Tata AIG R&SI - Sa-Dhan

advertisement

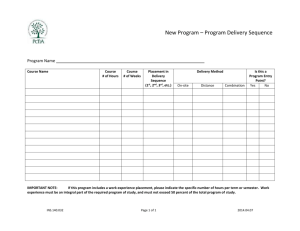

Tata AIG Rural & Social Initiative Kiran Kumar K -Tata AIG Cattle Insurance Rural Market Segmentation Demographics •650,000 Villages •800 m Population Risks / Insurance HIG/ MIG Segment - Top of Pyramid (TOP) •>20 acres Land •> 4 Cattle, Poultry •Tractor •Car, 2Wheeler, Cycle •RCC Home •TV, Fridge, AC •Telephone •< 5 - 10 acres Land •< 3 Cattle, Poultry •2Wheeler, Cycle •Tiled / RCC Home •TV Micro Insurance – Generally Group Biz Rich 2% Mid-Income 20% (Average Landholdings / Small Entrepreneurs) HH Income >$6/day (Annual Saving Rs.50,000/-) •Crop Ins •Cattle farm, Poultry •Tractor Ins •Car, 2Wheeler Ins •Home Ins •IPA Ins •Health Ins •Travel Ins •Life Ins •Crop Ins •Cattle farm, Poultry •2Wheeler Ins •Disaster Ins •IPA ins •Health Ins •Life Ins Channel Finance: Comm/ Rural Bank Coop Bank, PACS Agriculture: Rice Mills Agri. Dealers Dairying: Coop. Dairy Pvt. Dairy Others: Rural Agencies Rural Agents Micro Ins Segment - Bottom of Pyramid (BOP) •< 2 acres Land •1 Cattle, Livestock •Unorganized Labor •Skill based Occupation •Hut / Tiled Home •Landless Laborer •Unorganized Laborer •Semi-Skill Occupation •Hut Above Poverty Line (APL) – 50% (Very Marginal / No Landholding) HH Income < $3/day (Annual Saving Rs.3000/-) Below Poverty Line (BPL) – 27% (Landless / Self Employed) HH Income < $ 1/day (Annual Saving Rs.500/- to1000/-) •Cattle Ins •Sheep / Goat Ins •Hut / Disaster Ins •GPA Cover •Micro Health Ins •Life Ins •Hut / Disaster Ins •GPA Cover •Micro Health Ins •Life Ins Finance MFI NGO SHG Dairying Coop. Dairy Pvt. Dairy Market Potential – Cattle India has the largest cattle population in the world approximately 283 million cattle, constituting 30% of the worlds cattle population. Cattle in India is predominantly buffalo. Cows make up 30% of the cattle population India is the largest producer of milk (100 Million Tones). Even with per capita milk production being one of the lowest in the world It is one of the few countries where cattle is considered holy and revered with religious fervor. It drives the secondary economic activity in rural India. The primary being agriculture. Cattle Insurance - Product For Cow, Buffalo, Stud Bull EXCLUSIONS Provides comprehensive cover to cattle against death due to Diseases Accidents Intentional slaughter of the animal Missing, Theft and/or clandestine sale of the insured animal Natural calamities Riots, Malicious damage, temporary or permanent War, nuclear material or weapons. Consequential loss of whatsoever nature Claim arising due to disease contracted Permanent loss of milk yielding capacity due to disease Permanent Total Disablement (PTD) incapacity to conceive or yield milk Terrorism Partial Disablement of any type, whether within 15 days from risk date Claims received without intact Ear tag Issuance Process Identification of Cattle is key to successful implementation of cattle insurance Identified with unique numbered polyurethane (PU) Ear-tags This is done by proper Tagging of the animal at the time of acceptance for insurance Issuance Process Tagging shall be done by trained officer Check Tag and confirm the health of the animal the animal successfully with PU tag Digitally insured photograph the animal along with the Front View Identify Tag No. Identify shape of horns Identify facial colour and marks Side View Identify the owner along with the animal Identify health of the animal Identify the colour and marks on the animal Rare View Identify the udder of the animal Identify the shape of the legs Identify the health of the animal Identify colour and marks on the tail Adverse Selection Adverse Selection Issuance Process Prepare the Schedule of animals tagged for insurance Proposal cum Schedule Form Issuance Process Hand over a vernacular pamphlet on animal care and contact info in event of claim. Proposal form (Hard/Soft Copy) and Digital Photographs to sent to the insurance company within the next 48 hours In the event of claim field staff will intimate the insurance company on the Toll free No. Field staff will help the surveyor in identifying the animal and facilitates necessary documentation. Issuance Process Retagging Inform the Insurance Company immediately Arrange for retagging the animal Digitally photograph the animal once again Fill up a fresh proposal cum schedule and submit the same along with the photographs. Claims Settlement Experience with various set ups: NGO/MFI/NBFC Private Dairies Co Operative Dairies Government Projects Claims Settlement All genuine claims have been settled with 15 working days Proper underwriting ensures profitability in the long run to The Insured The Partner Then Insurance company Our Strengths The salient features of our service We fundamentally believe in standardization of services up to the last mile Our product strength lies in our capacity to customize processes, which mitigates hardships in verification for insurance and reporting of claims. We will ensure proper risk management and consequently a better portfolio which is fundamental to a successful Insurance program. Our hi-tech risk management expertise will help reduce premium rates in the long run, much to the benefit of the customer. Claim Surveyor network across the country. In house claims process for faster settlement. MFI Role in Rural Insurance Strength Trust-worthiness Knowledge of rural markets Well spread out Network Network at affordable cost Large customer base MFI Role in Rural Insurance Benefits Secures MFI’s loans Protect members loans Value added services Capacity building in terms of soft skills MFI Role in Rural Insurance Opportunity New channels of business PROPERTY RISKS Vehicle 2 Wheeler Personal car Commercial vehicle Tractor Property PEOPLE RISKS For Members / Employees Accident/ Injury Health & Hospitalization Home/ Hut Shops & Outlets Schools Machinery/ Pump-set 22 Our Milestones NGO/MFI/NBFC Indira Kranthi Pathakam – Vishakapatanam Grameen Koota – Karnataka Nava Karnataka Rural Development Society - Karnataka Private Dairies Dolphin Dairy – Andhra Pradesh Creamline Dairy Products Ltd Co Operative Dairies Baroda Dairy - Gujarat Amul Dairy –Gujarat Mehsana Dairy - Gujarat Government Projects Cross Section of our Strategic Tie-ups: LDB/LDA Projects – UP, Haryana & Rajasthan, Madhya Pradesh, Maharastra and Chhattisgarh Our cattle insurance program for IKP project in Visakhapatnam, Andhra Pradesh - which was a case study by itself - was well appreciated by World Bank and was a discussion forum topic at the World Bank Workshop on "Access to Insurance for the Poor," at Rio de Janeiro, in May, 2007 Tata AIG Presence Existing Sales Offices: 84 Branch Offices POS E-Franchisee Local Office: Tata AIG General Insurance Co Ltd II Floor, My Home Tycoon, Greenland’s, Begumpet Hyderabad 500 017 Email id: kumar.kiran@tata-aig.com Phone No 040 66575914 Mobile No 098855 22555 Appreciation from partners Together We Can !!!