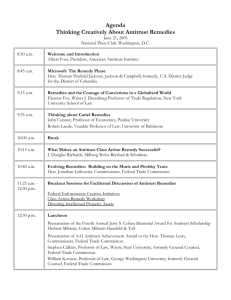

Antitrust Exam - the UNH Law Library

advertisement

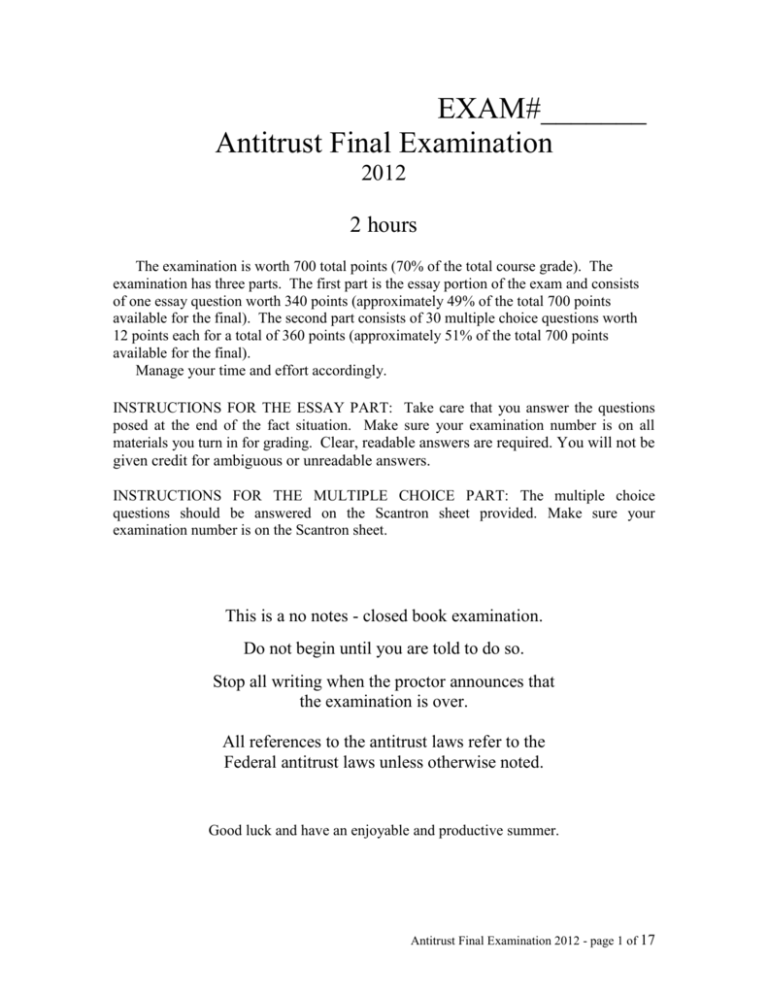

EXAM#_______ Antitrust Final Examination 2012 2 hours The examination is worth 700 total points (70% of the total course grade). The examination has three parts. The first part is the essay portion of the exam and consists of one essay question worth 340 points (approximately 49% of the total 700 points available for the final). The second part consists of 30 multiple choice questions worth 12 points each for a total of 360 points (approximately 51% of the total 700 points available for the final). Manage your time and effort accordingly. INSTRUCTIONS FOR THE ESSAY PART: Take care that you answer the questions posed at the end of the fact situation. Make sure your examination number is on all materials you turn in for grading. Clear, readable answers are required. You will not be given credit for ambiguous or unreadable answers. INSTRUCTIONS FOR THE MULTIPLE CHOICE PART: The multiple choice questions should be answered on the Scantron sheet provided. Make sure your examination number is on the Scantron sheet. This is a no notes - closed book examination. Do not begin until you are told to do so. Stop all writing when the proctor announces that the examination is over. All references to the antitrust laws refer to the Federal antitrust laws unless otherwise noted. Good luck and have an enjoyable and productive summer. Antitrust Final Examination 2012 - page 1 of 17 PART I –Essay (340 points) This part of the exam is based on the antitrust lawsuits filed against Apple and some of the largest book publishers alleging a conspiracy to raise ebook prices. You can base your answer on the documents that you were instructed to examine on the course website prior to the exam or on any other research you may have conducted in preparation. A summary of the situation, as well as the specific questions you are to answer, are found below. Make sure you clearly indicate which question you are answering. Apple and the e-book Controversy On April 11, 2012, the U.S. Department of Justice filed an antitrust lawsuit alleging Apple and five of the nation's largest publishers conspired to raise e-book prices in violation of section 1 of the Sherman Act. At the same time sixteen states and Puerto Rico also filed litigation in federal court in Texas claiming that Apple and the major book publishers colluded to artificially raise the prices of e-books. Although some of the publishers reached a settlement agreement with the DOJ and the states, Apple and two of the publishers (Macmillan and Penguin) announced their intention to fight the charges. According to the DOJ complaint at the center of the controversy was the introduction of an “agency model” by Apple that replaced the wholesale model that had existed with Amazon. It was claimed that this was done in collusion with the book publishers who Antitrust Final Examination 2012 - page 2 of 17 were unhappy with the discounting practices of Amazon. In developing and then mass marketing its Kindle e-reader and associated e-book content starting in 2007, Amazon had substantially increased the retail market for e-books and had become a dominant force not only in the sale of books in physical form but also in the e-book marketplace. Apple’s introduction of the iPad was seen as an opportunity for an alternative to Amazon in the inreasingly important e-book marketplace. The agency model adopted by Apple and the alleged co-conspirators allowed the book publishers to set the price of the ebooks and as a consequence discount retail prices quickly diminished. Questions you need to address: 1. Discuss the strengths and weaknesses of the DOJ lawsuit? Be sure to refer to any cases we covered in class that bolster your arguments. (150 points) 2. Each of the "Apple Agency Agreements" between the book publishers and Apple contains a most favored nation clause that the DOJ claims serves as a facilitating mechanism to the alleged price fixing conspiracy. What is a most favored nation clause and how could such a contract clause facilitate this alleged price fixing conspiracy? (75 points) 3. During the semester we discussed two-sided markets and how they might complicate antitrust analysis of pricing practices. What is a two-sided market and how might two-sided market analysis apply to the Apple e-book controversy? (50 points) 4. Explain why the various states can file separate antitrust lawsuits in federal court against Apple and the book publishers. (35 points) 5. What is your assessment of the likehood of success for the DOJ case against Apple and the book publishers? Be sure to give the underlying reasoning for your assessment. (30 points) Antitrust Final Examination 2012 - page 3 of 17 PART II – Thirty Multiple Choice Questions (12 points each - 360 points total) 1. 