Topic 7 Endowment effect1

advertisement

Econ 203: Topic 7

The choice between consumption and

leisure revisited

The Slutsky formulation

Reading: Varian Chapter 9

pages 166-171 and 174-175

Y

PxX= PxXc + PyYc

A

Y0

0

X0

X

Earnings

Leisure

=R

Total hours = T

W0

c

T

P

A

C0

0

R0

Leisure

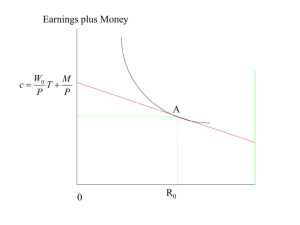

Earnings plus Money (M/P)

W0

M

c

T

P

P

A

C0

0

R0

Leisure

Earnings plus Money

Price of leisure rises

from W0 to W1

Budget constraint

swivels in

W0

M

c

T

P

P

A

C0

0

R0

Leisure

Earnings plus Money

U1

W1

M

c T

P

P

But the reward for

work also rises

shifting the BC out

W0

M

c

T

P

P

A

0

RA

Leisure

Earnings plus Money

U1

W1

M

c T

P

P

U2

New Equilibrium at D

W0

M

c

T

P

P

D

A

0

RA

RD

Leisure

Earnings plus Money

U1

W1

M

c T

P

P

U2

Moving income back to

U1 (Hicks)

W0

M

c

T

P

P

D

A

0

RA

RD

Leisure

Earnings plus Money

U1 U2

W1

M

c T

P

P

Deriving equilibrium at new

prices on U1 we find point B.

RA-RB is the Hicksian substitution

effect {A-B on diagram}.

W0

M

c

T

P

P

D

B

0

A

RA

RB RD

Leisure

Earnings plus Money

U0

W1

M

c T

P

P

Can also look at what

demand would have

been on original leisureprice-rise line. That is

point C.

U1 U2

W0

M

T

P

P

D

B

A

C

0

RA

RB RD

Leisure

Earnings plus Money

U0

W1

M

c T

P

P

U1

U2

RB-RC is the standard

income effect {Point B

to C on the diagram}.

W0

M

T

P

P

D

B

A

C

0

RC

RA

RB RD

Leisure

Earnings plus Money

U0

W1

M

c T

P

P

U1

U2

RC-RD is the endowment

income effect {Point C

to D on the diagram}.

W0

M

T

P

P

D

B

A

C

0

RC

RA

RB RD

Leisure

U0

W1

M

T

P

P

U1

Substitution

Effect

A -> B

U2

W0

M

T

P

P

D

B

A

C

0

RC

RA

RB

Leisure

RD

U0

W1

M

T

P

P

U1

Income Effect

B -> C

U2

W0

M

T

P

P

D

B

A

C

0

RC

RA

RB

Leisure

RD

U0

W1

M

T

P

P

U1

Endowment

Effect C -> D

U2

W0

M

T

P

P

D

B

A

C

0

RC

RA

RB

Leisure

RD

Now we have a substitution effect from A to B,

causing the number of hours of leisure worked to

fall

from RA to RB

Next we have an income effect from B to C,

causing the number of hours of leisure to fall from

RB to RC

Finally we have an ENDOWMENT effect from C

to D,

causing the number of hours of leisure to rise

from RC to RD

• Remember that we usually assume that leisure is a

normal good. The rise in the price of leisure

causes us to buy less of it (from RA to RB).

•

• A rise in the price of any good makes us poorer,

and since ‘real income’ is lower (ignoring the

endowment effect) we buy less leisure (the fall

from RB to RC ).

•

• But now if we take account of the endowment

effect our total income has risen, since for every

hour of work we actually do, our pay has

increased, and so we will consume more leisure

(the move from RC to RD).

•

• Get the idea!

• Good, because now we are ready for the

nasty bit.

