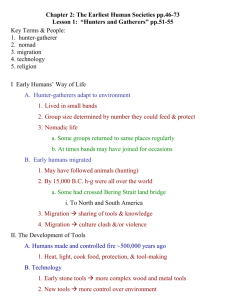

Press Release 25 June 2014 and Backgrounders

advertisement

EUROPEAN SPIRITS MIX A COCKTAIL FOR EXPORT SUCCESS Data confirm European spirits as an export leader: sector calls for trade to top EU Agenda Brussels, 25 June 2014. Today, alongside Trade Commissioner, Karel de Gucht, the European spirits drinks sector published “Spirits: a European Power House for Trade”, detailing the sector’s track record for exports over the past decade. Eurostat data show that spirits exports outside the EU remain strong and this impressive export performance makes a significant contribution to the economy of European Member States. The sector seized the occasion to call on the new European Commission and European Parliament to support the continued success of the sector by putting trade firmly at the top of their agenda in the next five years. Over the decade to 2013, European spirits exports have doubled to €10bn. In the latest year – 2013 - they contributed a positive net trade balance of €8.6bn to the European Union. High value, local and iconic European spirits are sold around the world, making them the EU’s most valuable agricultural export. The USA is the largest export market, and South East Asia the fastest growing region. “Local spirits are flying the European flag abroad,” said Paul Skehan, Director General of spiritsEUROPE, “but we can achieve so much more.” The sector aims to further increase exports significantly over the next five years, and to achieve this, spiritsEUROPE calls on the incoming European Parliament and Commission to continue to support a very positive, pro-active trade agenda. “Trade needs to top the EU agenda. This is not a selfish request but a win-win proposal for Europe,” said Skehan. On average, more than 55% of the price paid for a bottle of spirits is tax. Through VAT and excise duty alone, the spirits sector generated about €21bn for EU exchequers last year. Apart from this contribution towards public finances, export success also generates investment and employment in Europe. To take the example of the leading export category, some €2.5bn of investment has been committed by Scotch whisky producers over the next two years. There are at least 20 new distilleries being built and much related investment in new bottling plants – with a knock-on benefit for other sectors, such as glass manufacturers, coopers, transporters and packagers. For further information, please contact Paul Skehan, Director General: + 32 (475) 388415, or alternatively Carole Brigaudeau, Director Communications:+ 32 (486) 117199 : In the context of the EUROPE 2020 initiative, the EU is considering strategies and policies to sustain growth and stability in today’s highly globalised economy. As far as international trade is concerned, the answer is to call for more Europe. “The elimination of high import tariffs and other barriers such as discriminatory tax policy, insufficient intellectual property protection or complex custom procedures need to be addressed by the EU through the conclusion of ambitious Free Trade Agreements (FTAs) with our main trading partners, a reinforced market access strategy, and credible enforcement mechanisms”, concluded Skehan. India, for instance, is the largest whisky market in the world and yet less than 1% of consumption is of imported products. The abolition of the 150% import tariff would allow a boom in European spirits exports within a few years of liberalisation. ENDS ● ● spiritsEUROPE is the representative body for the spirits industry at European level comprising 32 associations and 8 multinationals: www.spirits.eu Publication available here PR-0052014 For further information, please contact Paul Skehan, Director General: + 32 (475) 388415, or alternatively Carole Brigaudeau, Director Communications:+ 32 (486) 117199 : BACKGROUNDER : CALL FOR PRO-TRADE AGENDA SPIRITS TRACK RECORD AS EUROPEAN POWERHOUSE FOR TRADE ● Over the past decade, European spirits exports have almost doubled from €5.6bn in 2003 to €10bn in 2013. In 2013, exports contributed to a positive net trade balance of €8.6bn. ● The value of exports of Scotch whisky, Cognac and Swedish vodka, and 300 other spirits registered Geographical Indications (GIs), represents twothirds of the total spirits exports, generating jobs and growth across many rural communities in Europe1. ● Top-five spirits export markets: 1. USA with €3.3bn exports; 2. Singapore with €1bn (logistic hub for Southeast Asia); 3. Russia with €725m exports; 4. China with €456m exports; 5. South Africa with €300m exports. Canada, Mexico, Taiwan, Australia and Japan are among the top-ten. ● Spirits are the EU’s biggest agri-food exports. The European agri-food sector is a major exporter of high value quality products of which spirits drinks represent the largest share (32%). The spirits sector at glance ● ● ● spiritsEUROPE represents the interests of the spirits sector in 32 national associations and the 8 leading multinational companies. As the voice of the European spirits sector, we seek to maintain and advance the freedom to produce and market spirits in a responsible way. Distilled spirits are as diverse as the EU’s Member States, with 46 product categories, including a host of geographically-specific products (GIs). These contribute to the culture of their regions and the European Union. Brandy de Jerez, Grappa, Ouzo, Genever, Deutscher Weinbrand are just a few of the 300 registered protected GIs. These spirits are important exports outside Europe. 