FSA Timber Sales Analysis 2007

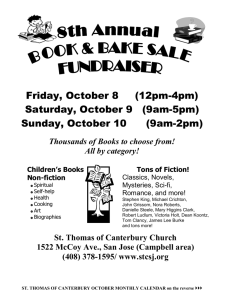

advertisement

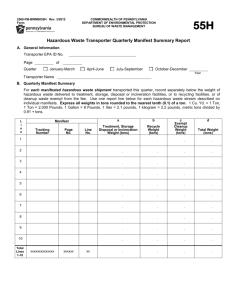

Forestry South Africa Roundwood Sales Analysis for the 2009 Financial Year Roger Godsmark Forestry South Africa February 2010 Analysis of Roundwood Sales and Income Generated 2009 Salient Points to Note The SA Forestry Industry did not escape the ravages of the international economic crisis that came to a head in September 2008. • Tonnage sales of 14.261 mt were not only 638 000t below the budget of 14.9 mt but a massive 2 398 000t (14.4%) less than the corresponding figure for 2008. • Sales across all species were down in comparison to 2008, the biggest decrease being attributable to eucalyptus sales which were over 1.7 mt or 19.6% down on last year. • In terms of sales per product, all products saw a decline in sales as compared to 2008, the biggest decrease being attributable to pulpwood with a drop in sales of over 1.9 mt (15.5%). Year on year, the biggest decline was that of Euc Pulpwood which dropped 1.4 mt or 17.7%. • Despite the levy having increased by 16.4% between 2008 & 2009 (110 cents to 128 cents per ton), total income generated of R17.85 million was actually R55 000 less than that generated the previous year. It was also over R1.2 million (6.4%) less than that budgeted for in 2009. • Overall levy coverage, as one would have expected given the depressed market conditions, decreased from 94% in 2008 to 82% in 2009 *. *Note: Caution should, however, be exercised with this comparison as it compares DWAF figures for 2007/8 with FSA’s 2009 figures. Roundwood Sales by Species 2009 Softwood Eucalyptus Wattle 8.4% 49.2% 42.4% Total Sales – 14 261 000 tons Roundwood Sales by Product 2009 Pulpwood Sawlogs Mining Timber Other 20.4% 1.8% 3.7% 74.0% Total Sales – 14 261 000 tons Pulpwood Sales by Species 2009 Softwood Eucalyptus Wattle 59.7% 11.1% 29.2% Total Sales – 10 559 000 tons Sawlog Sales by Species 2009 Softwood Eucalyptus 7.9% 92.1% Total Sales – 3 220 000 tons Other Roundwood Sales by Species 2009 Softwood Eucalyptus Wattle 60.2% 4.2% 35.6% Total Sales – 792 000 tons Sales Comparisons 2008 vs. 2009 Product Sawlogs: Soft 2008 2009 Diff tons Diff % 2 945 228 2 682 158 -263 070 -8.9% 276 704 228 628 -48 075 -17.4% Sawlogs 3 221 932 2 910 787 -311 145 -9.7% Pulpwood: Soft 3 433 277 3 079 425 -353 853 -10.3% Pulpwood: Hard 9 068 340 7 479 602 -1 588 738 -17.5% 12 501 617 10 559 027 -1 942 591 -15.5% Mng: Timber : 330 428 261 206 -69 222 -20.9% Poles :Soft 147 463 116 968 -30 494 -20.7% Poles: Hard 241 704 215 490 -26 214 -10.8% Poles 389 167 332 458 -56 708 -14.6% Woodchips: Soft 167 775 165 234 -2 541 -1.5% Other: Hard 48779 32 916 -15 863 -32.5% Grand Total 16 659 698 14 261 628 -2 398 070 -14.4% Sawlogs: Hard Pulpwood Roundwood Sales by Contributor 2009 Corporates Co-ops Independents 15.6% 1.6% 82.9% Total Sales – 14 261 000 tons Roundwood Sales per Month 2009 by Species Softwood Eucalyptus Wattle Total Thousand Tons 1 500 1 000 500 0 J F M A M J J A S O N Month Highest sales Lowest sales - March July 1 433 000 t 1 036 000 t D Roundwood Sales per Month 2009 by Product Pulpwood Sawlogs Other Total Thousand Tons 1 500 1 000 500 0 J F M A M J J A S O N Month Highest sales Lowest sales - March July 1 433 000 t 1 036 000 t D Roundwood Sales per Month 2009 Budget vs. Actual Budget Actual 1 500 Thousand Tons 1 400 1 300 1 200 1 100 1 000 J F M A M J J A S O N D Month Highest surplus Highest deficit - March July 191 000 t 206 000 t Contributions Generated by Contributor - 2009 Corporates Co-Ops Independents 15.9% 1.5% 82.6% Total Income Generated – R17 850 000 Levy Income Generated per Month 2009 Budget vs. Actual Budget Actual 1 900 Thousand Rands 1 800 1 700 1 600 1 500 1 400 1 300 1 200 J F M A M J J A S O N D Month Highest Income Lowest Income - March July R1 798 000 R1 289 000 Budgeted FSA Expenditure vs. Actual Levy Income 2009 Budgeted Exp. Actual Income 2 600 Thousand Rands 2 400 2 200 2 000 1 800 1 600 1 400 1 200 1 000 J F M A M J J Month A S O N Accumulated deficit by