2. A group of coal mining companies responsible for about 80 percent of the industry’s output periodically conducts, on an individual basis, salary surveys for nonunion, managerial employees. The companies submit this information to a third party consultant, who compiles a “benchmark” database on job titles, which includes duties and salaries associated with particular positions and “job families” at each of the companies. The database is updated every few months, and therefore represents a current account of the compensation being paid in the industry. Representatives from the human resources departments of these companies also occasionally convene to discuss current and future salary budgets. None of this information is made available to the public. Regarding these facts, which of the following is most correct? a. The information exchange is per se legal because no company is compelled to take any action based on the information. b. The information exchange is a violation of the antitrust laws because it involves a non-public exchange of information. c. The information exchange may be a violation of the antitrust laws if there are anti-competitive effects on the employee services by depressing salaries in the relevant market. d. The information exchange is a per se violation of the antitrust laws because it facilitates salary price fixing among competitors. Bank credit cards, such as VISA and MasterCard, are issued by individual banks, and each bank ordinarily sets the terms of its own card: user annual fees, interest rates, and merchant fees. Suppose that all the banks that issue VISA cards agree with each other that (i) they will charge their individual card holders a $15.00 annual fee for card membership; (ii) they will charge individual card holders an interest rate of 18% annually on unpaid charges; (iii) they will charge merchants who accept the VISA card a fee of 1.5% of each transaction in which the card is used; (iv) they will exchange with each other the names of people who are in substantial default on their VISA payments; and Which of these agreements would receive per se treatment? a. (i) only. b. (i) and (ii). Antitrust Final Examination 2012 - page 4 of 17 c. (i), (ii) and (iii). d. all of the above. The following fact situation applies to questions 3 and 4 The City of Cosmos contains nine physicians practicing in the field of internal medicine (internists); they all have independent practices. A new machine called the Diagnition was invented, which scans the bodies of people with certain symptoms and greatly aids internists in diagnosing what is wrong. Several of the Cosmos internists would like to own a Diagnition, but they are extremely expensive to purchase and to operate, since they require a specialized technician, and a single internist would probably only use it three or four times a month. 3. 4. One day six of the internists happen to meet at a local athletic club and decide to invest jointly in a Diagnition, share the cost of the technician’s salary, and share the rent for an office where it can be located. In reaching their decision, the six physicians agree that they will split the initial cost of the technician’s salary on a per use basis and allocate the operating costs and the technician’s salary on a per use basis, with each internist initially paying $500 into a central pool each time a patient of that particular internist uses the Diagnition. With regard to these facts, which of the following is most correct? a. The agreements standing alone are almost certainly legal. b. The agreements are the equivalent of price-fixing and after a quick look will be judged under a per se analysis. c. The agreements are the equivalent of price-fixing and after a quick look will be judged under a rule of reason analysis. d. The agreements will be judged using Clayton 7 merger analysis because the internists have formed a joint venture. Even though the six of the internists will maintain their own separate billing of patients they agree that they will charge patients $700 for one use of the jointly owned Diagnition. With regard to these facts, which of the following is most correct? a. The agreement standing alone is almost certainly legal. b. The agreement is the equivalent of price-fixing and after a quick look will be judged under a per se analysis. c. The agreements is the equivalent of price-fixing and after a quick look will be judged under a rule of reason analysis. d. The agreement will be judged using Clayton 7 merger analysis because the internists have formed a joint venture and jointly own the Diagnition. Antitrust Final Examination 2012 - page 5 of 17 5. 6. 