Slides for Part 1 - Rose

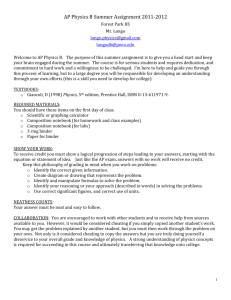

advertisement

Modeling Tradeoffs

x2(Things)

x2=Income

Lots of stuff

X

What else do we need in order to

build a theory that is useful for

analyzing decisions such as these?

X2

?

1

2

x

x

1

1

1

x

,

x

X

1

2

X

3

0

0

0

x

,

x

X

1

2 (An “Endowment”)

0

2

x11

24 hrs.

x10

x1 =Time

(Leisure)

Budget Constraints

0

m

x20

x2

Budget Line

(efficient

consumption)

Feasible

consumption

set

p1

p2

x1

m0

x10

Budget Constraints

Price Changes

Income Changes

x2

x2

m1

p2

m

p2

m0

p2

p11 p10

p10

p2

p11

p2

m

p10

m1 m0

m

p11

x1

p1

p2

m0

p1

m1

p1

x1

Modeling Preferences

Fundamental axioms:

1. Completeness

∀[A, B]∈X , A B, B A, or A ~ B

2. Transitivity

If A B, and B C, then A C

Necessary for rank

ordering and

functional

representation.

3. Continuity

Supplemental axioms:

4. Monotonicity

5. Convexity

If 0 < t < 1, then [tA + (1 t )B] A ~ B

Defines “wellbehaved

preferences.

Indifference Curves, Preferences, and Rational Ordering

x2

x20

X0

X2

x22

x12

X 2 X 0 ~ X1 X 3

x10

X3

x12

X1

x11

x1

Indifference Curves, Preferences, and Rational Ordering

x2

x20

X0

X2

x22

x12

x10

X3

x12

X1

x11

x1

Indifference Curves and Utility

x2

U x1 , x2 x10.5 x20.5

16

U = 16

8

4

0

0

4

8

16

U=8

U=4

x1 U = 2

Bentham and Utilitarianism

“By utility is meant that property in any object,

whereby it tends to produce benefit, advantage, pleasure,

good, or happiness (all this in the present case comes

to the same thing) or (what comes again to the same

thing) to prevent the happening of mischief, pain, evil,

or unhappiness to the party whose interest is

considered …

“The interest of the community then is what? -- the sum

of the interests of the several members who compose it.

Jeremy Bentham

1748 – 1832

“An action then may be said to be conformable to the principle of utility* … when

the tendency it has to augment the happiness of the community is greater than any

it has to diminish it.”

An Introduction to the Principles of Morals and Legislation, 1780

*Elsewhere, the greatest happiness principle.

ux1 , x2

2 x1 3x2

ax1 bx2

x1 x2 2

2 x1 x2

ln x1 x2

min ax1 , bx2

x1 x2

x1a x2b

x1 2x2 1

MU1

u x1 , x2

u x1 , x2

MU 2

x2

x1

MRS1, 2

MU 1

MU 2

Individual Demand

x2

m

p2

p1

m

p12

m

p11

p12

p11

p10

D

x1

m

p10

x1

Substitution & Income Effects: Normal Good

The Slutsky Approach – “Pivot and Shift”

Price Decrease for x1 (p1↓)

x2

A

B

A’

I1

I0

0

1

1

1

x

2

1

x

SE

x

IE

x1

Substitution & Income Effects: Normal Goods

The Slutsky Approach – “Pivot and Shift”

x1 (p1, p2, m) = 10 + m/10p1

p10 = 3

p11 = 2

m0 = 120

x2

Original Demand (A): {x10, x20} = {14, 78}

Compensated Income, m’ = 106

Compensated Demand (A’): {x1’, x2’} = {15.3, 75.4}

B

88

SE

IE

75.4

78

A

A’

