Title Insurance is Different … Unfortunately the Financial Reporting

advertisement

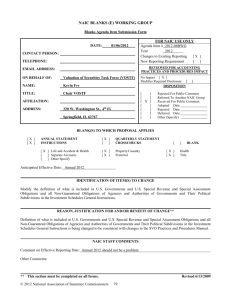

Joseph L. Petrelli, ACAS, MAAA, FCA President, Demotech, Inc. Arkansas Land Title Association In 2006 Demotech, Inc. published What We Have Here is A Failure to Communicate. Our white paper described the critical coverage and loss adjustment expense differences distinguishing Property and Casualty insurance from Title insurance. Furthermore, Demotech, Inc. described how financial reporting requirements failed to capture and summarize those differences. This presentation provides additional insight and detail on the failing of current, or proposed, statistical and financial plans applicable to Title insurance. The opinion and perspective presented are those of Demotech, Inc. and do not necessarily represent the opinions or perspectives of our clients, or the Title underwriters we review and rate. 2 The National Association of Insurance Commissioners’ Title Agent Statistical Data Plan The National Association of Insurance Commissioners (NAIC) has adopted the Title Agent Statistical Data Plan (“NAIC Plan”) to collect financial data from title agents nationwide. The NAIC has recommended that each state implement this NAIC Plan to assist regulators in the oversight of the title insurance industry. Part I of this section of the presentation tracks the origins and development of the NAIC Plan, and explores the purpose of the NAIC Plan. Part II provides details on the actual data reporting requirements, including a line by line analysis of the NAIC Plan and overview of the NAIC’s recommended standards for implementation. In Part III, we summarize the NAIC Plan’s Implementation guidelines. NAIC, Title Agent Statistical Data Plan Implementation Guideline, 2011. (“Implementation Guideline”) 4 Review of the NAIC and the REGULATION of INSURANCE ORIGINS of the TITLE INSURANCE AGENT STATISTICAL REPORT DEVELOPMENT of the NAIC PLAN PURPOSE of the NAIC PLAN 5 Insurance industry is regulated by the states National Association of Insurance Commissioners is a collective body Standard-setting, regulatory support organization Created and governed by the chief insurance regulators of the 50 states Started in 1871 to coordinate the regulation of insurers operating in multiple states The NAIC establishes standards and best-practices for the insurance industry’s regulators as well as insurers and other regulated entities http://www.naic.org/index-about.htm 6 Review of the NAIC and the REGULATION of INSURANCE ORIGINS of the TITLE INSURANCE AGENT STATISTICAL REPORT DEVELOPMENT of the NAIC PLAN PURPOSE of the NAIC PLAN 7 2007 Report from U.S. Government Accountability Office (GAO) to U.S. House Committee on Financial Services: Actions Needed to Improve Oversight of the Title Industry and Better Protect Consumers. (GAO-07-401)1 Highlights from report: Large insurers use local/regional title agents to conduct their business GAO thought understanding relationship between costs and amounts consumers pay could help regulators improve their ability to protect consumers GAO recommended that state regulators take action to: Improve consumers’ ability to shop for title insurance; AND Improve oversight of title agents GAO recommended that regulators collect data on title agents’ operations NAIC listened to GAO recommendations and formed a task force to evaluate the viability of a nationwide data call2 8 Review of the NAIC and the REGULATION of INSURANCE ORIGINS of the TITLE INSURANCE AGENT STATISTICAL REPORT DEVELOPMENT of the NAIC PLAN PURPOSE of the NAIC PLAN 9 Title Insurance Issues Working Group (TIIWG)/Title Insurance Task Force Sub-group of the P&C Committee of the NAIC Mission was to study issues related to title insurers and title insurance producers 2008--TIIWG decided a NAIC Plan for title insurers should attempt to measure, state by state: Profitability of title industry Competitiveness of title industry Reasonableness of rates and charges NAIC, Title Insurance (C) Task Force. Conference Call, Sept. 1, 2011. Project History: Title Agent Statistical Data Plan Implementation Guideline. (“Project History”) 10 2009—P&C Committee charged TIIWG with completing study on the ability to develop and implement a system to collect premium and expense data TIIWG concluded that it could assist states in developing a data call plan TIIWG became the Title Insurance Task Force and appointed the Title Statistical Plan Working Group to develop a nationwide statistical plan NAIC, Title Insurance (C) Task Force. Conference Call, Sept. 1, 2011. Project History: Title Agent Statistical Data Plan Implementation Guideline. (“Project History”) 11 Title Statistical Plan Working Group (TSPWG) Appointed by the Title Insurance Task Force to develop a nationwide statistical plan and implementation strategies to assist states in collecting data3 TSPWG, with input from The American Land Title Association (ALTA), insurers, title agents, and software vendors, developed Title Insurance Agent Statistical Report (“NAIC Plan”). 