What are tax compliance costs?

advertisement

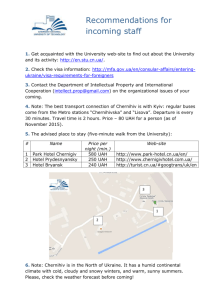

Tax compliance cost surveys Jacqueline Coolidge ITD Conference, Manila March 2 - 5, 2010 1 What are tax compliance costs? Enterprises’ tax compliance and statistical reporting costs – these are NOT amounts of taxes paid, but costs: • Enterprises’ tax compliance and statistical reporting costs – these are NOT amounts of taxes paid, but costs: • spent by by accountants accountantsand andother otherstaff staffon oncalculation calculation of working time spent taxes, providing taxes, preparing preparingall allreports reports,(including providingstatistical), explanations to tax authorities, explanations to tax and statistic authorities, trips to these bodies trips to tax offices •• for purchasing, installation for purchasing, installation and and maintenance maintenanceofofcorresponding corresponding equipment (cash registers) and programs (on workflow automation) equipment (cash registers) and programs (on workflow automation) • for purchasing all necessary forms of reporting, etc. • for outside consultants • • for purchasing all necessary forms of reporting, etc. for outside consultants 2 Why should we care about tax compliance costs? • Tax compliance costs add significantly to the cost of doing business • Tax compliance costs can be extremely regressive: a relatively minor burden for large firms but extremely onerous for small firms • The costs and risks of tax compliance (e.g., the risk of incurring penalties) can deter business formation and formalization of informal firms. 3 Examples of TCCS • South Africa • Yemen • Ukraine • Peru • India (Bihar) • What data did we get and how did we use it??? 4 South Africa Tax Compliance Burden • Time and cost estimates for four main taxes: – Income Tax (IT) – Provisional Tax (PT) – Value Added Tax (VAT) – Employees’ Tax (ET) • Significant processes: – Registration – Preparation, completion and submission of returns – Objections & Alternative Dispute Resolutions (ADR’s) – Audits, inspections & written queries from SARS 5 Regressive Compliance Cost % of turnover Compliance Burden for preparation of tax returns as a percent of turnover (firms registered/not registered for VAT; mandatory at R300,000) 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Firms registered for VAT Firms not registered for VAT 0.15 0.3 0.65 3.5 10 Turnover (in R million) 6 Source: FIAS Tax Compliance Cost Survey South Africa, 2007 6 South Africa: Formal vs. Informal • About 12% of SMEs reported having operated for some period before registering for tax, of which: – Majority operated informally for less than five years – About one quarter operated informally for less than one year • Most informal firms have been operating for several years: – About 2/3 for 5 years or less – About ¼ for 6 – 10 years – Just over 11% for more than 10 years 7 7 Informality comes with significant costs for many firms • Percentage of informal Yemeni businesses facing costs to avoid tax payments/ remain informal 8 Source: FIAS Tax Compliance Cost Survey in Yemen, 2008 8 Yemen TCCS – capacity for tax compliance 84 46 Computer bookkeeping 16 6 65 65 Manual bookkeeping 79 68 100 Keeping physical receipts 83 77 59 0 Not keeping physical receipts 18 23 41 0 Micro 20 Small 40 60 Medium 80 100 Large 9 Reported incidence of bribes to tax officials by businesses in Yemen (2008) 68 70 60 50 40 37 41 39 38 30 20 10 0 Micro Small Medium Large Total 10 Estimated profit reported for tax purposes in Yemen 46 Groups by turnover and size Micro 53 Small 46 53 Large 20% 25% or less 30% 40% 26% - 50% 50% 60% 51% - 75% 16 8 70% 12 26 13 29 16 4 2 17 48 Total 10% 10 30 26 Medium 0% 27 80% 15 90% 100% 76% - 100% 11 Tax morale (agreement with statement, scale 1 – 5) in Yemen, 2008 When business It is If I saw people justifiable if a The less believe a business govern- corruption I tax is fair, underreports ment taxes would be they are income in all willing to always order to pay busines- pay more willing to less tax ses fairly tax pay it Mean Mean Mean Mean Groups by Micro turnover and size Small Medium Large Total I trust the Tax Authority to calculate my taxes accurately Mean If the tax system was more transparent, business people would pay more tax Mean 3.21 2.10 3.85 4.40 2.25 3.93 3.62 3.59 2.78 3.33 2.16 2.28 2.46 2.12 4.27 4.69 4.21 3.99 4.59 4.57 4.63 4.46 2.26 1.84 2.29 2.24 4.11 4.06 3.72 3.98 12 Ukraine TCCS – incidence of inspections tax authority Pension fund social insurance funds % of inspected companies 73% 76% 60% 50% 35% 32% 29% 37% 48% 45% 48% 42% 40% 36% 35% 32% 31% 30% less than UAH UAH 300 000 - UAH 1 million - UAH 5 million 300 000 UAH 1 million UAH 5 million UAH 35 million over UAH 35 million Ukraine (average) Anuual turnover, UAH 13 South Africa: Incidence of inspections Income tax 0.5 Northern Cape 1.5 2.5 3.0 Western Cape Limpopo 2.5 3.5 4.5 5.5 0.5 1.5 2.5 3.5 4.5 5.5 1.7 4.3 4.4 1.7 5.7 1.5 0.5 3.3 1.8 2.0 3.2 1.4 1.3 1.5 2.1 1.5 1.6 Mean by respondents 1.7 Mean by provinces 1.7 6.5 6.2 1.9 Gauteng Eastern Cape 1.5 Employees’ tax 2.2 North West Kwazulu Natal 3.5 0.5 0.9 Freestate Mpumalanga VAT 2.4 2.7 1.1 1.6 3.1 3.0 2.2 2.3 VAT related inspections seem to be more frequent than inspections related to other taxes 14 14 Advantages and disadvantages of simplified regimes – Peru: reasons offered … ….Not to file under RER … to File under RG other reasons other reasons do not know about this regime allows to emit all invoices requirements are too difficult to comply lowest tax compliance cost client's expectations to grow above S/.500,000 the only regime that allows client to grow fixed assets >S/.126,000 only regime for which client is eligible net income >S/.500,000 easiest regime to understand does not allow for client's economic activiy did not advise 0% 10% 20% 30% 40% 50% N=1302 0% 10% 20% 30% 40% 50% n=1289 15 Bihar: On an average, over assessment of VAT liability is observed in 1 out of every 5 cases… % of cases of over assessment ; Base - 181 Almost half of the intermediaries believe that high assessment is given to 10-25% of the businesses… Level of over assessment ; Base - 181 More than 2/3rd of the tax intermediaries estimate that the extent of over assessment upto 25% of the VAT amount 16 16 Most businesses believe that ”Achieving tax collection target” is the main reason officials give a high assessment, and “correction” to be the second reason 22 Vindictive act by VAT officials To make personal gains 54 Correctness of assessment and tendancy of businesses to under rate their tax liability 55 To achieve the target of tax collection assigned to VAT officials Base – 181 respondents 84 0 20 40 60 80 100 However, almost 25% of the intermediaries believe the “main reason” for this move is aimed at making personal gains… 17 17 17