Entrepreneurship

advertisement

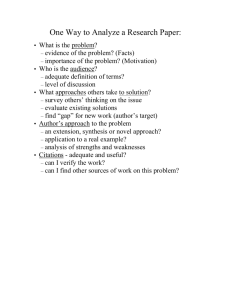

Entrepreneurship... or How to Turn Your Business Idea into Reality! Ian Duckett – Careers Advisor [Mar 2010] Learning Outcomes This presentation will cover: The success factors in start-ups and the motivation and skills that are required to run your own business How to start thinking about your business idea and to decide whether it is a practical proposition The information that goes into a good Business Plan Some key messages to take on board There is an accompanying handout ‘Starting Your Own Business’ which can be found on the Further Activities and Resources section of the Business and Commercial Awareness segment of the LearnHigher website Reality Check – Starting a Business!! If it was easy everyone would do it!!! 70% of start ups close down within 3 years but remember not all closures are because of business failure. People often sell businesses or take up paid employment. Running your own business provides you with great learning experience in terms of: Leadership and Team Working Communication and Networking Skills Commercial Awareness Planning and Organisation Adaptability, Flexibility and Resilience Independence Business Success Depends On ? Seriously considering your motivation (including appetite for risk!) Being aware of your own ability, skills and capabilities! Realistically thinking through the business idea and start-up options And, if you are starting straight from university, perhaps at the outset, not having too complex a business model! The MAIR Model Research the market & plan marketing Motivation Ability Potential for Success Idea Resources Gather team & plan operations Explore funding & plan finances Take lots of advice & network Write Your Business Plan Negotiate Yourself Into Business To be successful in business you usually have to offer: Something that is better in terms of quality, process, delivery , service and/or cheaper… OR just you and your team being plain nicer to deal with… …than the competition!! Serious Questions to Ask Yourself How committed are you? What are your driving forces? Are you prepared to work hard and to take risks? What are your goals? Does self-employment match with personal/family needs? (it’s definitely not a 9-5 job) Have you the right skills? Do you know your own strengths/weaknesses? Are you really good at the core skill required? Have you a feasible idea or can you find one? (maybe a franchise would be a low entry cost option: look at Kleeneze on www.HowWeEarn.com Does the idea fill a gap in the market: will it sell??? Can you find premises, tools/suppliers, staff required ? Have you a funding need (not easy to get for start-ups!!)? Can you survive initially on what may be a low income? Can you build networks for support and development? Who Mentioned Entrepreneurism !! Name some: Richard Branson Stelios Haji-Ioannou (Easy Jet) Alan Sugar Anita Roddick Philip Green Martha Lane Fox Clive Sinclair !! Samual Cunard !!!! Question What key skill do you think they all have in common? Answer Spotting an opportunity in the market! Entrepreneurism No agreed definition but a good one is perhaps: ‘An entrepreneur is someone who has the ability to recognise or grasp an opportunity and the ability, skill and commitment to manage risk in order to achieve success’ Merseyside Economic Review 2007 Do you have to be an entrepreneur to run your own business? No ! Not all business people are like Richard Branson or Stelios HajiIoannou Entrepreneurs tend to be involved in novel start-ups, new products or services or new routes to market and with fast growing businesses. They often switch sectors. Most start-up businesses are not novel or fast growing: they are plumbers, hairdressers, small retailers, web designers etc. Most start-ups are just undertaken by ENTERPRISING people Enterprising Attributes Initiative Flexibility Teamwork Leadership Hard work Creativity Planning/organisational skills Problem-solving ability Negotiation skills Calculated risk-taking Independence/desire to control one’s own destiny Desire to achieve Note that many of these are exactly the competencies required by the leading graduate recruiters. If you have a go at running your own business it will add to your CV and your ability to answer tough questions on application forms. Check Your Own Potential to Run a Business Go to: www.potentielentrepreneur.ca/client (A Canadian site) 40 questions, scoring 1-4 Receive a print out to show your responses against a typical entrepreneurs profile ! Ideas into Reality – the Idea It might be: A ground breaking invention (usually extremely high risk) A brand new product or service (very high risk) A new solution to an everyday problem (high risk) An enhancement to an existing product/service (less risky) A gap in an existing market that you can fill (less risky) An interest or hobby that you can turn into a business, possibly part-time at first, and using known contacts (low risk) Make sure that the idea fits with your needs as an individual or your family Test Your Idea Get feedback, bounce your idea off others, preferably those with some commercial experience (friends, family, the bank, business advisers etc.) Remember, above all, there has to be a MARKET and an end CUSTOMER who will pay real money for your product or service. Identify any weaknesses in your plans and consider the best strategy to overcome them. Beware ‘Product Infatuation’. It seems a good idea, you think people are bound to buy it, but they don’t. Yet you keep on going and going, throwing more time and maybe money at a likely failure. Do the Outline Sums Nearly every new business needs some money for : Premises, equipment, vehicles (capital items) Stock Advertising/marketing Rent or lease payments, business rates (If working from home do you need planning consent?) Utility costs (heat, light, power) Transport costs Your salary/drawings and maybe other staff costs Remember sales are often slow to build up and, unless they are for cash, you might not get paid for 1, 2 or even 3 months. Suppliers to new businesses often want cash! How your cash will flow in and out is the key to survival!! Use the Venture Navigator Assessment Tool Free, online 24/7, objective analysis of business viability. Delivers benchmarked report of individual business situation and points user towards resources, both web based and physical, that can offer relevant solutions Over time user can return to report to update information and seek further support and guidance System developed by 7 major universities including Cambridge, Warwick and Liverpool plus other institutions including National Council for Grad Entrepreneurship - www.venturenavigator.co.uk Write a Business Plan ??? WHY: Makes you think through the idea in some depth! It is a test to see if your idea will stand up to scrutiny! Usually