4 NAIC Plan was fully adopted by NAIC in Fall 2010 TSPWG drafted guideline to assist states in implementing the NAIC Plan Title Agent Statistical Data Plan Implementation Guideline was adopted by NAIC in Fall 2011.5 12 Review of the NAIC and the REGULATION of INSURANCE ORIGINS of the TITLE INSURANCE AGENT STATISTICAL REPORT DEVELOPMENT of the NAIC PLAN PURPOSE of the NAIC PLAN 13 “The purpose of the [NAIC plan] is to give information that is more useful to state regulators about the business of title insurance at the agency level.”* NAIC recognized that in most jurisdictions performance of the title insurance business is based on the title agent, not the title underwriter Annual financial report submitted by title underwriters includes information regarding premiums and losses, but does not include information about the title insurance business that is experienced only on the agent level Regulators lack valuable information and have an incomplete picture of the title insurance business NAIC proposes that jurisdictions need to obtain data from agents The purpose of the NAIC’s NAIC Plan is to collect information from title agents, particularly regarding their actual operating costs and their losses NAIC, Title Agent Statistical Data Plan Implementation Guideline, 2011. (“Implementation Guideline”) 14 NAIC PLAN - OVERVIEW NAIC PLAN - DETAILS TITLE AGENT STATISTICAL DATA PLAN IMPLEMENTATION GUIDELINE GOING FORWARD - WHAT WILL THE STATES DO? 15 NAIC undertook to design statistical data reporting plan to collect data in five categories: General information and agency information Risk assumption Income Expenses Loss and loss mitigation Goal of plan is to collect enough data to help regulators while not overburdening title agents Instructions for: Single State Agent Multi-State Agent Attorney Agent Underwriter Direct 16 NAIC PLAN - OVERVIEW NAIC PLAN - DETAILS TITLE AGENT STATISTICAL DATA PLAN IMPLEMENTATION GUIDELINE GOING FORWARD - WHAT WILL THE STATES DO? 17 Line # Line Description Single State Agent Multi-State Agent Attorney Agent Underwriter Direct General Information 1 2 3 4 Enter the four-digit Enter the four-digit Enter the four-digit Enter the four-digit calendar year for which calendar year for which you calendar year for which calendar year for which you you are reporting (e.g., are reporting (e.g., you are reporting (e.g., are reporting (e.g., reporting in 2012 for 2011, reporting in 2012 for 2011, reporting in 2012 for 2011, reporting in 2012 for 2011, Calendar year reporting enter 2011) enter 2011) enter 2011) enter 2011) Enter the two-letter state Enter the two-letter state Enter the two-letter state Enter the two-letter state abbreviation of the state abbreviation of the state abbreviation of the state abbreviation of the state for which you are reporting for which you are reporting for which you are reporting for which you are reporting (multi-state agencies (multi-state agencies (multi-state agencies (multi-state agencies should complete a should complete a should complete a separate should complete a separate separate report for each separate report for each report for each state, as report for each state, as state, as required by other state, as required by other required by other states) required by other states) State reporting for states) states) Agent/Agency/Firm Insert Firm name or Insert Firm name or Insert Firm name or Insert Firm Name Name individual agent's name individual agent's name individual agent's name If applicable, provide d/b/a If applicable, provide d/b/a If applicable, provide d/b/a N/A a) d/b/a (if applicable) name for agency name for agency name for agency Federal tax ID/SSN (for Underwriter direct Enter Federal Tax ID (or Enter Federal Tax ID (or SSN Enter Federal Tax ID (or Enter reporting entity's operations: use NAIC SSN for individual) for individual) SSN for individual) NAIC Company Code Company Code) A full copy of the Title Agent Statistical Stat Plan can be found at: www.naic.org/documents/committees_c_title_stat_plan_final.xls 18 Line # 5 Line Description Single State Agent If agency revenue is Parent Company EIN (if reported for taxes through applicable) (for a parent or other affiliate, Underwriter Direct enter such organization's Operations: use NAIC EIN; otherwise indicate Group Code) "N/A) Enter agency's license number in the state for License number (for this which you are reporting (if state) applicable) Multi-State Agent If agency revenue is reported for taxes through a parent or other affiliate, enter such organization's EIN; otherwise indicate "N/A) Enter agency's license number in the state for which you are reporting (if applicable) Enter the complete address for the agency's main office in the state for Enter the complete which you are reporting. If address for the agency's agency does not maintain main office. an office in the state for which you are reporting, enter the firm's main office address. 