2 out of every 3 bottles distilled annually by small, medium and large producers are sold in the EU, generating sales of €37bn with a clear trend towards quality. The average sales value of a litre of spirits in 2003 was €12, but had risen to €15 in 2013. A “premiumisation” of 23% in a decade. CONTRIBUTION TO EUROPEAN ECONOMIES BROADER THAN JUST EXPORTS… ● On average in Europe, more than 55% of the price paid for a bottle of spirits is tax. ● Through VAT and excise duty alone, the spirits sector generated €21bn for EU Exchequers in 2013. ● Over one million jobs can be attributed to the production and sale of sprits drinks (20% in production; 80% in retail, hospitality and tourism sector). 1 Value of production of agricultural products and foodstuffs, wines, aromatised wines and spirits protected by a geographical indication (GI) – October 2012 - http://ec.europa.eu/agriculture/external- studies/2012/value-gi/final-report_en.pdf spiritsEUROPE- rue Belliard 12, bte 5 / 1040 Brussels -Contact person : Carole Brigaudeau, Director Communications – T : +32.2.505.60.72 / Mobile : +32.486117199 / brigaudeau@spirits.eu BACKGROUNDER : CALL FOR PRO-TRADE AGENDA SOME COUNTRY-SPECIFIC FIGURES FRANCE ● ● ● ● GERMANY ● The French spirits sector has enjoyed a regular increase in exports up to €3.5bn in 2013 - split between the US (29%); Asia (37%); the EU (23%) and the rest of the world (11%). A large share of spirits exports are driven by Cognac, exporting 98% of production outside France. Exports of Cognac increased by 91.4% in value over the last decade. In France, there is more than 85% tax on a spirits bottle, generating over €3bn annual revenue to the Exchequer. The spirits sector in France employs more than 100,000 people in production and distribution. ● ● POLAND ● ● ● ● At about 700 million bottles, the German spirits market is the biggest in Europe. In 2013, exports of liqueurs, white and brown spirits rose to about 275 million bottles, of which 34% is exported outside the EU to countries such as USA, Russia, Switzerland, etc. to the value of €115m. German spirits are contributing €2.2bn to the Exchequer The sector employs 140,000 people. SPAIN Polish exports have increased by 94% over ● the last decade to €620 million, two-thirds of which is driven by Polish Vodka. Poland is the number one vodka producer in the EU, and number four in the world. The Polish spirits sector contributes €2.3bn ● to the Exchequer in excise duty and VAT annually. The sector employs more than 90,000 people directly and indirectly. ● Over the last 10 years, Spanish exports outside the EU have increased by more than 134%. This growth is mainly driven by the Brandy category (2/3 represented by Brandy de Jerez), followed by Whiskies and Liqueurs. Spirits consumption represents 27% of the total alcohol consumed in Spain, but generates 73% of the total excise revenues for alcoholic beverages. Spirits’ annual contribution in excise and VAT in Spain is €1.3bn. The sector employs around 200,000 people. UNITED KINGDOM ● ● ● ● Spirits exports outside the UK have increased by 82% over the last ten years from €2.3bn to €4.3bn in 2013. Exports are driven by the Scotch Whisky which generated over €5bn for the UK balance of trade in 2013 - the equivalent of €169 every second. In 2013, over 60% of Scotch whisky distilled was shipped outside of the EU to the value of €3.3bn. In the UK, a 79% tax on a bottle of spirits provides a €3.5bn annual contribution to the UK Exchequer. The British spirits sector supports over 150,000 jobs, of which 35,000 jobs are from Scotch Whisky. spiritsEUROPE- rue Belliard 12, bte 5 / 1040 Brussels -Contact person : Carole Brigaudeau, Director Communications – T : +32.2.505.60.72 / Mobile : +32.486117199 / brigaudeau@spirits.eu BACKGROUNDER : CALL FOR PRO-TRADE AGENDA THE SPIRITS INDUSTRY CALLS FOR MORE EUROPE - SEVEN PROPOSALS TO PROTECT EUROPEAN JOBS, FIRMS AND REGIONS • High value, local and iconic European spirits are sold around the world, making them the EU’s most valuable agricultural export. The publication: “Spirits: a European Power House for Trade” details the sector’s track record for exports over the past decade, shows how liberalisation is key to the growth of the sector, and in so doing, contribute significantly to Europe’s economy. spiritsEUROPE outlines its proposals for the European Commission and incoming European Parliament to support a positive EU trade agenda and warns against protectionism. • 1. Conclude bilateral agreements with EU’s spiritsEUROPE calls for a pro-trade EU agenda for next 5 years: • 1. Conclude bilateral agreements with EU’s main trading partners • 2. Reinforce the market access strategy • 