New Demand (B): {x11, x21} = {16, 88}

I1

I0

14

x1

15.3 16

1.3 = SE IE = 0.7

Substitution & Income Effects: x1,Normal Good; x2, Inferior Good

The Slutsky Approach – “Pivot and Shift”

x2

SE

IE

A

A’

B

I1

I0

x1

SE

IE

Substitution & Income Effects: Inferior Good

The Slutsky Approach – “Pivot and Shift”

Price Decrease for x1 (p1↓)

x2

B

I1

A

A’

I0

0

1

2

1

x x

SE

IE

1

1

x

x1

Substitution & Income Effects: Giffen Good

Slutsky Approach – “Pivot and Shift”

Price Decrease for x1 (p1↓)

x2

B

I1

A

A’

I0

2

1

x

0

1

1

1

x

x

SE

IE

x1

Substitution & Income Effects: Normal Good

The Hicksian Approach – “Rotate and Shift”

Price Decrease for x1 (p1↓)

x2

A

B

A’

I1

I0

0

1

1

1

x

2

1

x

SE

x

IE

x1

Buying & Selling

x2

x2

Initial

Endowment

x 20

Net Demander

of good x

2

I0

0

2

Initial

Endowment

Net Supplier

of good x

20

2

x 20

0

1

x

0

1

Net Supplier

of good x1

x1

10

x10

Net Demander

of good x1

I0 x

1

Buying and Selling: Consumer Choice Theory with Endowments

Decomposition of effects of a price change into substitution, ordinary income and endowment income

effects: Price decrease of a good currently being demanded.

x2

20

x20

The agent is a net

demander of x1;

thus, when its price

falls, the agent’s

purchasing power

goes up – the

ordinary income

effect is positive.

•

The value of the

agent’s endowment

is dependent upon

the price of x1;

thus, when its price

falls, the agent’s

purchasing power

goes down – the

endowment income

effect is negative.

•

E = { 10 , 20 }

•

•

{

}

A= x ,x

0

1

0

2

•

I0

10

x1

x10

SE

OIE

EIE

Buying and Selling: Consumer Choice Theory with Endowments

Decomposition of effects of a price change into substitution, ordinary income and endowment income

effects: Price increase of a good currently being demanded.

x2

20

The agent is a net

demander of x1;

thus, when its price

increases, the

agent’s purchasing

power goes down –

the ordinary

income effect is

negative.

•

•

E = { 10 , 20 }

x20

•

•

10

•

A = {x10 , x20 }

x10

OIE

EIE

SE

The value of the

agent’s endowment

is dependent upon

the price of x1;

thus, when its price

increases, the

agent’s purchasing

power goes up –

the endowment

income effect is

positive.

x1

Buying and Selling: Consumer Choice Theory with Endowments

Decomposition of effects of a price change into substitution, ordinary income and endowment income

effects: Price decrease of a good currently being supplied.

x2

•

x

0

2

A = {x10 , x20 }

•

•

•

20

• E = {

x10

10

SE

EIE

OIE

0

1

, 20 }

x1

Buying and Selling: Consumer Choice Theory with Endowments

Decomposition of effects of a price change into substitution, ordinary income and endowment income

effects: Price increase of a good currently being supplied.

x2

•

x

0

2

0

2

•

A = {x10 , x20 }

•

•

E = { 10 , 20 }

•

x10

OIE

EIE

SE

10

x1

Buying and Selling: Consumer Choice Theory with Endowments

Decomposition of effects of a price change into substitution, ordinary income and endowment income

effects: Price increase of a good currently being supplied.

x2

An outcome illustrating perfectly inelastic

demand for x1 …

•

•

x

A = {x10 , x20 }

0

2

•

•

E = { 10 , 20 }

•

0

2

x10

OIE

EIE

SE

10

x1

Labor-leisure tradeoffs and labor supply

x2 = consumption, c

C0 + (w/p)L0

•

c0

A

•E

C0

l0

Leisure

L0

Labor

x1 = leisure, l