6 7 Address Contact person Enter First, Middle Initial Enter First, Middle Initial and Last name of person and Last name of person responsible for completing responsible for completing this report this report Attorney Agent Underwriter Direct If agency revenue is reported for taxes through a parent or other affiliate, Enter reporting entity's enter such organization's NAIC Group Code EIN; otherwise indicate "N/A) Enter agency's license Enter underwriter's license number in the state for number in the state for which you are reporting (if which you are reporting applicable) Enter the complete address for the direct operation's main office in the state for which you are Enter the complete reporting. If the direct address for the agency's operation does not main office. maintain an office in the state for which you are reporting, enter the operation's main office address. Enter First, Middle Initial Enter First, Middle Initial and Last name of person and Last name of person responsible for completing responsible for completing this report this report 19 Line # Line Description General Information 1 Calendar year reporting 2 State reporting for 3 Agent/Agency/Firm Name a) d/b/a (if applicable) 4 Federal tax ID/SSN (for Underwriter direct operations: use NAIC Company Code) Parent Company EIN (if applicable) (for Underwriter Direct Operations: use NAIC Group Code) 5 License number (for this state) 6 Address 7 Contact person 8 Contact phone 9 Contact e-mail 20 Agency Information 10 Independent 11 Affiliated (owned by underwriter) 12 Underwriter direct Is reporting agent an Affiliated Business Arrangement (affiliated with real estate brokerage, mortgage company, etc.)? (Y)es/(N)o. If Yes, List affiliated business 13 names on Appendix A 15 16 17 14 Agency/Branch Type: Title & closing (full service) 18 Title only Closing only Attorney title 19 State of domicile/residence of Reporting Entity/Person Number of states in which Reporting Entity operates (list all states on Appendix A) How long has agency been performing business in this state? 0-5 years 5-10 years 10-15 years Over 15 years Percentage of business for this state (by premium) a) Percentage of law firm revenue Number of underwriter appointments, contracts, or agreements. (List underwriters on Appendix A) 21 20 21 22 23 No. of employees (total FTE - as of last date of reporting period) a) No. of FTE on March 31 (end of Q1) b) No. of FTE on June 30 (end of Q2) c) No. of FTE on September 30 (end of Q3) No. of unallocated FTE, as of last date of reporting period (December 31) Licensed employees a) No. of licensed FTE on March 31 (end of Q1) b) No. of licensed FTE on June 30 (end of Q2) c) No. of licensed FTE on September 30 (end of Q3) 24 No. of licensed, unallocated FTE, as of last date of reporting period (December 31) List licensed employees (both allocated and unallocated employees) accounted for in Lines 21(a), (b), (c), and (d) on Appendix A Unlicensed employees a) No. of unlicensed FTE on March 31 (end of Q1) b) No. of unlicensed FTE on June 30 (end of Q2) c) No. of unlicensed FTE on September 30 (end of Q3) 25 No. of unlicensed, unallocated FTE, as of last date of reporting period (December 31) 22 Risk Assumption 26 Open Title Orders 27 Completed Title Orders in Which Policy Was Issued 28 Total number of policies issued in reporting period a) Residential Policies b) Non-residential Policies 29 a) Number of searches billed to 3rd parties b) Number of searches purchased from 3rd parties 30 Number of non-insurance title products produced a) Total settlement/escrow/closing transactions 31 conducted b) Number of line 28 that were sale/purchase settlement/escrow/closing transactions Number of settlement/escrow/closing transactions 32 conducted in which a title policy was not issued 23 Income 33 34 35 36 37 38 39 40 Premium written Premium remitted to underwriters Settlement/closing/escrow income Title examination income Abstract/search income Income from cancelled orders Investment income All other income 41 Total income 24 Expenses 42 Employee compensation 43 a) Contract labor (1099) b) Temporary labor (non-1099) 44 Payroll taxes 45 Employee Benefits 46 Rent, utilities, and repair 47 Title plant maintenance/subscription expenses 48 Abstract/search expenditures 49 Computer/software a) Depreciation (if applicable) 50 Business insurance 51 52 53 54 55 56 57 58 59 60 61 Business legal Accounting Licenses, taxes, and fees Marketing/sales Travel and