Implementation of Health Care Decisions

advertisement

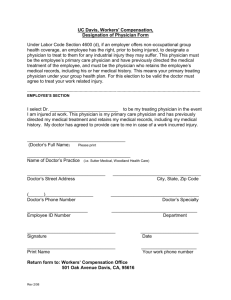

Healthcare Law I 1/9/2012 4:22:00 AM - Principles from Better, A. Gawande, that apply to practice of healthcare law: - PPACA = new healthcare reform act 1) diligent 2) doing right 3) ingenuity I. Intro to Healthcare System (Players, Payors, and Policers in the U.S. Healthcare System) - US used to be the only developed nation in the world that didn’t have a “universal healthcare” system; government did contribute to Medicaid, Medicare, VA, CHIP children’s health, etc. (about 27% of people’s healthcare) 60% of country received healthcare insurance from their job (16%) A lot are uninsured: some can’t afford it & some opt against it - Through the system person gets sick; goes to primary care physician; then specialty physician; then hospital or testing facility; then pharmacy; then person gets better - Players in system consumers on the bottom, then providers, then payors, and finally regulators/enforcers Consumers - patients, sick/injured people, etc. o Important issues: looking for affordable, quality care and access to care (i.e. location, finances, discrimination, etc.) Providers - hospitals, specialty hospitals, ASC’s (ambulatory surgery centers multi-specialties and single specialty), public health clinics, mental health centers, physicians, diagnostic imaging providers, ESRD facilities (end-stage renal disease), nursing homes, etc. o Physicians: Primary Care physicians (who can always refer) Family Practice Physicians Pediatricians OB’s Mid-level providers Nurse practitioners, PAs, etc. Specialists Referring: Neurosurgeons Cardiologists Orthopedists Oncologists Radiologists (may refer - interventional) Anesthesiologists Pathologists Payors - Medicaid, Medicare (who do have to pay a premium), VA, private insurance (BCBS & deductibles, co-pay’s, etc.), patients, workers’ comp programs, lawsuits (damages), charity care (no payment), etc. o Almost 50% of MS is on Medicaid o Important issues: low cost, value for the amount paid, etc. Regulators - government is the big healthcare regulator o Important issues: compliance, quality control, to ensure no discrimination, no fraud o There are many state & federal government agencies that regulate hospitals o Major regulatory schemes: CON laws - cert of need EMTALA HIPAA - privacy law Dermatologists Non-referring: ERISA - pension plans, group insurance plans UHCDA - uniform healthcare decisions act about informed consent STARK - Pete Stark - involving referrals; “anti-self-referral law” ANTIKICKBACK STATUTE - paying for referrals FCA - false claims act Interrelationships o Physician/hospital relationship Sometimes physicians are employees of the hospital (usually nonreferring doctors), but mostly they are not Medical staff membership - loose affiliation of all the doctors that have been granted privilege to practice in the hospital Credentialing process must be completed in order to become a part of the medical staff Documents (bylaws, fair hearing plan, etc.) Peer Review Doctors can put patients into hospital = referral to hospital Patients go into hospital voluntarily (i.e. ER doc) If doctor is employed by hospital, doc gets salary but no direct money from patient If not an employee, doc gets paid a “professional fee” and hospital gets paid “technical fee” for aspirin, bed usage, etc. 2010 Healthcare Reform Brief History The Patient Protection and Affordable Care Act (PPACA) - March 23, 2010 The Health Care and Education Reconciliation Act - March 30, 2010 Key Implementation Dates: – Immediately after passage – September 23, 2010 (6 month mark) – January 1, 2011 and annually thereafter – Other dates as designated in implementing regulations Key Provisions for 2010-11 Grandfathered Plan Provisions o Any plan that existed on the date of passage 3/23/10 could stay in effect, sort of but not absolutely (can't be grandfathered into everything) o Grandfathered status could be forfeited by these plans If after 3/23/10 wants to eliminate all coverage for a particular condition (want to not cover diabetes anymore, etc.) Could not increase co-insurance amounts Could not increase annual benifit amounts There is no way they could stay the exact same, eventually would lose grandfathering Pre-Existing Conditions - Can no longer impose on people under 19, after 2014 can't do this at all (any condition that was present before coverage whether or not diagnosis had occurred) o Under 19 - Can't impose on people, can't use PEC (after 6 months) o Everyone - After 2014 -Lifetime Maximums - No lifetime maximum on ESB 6 months after passage What are essential health benefits - ESB, who the hell knows - Annual Maximums - on ESBs are being phased out - 4 phases PPACA Interim Regulations -Dependents - now goes up to age 26 (children, step, foster, adopted) Can't increase premium for adult child, but can charge more if you add one to policy -Rescission of Coverage - retroactive cancellation of a policy You can't rescind policies anymore except in case of fraud or material misrepresentation of facts You can still cancel prospectively, you just can't