7. Larry Shea holds a patent on air conditioning ductwork. In order to market and exploit the patent, he incorporates ATS Products and conveys to ATS an exclusive license to use the patent. Later Shea and ATS enter a contract to give a nonexclusive license for use of the patent to Levi Co. to manufacture ductwork. Thereafter, ATS and Levi Co. agree that ATS would not give a similar license to Levi’s chief competitor, Case Systems. Case sues ATS and Levi on a group refusal to deal theory under section 1 of the Sherman Act. Given these facts, which of the following is most correct? a. An agreement between a patentee and a licensee that the former would not give a second license to a third party is illegal under Sherman 1. b. The contract whereby ATS and Shea grant a nonexclusive license to Levi Co. is illegal under Sherman 1. c. The agreement to exclude Case Systems is a per se group boycott. d. Under the Copperweld doctrine Shea and ATS Products will be treated as a single entity for purposes of Sherman 1 analysis. Yellow Pages Cost Consultants (YPCC) provides consulting advice to advertisers in yellow page directories. GTE, the publisher of a yellow page directory, decides to end its long-standing practice of allowing consultants like YPCC to order, place, and process advertisements on behalf of client advertisers. As soon as GTE refuses to deal with YPCC and other advertising consultants, YPCC sues GTE, claiming an illegal attempt to monopolize and a refusal to deal under sections 1 and 2 of the Sherman Act. With regard to these facts, which of the following is most correct? a. YPCC will lose because it has not suffered antitrust injury. b. YPCC will lose because of the holding in Illinois Brick. c. YPCC will win if it can demonstrate that competition has been harm in the relevant market. d. YPCC will win if it can show that it has lost revenue as a result of GTE’s actions. Spree, Inc., is a manufacturer of clothing for teenagers, a very competitive market in which the key to success is convincing fashionable department stores to give the product display space. Products that do not receive prominent, glitzy displays do not sell, no matter how high their quality. Spree sells to several stores in Boston, one of which is Mack’s Department Store, a high quality, eminently fashionable, high priced store that is all the rage among teens. A block away is Feline’s Bargains Galore, an off price retailer. Spree also sells to Feline’s, which resells Spree clothing at about one-half the price that Mack’s charges. Mack’s suddenly announces a policy to all its suppliers. It will give prominent floor space only to suppliers who either limit the distribution of their product in Boston to Mack’s, or else who promise to pressure other stores to “keep their prices up.” If the supplier fails to do Antitrust Final Examination 2012 - page 6 of 17 this Mack’s will either stop dealing in that supplier’s product or move the product downstairs into “Mack’s Bargain Basement,” where clothing is piled indiscriminately on large tables and sold at substantial discounts. Two weeks after issuing this communication, Mack’s writes Spree a letter, stating that henceforth it will sell Spree clothing only in its bargain basement. A week after that Spree informs Feline’s that it will no longer sell it Spree clothing. With regard to these facts, which of the following is most correct? 8. 9. a. As presented, the facts give rise to an inference of an agreement to restrain trade between Spree and Mack’s. b. After the Leegin case there can be no liability for Mack’s actions with Spree. c. The rule of reason will be used to assess Mack’s actions with Spree. d. After Leegin dealer termination situations are per se illegal. Christy Bernard has obtained a patent for a new method for manufacturing Angiotensin-Converting Enzyme (ACE) inhibitors which are widely used to treat hypertension. Originally derived from the venom of the Brazilian Pit Viper, the new method of manufacturing is extremely popular because of its lower costs and higher safety. Christy licenses her patent to various pharmaceutical companies throughout the United States. As part of her standard 2 year license, Christy requires a certain minimum price for the hypertension medicines made using her patented process in order to maintain a quality image. One of Christy’s licensees challenges the license arrangement under the antitrust laws. Based on these facts what is the most likely outcome regarding Christy’s success in defending herself against the licensee? a. Christy will not be successful because Christy’s actions amount to per se illegal resale price maintenance in violation of the Sherman Act. b. Christy will not be successful because the minimum price she requires will be considered the same as a maximum price for price fixing purposes. c. Christy will be successful because the antitrust laws are not applicable to patent licensing arrangements involving pharmaceutical products. d. Christy will be successful because Christy’s actions are a reasonable approach to maintain the desired quality image. Cheap Charlie’s is a small discount appliance dealer. Other local retail appliance dealers dislike Cheap Charlie’s price cutting and Cheap Charlie’s is equally unpopular with the appliance manufacturers who would like to have their products sold with a more luxurious image. Cheap Charlie’s appliance