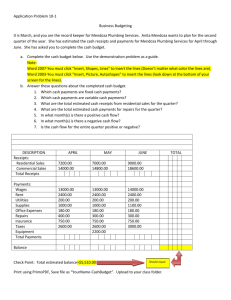

Business Budget

advertisement

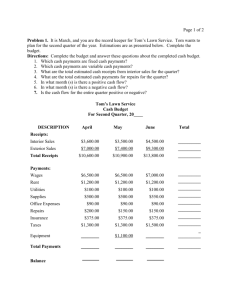

H006-01.05 Page 1 of 2 Problem 1. It is March, and you are the record keeper for Tom’s Lawn Service. Tom wants to plan for the second quarter of the year. Estimations are as presented below. Complete the budget. Directions: Complete the budget and answer these questions about the completed cash budget. 1. Which cash payments are fixed cash payments? 2. Which cash payments are variable cash payments? 3. What are the total estimated cash receipts from interior sales for the quarter? 4. What are the total estimated cash payments for repairs for the quarter? 5. In what month (s) is there a positive cash flow? 6. In what month (s) is there a negative cash flow? 7. Is the cash flow for the entire quarter positive or negative? Tom’s Lawn Service Cash Budget For Second Quarter, 20____ DESCRIPTION April May June Total Receipts: Interior Sales $3,600.00 $3,500.00 $4,500.00 __________ Exterior Sales $7,000.00 $7,400.00 $9,300.00 __________ Total Receipts $10,600.00 $10,900.00 $13,800.00 __________ Wages $6,500.00 $6,500.00 $7,000.00 __________ Rent $1,200.00 $1,200.00 $1,200.00 __________ Utilities $100.00 $100.00 $100.00 __________ Supplies $500.00 $500.00 $550.00 __________ $90.00 $90.00 $90.00 __________ Repairs $200.00 $150.00 $150.00 __________ Insurance $375.00 $375.00 $375.00 __________ $1,300.00 $1,300.00 $1,500.00 __________ Payments: Office Expenses Taxes Equipment ________ $1,100.00 ________ _ __________ Total Payments ________ ________ ________ __________ _________ _________ _________ Balance H006-01.05 Page 2 of 2 Problem 2. You are the record keeper for Bill's Computer Services, a business that installs and services computer systems for businesses and government agencies. The owner, Bill Turner, has estimated the cash receipts and cash payments for the company for the first quarter of next year. He has asked you to complete the cash budget. Directions. Complete the cash budget above and answer the questions below: 1. Which cash payments are fixed cash payments? 2. Which cash payments are variable cash payments? 3. What are the total estimated cash receipts from business sales for the quarter? 4. What are the total estimated cash payments for taxes for the quarter? 5. In what month (s) is there a positive cash flow? 6. In what month (s) is there a negative cash flow? 7. Is the cash flow for the entire quarter positive or negative? Bill's Computer Services Cash Budget For First Quarter, 20__ DESCRIPTION Jan Feb Mar Total Receipts: Business Sales $6,500.00 $6,500.00 $6,700.00 Government Sales $3,900.00 $4,200.00 $3,800.00 __________ __________ __________ Wages $6,200.00 $6,200.00 $6,200.00 Rent $1,000.00 $1,000.00 $1,000.00 Insurance $400.00 $400.00 $400.00 Telephone $250.00 $250.00 $250.00 Utilities $170.00 $170.00 $130.00 $1,100.00 $1,100.00 $1,350.00 Equipment $100.00 $300.00 $300.00 Supplies $600.00 $600.00 $600.00 __________ __________ __________ __________ __________ __________ __________ __________ __________ __________ __________ __________ __________ $1,100.00 Total Payments __________ __________ __________ __________ __________ __________ __________ Balance __________ __________ __________ __________ Total Receipts Payments: Taxes Other H006-01.06 PROBLEM 3-BUDGET VARIANCE Directions. Complete the budget variance report below and answer each question. Answer the questions below: 1. Which cash receipts had a positive variance? 2. Which cash payments had no variance? 3. Which cash payments had a negative variance? 4. Which cash payment had the largest positive variance? 5. Was the actual cash balance greater or less than the budgeted cash balance? Taylor's Roofing Company Budget Variance Report For March,20 ____ DESCRIPTION Receipts: Business Sales Home Sales Total Receipts Budgeted Actual Variance $66,800.00 $22,000.00 $88,800.00 $66,280.00 $23,540.00 _________ _________ _________ _________ $54,500.00 $2,390.00 $750.00 $12,500.00 $54,500.00 $2,390.00 $680.00 $11,900.00 $790.00 $860.00 Equipment $1,500.00 $1,020.00 Insurance $2,300.00 $2,300.00 $12,750.00 $12,750.00 $350.00 $350.00 $87,830.00 _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ $970.00 _________ _________ Payments: Wages Mortgage Payment Gas and Electric Roofing Supplies Office Expenses Taxes Telephone Total Payments Balance PROBLEM 4-BUDGET VARIANCE Directions. Complete the budget variance report below and answer the questions. Questions: 1. Which cash receipts had no variance? 2. Which cash payments had no variance? 3. Which cash payments had a negative variance? 4. Which cash payment had the largest negative variance? 5. Was the actual cash balance greater or less than the budgeted cash balance? Thompson's Paper Company Budget Variance Report For November, 20 ____ DESCRIPTION Budgeted Actual Variance Receipts: Sales of Pulp __________ __________ __________ $148,350.00 $148,350.00 Sales of Boxes $69,200.00 $72,250.00 Total Receipts $217,550.00 __________ $110,000.00 $115,000.00 $15,800.00 $15,800.00 $3,250.00 $3,380.00 $45,700.00 $46,400.00 Office Expenses $4,850.00 $4,550.00 Equipment Repairs $2,500.00 $2,145.00 Insurance $5,760.00 $5,760.00 $23,750.00 $22,480.00 $1,490.00 $1,560.00 $213,100.00 __________ __________ __________ __________ __________ __________ __________ __________ __________ __________ __________ $4,450.00 __________ __________ Payments: Wages Rent Gas and Electric paper Supplies Taxes Telephone Total Payments Balance