Ecns 300 Midterm #3 Due: Wednesday, Oct. 26, 2011 at the

advertisement

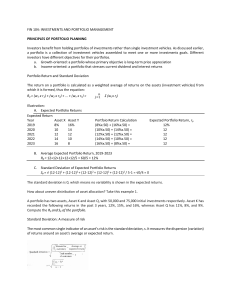

Ecns 300 Midterm #3 Due: Wednesday, Oct. 26, 2011 at the beginning of class. 1. If the risk-free nominal interest rate over a given period is 10% and the real interest rate for that same period is 2.5%, what is the exact expected rate of inflation for that period? 2. Will Wisp will live for exactly two periods. His utility function is U(c1, c2) = c1c2, where c1 is consumption in period 1 and c2 is consumption in period 2. He will have no income in period 2. His income in period 1 is $40,000. If the interest rate rises from 10 to 14%, how will his savings and consumption change in period 2? 3. A certain wine costs $3 a bottle to produce. The amount that people are willing to pay to drink it t years after it has been bottled is $2 + 3t. Storage costs, not including interest, are $.50 per year. If the interest rate is 5%, how much would a rational investor be willing to pay for it at the time it is bottled? Explain how you got your answer. Feel free to write formulas for present value calculations without working out the numerical answer if it involves long calculations. (Hint: How long would the wine be kept before it is drunk? At what price would it sell?) 4. Fill in the blank: Ronald has $18,000. But he is forced to bet it on the flip of a fair coin. If he wins he has $36,000. If he loses he has nothing. Ronald’s expected utility function is .5x.5 + .5y.5, where x is his wealth if heads comes up and y is his wealth if tails comes up. Since he must make this bet, he is exactly as well off as if he had a perfectly safe income of ____________. 5. You have been hired as a portfolio manager for a stock brokerage. Your first job is to invest $100,000 in a portfolio of two assets. The first asset is a safe asset with a sure return of 4% interest. The second asset is a risky asset with a 26% expected rate of return, but the standard deviation of this return is 10%. Your client wants a portfolio with as high a rate of return as possible consistent with a standard deviation no larger than 4%. How much of her money do you invest in the safe asset?