Lesson Plans - IHMC Public Cmaps (3)

advertisement

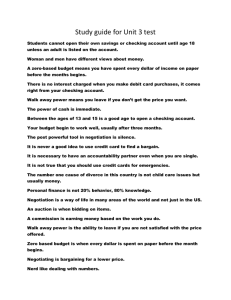

Instructional Design Checking Accounts (Financial Management Course) By: Luann Bacon Pre-Assessment of Checking Accounts Unit Name ________________________ Directions: Answer each question to the best of your ability. If you do not know the answer, leave the question blank. Do not attempt to guess. This assessment is not for a grade. 1. Do you have a checking account of your own or a joint account with a parent? 2. What documents do you need to take with you to the bank in order to open a checking account? 3. How much money do you need to open a checking account? 4. What is a Signature Card? 5. Fill out the “sample practice check” on the next page. Instructions: Make the check out to one of your friends. Make the check out for the amount of $36.75. 6. What is the routing number on the check shown above? 7. What is the account number on the check shown above? 8. Explain what “endorsing a check” means. 9. Can you use a debit card as a charge card? 10. When you use a debit card, is the money immediately withdrawn from your checking account? 11. What does “insufficient funds” mean? 12. What does it mean to “overdraw” your account? In other words, what is an “Overdraft? 13. Does anything happen if you “overdraw” your checking account? 14. What does “Overdraft Protection” mean? 15. If you answered yes to Question #11, what do you think happens when you overdraw your checking account? 16. What does ATM stand for? 17. Have you ever used an ATM machine? 18. What is a “check register?” 19. Why is a check register important? 20. What is “Mobile Banking?” 21. Can you pay your bills online through your checking account? 22. What does “Reconciling a Checking Account” mean? 23. Why is important to reconcile a checking account? Lesson Plan – Day One Opening a Checking Account Unit Outcomes Students will explain what a checking account is. Students will explain the documents they need to take to the bank in order to open a checking account. Students will explain what a signature card is and why it is important. Materials Needed Handout “Money Talks/ Should I Be Banking/Taking Charge of Your Own Banking Account” Smart Board LCD Projector Computer Internet Paper Pencil Procedures 1. Introductory Activity (5 minutes) a) Start a discussion with the students. Ask the following questions: What bank(s) do your parents use? Who has already opened a checking account? Who is willing to share how you went about opening your checking account? What official documents do you think you need to take with you to the bank when you open a checking account? How old do you have to be to open a checking account without a parent? Why is having a checking account important? Do you think you will bank where your parents do? Explain. 2. Developmental Activity (20 minutes) a) Give each student a copy of Money Talks/Should I Be Banking /Taking Charge of Your Own Checking Account found at http://anrcatalog.ucdavis.edu/pdf/8355.pdf b) Read pages 1-4 in the Money Talks handout. Take time to discuss the information about opening a checking account. c) Go to website: http://www.wikihowhttp://anrcatalog.ucdavis.edu/pdf/8355.pdf.com/Open-aChecking-Account and explain each step to opening a checking account d) Teacher discusses and reviews in with students, the formation presented. 3) Concluding Activity (10 minutes) Students fill out the Checking Account Crossword Puzzle in the Money Talks Should I Be Banking? If not finished in 10 minutes, complete at home as homework. Due next day of class. Summary/Evaluation 1. Summary (5 Minutes) a) Have students take out a sheet of paper and write down the steps to opening their own checking account. Be sure to include what a Signature Card is and why it is important. Turn paper in for a grade. 2. Evaluation (5 minutes) a) Students will go to the bank website that they or their parents use. Write a minimum of one paragraph about the checking account types offered at that bank. Look for information about student checking accounts and include it in your paragraph summary. Bank Websites: https://www.fm-bank.com/ https://www.first-fedbanking.com/ https://www.huntington.com/ Complete as homework. Due the next day at the beginning of class. Lesson Plan – Day Two Managing a Checking Account Writing Checks Unit Objectives Students will demonstrate check writing. Students will enter transactions into check register. Students will demonstrate endorsing checks. Students will explain how to cash a check. Students will be able to list and explain the 12 rules about writing checks. Students will be able to explain what “bouncing a check” means. Students will be able to define “overdraft protection.” Students will be able to explain how money is deposited into their checking account. Students will be able to explain how to withdraw money from their checking account. Student will be able to fill out a