratio at which a country can trade domestic products for imported products is the ___terms of trade____.* 8. An ___exchange rate ___is the ratio at which two currencies are traded, or the price of one currency in terms of another.* 9. If exchange rates end up in the right ranges, the free market will drive each country to shift resources into those sectors in which it enjoys a ___comparative advantage___. 10. ___Factor endowments____ refer to the quantity and quality of labor, land, and natural resources of a country.* 11. The Heckscher-Ohlin theorem is a theory that explains the existence of a country’s comparative advantage by its ___factor endowments___. * 12. There are several ways of protection of a country from a foreign trade : ___import tariffs__, __quotas___ *** 13. A ___tariff___ is a tax on imports.* 14. A __quota ___is a limit on the quantity of imports.* 15. Export ___subsidies_____ are government payments made to domestic firms to encourage exports.* 16. ___Dumping___ refers to a firm or industry that sells products on the world market at prices below the domestic price.* 17. The ___General Agreement on Tariffs and Trade (GATT)___ is an international agreement signed by the United States and 22 other countries in 1947 to promote the liberalization of foreign trade. *** 18. ___Economic integration___ occurs when two or more nations join to form a __free-trade zone____. *** 19. The ____European Union (EU)___ and the _____North American Free-Trade Agreement NAFTA____ are examples of economic integration.*** 20. The North American Free-Trade Agreement (NAFTA) is an agreement signed by the __United States__, ___Mexico___, and ___Canada___ in which the three countries agreed to establish all of North America as a free-trade zone. *** 21. There are several reasons for protection a country from foreign trade: to save __jobs__ , to prevent __unfair competition__ , to safeguard __national security___, to discourage __dependency__ , to protect __infant industries___ ** 22. An ___infant___ industry is a young industry that may need temporary protection from competition from the established industries of other countries to develop an acquired comparative advantage. *