sales constitute less than .01% of the relevant market. The marketplace has an abundance of retailers, and competition is vigorous. The manufacturers and the retailers have jointly decided to boycott Cheap Charlie’s, thereby significantly limiting Cheap Charlie’s access to appliances and thus hoping to drive the company out of business. Cheap Charlie’s has commenced legal action against the various parties based upon a Antitrust Final Examination 2012 - page 7 of 17 violation of the Sherman Act. Cheap Charlie’s is seeking injunctive relief and damages. Under the circumstances which of the following is the most likely outcome? a. Cheap Charlie’s will be entitled to the relief requested since the facts indicate a per se violation. b. Cheap Charlie’s complaint should be dismissed since it alleges only a private wrong as opposed to a public wrong. c. Cheap Charlie’s will be entitled to the relief requested against any interstate commerce manufacturers, but not against any intrastate retailers. d. Cheap Charlie’s will not be entitled to injunctive relief. Only the Department of Justice and the Federal Trade Commission are entitled to such relief. The following fact situation applies to questions 10 through 14. Shirley S. Pilletti is the president of the EcoFrendlee Biotechnology Company. EcoFrendlee operates its own laboratory that has produced a number of patentable inventions. In addition, EcoFrendlee acquires the rights to various patented inventions developed by others. EcoFrendlee does not use the technology it owns, but instead EcoFrendlee seeks licensees for both its own and acquired patents. Ms. Pilletti has hired you as general counsel and poses the following questions: 10. Is a patent holder exempt from the antitrust laws when dealing with the licensing of the patent it owns? a. Yes, because the patent code preempts the antitrust laws. b. Yes, if the patent holder obtained the patent by grant from the U.S. Patent and Trademark Office (as opposed to a patent acquired from others). c. No, the licensing of a patent can subject the patent holder to antitrust liability. d. No, because section 6(a) of the Sherman Act, as amended in 1982, specifically states so. 11. Can EcoFrendlee’s acquisition of patents through purchase subject the firm to Sherman §2 liability if the patents were acquired with the intent to obtain monopoly power? a. Yes, because patents acquired in this manner would be treated no differently than other property. b. Yes, but only if the acquisitions violate Clayton §7. c. No, because the seller of legitimate patents has a right to sell to whomever he or she wants. Antitrust Final Examination 2012 - page 8 of 17 d. No, because the acquisition is viewed as superior business acumen to obtain superior business products. 12. Can EcoFrendlee’s acquisition of numerous patents through original grant (as opposed to those acquired from others) subject the firm to Sherman §2 liability if the patents were acquired with the intent to obtain monopoly power? a. Yes, because such an acquisition can be viewed as a monopolizing activity. b. Yes, because the intent to obtain monopoly power taints an otherwise legitimate activity. c. No, because section 6a of the Sherman Act, as amended in 1982, specifically states so. d. No, because acquisition of numerous patents through original grant is viewed as superior business acumen to obtain superior business products. 13. Can EcoFrendlee’s acquisition of patents by means of fraud on the Patent Office subject the firm to Sherman §2 liability if the patents were acquired with the intent to obtain monopoly power? a. Yes, because fraud on the Patent Office in acquiring a patent will give rise to the presumption that monopoly power is present. b. Yes, because obtaining a patent through fraud can be viewed as a monopolizing act. c. No, because fraud on the Patent Office is a separate matter from a federal antitrust claim, and needs to be pursued at the Patent Office. d. No, because the acquisition is viewed as superior business acumen to obtain a competitive advantage. 14. EcoFrendlee holds the patent rights to a particularly valuable technology that is critical to the low-cost manufacture of certain medicines. Can EcoFrendlee grant an exclusive license to use the technology to Western Corporation that is restricted to the U.S. west of the Mississippi River, and another exclusive license to use the technology to Eastern Corporation that is restricted to the U.S. east of the Mississippi River without running afoul of the antitrust laws? a. Yes, because § Section 261 of Patent Code specifically mentions this type of restriction. b. Yes, but only if it is a unilateral decision under the Colgate doctrine. c. No, because territorial division can have the same competitive effect as a price fixing arrangement. Antitrust Final Examination 2012 - page 9 of 17 d. No, because the grant of an exclusive license is the equivalent of a sale for antitrust purposes. The following fact