lodging Employee education Bank charges Charge offs E&O insurance premiums Fidelity/Surety bond premiums Miscellaneous expense 62 Total business expenses 25 Loss, Loss Mitigation, and Underwriting Expenses 63 64 65 66 67 68 69 70 71 72 73 Title losses paid and not reimbursed by underwriter or included in underwriter loss reserves a)Title Loss Files Opened b) Title Loss Files Paid c) Reimbursements paid to underwriter for title losses Closing/Escrow losses a) Number of Closing/Escrow Losses resulting from escrow shortages b) Total amount of funded shortages Abstract/search losses (from abstracts/searches sold) Title loss-related and Closing/Escrow loss-related legal expenses Deductibles paid Total loss expenses Total expenses Net income before taxes Federal income tax incurred Net income Demotech’s note: Loss mitigation efforts are not captured. We suggested that, at a minimum, Schedule A and B counts be reported. 26 NAIC PLAN - OVERVIEW NAIC PLAN - DETAILS TITLE AGENT STATISTICAL DATA PLAN IMPLEMENTATION GUIDELINE GOING FORWARD - WHAT WILL THE STATES DO? 27 Title Statistical Plan Working Group issued an Implementation Guideline for the new Statistical Data Plan to assist state regulators with implementing the NAIC Plan Part A. Introduction Outlines the background and purpose of the NAIC Plan and provides general information regarding the NAIC Plan 28 Part B. Mechanism for Reporting and Collection of Data/Implementation Data required has not been previously reported, but should be readily available to title agents Task Force recommends that regulators provide as much notice as possible before implementing the NAIC Plan so agents may adapt their systems to collect the required data Task Force recommends annual reporting date of June 1 for previous year’s data Recommend that regulators establish web-based reporting system 29 Part C. Confidentiality of Data Task Force recommends that regulators keep individual responses on the NAIC Plan confidential, but regulators should be allowed to share/publish aggregate data Part D. Uses of Data Regulators should be careful if they intend to use NAIC Plan to set rates or analyze justifications of rates and fees because NAIC Plan does not capture the entire agent experience Task Force recognizes that regulators may use data to set rates 30 Other uses of the data include: Fulfillment of GAO recommendations of increased title agent data collection Comparison of relationships of costs to title agents and prices consumers pay Quantitative analysis of differences between title insurance and other lines of insurance Comparison of FTEs in agencies vs. total licensees in a jurisdiction Agent premium experience Market share analysis Marketing expense ratios (compared to market share) Premium vs. agency claims loss experience Agent experience by locality Development of market conduct base line market analyses 31 Part E. Insurance Department Outreach Efforts Task force recommends that regulators engage in outreach and training initiatives Suggest contacting state and national title associations, title insurance data collection and consulting firms, title insurance underwriters’ state offices, state departments of insurance, and NAIC 32 Part F. Suggested Statute Language Title Agent Statistical Data Plan. 1) 2) Every title agency doing business in this state, on or before the last day of May in each year, shall submit to the commissioner a report, signed and certified by an owner, officer, partner, or director of the agency, of the specific information listed in the NAIC Title Insurance Agent Statistical Data Plan. Information relating to the individual agencies filed with the commissioner under subsection (1) shall be kept confidential and not subject to public disclosure. However, nothing in this subsection (2) shall prohibit the commissioner from publishing data collected in an aggregate form, so as not to identify individual agencies’ data, or from sharing particular agency data with other state, federal and international regulatory agencies, with the National Association of Insurance Commissioners, its affiliates or subsidiaries, and with state, federal, and international law enforcement authorities, provided that the recipient agrees to maintain the confidentiality and privileged status of the information. 33 Part F. Suggested Statute Language The commissioner may establish rules, including rules providing statistical plans, for use by all title insurers and title insurance agents in the collection and reporting of demographic, revenue, expense and loss experience data in such form and detail as is necessary to aid him or her in the evaluation of the title insurance industry at the agency level. Drafting Note: States that require the data to be submitted electronically should establish a method of electronic signature verification that is acceptable to the commissioner. 