year end - R3 907 000 (Excludes approved but unbudgeted expenditure nor attributable income) D Tonnage & Levy Income Comparison 2009 Budget vs. Actual Actual Budget 20 19 Million Rand / Tons 18 17 16 15 14 13 12 11 638 000 Ton Deficit R1 222 000 Deficit Tonnage Rands 10 Tonnage @ 128 cents per ton Tonnage @ 75 cents per ton - 13 497 000 t 764 000 t Roundwood Sales Comparisons 2007/08 DWAF vs. 2009 FSA by Species DWAF FSA 7.014 Eucalyptus 7.524 93% of DWAF 6.043 Softwood 9.163 66% of DWAF Overall coverage 82% (94% last yr) 1.204 Wattle 0.771 156% of DWAF 0 2 4 6 8 10 Million Tons Sales ex Plantations 2007/08 (DWAF) FSA based sales 2009 - 17.5 m tons 14.3 m tons 12 Roundwood Sales Comparisons 2007/08 DWAF vs. 2009 FSA by Product DWAF FSA 10.559 10.881 Pulpwood 97% of DWAF 2.911 Sawlogs 5.427 54% of DWAF 0.261 0.427 Mining Timber 61% of DWAF 0.332 0.352 Poles 94% of DWAF 0.330 0.387 Other 85% of DWAF 0 2 4 6 8 10 12 14 Million Tons Sales ex Plantations 2007/08 (DWAF) - 17.5 m tons FSA based sales 2009 - 14.3 m tons 16 Analysis of Roundwood Sales and Income Generated 2002 - 2009 Roundwood Sales per Year 2002 - 2009 @ lower levy 16.994 16.476 16.541 16.600 16.040 16.660 14.305 14.261 Million Tons 20 18 16 14 12 10 8 6 4 2 0 @ full levy 2002 2003 2004 2005 2006 2007 2008 2009 Lower levy excludes a contribution to the ICFR Sales Comparisons per Species 2002 - 2009 Eucalytpus Softwood Wattle 12 Million Tons 10 8 6 4 2 0 2002 2003 2004 2005 2006 Year 2007 2008 2009 Roundwood Sales 2002 - 2009 Eucalyptus 10 9.237 9.010 Million Tons 9 8.828 8.725 8.511 8.065 8 7 7.014 6.889 6 2002 2003 2004 2005 2006 Years 2007 2008 2009 Roundwood Sales 2002 - 2009 Softwood 7.0 6.664 6.667 Million Tons 6.526 6.5 6.229 6.208 6.043 5.995 6.0 5.900 5.5 2002 2003 2004 2005 2006 Years 2007 2008 2009 Roundwood Sales 2002 - 2009 Wattle 1.7 1.575 Million Tons 1.6 1.517 1.5 1.471 1.484 1.425 1.409 1.4 1.309 1.3 1.204 1.2 2002 2003 2004 2005 2006 Years 2007 2008 2009 Roundwood Sale Comparisons per Species 2008 vs. 2009 2008 2009 10 8.725 9 8 6.526 7 Million Tons 7.014 6.043 6 5 4 Down 205 000t - 14.6% Down 483 000t - 7.4% Down 1 711 000t -19.6% Softwood Eucalyptus 3 2 1.409 1.204 1 0 Wattle Overall decrease of 2 398 000t or 14.4% Sales Comparisons per Product 2002 - 2009 Pulpwood Sawlogs MT & Other 14 Million Tons 12 10 8 6 4 2 0 2002 2003 2004 2005 2006 2007 2008 Year Pulpwood growth over period Sawlog decline over period MT & Other growth over period + 238 000 tons + 2.3% - 376 000 tons - 11.4% + 95 000 tons +13.6% 2009 Roundwood Sales 2002 - 2009 Pulpwood 14 13 12.667 12.674 12.502 Million Tons 12.381 12 11.707 11.391 11 10.559 10.321 10 9 2002 2003 2004 2005 2006 Years 2007 2008 2009 Roundwood Sales 2002 - 2009 Sawlogs 4.50 3.991 Million Tons 4.00 3.638 3.50 3.429 3.287 3.228 3.222 3.039 2.911 3.00 2.50 2.00 2002 2003 2004 2005 2006 Years 2007 2008 2009 Roundwood Sales 2002 - 2009 Mining Timber & Other 1.10 1.011 Million Tons 1.00 0.936 0.931 0.924 0.901 0.90 0.792 0.80 0.70 0.763 0.697 0.60 2002 2003 2004 2005 2006 Years 2007 2008 2009 Roundwood Sale Comparisons per Product 2008 vs. 2009 2008 2009 14 12.502 12 10.559 Million Tons 10 8 Down 144 000t -15.4% Down 311 000t - 9.7% Down 1 943 000t -15.5% 6 4 2 3.222 0.936 2.911 0.792 0 Other Sawlogs Pulpwood Overall decrease of 2 398 000t or 14.4% Levy Income Generated per Year 2002 - 2009 20 Million Rand 18 16 17.850 2008 2009 15.607 14 13.002 11.855 12 10 17.905 12.249 11.468 9.570 8 2002 2003 2004 2005 2006 2007 Year Levy income in 2009 actually R55 000 less than in 2008 and R1 222 000 under budget Sales Tonnage per Contributor 2008 vs. 2009 2008 2009 16 13.581 14 11.822 Million Tons 12 10 8 Down 1 759 000t -13.0% Down 641 000t -22.4% Up 2 000t +09% 6 2.859 4 2.218 2 0.220 0.222 0 Corporates Co-ops Independents Overall decrease of 2 398 000t or 14.4% Income Generation per Contributor 2008 vs. 2009 2008 16 14.549 2009 14.745 14 Million Rand 12 10 8 Up R196 000 +1.3% Down R306 000 -9.7% Up R55 000 +26.1% 6 4 3.145 2.839 2 0.211 0.266 0 Corporates Co-ops Independents Overall decrease of R55 000 or 0.3%