3. Police existing agreements • 4. Enforce protection of Intellectual Property Rights • 5. Deepen regulatory dialogue with trading partners • 6. Reaffirm the role of WTO in securing free trade • 7. Promote evidence-based policy: trade liberalisation does not correlate with alcohol misuse main trading partners such as India - Following successful negotiations with Korea, Colombia/Peru and Central America, spiritsEUROPE looks forward to continued implementation of the FTA strategy in order to overcome difficulties in terms of market access. An FTA with India will dismantle the exceptionally high tariff (150%), by far the greatest impediment to market access, and would increase the market share of European products (today it stands at less than 1%). • 2. Reinforce the Market Access Strategy - Market access for imported spirits remains complicated. To support SMEs, the EU should continue to develop its toolkit to dismantle unjustifiable barriers and strengthen the rulebased trading system. In this context, spirits EUROPE plays an active role in the EU Market Access Partnership. Thanks to the adoption of an action plan for the removal of tax discrimination and the abolition of import certificates three years ago, exports to Turkey have made good progress. • 3. Police existing agreements - The successful defence of the European Union’s rights requires that the EU has the capacity to use all enforcement tools, to ensure trading partners respect negotiated trade rules, from trade diplomacy to dispute settlement. With an increasing number of FTAs in negotiation, and consequent workload for the Commission, spiritsEUROPE calls for increased resources to ensure the EU’s capacity to police export growth. spiritsEUROPE- rue Belliard 12, bte 5 / 1040 Brussels -Contact person : Carole Brigaudeau, Director Communications – T : +32.2.505.60.72 / Mobile : +32.486117199 / brigaudeau@spirits.eu BACKGROUNDER : CALL FOR PRO-TRADE AGENDA In 2011, the WTO confirmed that the Philippines maintained a discriminatory excise tax regime on distilled spirits that favoured local production for some years, and this taxation regime should be ended promptly. This WTO conclusion has already resulted in a rise in European spirits drinks exports to this country. • 4. Enforce protection of Intellectual Property Rights - A clear and predictable legal framework for IPR protection is essential to sustain access to third countries. spiritsEUROPE supports the inclusion of robust IPR disciplines, including enforcement, in multilateral and bilateral trade arrangements. In addition, more indirect means can contribute to the armoury of fighting counterfeits, such as persuading third countries to lift product standards and food safety regulations to the EU’s level. In the LATAM region (Colombia, Ecuador, El Salvador, Honduras, Panama, Peru), the illegal market represents on average 21% of the total alcoholic market. Colombia, Ecuador and Peru account for more than 94% of the total illegal market. • 5. Deepen regulatory dialogue with trading partners The EU clearly has a role to promote its own internal standards, especially towards countries that do not yet have regulations in place for complex food safety or consumer protection matters. Today, the EU runs state-of-the-art food traceability systems and spirits definitions regulations, which could be extended to other countries as they pursue similar levels of economic development. While Russia remains our second largest market, the European spirits sector is constantly facing a complex and unpredictable regulatory situation. • 6. Reaffirm the role of WTO in securing free trade - spiritsEUROPE urges the WTO and Member States to use the momentum generated in the “Bali Package”2 to make progress regarding greater market access - notably on reducing tariff peaks and enhanced protection for Geographic Indications – and to reaffirm the wider role WTO plays on: ● Discussions under the TBT and SPS Agreements3 to prevent unnecessary trade obstacles. ● The Trade Policy Review, which affords another opportunity for constructive discussions with third countries, going beyond mere tariff issues. ● The WTO Dispute Settlement Understanding, an important tool in the EU’s fight against unfair trade practices around the world. 7. • Promote evidence-based policy: trade liberalisation does not correlate with alcohol misuse - Demands from some third countries to carve wine and spirits out of trade agreements must be resisted by the EU. Religious, health and/or cultural justifications are seen to be groundless when significant domestic alcohol beverage producers already exist and seek protection from international competition. 2 The Bali Package is a trade agreement resulting from the Ninth Ministerial Conference of the World Trade Organization in Bali, Indonesia on 3–7 December 2013. 3 Sanitary and Phytosanitary Measures (SPS) and Technical Barriers to Trade (TBT) spiritsEUROPE- rue Belliard 12, bte 5 / 1040 Brussels -Contact person : Carole Brigaudeau, Director Communications – T : +32.2.505.60.72 / Mobile : +32.486117199 / brigaudeau@spirits.eu