3) 34 Part G. Suggested Regulation on Reporting Requirements Drafting note: This is not a model regulation, but a suggested regulation/best practice for any necessary rules that may need to be promulgated for the implementation of the NAIC plan. When drafting regulations, take into account local statutes, practices, and customs and modify this regulation accordingly. Section 1. Statement of Purpose This regulation is intended to provide standards and direction for the collection and reporting of title agent data in accordance with the NAIC’s Title Agent Statistical Data Plan. The regulation specifies the data required, due dates and time periods for collection and submission of data, methods of submission, and addresses the confidentiality of the data submitted. 35 Section 2. Statutory Authority This regulation is issued based upon the authority granted the commissioner under (cite any enabling legislation and state law corresponding to market analysis, market regulation, and/or title insurance regulation). Section 3. Applicability and Scope Under this regulation, all operating title insurance agencies and underwriter direct operations are required to provide yearly reports of their policy issuance, business income and expense, and loss experience (excluding losses forwarded to or paid by an underwriter). Agencies include independent title agencies, affiliated business arrangement (AfBA) title agencies, attorney firms/title agencies, and underwriter direct operations. Drafting note: Types of entities may vary by state 36 Section 4. Definitions 1. Affiliated Business Arrangement (AfBA) – an arrangement in which a settlement producer, such as a real estate broker, developer, mortgage loan originator, or bank, or any other individual or entity that is in a position, directly or indirectly, to refer settlement business to a title entity, also maintains a direct or beneficial ownership interest in that title entity. 2. Affiliated title agency – a title agency that is owned, either wholly or in part, by a title insurance company/underwriter, but does not operate as an underwriter direct agency. 3. Attorney firm/title agency – a title agency that is owned and operated by an attorney or law firm. 4. Independent title agency – a title agency that is not part of an ownership arrangement with a real estate settlement producer, or with a title insurance company/underwriter. 37 Section 4. Definitions (cont.) Drafting note: Individual states may have different definitions for some of the above items, or may have more or fewer definitions to include. In addition, definitions under Real Estate Settlement Procedures Act (RESPA) may vary from those listed above. States should update, add or delete definitions, as well as add relevant statutory citations as necessary. Section 5. Data Required Incorporate reference to NAIC plan here, rather than including the actual plan (to accommodate for future amendments to plan). Section 6. Due Dates/Time Periods for Collection All reporting entities are required to submit the data referenced in Section 5 of this regulation on or before May 30 for the immediately preceding reporting period. 38 Section 7. Method of Submission All reporting entities shall submit the data in a manner prescribed by the commissioner. Drafting note: States should develop a method for collecting data electronically, either through a database in which entities can log in to report or through a dedicated email address, as well as methods of communicating requirements and any changes to the industry. Such method should be noted in Section 7. Section 8. Confidentiality and Sharing Information filed with the commissioner relating to the experience of a particular agent shall be kept confidential unless the commissioner finds it in the public interest to disclose the information required of title insurers or title insurance agents under this section. 39 Section 8. Confidentiality and Sharing (cont.) In order to assist in the performance of the commissioner’s duties under this chapter, the commission may share data and information submitted by title insurance entities, including agencies, insurer direct operations, and title agent attorney firms, pursuant to Title Agent Statistical Plan data calls and collections, with other state, federal, and international regulatory agencies, with the National Association of Insurance Commissioners, its affiliates or subsidiaries, and with state, federal, and international law enforcement authorities, provided that the recipient agrees to maintain the confidentiality and privileged status of the information. Additionally, nothing contained herein shall prohibit the commissioner from sharing or publishing data in an aggregate form with the above parties or any other