Full Word Version

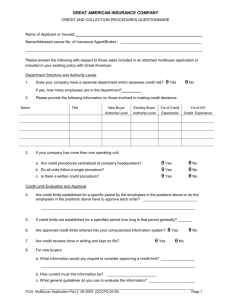

advertisement