H571 Week 6 - Behavioral economics

advertisement

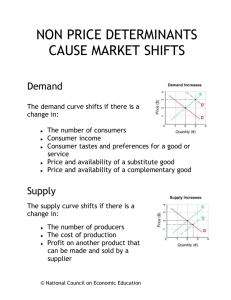

H571 Week 6 Behavioral Economics • Questions re assignment #2 • Discuss why BE is slotted here – Still essentially value-expectancy – But also more socio-structural • Presentations/discussion of all readings – – – – – – Ling: DSC part 1 Schrader: DSC part 2 Azaher: DSC applications Ying: Buttenheim & Asch Anthony: Lee et al Me: Robinson & Hammitt • Activity DSC – Chapter 5 • Behavioral Economics (BE) integrates insights from psychology and economics to understand a person’s values, preferences, and choices • Most commonly applied to behaviors that involve consumption (e.g., smoking, drug use, over-eating) • The paradox that autonomous personal choices to engage in behaviors that are ultimately self-defeating, and associated with major health problems, is at the heart of a BE approach • There is no single super-ordinate theory in BE, but it has two essential characteristics: – Emphasizes the individual person as the unit of analysis – Focuses on understanding the nature of rationality and irrationality in human behavior What is rationality? • BE emerged as a discipline from the programs of research investigating the systematic ways people tend to be irrational. • However, decision making biases are not entirely haphazard, but are present in ways that consistently deviate from the assumption of rationality. • Economic definitions of rationality are diverse, but core features include: – Utility maximization (i.e., people or other economic agents will attempt to maximize positive outcomes, profit, etc.) – Consistency (i.e., peoples preferences will apply equally to equivalent choice and not shift over time) Prospect Theory • Prospect theory reveals that preferences are a function of relative changes in resources – If given the opportunity to make a gamble with a 50% chance to win $150 but a 50% chance to lose $100, very few people will accept it. In contrast, however, if given the choice between definitely losing $100 and a gamble with a 50% chance of winning $50 and 50% chance of losing $200, the majority will take the gamble. • Addictive commodities are substantially overvalued for individuals with addictions • BE hypothesizes that temporal and probabilistic value preferences also contribute to excessive consumption Framework • A strong preference for immediate rewards at the cost of larger delayed rewards, referred to as impulsive temporal discounting (i.e., overvaluation of immediate rewards and devaluation of future rewards), is hypothesized to play an important role in overconsumption • Conversely, insensitivity to risky outcomes, that is, willingness to accept greater probabilities of negative outcomes to gain larger rewards, is also hypothesized to contribute to excessive consumption • The (relative) value of a preference is determined relative to the value of alternative possible options. Quantifying Relative Value • A fundamental law in economics is the law of demand. – Demand: the level of the commodity sought or consumed by an individual at a given price. – Law of demand: all other things being equal, as the cost of a commodity goes up, its consumption tends to go down, eventually terminating at zero. • The relationship between consumption and price can be visualized on a demand curve. Figure 7-3a: Demand Curve Characteristics of demand curves • Consumption at zero or very low cost (the Y-axis intercept) reflects the initial level of consumption, which is referred to as intensity of demand • At the other end of the demand curve, at high prices, demand is typically completely suppressed to zero, reflecting the costs outweighing the benefits – the price that first achieves this is the breakpoint • The slope of the demand curve, summarizing the relationship between consumption and price, is described in terms of elasticity. Characteristics of demand curves • Elastic portions are defined by larger decreases in consumption relative to increases in price. – The point at which demand transitions from being relatively insensitive to price to elastic demand is termed Pmax (i.e., price maximum) – Pmax is an index of elasticity because it reflects how far demand goes before it starts to be affected by costs • Demand at each price translates into varying levels of expenditure, can be translated into expenditure curve – An expenditure curve escalates during the inelastic portion of the demand curve (price is going up faster than consumption is going down) and then decreases once demand is sensitive to prices (consumption is going down faster than price is going up) Expenditure Curve Characteristics of expenditure curves • The peak of this expenditure curve measures the relative value of a commodity, termed Omax (i.e., output maximum) • Omax reflects the maximum amount the individual was willing to spend on the commodity (e.g., drug) • A demand curve tells us a person’s level of consumption if price were no object (Intensity), maximum allocation of resources (Omax), price limits before the costs outweigh the benefits (breakpoint, Pmax), and overall cost-benefit ratio (elasticity) Delay Discounting • Delay discounting is a BE measure of impulsivity – how deeply a reward is discounted based on its delay – = capacity to delay gratification • Indifference point represents the time at which the combination of amount and delay makes the smaller immediate reward equal to the larger delayed reward – People vary in terms of where the switches take place, but the smaller the delay to provoke a switch, the more impulsive the individual • The mathematical properties of delay discounting can provide insight into behavioral self-control • Overvaluation of immediate rewards plays a key role in many unhealthy behaviors Probability Discounting • Probability discounting refers to how sensitive a person is to the risk associated with rewards – i.e., how