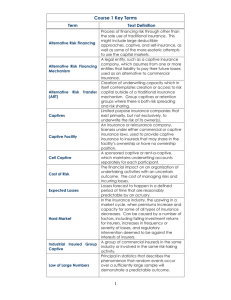

The Road Less Traveled presentation files

advertisement

The Road Less Traveled: How to Anticipate and Avoid Group Captive Potholes along the Path to Success 2014 Cayman Captive Forum Eric I. Lark Member Kerr, Russell and Weber, PLC Ronald Jordan Finance Committee Chair FS Insurance, Ltd. F. Geoffrey Welsher, Jr Managing Director Marsh Detroit 1 Introduction 1. 2. 3. 4. Hear a lot about some group captive issues Not much on others FS Insurance Ltd. 14 years of existence A case study, deep dive into potential group captive potholes 2 Introduction of FS Insurance, Ltd. (The Case Study) 1. Organized by a Global Broker/Captive Manager and U.S. legal 2. 3. 4. 5. counsel Incorporated in the Cayman Islands in 2000 Started with a handful of members Make-up: • strangers, • perhaps competitors, • disparate geographically and philosophically • like herding cats Homogenous group captive – trucking companies (heterogeneous within trucking/transportation industry) 3 Introduction of FS Insurance, Ltd. (cont.) 6. All “driven” by one thing – a strong desire to leverage best in class safety records and take control over their insurance destiny. 7. FS Insurance is a thriving group captive that is entering its 15th year of existence! 8. Structure: See following chart 4 a. Structure Onshore (US) Owners/Insureds Premium 1 Offshore (Cayman) Board of Directors Officers Ownership Executive Committee 2 3 Front/Reinsurer 4 FS Insurance, Ltd., a Cayman Islands insurance company 5 6 C.I. Manager C.I. Counsel 7 8 Finance/ Audit Committee Risk Control Committee Underwriting Committee C.I. Auditor 9 10+ Fronting and Reinsurance Agreement 5 Introduction of FS Insurance, Ltd. (cont.) b. Ronald Jordan – Finance Committee Chair • Member – Fleet Car Carriers, Denver, CO • Involvement with the captive c. Hurdles / Potholes along the way: • 3 fronting/reinsurance companies • Front/Reinsurer downgraded and in runoff • Personnel Turnover; Initial point person left and tried to take captive Off-Shore point person left and tried to take administration with him • First captive president left and created more drama • Lengthy soft market pricing • Member Attrition – 2008 recession & acquisitions 6 Introduction of FS Insurance, Ltd. (cont.) d. Just a few of the potholes along the path to success – e. Yet, despite the challenges, FS is stronger than ever: • 15 active and engaged members • $26mm in premiums • Benchmarking Surplus Loss Ratios 12 key transportation metric's vs national averages (e.g.. OSHA Recordable Injury Rate, Driver TO, Preventable DOT Collision Frequency etc.) f. Let us elaborate on some potholes (some not so obvious) to avoid along the path (less taken) to success g. Title of Presentation – play on Robert Frost’s famous poem, “The Road Not Taken” 7 Group Captive Potholes Along the Path to Success The Road Not Taken Two roads diverged in a yellow wood, And sorry I could not travel both And be one traveler, long I stood And looked down one as far as I could To where it bent in the undergrowth; Then took the other, as just as fair, And having perhaps the better claim, Because it was grassy and wanted wear; Though as for that the passing there Had worn them really about the same, And both that morning equally lay In leaves no step had trodden black. Oh, I kept the first for another day! Yet knowing how way leads on to way, I doubted if I should ever come back. I shall be telling this with a sigh Somewhere ages and ages hence: Two roads diverged in a wood, and I— I took the one less traveled by, And that has made all the difference. Robert Frost ~1916 8 Potholes Along the Path to Success (In Loose Chronological Order) 1. Choosing the Right Captive a. How were you introduced to the captive concept? b. To whom are you talking? • What are they suggesting? • What is their agenda? • What are their incentives? c. What are the options? • Homogeneous • Heterogeneous • Agency/Industry Owned • Structure – Pure, Rent-A-Captive, SPC 9 Potholes Along the Path to Success 1. Choosing the Right Captive - continued d. What kind of information are you being provided? • Written information • Member access • Attendance at meetings/workshops e. What are you being told? Not told? What’s Important? • Fixed cost ratio • Underwriting Guidelines • Membership Criteria • Historical performance • Closing of policy years • Distributions • Level of participation • Exit strategy!! 