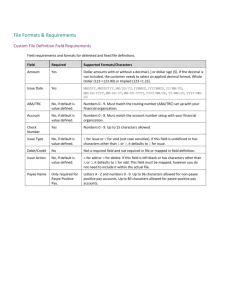

Payee Tax Representations

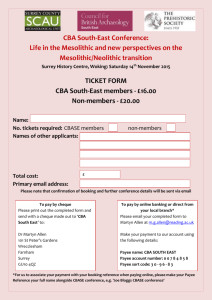

advertisement

Tax Provisions in the Multicurrency–Cross Border ISDA Master Agreement and Schedule Ruth Ainslie Senior Policy Director ISDA Fundamentals of ISDA Documentation Sao Paulo, Brazil August 6, 2002 ISDA Master Agreement and Schedule Tax provisions: what are they for? • Establish basis for concluding that no withholding is required —Representations —Tax forms • Allocate risk of withholding tax • Allow innocent burdened party to terminate ISDA Master Agreement and Schedule Tax provisions: how do they work? (1) • Payer makes Payer Tax Representation that it is not required to withhold - Section 3(e) and Schedule Part 2(a) — In making Payer Tax Representation, Payer may rely on Payee Tax Representations, Payee’s compliance with Tax Agreement and provision of tax forms ISDA Master Agreement and Schedule Tax provisions: how do they work? (1) (contd.) • Payee obligations and representations are designed to ensure conditions are met so that no withholding is required —Payee makes Payee Tax Representations - Section 3(f) and Schedule Part 2(b) —Tax Agreement: Payee agrees to notify Payer if Payee Tax Representations cease to be true - Section 4(d) —Payee agrees to provide tax forms - Section 4(a)(i)&(iii) and Schedule Part 3(a) ISDA Master Agreement and Schedule Tax provisions: how do they work? (2) •Payer takes risk of withholding under Indemnifiable Tax ... —Payer is required to gross up for any withholding arising under an Indemnifiable Tax - Section 2(d)(i)(4) •Section 14 "Indemnifiable Tax" = any tax other than —Stamp Tax —Tax imposed due to a connection between Payee and taxing authority’s jurisdiction ISDA Master Agreement and Schedule Tax provisions: how do they work? (2) (contd.) • …unless Payee is at fault… —Payer is not required to gross up if Payee breaches Tax Agreement or does not provide tax forms Section 2(d)(i)(4)(A) —Payer is not required to gross up if Payee Tax Representations cease to be true - Section 2(d)(i)(4)(B) • … but Change of Tax Law risk remains with Payer —Payer must gross up even if Change of Tax Law causes Payee Tax Representations to be false – Section 2(d)(i)(4)(B) ISDA Master Agreement and Schedule Tax provisions: how do they work? (3) • Tax Termination Events allow the burdened party to terminate the transaction —Tax Event: if the obligation to withhold is caused by a Change in Tax Law or similar legal development Section 5(b)(ii) —Tax Event Upon Merger: if the obligation to withhold is caused by a party merging with another entity Section 5(b)(iii) • BUT Payee may not terminate if it is at fault Allocation of risk under ISDA Master Agreement and Schedule START Does obligation to withhold arise under an Indemnifiable Tax? PAYEE RECEIVES NET Payee may terminate transaction if, for example, obligation to withhold is caused by a Change in Tax Law NO YE S PAYEE RECEIVES NET Has Payee provided tax forms and complied with Tax Agreement? Payee may not terminate transaction NO NO YE S PAYER GROSSES UP Are Payee Tax Representations true? NO Is this failure due only to a Change in Tax Law or similar legal development? YE S YE S Payer may terminate transaction if obligation to withhold is caused by EITHER a Change in Tax Law or similar legal development OR the merger of a party ISDA Master Agreement and Schedule Tax-related provisions • Master Agreement —Section 2(d) - Withholding tax gross-up —Section 3(e) - Payer Tax Representation —Section 3(f) - Payee Tax Representations —Section 4(a)(i) and (iii) - Tax forms —Section 4(d) - Tax Agreement ISDA Master Agreement and Schedule Tax-related provisions (contd.) —Section 4(e) - Payment of Stamp Tax —Section 5(b)(ii) - Tax Event —Section 5(b)(iii) - Tax Event Upon Merger —Section 14 - Definitions of “Indemnifiable Tax” and "Tax" •Schedule —Part 2 - Tax Representations —Part 3 - Tax Forms New US Regulations (Effective 2001) •No withholding on swaps (provided no embedded loan) •No US tax form required to avoid withholding •But representations may be needed to avoid information reporting Information reporting on payments to foreign parties Form 1042S reporting for swap payments to US branch of foreign counterparty • • Foreign counterparty establishes that it is not acting out of US branch by: — Representing in a swap schedule or confirmation that it is a US person or non-US branch of a foreign person; — Providing Form W-8BEN to certify that it is a foreign person Domestic information reporting on Form 1099 •Does not apply if payee —represents in swap schedule or confirmation that it is a foreign person or provides Form W-8BEN —is an exempt recipient (such as a corporation) Standard representations for US information reporting •In October, 2001, ISDA issued standard representations for purposes of the US information reporting requirements just described •Available on ISDA website (www.isda.org) New ISDA Master Agreement •Tax provisions currently under review by ISDA's Tax Committee •Change to 5(b)(iv)(2) •Some further changes under discussion •Incorporates October, 2001 US withholding representations —See October explanation (and get tax advice) for help selecting appropriate representation