stakeholder. Drafting note: States should ensure that the language that they use does not, nor can be construed as attempting to, limit the sharing or publication of aggregated data, since such publication may in fact make important disclosures regarding the experience of title agents in a particular geographic area or business demographic (i.e. by county, state or by agency type.) Furthermore, states should contemplate whether or not they intend to publish aggregated data and the extent to which they are prepared to be required to publish or just may publish, etc. 40 Section 9. Enforcement The commissioner may require that the information provided under this section be verified by oath of the insurer’s or agent’s president or vice president or secretary, as applicable. The commissioner may further require that the information required under this section be subject to an audit conducted by the commissioner. The commissioner shall have the authority to establish a minimum threshold level at which an audit would be required. Noncompliance with this regulation may result, after proper notice and hearing, in the imposition of any of the sanctions available in the (insert state) statutes pertaining to the business of insurance or other laws which include the imposition of fines, issuance of cease and desist orders, and/or suspensions or revocation of license. Among others, the penalties provided for in (cite appropriate state laws concerning failure to respond, unfair business practices, etc.) may be applied. 41 Section 10. Severability If any of the provisions of this regulation shall be held invalid or unenforceable, this regulation shall be construed as if not containing such provisions and the validity, legality, and enforceability of the remaining provisions shall not be affected or impaired in any way. Section 11. Effective Date This regulation is effective on [insert date] and applies to all transactions entered into after the effective date. 42 NAIC PLAN - OVERVIEW NAIC PLAN - DETAILS TITLE AGENT STATISTICAL DATA PLAN IMPLEMENTATION GUIDELINE GOING FORWARD - WHAT WILL THE STATES DO? 43 New Jersey is moving to adopt a statistical plan* Interest for data collection in Florida* New York and Pennsylvania issued their own data calls in early 2010 (Jeremy Yohe, Creation of a National Title Agent Data Call, Title News, Vol. 89, No. 6, June 2010, at 8.) NAIC survey indicated that only 11 states, and Puerto Rico, intended to participate in the NAIC Plan:* *ALTA Advocacy Update (Dec. 28, 2011) reported Alaska Arizona Colorado Florida Michigan Minnesota New Hampshire New Jersey Nevada Puerto Rico Tennessee Washington 44 45 Title insurance coverage is retrospective from the policy’s effective date and remains in force throughout the term of a loan or the ownership of real property. Policies are issued once the Title insurance professional has addressed issues that adversely impact marketability of the title have been identified, addressed or resolved prior to policy issuance. In contrast, P&C insurance coverage is prospective, identifying a finite future period with a definitive expiration date, as the coverage period for covered incidents that arise during the term of the policy. Events occurring prior to the effective date are excluded as are those that occur subsequent to the expiration date. 46 The coverage timeframe differential in conjunction with a misunderstanding of the nature of Title insurance curative activities are ignored by existing and proposed reporting requirements. As a result, the value proposition of Title insurance can not be properly presented, captured or understood. The target loss and loss adjustment expense ratio for Title insurance is zero. 47 Subject to the exclusions from coverage, the exceptions from coverage contained in Schedule B and the conditions and stipulations, the Title Underwriter, as of the effective date, insures against loss or damage… 48 In Consideration of the Provisions and Stipulations herein, Property and Casualty Insurance Company, for the term of Effective Date at 12:01 a.m. to Expiration Date at 12:01 a.m., does insure… 49 Incident must have occurred prior to policy period and remain unresolved prior to policy issuance to be considered Effective Date of Policy Retrospective Effective Date of Policy Title Property & Casualty Prospective Incident must occur within policy period to be considered 50 Loss adjustment expenses can be considered “allocated” or “unallocated”. (Defense and Cost Containment or Adjusting and Other) Allocated loss adjustment expenses are expenses, such as attorneys’ fees or incident specific legal costs, that are incurred in connection with the investigation and analysis of a incident that has been reported to the insurer. Unallocated loss adjustment expenses are claim department overhead. They are related to maintaining a claims function but not readily assignable to a specific incident. Examples include salaries, utilities and rent. Unallocated loss adjustment expense is the cornerstone of effective Title insurance risk mitigation, yet it is not captured in current or proposed financial or statistical reporting. In other words, given Title insurance’s retrospective coverage, what the Title insurance industry characterizes as “curative effort” would be considered loss adjustment expense in the P&C insurance industry. 