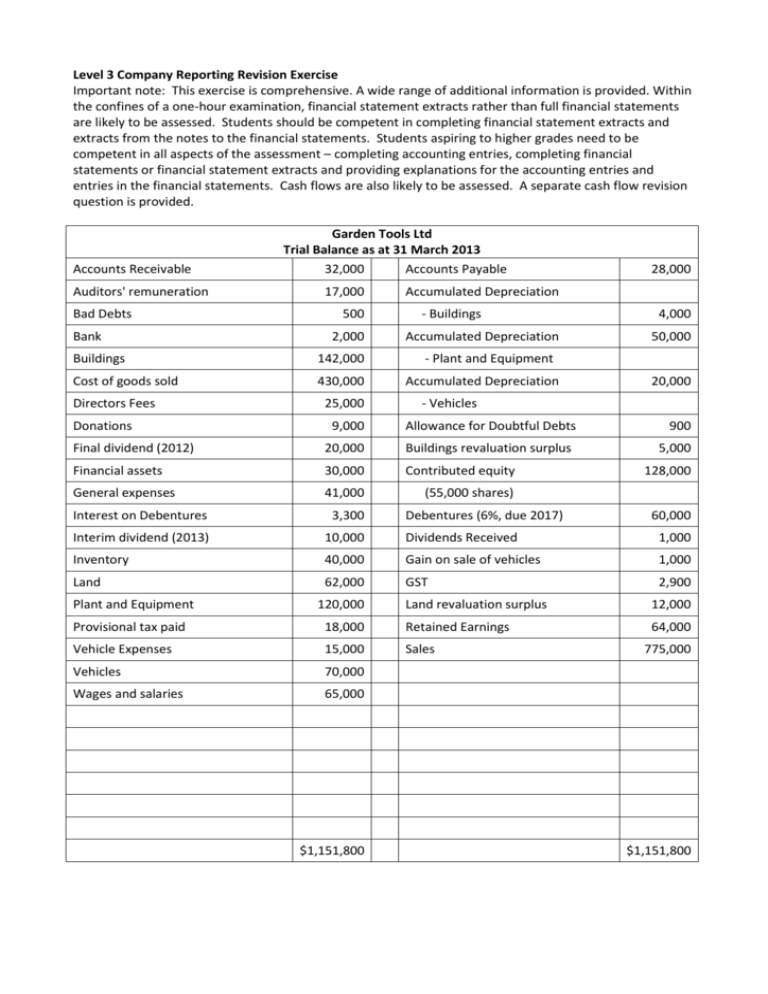

Level 3 Company Reporting Revision Exercise

advertisement

Level 3 Company Reporting Revision Exercise Important note: This exercise is comprehensive. A wide range of additional information is provided. Within the confines of a one-hour examination, financial statement extracts rather than full financial statements are likely to be assessed. Students should be competent in completing financial statement extracts and extracts from the notes to the financial statements. Students aspiring to higher grades need to be competent in all aspects of the assessment – completing accounting entries, completing financial statements or financial statement extracts and providing explanations for the accounting entries and entries in the financial statements. Cash flows are also likely to be assessed. A separate cash flow revision question is provided. Accounts Receivable Auditors' remuneration Bad Debts Bank Garden Tools Ltd Trial Balance as at 31 March 2013 32,000 Accounts Payable 17,000 500 2,000 Buildings 142,000 Cost of goods sold 430,000 Directors Fees Donations 25,000 28,000 Accumulated Depreciation - Buildings Accumulated Depreciation 4,000 50,000 - Plant and Equipment Accumulated Depreciation 20,000 - Vehicles 9,000 Allowance for Doubtful Debts Final dividend (2012) 20,000 Buildings revaluation surplus Financial assets 30,000 Contributed equity General expenses 41,000 (55,000 shares) 5,000 128,000 Interest on Debentures 3,300 Interim dividend (2013) 10,000 Dividends Received 1,000 Inventory 40,000 Gain on sale of vehicles 1,000 Land 62,000 GST 2,900 Plant and Equipment 120,000 Debentures (6%, due 2017) 900 Land revaluation surplus 12,000 64,000 Provisional tax paid 18,000 Retained Earnings Vehicle Expenses 15,000 Sales Vehicles 70,000 Wages and salaries 65,000 $1,151,800 60,000 775,000 $1,151,800 Additional information Financial assets have a current market value considered to be fair value of $34,000 Financial assets are shares in Briscoe Group Ltd Dividends are owing $1,200 Adjust the allowance for doubtful debts to 5% of accounts receivable Wages and salaries owing $2,000 General expenses paid in advance $3,450 including GST Inventory with a cost of $7,000 has a net realisable value of $4,000 Invoice on hand for delivery vehicle expenses $2,300 including GST Interest is owing on debentures Depreciation on vehicles 20% p.a. diminishing value (use the balances in the trial balance) Depreciation on plant and equipment 10% p.a. straight line Depreciation on buildings $2,000 Tax expense $42,000 Garden Tools Ltd repurchased 5,000 shares at a fair value of $2.90. These shares were initially issued at $2.20 The directors of Garden Tools Ltd placed a public share issue of 15,000 shares at a fair value of $3.00 with a sharebroker. The share issue was fully subscribed and payment received less the sharebroker’s 5% brokerage fee. Revalue land to its current independent valuation of $67,000 Revalue buildings to their current independent valuation of $145,000 Auditors' remuneration is the audit fee A vehicle, which cost $20,000, with a carrying amount of $15,000 was sold in April 2012 A new vehicle costing $34,500 including GST was purchased in April 2012. Directors have recommended a final dividend of 10c per share on 30 April 2013 to be paid on 15 May 2013. You should complete the following tasks: (a) Prepare journal entries for the provisional tax paid and tax expense, share issue and revaluation of buildings. (b) Complete the Retained Earnings general ledger account from 1 April 2012 to 31 March 2013, including any necessary closing entries. (You will need to complete the income statement before you can finish this task.) (c) Complete the Contributed Equity general ledger account from 1 April 2012 to 31 March 2013. (d) Prepare a Statement of Comprehensive Income and accompanying notes. (e) Explain in detail the impact each of the following has on the Statement of Comprehensive Income: i. Revaluation of land ii. Financial assets have a current market value considered to be fair value of $34,000 iii. Provisional taxation paid (f) Prepare a Statement of Financial Position and accompanying notes. (g) Identify and explain in detail one temporary current asset and one temporary current liability that arise from the additional information.