personal liability - New England Association of Insurance Fraud

advertisement

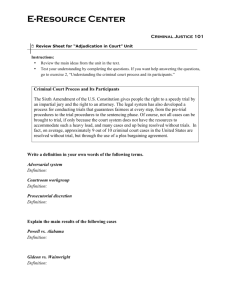

Protecting Yourself From Individual Liability May 12, 2012 PRESENTED BY: DAVID O. BRINK, ESQ. SMITH & BRINK, P.C. 350 GRANITE STREET, SUITE 2303 BRAINTREE, MA 02184 DIRECT: 617-657-0120 CELL: 617-593-4180 DBRINK@SMITHBRINK.COM Materials Prepared By: David O. Brink, Esq. Melissa C. Bruynell ___________________________________________________________________________________________ Massachusetts Michigan New York Pennsylvania Rhode Island New Jersey Individuals working for corporations may be sued! ◦ Example: Tilman v. Brink, 74 Mass. App. Ct. 845 (2009) It is possible for the accuser to become the accused! Why Are SIU Investigators Normally Protected From Individual Liability? ◦ A legal relationship called agency is formed when an employee works for an employer, permitting the “agent” (SIU Rep.) to represent the “principal” (the Insurance Company) in business dealings with “third-parties” (insureds/claimants/witnesses, etc.). ◦ Known as the “agent of the disclosed principal” Rule. Where a third party knows that the insurance company exists and that the employee works for the insurance company (as is almost always the case), the insurance company CAN BE liable on a contract, and the employee is GENERALLY NOT LIABLE. HOWEVER, there are several exceptions to the general rule that “agents” are not personally liable: ◦ A) The parties to the contract intended the insurance employee to be personally liable; ◦ B) When the person working for the insurance company was not an employee, but was an “independent contractor”; When the employee’s conduct was not within the scope of authorized employment. ◦ C) When the employee was on a “detour,” a small deviation from the scope of authorized employment, he or she IS NOT personally liable; however, when the employee was on a “frolic,” a major deviation from the scope of authorized employment, he or she CAN BE personally liable; ◦ D) Serious criminal acts; and, ◦ E) Intentional Torts including: assault, battery, conversion/trespass to chattels (intentional taking of the property of others), trespass to land, false imprisonment, intentional infliction of emotional distress, etc. In other words, there are certain traps that insurance employees can fall into, exposing themselves to personal liability. Insurance company employees face stringent criminal and civil penalties if they do not follow protocol when accessing criminal record information. Massachusetts has very specific rules concerning the circumstances under which Criminal Offender Record Information can be released. Specifically, unless the requestor fits into very narrow categories, mainly involving screening for employment or housing purposes, or has authorization from the individual whose criminal record is being released, the requestor is only eligible to receive the limited information available under “Open Access.” Massachusetts Regulations provide, “A nonlaw enforcement requestor shall not request an individual’s CORI without that individual’s authorization, except when requesting Open Access to CORI.” (803 CMR 2.23). The information available under “Open Access” is more limited than that available under requested or standard access. Proper procedure when requesting an Open Access to CORI is to file a paper submission stating the name and birth date of the person whose record is being requested by first class mail. Full automation of the CORI request system is anticipated in the future. Massachusetts has enacted statutes providing stringent civil and criminal punishment to violators of these procedures. ◦ Pursuant to M.G.L. c. 6, § 177, an offender is liable for actual damages, and in the event of a willful violation, between $100 and $1000 in exemplary fees in addition to attorneys fees. ◦ Pursuant to M.G.L. c. 6, §178, for each offense, an offender may be punished by up to one year in the house of corrections and up to $5000 in fines. ◦ A corporation may be liable for up to $50,000 in fines. A violation of Civil Rights in the handling of an insurance claim can expose an insurance employee to significant civil liability. Not only can a Civil Rights violation subject an insurance company employee to individual liability because it falls under the category of intentional torts and also possibly severe criminal acts, but it can expose that employee to treble damages under M.G.L. ch. 93A. For example, in Ellis v. XXXXX Ins. Co., 41 Mass. App. Ct. 630 (1996), an employee of the insurer allegedly made racially motivated comments and performed racially motivated acts while investigating a claim. The Massachusetts Appeals court found that racial harassment during the investigation of an insurance claim was a triable issue and reversed summary judgment for the defendants. Federal Statute, 18 USCS § 2510, established criminal penalties for “wiretapping” and other privacy violations. Massachusetts Criminal Statute, M.G.L. c. 272, § 99 is a two-person consent law which makes recording a conversation without the consent of all parties illegal. A violator may also be liable for civil damages to the aggrieved party. Misdemeanor criminal statute Massachusetts General Laws, ch.175, § 181. A person may be sued for DEFAMATION when he publicizes language concerning the plaintiff which