•

• The Endowment Slutsky Equation

•AAAGGGGHHH

Slutsky Endowment Effect

•

•

•

•

Varian Ch 9

And Especially

9.7 - 9.9

& the Appendix

Terminology:

•

•

•

•

•

•

•

•

I is Income

M is Money or unearned income

W is the nominal wage rate, (w real wage)

P is the price level

T is the total number of hours in the day

R is the number of hours of leisure taken

L is the hours of work done.

c is our actual or real consumption of goods

The Endowment Slutsky Effect

Our consumption of Leisure depends on the price of

R (W) and our overall level of Wealth. We are

endowed with M amount of Money and T units of

Time. So our Wealth (I) is:

I = M +WT = Pc+WR

or

c = (T-R)W/P +M/P

which in real terms

implies that

c = (T-R)w +m,

where w is the real wage rate and m is real money

balances

The Endowment Slutsky Effect

So R depends on w and I which is also a function of

w.

That is R[W, I(W)]

So

_

R[W , I (W )] R[W , I ] R I

W

W

I W

The Endowment Slutsky Effect

_

R[W , I (W )] R[W , I ] R I

W

W

I W

But if we differentiate I=M +WT with respect to W

we get T

_

R[W , I (W )] R[W , I ] R

T

W

W

I

The Endowment Slutsky Effect

_

R[W , I (W )] R[W , I ] R

T

W

W

I

What about the first term on the RHS?

It is the change in R when Income cannot change

-that is, it’s the usual Slutsky effect

_

R[W , I ] R

R

R

W

W

I

S

The Endowment Slutsky Effect

_

R[W , I (W )] R[W , I ] R

T

W

W

I

_

R[W , I ] R

R

R

W

W

I

S

The Endowment Slutsky Effect

R[W , I (W )]

W

R

T

I

R

R

R

W

I

S

The Endowment Slutsky Effect

R[W , I (W )] R

R

R

R

T

W

W

I

I

S

Substitution

Effect

RA to RB

Income Effect

RB to RC

Endowment Effect RC

to RD

or in other words, the overall effect is:

the substitution effect (from RA to RB),

minus the usual income effect (from RB to RC)

plus the endowment effect (from RC to RD).

The Endowment Slutsky Effect

R[W , I (W )] R

R

R

R

T

W

W

I

I

S

R[W , I (W )] R

R

(T R)

W

W

I

S

The Endowment Slutsky Effect

R[W , I (W )] R

R

(T R)

W

W

I

S

Differentiating c = (T-R)w +m, with

respect to the real wage yields

R

R R I

w U w I w

R

R

R

R T

I

w U w

Hours worked

when Free to

Choose

Earnings plus Money

Holdings

U2

C

*

M/P

0

R*

T hours

Earnings plus Money

Holdings

But what if you have

to work a 40 hour

week minimum?

U2

C

*

M/P

_

0

R

R*

T hours

Utility falls to U1

and work and

consumption rise

Earnings plus Money

Holdings

U1

_

U2

C

C

*

M/P

_

0

R

R*

T hours

Earnings plus Money

Holdings

Note if choose not to

work, get U0

but since U1 is greater

will prefer work.

U0 U1

_

U2

C

C

*

M/P

_

0

R

R*

T hours

But if like leisure more

you have steeper U

curves and so choose not

working U1 to work U0

Earnings plus Money

Holdings

U0

U1

U2

C

*

M/P

0

R*

T hours

Exercise Topic 7

• Bottom Line:

• Changes in w/p over the cycle will not

induce much variation in hours worked

• However, changes in overtime rates will

(pure substitution effect)

• Main effect will be on marginal individual

making the work/no-work decision

• In particular for higher w/p people are more

likely to make the effort to be in

employment

What are the implications of this for our

Labour Demand & Supply diagrams?

W/P

lD

lS

W/P

lD

lS

W/P

lD

lS

lS’

ll

lu

W/P

lD

lS

lS’

ll

lu

W/P

lD

lS

lS’

ll

lu

W/P

lD

lS

lS’

ll

lu

Non-Assessed test 1998/99

Frequency

40

30

20

10

0

29.9

39.9

49.9

59.9

69.9

More

Non-Assessed test 1998/99 &

Non-Assessed test 2000/1

Frequency

40

30

20

10

0

29.9

39.9

49.9

59.9

69.9

Better, but still not very good

More

203 Assessed test

98/99

99/00

50

40

30

20

10

0

90-100

80-89

70-79

60-69

50-59

40-49

35-39

30-34

<30