much a reward is discounted based on the probability of its receipt – As delay discounting is an index of impulsivity, probability discounting is a measure of risk taking • As the larger of two rewards becomes more uncertain, there is greater variability in preferences for larger, riskier rewards compared to safe, smaller rewards. • In contrast to delay discounting, the less sensitive individuals are to increasingly uncertain rewards, the more risky their decision making is considered. – E.g., gambling, substance abuse, unprotected sex Buttenheim & Asch, 2012 • Framing Effects – Loss-framing better than gain-framing • Present Bias – Present desert is more appealing than later protein • Zero Price Effects – Free is more attractive than paying for something – Demand-side vouchers • Bandwagoning and Social Norms – C.f., influence of important others • Loss Aversion – People weight losses more heavily than gains in decisionmaking Lee et al., 2011 • Experimental tests of three BE strategies – default option/choice, – planning, and – asymmetric choice • Tested with human, robot and website scenarios • Found that default option/choice and planning strategies were more effective than control conditions • Good example of a micro-level experimental tests of different strategies – Potentially a good approach to “piloting” something before implementing on a larger scale • Big question of long-term effects of BE approaches Unrealistic Traits of the Classical Economic Model (Robinson & Hammitt, 2011) • Unbounded rationality – Bounded rationality recognizes that our limited capacity to process information may lead us to make suboptimal decisions (c.f., attitudes) • Unbounded willpower – Bounded willpower recognizes that our incomplete selfcontrol may cause us to engage in behaviors we know we will regret (c.f., self-determination and self-efficacy) • Unbounded selfishness – Bounded selfishness refers to the fact that we may act selflessly - the way others would like us to (c.f., desire to please others and social normative beliefs) Neo-Classical Model • Incorporates Expected Utility Theory • Another version of value-expectancy theory • Preferences are defined over consequences – Rather than changes from some reference point • Changes in the probability of a consequence are assumed to be linear • Much behavior still does not follow this model • Prospect Theory developed to accommodate Prospect Theory • Describes how individuals tend to: – Underweight outcomes that are probable in comparison to those that are certain – Be more sensitive to differences in probabilities near zero and one than to intermediate probabilities – Be loss averse (overweight losses relative to gains) – Overweight small risks (esp. when fearsome) – Often insensitive to small changes in risk – Be sensitive to the form in which a choice is presented • Ideas popularized in: – “Nudge” (Thayer & Sunstein, 2008) and – “Predictably Irrational” (Ariely, 2008) BE and Benefit-Cost Analysis • Economics has positive and normative objectives – Aims to both describe the effects of public policies and to evaluate their value • Requires considering two components of human decision-making – One describing choices • To forecast the effects of policies on individuals’ actions • And on prices and allocations – One describing well-being (e.g., health outcomes) • To determine whether these changes benefit or harm consumers • This distinction between behavior and welfare is not necessary in traditional economic models – that – assume that preferences are revealed through behavior Willingness to Pay (WTP) or Accept (WTA) Compensation • Health-risk reductions and environmental improvements cannot be valued directly • Estimated through revealed- or stated-preference research – Reveal-preference studies use data from market transactions or observed behavior – Stated-preference studies involve asking respondents how they would behave in a hypothetical market • WTP represents max. willing to pay for a beneficial outcome or to avoid a harmful outcome • WTA represents min. amount to forego the amenity (e.g., risk reduction) or to accept the harm Robinson & Hammitt: Summary • BE and Regulatory Analysis – Implications for valuation of policy consequences • Three concerns: – Using estimates of willingness to pay (WTP) or willingness to accept (WTA) compensation for valuation – Considering the psychological aspects of risk when valuing mortality-risk reductions – Discounting future consequences • Analysts should avoid making judgments about whether values are “rational” or “irrational” – Avoid paternalistic approach to policy analysis – Describe preferences of those affected, and ensure that these preferences are based on knowledge and careful reflection Take Home Messages • BE applies insights from psychology and economics to systematically understand the factors that influence individuals’ values, preferences, and choices • Demand curve analysis provides a systematic approach to measuring a person’s cost-benefit motivation for a given commodity or behavior • Delay and probability discounting provide methods for measuring impulsivity and risk-proneness • Framing effects, present bias, zero price, bandwagon, social influences, loss aversion • Three traits of rational economic model parallel those of the cognitive side of expectancy-value theories Discuss the topic, relate to complete DSC chapter, related to expectancy-value theories, come up with a new example, and present to the class (7 min prep, 7 min presentation) 1. Prospect Theory (DSC, R&H) & Framing Effects (B&A) 2. Delay & probability discounting (DSC), Present Bias (B&A) & Time Preferences (R&H) 3. Zero Price Effects & Loss Aversion (B&A) 4. Bandwagoning and Social Norms (B&A) 5. Default, asymmetric and planning options (Lee et al) 6. Willingness to Pay & Willingness to Accept (R&H) 7. Unbounded rationality, willpower, selfishness (R&H)