tends to adversely affect his reputation, and thereby actually causes damage to his reputation. In other words, making statements about claimants, witnesses or insureds to third parties, orally or in writing, which harm their reputations, can expose employees of an insurance company to individual liability. Defamation actions are divided into two categories: ◦ 1) Slander; and ◦ 2) Libel. Libel is the written publication of defamatory statements, whereas slander is the spoken publication of defamatory statements. In Carter v. State Farm Fire & Cas. Co., 850 F. Supp. 2d 946 (S.D. Ind. 2012), a $14.5 million verdict was awarded against the insurer where the Court found that an insurance company employee was guilty of both libel and slander for accusing a claimant of committing fraud. An older case held an insurer vicariously liable for an investigator’s slander of a claimant because the investigator implied that the claimant had been involved in various crimes when speaking with the claimant’s neighbors. Is a person practicing law when he or she conducts an Examination Under Oath? ◦ (…no, but you need to be careful.) Massachusetts criminal statutes not only prohibit disbarred former attorneys from practicing law and non-attorneys from holding themselves out as attorneys, but more relevantly, prohibit any non-attorney from “solicit[ing] or procur[ing] from any such person or his representative, either for himself or another, the management or control of any such claim, or authority to adjust or bring suit to recover for the same.” Massachusetts General Laws, Ch. 221 ◦ Section 41. Attorneys—Discipline—Penalties on Disbarred or Unauthorized Attorneys and for Soliciting Law Business Criminal misdemeanor statute M.G.L. ch. 221, § 41 states, in relevant part, that violators “shall be punished for a first offence by a fine of not more than one hundred dollars or by imprisonment for not more than six months, and for a subsequent offence by a fine of not more than five hundred dollars or by imprisonment for not more than one year. Insurance employees must take care not to give the impression to claimants, insureds and witnesses that they represent them or can provide them with legal advice with respect to their insurance claims. A first offence is punishable by as much as $100.00 in fines and six months in prison. ◦ Subsequent offences are punishable by as much as $500.00 in fines and one year in prison. ◦ Insurance company employees may be exposed to personal liability for instituting criminal or civil matters with improper motive, as doing do can fall under the intentional torts of Malicious Prosecution and Abuse of Process. Today, Massachusetts courts also recognize Malicious Prosecution where the Defendant instituted civil proceedings against the plaintiff with malice, without probable cause and where the proceedings terminated in the plaintiff’s favor. Maxwell v. AIG Domestic Claims, Inc., 460 Mass. 91 (Mass. 2011) Malice may be inferred from the absence of probable cause, but may also be found through an improper motive, such as “vexation, harassment, annoyance, or attempting to achieve an unlawful end or a lawful end through an unlawful means.” Beecy v. Pucciarelli, 387 Mass. 589, 594-595 (1982). Abuse of Process is the use of legal process “to accomplish some ulterior purpose for which it was not designed or intended, or which was not the legitimate purpose of the particular process employed.” Caroll v. Gillespie, 14 Mass.App.Ct. 12, 26 (1982). Abuse of process is a 'form of coercion to obtain a collateral advantage, not properly involved in the proceeding itself, such as the surrender of property or the payment of money.'” Vittands v. Sudduth, supra, quoting Cohen v. Hurley, 20 Mass. App. Ct. 439 (1985). Insurance companies and their employees have been sued for Malicious Prosecution and Abuse of Process on several occasions. For example, the Rhode Island Superior Court denied an insurer’s motion for summary judgment on an Abuse of Process count where the insurer was involved in a fraud sting of the plaintiff, which led to his arrest. The Massachusetts Supreme Judicial Court found that the elements had been established for a showing of Malicious Prosecution against an insurer where the insurer filed a third party medical malpractice suit with significant evidence that the suit was not meritorious. The U.S. District Court in Pennsylvania found an insurer’s instruction to counsel to issue subpoenas and take depositions to allegedly harass a medical provider and allegedly attempt to drive it out of business met the elements for abuse of process. Personal Umbrella Policy ◦ 1. Insuring Agreement: … b) personal injury for which an insured becomes legally liable due to one or more offenses listed under the definition of personal injury to which this insurance applies. Damages include prejudgment interest awarded against the insured. Personal Umbrella Policy (cont.) ◦ …8. Personal injury means injury, other than bodily injury, arising out of one or more of the following offenses: a. false arrest, detention or imprisonment, or malicious prosecution; b. libel, slander or defamation of character or c. Invasion of right of private occupancy, wrongful eviction or wrongful entry. If you have any questions or would like more information, please feel free to contact us. David O. Brink dbrink@smithbrink.com