situation applies to questions 15 to 17 The Bart Favour Co., founded by a former professional athlete who has since fallen on hard-times and is no longer associated with the company, manufactures vitamin preparations for sale by independent house-to-house distributors. The distributors are recruited by the company, their personnel are given a ten-day training course by the Favour Company, and then join the business of the independent distributor. Each such distributor buys vitamins from the Bart Favour Co. at wholesale prices and resells them to home customers at prices determined by the distributor. The distributorship agreement provides that the distributor shall not sell any vitamin preparations other than Favour's, and the agreement is of indefinite duration. It is, however, terminable on 60 days’ notice by Favour; a distributor must give 18 months’ notice if it desires to terminate. Favour markets its product through 6,700 distributors, and has 71.5% of the all the sales of vitamin preparations on a house-to-house basis. When all sales of vitamin preparations through all types of outlets are considered, Favour's market share is 9.6%. The physical characteristics of the vitamin preparations marketed on a house-to-house basis are identical to those marketed through other outlets, but house-to-house salespeople generally quote prices 20% lower than drugstores and 5% higher than mailorder houses. 15. Favour has retained you for advice and would like an opinion on whether they may have violated any antitrust law with regard to its distributors. In this regard, which of the following is correct? a. Since Favour is merely a “single player” the exclusivity clauses in its distribution agreements cannot give rise to an antitrust claim under Sherman §1 in accordance with the holding the Copperweld. b. Under the Colgate doctrine Favour is free to set the terms it wants to use with its distributors free from antitrust interference. c. The size of Favour’s market share may be decisive in determining the antitrust risk. d. A prohibition against the distributors handling competitive goods, such as that used by Favour, is illegal under Clayton §3. 16. Favour specifically wants to know it could change any antitrust exposure it may have by deleting the exclusive dealing clause from its distributorship agreement, and after consultation with an offending distributor, simply terminated any distributor that insisted on buying vitamin preparations from any of Favour's competitors? Antitrust Final Examination 2012 - page 10 of 17 a. Such an action would reduce Favour’s antitrust risk since it would place Favour under protection of the Colgate doctrine. b. Such an action would increase Favour’s antitrust risk since the consultation would constitute an agreement that might be actionable under Sherman §1. c. Such an action would reduce Favour’s antitrust risk if it terminated without consultation. d. Such an action would not have any meaningful effect on Favour’s antitrust risk since the result is the same. 17. Favour also has exclusive agreements with several chemical companies that supply it with K932, one of the basic ingredients of its vitamins. These agreements bind the chemical companies, which produce 7.1% of K932, not to sell any of their production to other vitamin companies. Favour's three major competitors apparently are not prejudiced, since each of them also has contracts with various chemical companies under which they purchase all of the output of the contracting companies. The three major competitors have contracts that account for 53% of the K932 produced. In addition, some of the twelve relatively small vitamin companies in the field have similar “purchase of output” contracts. Which of the following is incorrect regarding these purchase of output contracts? a. In determining the effect on competition a court must assess the amount of the market that has been foreclosed by the Favour arrangements. b. In the Tampa Electric v. Nashville Coal Co. case [365 U.S. 320 (1961)] the Supreme Court held that requirements contracts of the nature used by Favour are against public policy and are illegal per se. c. In vertical foreclosure cases the antitrust laws seeks to protect the ultimate consumers by ensuring that they will bot be deprived of the protection afforded by alternative sources of supply. d. In assessing the qualitative substantiality of the alleged foreclosure a court will be receptive to evidence regarding barriers to entry into the manufacture of K932. 