deposit ticket correctly. Materials Needed Smart Board LCD Projector Internet Computer Handout “Money Talks/Should I Be Banking?” (Handed out in Lesson One) Paper Pencil Procedures 1. Introductory Activity (5 minutes) a) Each student will be given a blank check and will be asked to fill it out using the information provided in the directions. Teacher will collect student work. 2. Development Activity (25 minutes) a) Show PowerPoint about check writing to students. Website: http://financeintheclassroom.org/teacher/ppt.shtml b) c) d) e) f) Teacher must click on “How to Write a Check PPT” on this webpage in order to show the slideshow/ppt. Talk to students about the information on each slide. Allow students to ask questions. Students will log on to their computers. In Google Docs, they will open a document shared with them and they will click on the link http://www.themint.org/teens/writing-a-check.html Students will enter checks into a register and keep an accurate balance. Students will follow the instructions and write a check on this webpage and share their completed work with me on Google Docs. Teacher will be able to comment on their check writing work through Google Docs. Teacher will send them an Endorsing a Check document through Google Docs. The “Endorse a Check” worksheet is included in this Instructional Design Project but it would not copy and paste correctly into this word document. (You must have a paid membership to access worksheets on Money Instructor.) Teacher will grade Endorse a Check through Google Docs. Concluding Activity (5 minutes) a) Students will list as many of the 12 rules about checking accounts as they can remember. Teacher will collect their written assignments. Summary/Evaluation (10 minute) Summary: Students will answer review questions asked by the teacher. Questions: What information do you write on a check? What are some mistakes people make when writing checks? Where is the bank routing number found? Where is your bank account number found? What are the different ways you can endorse a check? Explain what you do to cash a check. Evaluation: Students will read pages 5-8 in the handout received on Day One called Money Talks/Should I Be Banking/Taking Charge of Your Own Checking Account. Students are to write a one page report about what they learned about check writing and how they will use the information as a young adult. Due next school day. Complete as homework if not finished before the end of class. Lesson Plan - Day Three Managing a Checking Account Debit Cards *Please note that some of the information about checks will have be revisited in the PowerPoint being shown and discussed in this lesson plan. Unit Outcomes Students will explain what PIN stands for. Students will explain when you use a PIN number. Students will explain the importance of a PIN number. Students will explain how to use a debit card for purchase Students will demonstrate how to fill out a check register following a debit card transaction. Materials Needed Smart Board LCD Projector Computer Internet Handout “Money Talks/Should I Be Banking?” (handed out in Lesson One) Handout “Using Debit Cards.” www.consumer.gov (what to know and do) Paper Pencil Procedures 1. Introductory Activity (5 minutes) a) Start a discussion with the students. Ask the following questions? Who has a debit card? What does ATM stand for? Who has a debit card already? Where did you get your debit card? Explain how to use a debit card? What should you do if you lose your debit card? 2. Developmental Activity (25 minutes) a) Show PowerPoint on Smart Board. http://financeintheclassroom.org/teacher/ppt.shtml Click on the PPT called Checking Accounts and Debit Cards b) Discuss slides that need further explanation. c) Show this You Tube that quickly explains how to use an ATM machine https://www.youtube.com/watch?v=UXHJ2S8wug4 d) Discuss video about ATM machines. Concluding Activity (5 minutes) Students read Using My Debit Card in Money Talks on page 9. Summary/Evaluation (10 Minutes) Evaluation: Give students the handout “Using Debit Card www.consumer.gov. Students read the handout. Summary: Students get on Google Docs at school and at home and write a summary about what they learned in class about debit cards. Students will also include how to use an ATM machine in the document they share through Google Docs. Due next day before class starts. Lesson Plan – Day Four Reconciling a Bank Statement Unit Outcomes Students will understand the concepts and skills needed to reconcile a bank statement. Students will explain why their records might not match the bank’s balance on the bank statement. Materials Needed Smart Board LCD Projector Computer Internet Handout “Finance in the Classroom/ Managing a Checking Account” Handout “Money Talks/Should I Be Banking” (handed out in Lesson One) Pencil Eraser Calculator Procedures 1. Introductory Activity (10 minutes) a) Teacher will show one of her actual online banking account and explain some of the transactions on the Smart Board. b) Teacher will explain reasons why the bank’s balance might not be accurate. I might have 2 checks that haven’t cleared the bank yet but they are in my check register. I might have a bill that I paid online but it hasn’t posted to my bank account yet. c) Allow students to answer questions about what they are learning and what they see on the online bank statement. 