51 52 Examination ◦ Legal Description ◦ Conveyances ◦ Execution ◦ Notarization ◦ Evidence of fraud, forgery, competence, etc. 53 Order Entry ◦ Verify property address ◦ Verify owner(s) ◦ Legal description of the property Run the Chain of Title ◦ Run names and nicknames ◦ Determine if encumbrances exist, is an unallocated loss adjustment effort but the activity to address them is allocated loss adjustment expense. ◦ Legal incompetence, conservatorship, bankruptcy, etc. ◦ Impairments in chain of title ◦ Enumerate adverse claims ◦ Interests which affect tenancy ◦ Property tax paid or in arrears, i.e., lien 54 Matters Affecting ◦ Covenants or restrictions ◦ Easements ◦ Rights of first refusal ◦ Judgment or lien ◦ Market requirement to cure ◦ Indemnities ◦ Review prior transaction ◦ Application of statute of limitations 55 Matters Affecting (cont.) ◦ Update for last minute items ◦ Review tax certificate ◦ Reconcile difference with tax discrepancies ◦ Check for outstanding tax sales ◦ Review survey for adverse matters ◦ Verify legal access ◦ Mineral reservations ◦ Geographic posting 56 57 Once an incident is uncovered, through the expenditure of unallocated loss adjustment expense, the time, effort and expense associated with resolving or underwriting the incident should be considered allocated loss adjustment expense. Effort and expense attributable to resolving a specific incident identified during the investigation of marketability of Title, i.e. Commitment. Addressing specific defects, incidents or matters referenced in Schedule B-1 or B-2. (minimum) 58 59 State Policies in Sample Incidents Discovered and Resolved Colorado 83 888 Florida 43 248 Louisiana 114 585 North Carolina 270 3,323 All Samples Combined 510 5,044 60 Allocation to Loss Adjustment Expense Settlement or closing fee Abstract or title search Title examination Title insurance binder Document preparation Notary fees Attorney's fees Title insurance premium Title insurance endorsements Mortgage certificates Closing protection coverage Courier fees Bank wire fees Service Costs 100% 100% 100% 100% 100% 100% 100% 80% 80% 100% 100% 100% 100% 61 100% 90% 80% 70% 60% Health 50% P&C Title 40% 30% 20% 10% 0% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 62 100% 90% 80% 70% 60% Health 50% P&C Title 40% 30% 20% 10% 0% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 * Title estimates are based on one state study completed by Demotech, Inc. 63 Given the retrospective nature of a Title insurance policy, appreciable loss adjustment expense – unallocated and allocated – must be expended PRIOR to policy issuance. This effort resolves matters that could otherwise be presented as claims SUBSEQUENT TO POLICY ISSUANCE! Unfortunately, current and proposed financial and statistical reporting requirements are focused on recording results as if a prospective P&C policy had been issued. Similarly, the NAIC Plan misses the mark by focusing on financial results rather than risk mitigation efforts. These reporting formats overstate the Title operating expense ratio and understates the Title loss adjustment expense ratio, by the same amount. Under these circumstances, the value proposition of Title insurance can not be properly evaluated, presented nor understood. 64 Continue to do whatever we can to educate regulators, legislators and consumers on the fundamentals of title insurance ALTA Title 101 Louisiana Land Title Association When your goal is a loss and loss adjustment expense ratio of zero, what will regulators do or say if you get there! For copies of this presentation, iwasson@demotech.com or 614-526-3080. contact Irisa Wasson, 65 1. U.S. Government Accountability Office. April 2007. Title Insurance: Actions Needed to Improve Oversight of the Title Industry and Better Protect Consumers. Publication No. GAO-07-401. 2. http://www.gao.gov/products/GAO-07-401; see also NAIC, Title Insurance (C) Task Force. Conference Call, Sept. 1, 2011. Project History: Title Agent Statistical Data Plan Implementation Guideline. (“Project History”). 3. http://www.naic.org/committees_c_title_stat_plan.htm. 4. Project History, supra n. 4. 5. NAIC, Joint Executive (Ex) Committee/Plenary. Oct. http://www.naic.org/meeting1108/summary_joint_ex_plenary.htm. 11, 2011. Summary Report. 66