essential if you want to borrow money ! Provides an ongoing reference point for when you are in business! Business Plan Tips Before you start writing, think where you want to be in 3 to 5 years time, outline your vision Address it to the appropriate audience, be that financial or technical: it must be readable and understandable Many people start with the ‘back of an envelope’ approach and develop that into a marketing/funding feasibility study and ultimately a full blown business plan Most important areas are management, sales generation and cash flow: you must understand your numbers!!!!! Be clear and concise, between 10 – 15 pages, 20 max Your Business Plan – should cover these broad areas: Business description and vision. Outline of your/your team’s background, skills and experience Product or service detail Marketing analysis including competitor detail and your strategy Operational requirements Detailed financial requirements Risk evaluation All of the above are usually précised in an Executive Summary which forms the first section of the completed plan. Numerous templates are available online from agencies and banks. More detail is set out in the accompanying handout and the slides at the end of this presentation Some More General Points !! If you need funding then your knowledge and experience (and that of other members of your team) are key: Management/Management/Management is the investor mantra!!! If you have no experience think about getting it first!! Choosing the right legal status needs careful thought. I would recommend Sole Trader or Limited Company. Partnerships can be fraught when things go wrong. Funding It is better to have 70% of something than 100% of nothing. People will not invest risk capital without a reasonable stake and return. Commercial lenders like to see you invest some real money into a project before they will lend. That ties you into the business and means you are less likely to give up if the going gets tough. It used to be £ for £ but with schemes like SFLG it can be 20/80 or 30/70 Don’t try and fund long-term purchases (property/equipment/cars etc.) with short-term money (Overdraft/Credit Card) Customers are King!! Customers can be difficult and sometimes expensive to find, make sure you look after the ones you have! Just printing a few leaflets or having a website is not enough. People have to find that website and you need to know about internet search engines. If you are planning to sell to large companies such as the major supermarket chains there is a long and rigorous process that has to be followed. Products are often trialled in a small number of outlets before being sold across all outlets. Can you gear up production? Remember your customers are your best sales brochure!! Other Events/Resources Use ‘Venture Navigator’ site to initially evaluate your idea www.venturenavigator.co.uk General business advice from www.businesslink.gov.uk Look at NCGE site www.ncge.org.uk NCGE sponsor ‘Flying Start ‘ programme that offers a series of 1-3 day, free business training events www.flyingstartonline.com Business Planning The following slides show, in more detail, the areas to be covered by a Business Plan Business Description & Background Business Aims and Objectives incorporating what you are seeking by way of investment and other funding History of Development and any Trading to date Current or proposed Legal Status (E.G. Sole Trader, Partnership, Limited Company) Details of You and other key personnel. Your experience in the industry/sector and professional or other qualifications Product or Service and Marketing Provide full detail of your product or service. What specific market are you targeting? Details of any major customers/target customers groups What market research have you undertaken, why will people buy your product/service? How will you cost/price your product/service? Who are your competitors? What makes your product/service better, faster, cheaper or nicer than the competition? Effectively what is your USP!! Operational Requirements How will the product be made and sold or how will the service be delivered? What premises and equipment will be needed at the outset and as the business develops? What staff will be needed both initially and as the business builds up? Can those staff of the right quality be found and trained? Financial Information Monthly profit and loss, balance sheets and cash flows are usually required for 3 years You must fully understand these figures even if you get specialist help in their preparation Detail the assumptions made in the preparation of the figures (E.G. in sales growth, in profit margins, in payment terms) You must understand those assumptions If you need to borrow to fund asset purchases then assume that borrowing is available and bring the finance costs and repayment projections into the plan/forecasts Risk Evaluation – SWOT Analysis Outline Strengths and Weaknesses of the business and yourself. How can any known weaknesses be overcome? What opportunities exist and how can they be exploited? What are the threats, including the competition, and how can they be overcome or mitigated? Executive Summary (Comes first in the plan document but usually written last!) Brief Overview of the business/proposed business outline your vision 3/5 years out from start up Say who you are, role in business, background and qualifications. Also detail other key members of team Summarise how you will trade and why there is a market for your product or service (and justify claims if you can) Summarise current financial position Summary of Forecast P&L, Balance Sheets, Cash Flows Outline funding needs in terms of: Asset finance (Capital purchases) Working capital (Funding sales costs and day to day expenses, pending invoicing sales & then the receipts from those sales actually being received) Final Message!!! If at first you don’t succeed, don’t give up!!!! BBC Dragons Den rejected these two ideas: ‘Stabletable’ - gadget for levelling wobbly tables. Product made in China. Has deals in US and UK (here with wholesaler who supplies Tesco & Asda). Turned down for £90k investment. Sales now £1m+ ‘Trunki’ - children’s sit-on suitcase. Started with £4k from Princes Trust. Had a minor design fault when demonstrated on the show. Wanted £100k for 10%, was offered £100k for 50%, didn’t accept. Product now stocked by John Lewis, Next, Mothercare, Harrods, Fenwicks. Walmart deal pending. Sales circa £2.2m p.a. Good Luck! A Little About Me! (the author) Currently Part-Time Careers Adviser 1998 – 2005 Merseyside Special Investment Fund Investment Manager Objective 1 Fund lending money to Merseyside SMEs including Start Up Businesses 1963 – 1998 Barclays Bank North West Region. Posts included: Assistant Operations Director (1995 -1998) Regional Personnel Manager (1990 -1995) Branch Manager 3 Branches (1981 -1990)