2. Development Activity (25 minutes) a) Put the following document on the Smart Board from website https://www.sandi.net/cms/lib/CA01001235/Centricity/ModuleInstance/21076/St udent_Handout-_Reading_a_Bank_Statement.doc b) Give each student a copy of this document called “Reading a Bank Statement.” c) The teacher will explain each piece of information on this document. d) Students will fill out the “Reconciling an Account” worksheets together with the teacher. e) Teacher will answer questions as they arise. Concluding Activity (5 minutes) Students will take turns going to the board and writing a comment about what they learned in class today about reconciling a bank statement. Summary/Evaluation (5 minutes) a) Students will read page 10 “Reading Your Statement” in handout “Money Talks/Should I Be Banking.” b) Students will be given a worksheet titled “Finance in the Classroom/Managing a Checking Account.” c) Students will complete this worksheet outside of class. Due at the beginning of class the next day. Lesson Plan – Day Five Other Checking Account Services and Fees *This lesson plan will probably take longer than 1 or 2 days to complete. Unit Outcomes Students will discuss fees associated with checking accounts Students will explain and discuss electronic banking Students will discuss and explain mobile banking Students will explain and discuss online bill pay Students will learn how to transfer money to different accounts Materials Needed Textbook Business and Personal Finance Computers for each student Bank websites Internet Pencils Paper Procedures 1. Introductory Activity (5 minutes) a) Discussion with students. Ask following questions: What are some of the services banks offer their customers for their checking accounts? What are some of the fees bank charge customers with checking accounts? 2. Development Activity (40+ minutes) (This make also become Lesson Six.) a) Divide students into 4 groups (approximately 4 students in each group). b) Give each group an assignment. Students will use the class textbook and bank websites they are familiar with to complete the assignment. Group 1 – Research Online Bill Pay and create a PowerPoint or a Prezi to present to the class. Group 2 - Research Mobile Banking and create a PowerPoint or Prezi to present to the class. Group 3 - Research Electronic Banking and also explain how to Transfer Money from one account to another and create a PowerPoint or Prezi to present to the class. Group 4 - Research and compare the various checking account fees between 2 banks. Concluding Activity (10 minutes) Each person in each group will present their PowerPoint project to their family at home one evening. Summary/Evaluation (5-10+ minutes per group) a) b) c) d) Each group presents their PowerPoint or Prezi project to the class. Class discussion encourage following each presentation. Applause from all students after each presentation. Teacher comments after each presentation. Post-Assessment Checking Accounts Unit Name _____________ 1. List 2 documents you need to take with you to open a checking account. 2. Do you need to take money with you to the bank to open a checking account? 3. How much money do you need to open a checking account? 4. Explain what a Signature Card is. 5. Why is a Signature Card important? 6. On a check, is the routing number at the bottom left or the bottom right? 7. On a check, is the account number to the right or the left of the routing number? 8. Can you use a pencil to fill out a check? Explain your answer in detail. 9. What are 3 ways to endorse a check? Explain the difference between the three ways. 10. Explain the steps to cashing a check. 11. What does PIN stand for? 12. How many numbers does a PIN have? 13. Who else besides yourself should have knowledge of your PIN number? 14. Define Check Register. 15. What does ATM stand for? 16. Can there be fees associated with an ATM machine? Explain. 17. List the steps to using an ATM machine. 18. What should you do if you leave your card in the ATM machine accidently? 19. Explain why it is very important to record all of your transactions in your check register. 20. Give 2 reasons why your bank account might become “overdrawn.” 21. Why is it important to “reconcile your bank statement” every month? 22. Explain why your check book register and the bank statement might not match. 23. Explain “mobile banking.” 24. List 3 fees a bank might charge to a checking account. 25. Can bills be paid online through your personal bank account?