18. A group of CEO’s from New Hampshire lumber products manufacturers has decided to meet once a month to “discuss issues of importance to the industry and New Hampshire”. Before their first meeting the general counsel of Woodsense Inc., one of the manufacturers, warned the CEO of Woodsense regarding any agreements among the group that could be illegal under the antitrust laws. Which of the following agreements would pose the least risk of a federal antitrust violation? a. An agreement aimed at lowering prices to make New Hampshire lumber products more competitive with imports from Canada. Antitrust Final Examination 2012 - page 11 of 17 b. An agreement aimed at eliminating cutthroat price competition among the New Hampshire manufacturers so that wages could be maintained a decent level. c. An agreement that seeks to set prices reasonably and fairly for the consumers’ benefit. d. An agreement to collectively set prices for New Hampshire lumber products that are sold in Canada. 19. In response to the government's call for greater internet security against terrorists, a group of software programmers have decided to establish the Safe Internet Programming Society (SIPS) to promote secure software programming practices that meet certain standards of security. At its first meeting the SIPS decides that Jao Thurtson should be banned because he is deemed a "security risk". The group then sends out a letter to 100 of the top internet software companies announcing that Jao Thurtson has been banned and that the companies should not hire him in the future to write software code if they are concerned about security. As a result of the letter writing campaign by SIPS, Jao Thurtson’s free lance software programming business shrinks by 50%. Jao Thurtson decides to sue the SIPS for violating the antitrust laws. Which of the following is necessary to support charges that the SIPS' actions amount to a group boycott under the antitrust laws? a. Coordinated or concerted activity of multiple actors. b. The labeling of Jao Thurtson as a "security risk" is incorrect.. c. An absolute refusal to deal. d. The information labeling Jao Thurston as a “security risk” came from secret government sources. 20. Section 7 of the Clayton Act is the primary statutory provision used by the government in controlling anticompetitive mergers and acquisitions. In general, the Clayton Act is used because: a. it provides for harsher criminal penalties than does the Sherman Act. b. it enables the government to proscribe mergers and acquisitions in their incipiency. c. it provides for exclusive jurisdiction over such activities. d. the Sherman Act applies to asset mergers or acquisitions only, not to stock mergers or acquisitions. 21. Dr. Paula Liston, a famous government economist, is planning to testify before the Senate Judiciary Committee regarding antitrust enforcement policies. Her testimony is entitled “Market Failures and Antitrust”. Which of the following statements Antitrust Final Examination 2012 - page 12 of 17 would be incorrect for Dr. Liston to make in her testimony regarding market failures? a. They can be caused by positive externalities. b. They can be caused by inadequate or erroneous information. c. They are the inevitable result of cartel activity. d. They have an effect on a person not a party to the decision. 22. World Wide Full Contact Wrestling, a form of televised entertainment, has demonstrated unbelievable popularity since its introduction in New Hampshire in 1996. The World Wide Full Contact Wrestling Association (WWFCWA) is composed of 27 Professional World Wide Wrestling franchises located throughout the United States and Canada. WWFCWA franchise members have agreed to eligibility requirements for all persons who want to participate in a WWFCWA tournament and WWFCWA controls 98% of all “professional” (where cash is paid to participants) World Wide Full Contact Wrestling events. Brusing Bruce Bradless, a professional full contact wrestler, has been ruled ineligible under the WWFCWA developed rules for “unprofessional conduct” and has been prohibited from competing in WWFCWA sponsored tournaments. Although Brusing Bruce was afforded a fair hearing under reasonable procedures to contest the WWFCWA decision, he has decided to sue WWFCWA and its members on a Sherman §1 theory based on an alleged illegal group boycott. WWFCWA and its members move for summary judgment. a. The court should summarily dismiss the case for failure to state a case of action upon which any antitrust relief can be granted. b. The court should dismiss the case against WWFCWA as a defendant but allow the case to proceed against the individual franchise members as defendants. c. The court should use a rule of reason analysis to examine WWFCWA’s eligibility arrangement. d. The court should use a per se analysis to assess the arrangement. The following fact situation applies to questions 23 to 26 In 2005, the Pemigasset Cable Co. (PCC) obtained from the City of Pemigasset, New Hampshire, an exclusive ten-year franchise to install and operate a new fiber optic cable TV transmission system in that city. New Hampshire and federal law (and the enabling regulations) left cable TV franchising decisions to the discretion of local authorities and the Pemigasset city council recommended, and the mayor approved, grant of the franchise. Antitrust Final Examination 2012 - page 13 of 17 While PCC was undertaking studies and