10 Potholes Along the Path to Success 1. Choosing the Right Captive - continued f. g. h. Incentives/Disincentives of program administrator/brokers Other considerations Unpleasant consequences of choosing the wrong captive 11 Potholes Along the Path to Success 2. Fronting / Reinsurance Company Selection a. Commitment to captives/alternative risk • History with group captives • Current group captives • Ultimate decision makers • Underwriting Experience with groups b. Familiarity with your industry c. Culture/outlook/vision/philosophy • Underwriting • Collaborative outlook or heavy-handed • Goals for captives – aligned with yours? • Corporate Reporting Structure • Channel Conflict 12 Potholes Along the Path to Success 2. Front / Reinsurance Company Selection - continued d. e. f. g. h. Collateral issues Unbundling Pricing philosophy and considerations Flexibility on attachment points Financial Stability and Ratings • The FS Insurance Situation – Dealing with a front/reinsurer that implodes 13 Potholes Along the Path to Success 3. Reinsurance Agreement Issues a. Do members see the reinsurance agreement? Binder? b. Captive is reinsurer, but takes the first loss layers (beyond any deductibles) • Front paper is used • Aggregate limits for captive • Front takes the excess layer beyond captive layer • So in many ways it is the captive that is in essence reinsuring to the program insurer, Yet the agreement is not set up that way 14 Potholes Along the Path to Success 3. Reinsurance Agreement Issues - continued c. Follow the fortunes issues • Concept and logic behind it • Application to group captive situation • Claims administrators – bundled or unbundled d. Other provisions • Collateral and collateral release upon exit • Choice of law, jurisdiction and dispute resolution • Other issues 15 Potholes Along the Path to Success 4. Collateral Issues a. Understanding the requirements going in b. Types of collateral • Deductible • Schedule F • GAP c. Forms of member collateral • Incoming collateral d. Forms of company collateral • Outgoing Trust options (114 Trusts and similar) Pro’s and con’s of LOC’s vs. trusts e. Collateral surplus vs. distributions 16 Potholes Along the Path to Success 4. Collateral Issues - continued f. Collateral implications when changing Fronting Company • Collateral releases from departing front • Collateral flexibility from new front • FS experience on this issue g. What is the collateral release policy h. Other collateral issues 17 Potholes Along the Path to Success 5. Unbundling: Talking the Talk vs. Walking the Walk a. Could do an entire seminar on this b. Many talk the talk but don’t walk the walk • Key Control Issue • Members become less reliant as captive matures Understand captive better Overcome obstacles and learn • Common bundling situations Structure may dictate amount of bundling One-stop shop Front with in-house claims administrator Program admin/broker/captive manager Bank/investment manager Pre Loss Risk Control 18 Potholes Along the Path to Success 5. Unbundling: Talking the Talk vs. Walking the Walk - continued c. Pro’s and con’s of bundling vs. unbundling • Profit built in? • Accountability on decision making • Bundled - You are stuck • Knowing delegation vs. blind reliance • Meeting Expectations 19 Potholes Along the Path to Success 6. Service Provider Internal Turnover a. Turnover and intra-company transfers not unusual in the insurance industry b. FS Insurance – On-shore captive administrator (point person) who was on the team who helped in forming the captive left after the first 3 years Very disruptive because of the infancy stage of the captive Geoff brought in to shore up unrest c. FS Insurance – Off-shore Captive Manager who was on the team who helped in forming the captive left after the first 5 years 20 Potholes Along the Path to Success 6. Service Provider Internal Turnover (cont.) d. Do you stay with the person or the organization? • Program Administrator – In the early 2000 the ‘on and off shore’ administrators left their role • TPA Point-Person left their role in the early years • Fronting Carrier underwriting team left their roles in the early years e. What can you do about this? • Gauge commitment • Captive controls and procedures in place • Exact concessions to make up for disruption • Know your service provider bench strength • Knowledge/understanding of all aspects of the captive is key 21 Potholes Along the Path to Success 7. Dealing with Difficult and Inactive Members a. Financial difficulties • Macro-economic issues – the Great Recession • Industry challenges – multiplied in homogeneous programs • Company-specific issues • Ability to meet captive obligations • Cost cutting – rippling affect (safety, LOC etc.) • Financially distressed member focused on survival not captive partners 22 Group Captive Potholes 7. Dealing with Difficult and Inactive Members - continued b. The member with increasing losses • Potential Loss-sharing with other members • Impact on relations with program insurer • Established process for dealing with the member Watch list, Probation, Remedial action plan, Termination from program c. The difficult member • Active Member Power hungry Separate agenda (role for member may dictate) Personality, Encourages factions, FS examples Defense: stick to established procedures and protocols 23 Group Captive Potholes 7. Dealing with Difficult and Inactive Members - continued • • • • • Separate agenda (role for member may dictate) Personality Encourages