preparing to subcontract installation work, a regular city election was held, and the incumbent mayor and three of the five incumbent city council members were replaced. Prior to the election, the two principal shareholders of Pemigasset's local regular (over-the-air) television station, Huey and Duey, and one of the successful city council candidates, Louey, had formed Mallard CATV, Inc., with the purpose of securing the exclusive franchise earlier issued to PCC Huey and Duey each made substantial campaign contributions to Louey and other council candidates on the successful ticket. PCC alleges that their television station's coverage of the election was biased in favor of the same candidates. After the election, Mallard CATV, Inc. and its affiliated local TV station filed an unfair competition complaint in a state court in Pemigasset alleging that PCC had within the previous year hired several employees from the affiliated local TV station to obtain trade secrets with respect to the Pemigasset television advertising market. Plaintiffs claimed damages and sought an injunction prohibiting PCC from proceeding with any activity to carry out plans to implement its Pemigasset cable TV franchise. Extensive discovery procedures failed to disclose facts sufficient to support the allegations and defendant's motion for summary judgment was eventually granted. Shortly thereafter, at Louey's behest, the city council invited Huey and Duey to appear before it. They testified that PCC was both technically and financially unqualified to implement the franchise. After some discussion, but no public hearing or other opportunity for PCC to dispute the charges, the council exercised a revocation clause in the franchise agreement and transferred the exclusive franchise to Mallard CATV, Inc. PCC charged a conspiracy in restraint of trade among Huey, Duey, Louey, and Mallard CATV, Inc. under the federal antitrust laws. It alleged, inter alia, that Mallard CATV's lawsuit was brought in bad faith and for harassment, the statements of Huey and Duey before the council were false and motivated solely by their interest in CATV's obtaining the franchise, and that the decision of the council was tainted as a result of Huey and Baker's campaign contributions. 23. With respect to the unsuccessful unfair competition litigation filed in state court, which of the following is correct? a. The completion of the state unfair competition litigation now precludes both parties from bringing up issues regarding competition in the antitrust litigation on the principle of res judicata. b. On the basis of the facts presented in the problem statement the litigation constitutes a “sham litigation” and, as such, is actionable under the antitrust laws. c. Citizens (both natural and corporate) have a constitutional right of access to the courts and it does not matter in an antitrust action that their sole purpose in bringing litigation is to destroy a competitor by means of unsupported allegations. Antitrust Final Examination 2012 - page 14 of 17 d. In Professional Real Estate Investors v. Columbia Pictures [113 S. Ct. 1920 (1993)] the Supreme Court put forth a two-part definition of “sham” litigation. 24. Mallard CATV in its defense against the federal antitrust law action claims it is protected by the Noerr/Pennington doctrine. Which of the following is correct regarding this doctrine? a. Even where group action is involved the Noerr/Pennington doctrine makes it clear that wide latitude is permitted to groups to petition or put pressure on government officials. b. The Noerr/Pennington doctrine does not extend to actions that would amount to actionable fraud or deceit. c. Policy considerations supporting the Noerr/Pennington doctrine can be found in each citizen’s Third Amendment rights of petition. d. The Noerr/Pennington doctrine applies only to “natural” citizens, and not to corporations since corporations can not vote and are not “politically franchised”. 25. Regarding the involvement of Huey, Duey, Louey, and Mallard CATV in the city council campaign, which of the following is correct? a. Although individuals and organizations can be “politically active”, if the political activity is motivated by a desire to subvert the free market process and eliminate competition it is subject to antitrust censure. b. The use of campaign contributions to obtain a competitively lucrative license is a form of bribery that removes the protection of the Noerr/Pennington doctrine. c. Since the anti-competitive conspiracy among the participants existed prior to Louey’s election to the city council, the conspirators’ actions in getting Louey elected can be actionable on antitrust grounds if the main purpose of getting Louey elected was to harm a competitor. d. To determine the competitive effect of the acts involved would require an examination of the purity of motives underlying the acts of a legislative body, and it is unlikely that a court would do so. 26. The defendants in the antitrust case, Huey, Duey, Louey, and Mallard CATV, move to dismiss on the grounds that their conduct was protected under the Noerr/Pennington doctrine. What is the most likely result? a. The defendant’s motion is denied since the plaintiff has made out a prima facie case that the defendants specifically intended to harm a competitor and took steps to implement that harm. Antitrust Final Examination 2012 - page 15 of 17 b. The defendant’s motion is denied since federal judges are reluctant to dismiss an antitrust suit before trial, especially one that involves local political corruption. c. The defendant’s motion is granted since the two anti-competitive actions alleged (the “sham litigation” and the testimony before the council) alone on the facts presented are unlikely to support an antitrust suit. d. The defendant’s motion is granted because Noerr/Pennington is an absolute defense where the action is a situation where petitioning the government is involved. 27. The Runner Shoe Company is a major player in the athletic show business and spends a considerable percentage of its budget on improving its technology. In addition to developing new technology in its own laboratories the company actively seeks out promising technology developed by others. Which of the following would be correct legal advice to give to Runner? a. Runner is immune from the antitrust laws when dealing with the licensing of any patent it owns. b. Acquisition of patents through original grant (not licensing from others) may subject Runner to Sherman §2 liability if the patents were acquired with the intent to obtain monopoly power. c. Acquisition of patents through purchase may subject Runner to Sherman §2 liability if the patents were acquired with the intent to obtain monopoly power. d. Acquisition of patents by means of fraud on the Patent Office will not subject Runner to Sherman §2 liability even if the patents were acquired with the intent to obtain monopoly power. 28. The Cosmo Company has been accused of charging Harry’s Holesail Outlet and higher price than Rita Reetail Stores. In trying to determine the anti-competitive effects of the price discrimination under the Robinson-Patman Act, which of the following factors would not be relevant and helpful to the court in making its determination? a. The alleged price discriminator made substantial use of television advertising that created a barrier to entry. b. The product was sold to competing buyers in the same market. c. There was extensive competition among the buyers, as manifested by low profit margins. d. The alleged discrimination resulted in a substantial difference in price. Antitrust Final Examination 2012 - page 16 of 17 29. eDiscount is a small, start-up discount appliance dealer operating on the internet. Several large national retail appliance dealers dislike eDiscount's price cutting and have complained to the appliance manufacturers who supply them. At this point in time eDiscount's appliance sales constitute less than .01% of the relevant market. The market share of the complaining national retail appliance dealers is 57%. The marketplace has an abundance of smaller retailers, and competition has been described as vigorous. The manufacturers, under pressure from national retailers have decided to jointly raise the prices they charge to eDiscount, thereby significantly limiting eDiscount ability to compete. eDiscount has commenced legal action against the various parties based upon a violation of the Sherman Act. eDiscount is seeking injunctive relief and damages. Under the circumstances which of the following is the most likely outcome? a. eDiscount will be entitled to the relief requested since the facts indicate a per se violation. b. eDiscount complaint should be dismissed since it alleges only a private wrong as opposed to a public wrong. c. eDiscount will be entitled to the relief requested against any interstate commerce manufacturers, but not against any intrastate retailers. d. eDiscount will not entitled to injunctive relief. Only the Department of Justice and the Federal Trade Commission are entitled to such relief. 30. In the 1993 Supreme Court case Hartford Fire Insurance Co. v. California Justice Souter, writing for the majority, reaffirmed both the “effects” test for extraterritorial antitrust jurisdiction and the principle of international comity. Which of the following is correct regarding that case? a. The case made no basic changes in the substance of the comity doctrine but clarified when and how comity should be applied. b. The comity doctrine was first introduced after World War II to ease international trade in a devastated global economy. c. The opinion was so well received that Justice Souter was invited to host a show on cable television’s Comity Central. d. Justice Scalia loved the majority opinion calling it a “vision of clarity that has made me change my way of thinking.” Antitrust Final Examination 2012 - page 17 of 17