factions FS examples Defense: stick to established procedures and protocols The inactive member conundrum Inherent conflict in goals between the captive and its inactive members Collateral issues/collateral policy Exit strategy 24 Group Captive Potholes 7. Dealing with Difficult and Inactive Members - continued • • Level of corporate participation of inactive Board, committee, shareholder participation Fiduciary duties vs. self-interest A “cancer” in the boardroom Impact on active members, prospects Spreading confidential/proprietary information of the captive To captive competitors To competitive service providers Early buyout of the “squeaky wheel” 25 Group Captive Potholes 7. Dealing with Difficult and Inactive Members - continued e. Defenses against the difficult member • Adhere to established protocols and procedures • Research your new partners • Carefully screen and underwrite incoming members Follow strict underwriting protocols: Avoid exceptions Gauge outlook, understanding of the captive Strive for good fit (organization, philosophical, personality) and captive decides Don’t grow for the sake of growth! raise the bar mandate commitment 26 Group Captive Potholes 8. Loss of Control over Loss Control (and Claims Handling) a. Controlling losses – The rason FS overcame obstacles b. #1 reason captives fail – bad losses c. Strict underwriting coming in: • Financial • Safety, loss control, claims • Management commitment to safety • Like kind and quality 27 Group Captive Potholes 8. Loss of Control over Loss Control (and Claims Handling) - cont. d. Take control of loss control and claims handling • Pro-active approach to each • Active loss control committee Safety Claims • Accountability of each member and consequences • Loss control workshops – mandatory • Established procedures for underperforming members • Benchmarks, safety awards, priority e. Do not compromise best in class for growth or to satisfy a service provider agenda f. FS and Risk sharing – a tweak to the program 28 Group Captive Potholes 9. Lack of Good Corporate Governance/Internal Controls a. Employ corporate best practices to avoid, anticipate and handle problems • Will insulate directors and the captive from scrutiny • Will ensure that fiduciary duties (care, loyalty) are not breached b. Some suggested best practices • Basic captive governance documentation is in order and followed Memorandum and Articles of Association Offering documents Shareholder/participation agreements 29 Group Captive Potholes 9. Lack of Good Corporate Governance/Internal Controls (cont.) • • • • • • • Engaged directors – knowledgeable and committed Independent directors - possibly Informed delegation to service providers, advisors Form committees of the board and use them Types of committees Role of committees – decisions, reports and recommendations to full board Charters, duties and responsibilities Meetings, minutes Interplay between committees clearly defined Issues may cross into several committees 30 Group Captive Potholes 9. Lack of Good Corporate Governance/Internal Controls (cont.) • • • • • • Board, shareholder, committee meetings occur regularly Minutes Maintain confidentiality Significant governance principals in writing Minutes and resolutions Policies and procedures Establish, test and maintain internal controls/standards Clarify and define reporting lines, responsibilities. Stay engaged, involved and informed! Do not drink the Kool-Aid As Reagan said, “trust but verify” Other protections -For directors and officers -For captive 31 Group Captive Potholes 9. Lack of Good Corporate Governance/Internal Controls (cont.) • Goal is to avoid surprises, anticipate troublesome issues and handle surprises/issues when they do occur Other FS Surprises How they were handled 32 Group Captive Potholes 10. Distributions, Policy Year Closure and Exit Strategy • • • • Distributions well reasoned policy Board flexibility What form – dividends, policyholder returns, credits tax consequences to members, insureds, captive When too early, too late enough, not enough Case Study Impact on surplus and implications Consistency or lack thereof 33 Group Captive Potholes 10. Distributions, Policy Year Closure and Exit Strategy (cont.) b. Closing of Policy Years – Well reasoned policy How long? Too soon? Too long? Flexibility or firm? • Ability to profit from your own loss control efforts and good loss performance • Tail funds, closing into current year, selling the tail c. Understand the exit proposition • Exiting the company as a shareholder • Clear collateral release policy Timing and expectations Balance protection of captive with ability to exit • One-off buyouts Sparingly – precedent issues 34 Anticipating as many potholes and roadblocks as possible, utilize established and tested procedures and principles, this journey has allowed FS Insurance Ltd to stay the course along the road less traveled, and that has made all the difference! Thank you! 35 36