rescind (ask for benefits paid back) You can still cancel for unpaid premiums -Post-2011 Effective Provisions Individual Mandate - by 2014 all citizens are required to purchase minimum essential coverage (term of art) Exceptions o American Indians - o Incarcerated Persons o Those with religious objections o Those with financial hardship (below tax filing threshold) $18700 per couple in 2009 Penalty for non-compliance with individual mandate 2014-$95 per person or 1% of taxable income 2015-$325 per person or 2% of taxable income 2016-$695 per person or 2.5% of taxable income After 2016 it will increase by a cost of living increase A maximum of 3 times the flat rate for families -Health Benefit Exchange (every state must have one) o Like Travelocity for insurance o Supposed to be user-friendly and easy (is this run by the same government, haha) o UT, MA, MI already have one o It will offer 4 levels Precious metals - Bronze, Silver, Gold, and Platinum (60, 70, 80, and 90% coverage) They have to be qualified health plans (not sure what this means) Available to individuals and small groups (1-100 people) -Expansion of Medicaid -It will cover people under 60 with incomes under 133% of federal poverty level - Add 14,000,000 new medicaid - The gov't will pay the first 2 years of all additional cost (for new people) - After this they will cover 90% - All new beneficiaries will receive a package equivalent to something bought through the exchange (probably bronze or silver) -Tax/Fee Related Provisions - Medicare (2013) o Payroll Taxes (has always been 1.45 %, now it will be 2.3%) o If you make over $200,000 as a single or $250,000 as a couple there will be an addition 3.8% tax on unearned income -Industry Specific Revenue Raising Provisions - Insurance - $8 billion fee due to the gov't, by 2018 it goes to $14.3 billion - Pharmaceutical - $2.3 billion, 2018 $4.1 billion, 2019 back to $2.3 and stays - Medical Device Mfrs. - Excise tax of 2.3% -Impact to Employers - generally they will have to provide affordable coverage to employee and if they go to exchange and get a credit they get penalized - Small employers will get credits if they offer health insurance to employees - Middle sized want get anything really o For instance, if 1 employee goes to exchange and receives credit they receive $2000 penalty - Large employers will get penalized if they don't offer insurance affordably -Cost - $938 billion over ten years (CBO) o Covers additional 32 million by 2019 o Leaves 23 million uninsured o Provisions effective various times from NOW through 2019 Tension over public option - Senate didn’t want to include a public option & the House firmly wanted it; House did adopt Senate’s version with a few changes *March 23, 2010 - President Obama signs into law the Patient Protection and Affordable Care Act o Very important date since certain provisions must happen 6 months & also 1 year after this date - Public option = government-paid insurance PPACA doesn’t have a public option, but instead created a state-based American Health Based Exchange - Changes to Insurance industry - no pre-existing conditions anymore = insurance companies can’t deny coverage on this basis anymore People will now avoid paying premiums & wait until something bad happens until procuring insurance o What is the long-term effect on private insurance companies? economic problems CON Law 1/9/2012 4:22:00 AM - Mornings on Horseback, David McCullough - Cordato thinks CON laws should be repealed & that there should be a free market in health care Are CON laws productive/destructive? What is the CON Law and Why is it here? - 1974: National Health Planning and Resource Development Act Intent to have major healthcare services/equipment pre-approved - Legislative intent: Insure quality healthcare Insure access to indigent population, etc. - 1987: government repeal of Act followed end of cost-plus reimbursement 15 states dropped CON programs 35 (including MS) still have them CON Process Governed by: - MS State Dept of Health State Health Plan o Issued each year, effective 7/1 Parameters for Obtaining CON - CON granted only if Dept determines: Need exists Other specific/general criteria are satisfied o I.e. X amt of MRI scans per year; X amount of people in order to have an open heart area, etc. Indigent care o “R/ amount of indigent care” is defined by MDOH as: that amount comparable to the amount of indigent care offered by other providers of the same service in the same geographic area What about being around providers that refuse to provide Medicaid services? (especially MS) Access to indigent patients MCA §41-7-191 (sets out everything that needs CON approval) - Requires CON approval for any of the following 10 types of activity: 1. Any expenditure that exceeds the “capital expenditure threshold,” as defined by MDOH o $1.5M for major medical equipment o $2M for anything else 2. Construction, development, establishment of a new health care facility o “Health Care Facility” = hospitals, nursing homes, comprehensive medical rehab facilities, ambulatory service centers, home health agencies o NOT doctors’ offices, dentists’ offices, diagnostic testing facilities 3. Relocation of a health care facility or portion thereof, or major medical equipment o Unless within a mile; AND o Costs less than capital expenditure threshold What is a “portion” of a health care facility/service? CON Manual says wing, unit, service, or beds = parts of a facility 4. These always require CON: o Open heart surgery, cardiac catheterization, skilled nursing beds, home health services, MRI/PET scanners* (exam Q), radiation therapy, ASC (if single specialty), LTAC service, invasive diagnostics, swing beds, etc. 8. Relocation of one or more health services (within mile, under cap, etc.) 6. Acquisition or control of “major medical equipment” (if your replacing a new one since old one worn out, then you don’t need CON if bought at FMV) 7. Change in ownership 10. Any capital expenditure b or on behalf of a health care facility not covered in 1-10 above o Can’t have someone else build for you, and then you buy from them trying to avoid CON laws To obtain CON: Satisfy 4 general goals of State Health Plan: o To prevent the unnecessary duplication of health resources o To provide cost containment o To improve the health of MS residents o TO increase the acceptability, accessibility, continuity and quality of health services Specific Standards and Criteria: - Open Heart Surgery MUST show you have MIN pop of 100K people; 150 surgeries per year by end of 3d year; other providers in area doing 150 surgeries per year for 2 years; staffing levels of personnel and location; data maintenance The way to show required amount of surgeries hospitals usually: 1) bring in other doctors with established client base, or 2) bring in doctors that sign affidavits to state he will refer at least X amount of heart surgeries to this hospital per year - MRI Services/Equip*** MUST show 2700 procedures per year by end of year 2; existing units must be performing at least 1700 procedures a year; full range of diagnostic imaging modalities available; staffing levels personnel and location; data maintenance - Acute Care Beds 3 “bed need formulas:” 1) counties with no hospital - state average below is the base; 2) counties with a hospital - Average daily census of existing hospital in a county (how many beds are occupied daily): ADC + K * √ADC; 3) counties with rapidly growing populations - if county is projected to grow at least 10% & has population of 140,000 & there must be fewer than 3 beds per person MS 1.72 bed per 1000 K = 2.57 (confidence factor) - ASC’s 1000 surgeries per operating room per year; population base of 60,000 within 30 minutes; existing facilities in ASPA have done 800 surgeries per room per year in most recent year; economically viable in 2 years; physician support within 25 miles; other services available Haven’t granted one of these if several years since no facility existed then when it was passed - St. Dominic v. MSDOH and Methodist (1998) 1) Can a new hospital be a relocation when nothing of substance is being relocated? o MSSC said DOH has authority to adopt its own definition of terms 2) Can designation of “relocation” eliminate the statutory requirement of proof of need for the project? o Still have to meet the need requirement 3) Is there substantial objective evidence in the record of need for a new hospital in Jackson? o Not needed; but DOH wanted new hospital, so they created a new standard of “any specific advantage” (i.e. anything good from new hospital) -- BUT MSSC said this is not acceptable o Methodist pointed to caring for the “indigent” in Jackson - but they wanted to build it in NE Jackson (and they had by this time) - St. Dominic v. Madison County Medial Center (2006) - St. Dom wanted to move beds, staff, furniture, really “relocate” MSSC said NOT a relocation since you will be hiring new people, etc. - it would be a New hospital Methods to Satisfy the SHP’s “Need Requirements” - “The MSDH may use a variety of statistical methodologies including, but not limited ot, market share analysis or patient origin data to determine substantial compliance with projected need and with applicable criteria and standards in this Plan.” - Some sets of standards prescribe formulas for projected need Use prescribed formula Use another methodology o Recent MRI cases - no published decision - Where there is no prescribed formula, a variety of methodologies have been approved by the Dept and on appeal: Population calculations based on patient origin data Sworn affidavits by supporting physicians Reference to historical utilization and document growth of practices -MSDH v. Natchez Community (1999) - HUGE holding “Unsupported statements by physicians do not constitute substantial evidence upon which Department should grant CON” o Significant deference give to MSDH on CON review o Substantial evidence = “more than a scintilla or a suspicion” General Review Criteria - 16 general review criteria apply to every project - those with specific criteria and those without Economic viability (making profit in third year, even a penny) Need, generally, for project No significant adverse impact to existing service providers o A shuffle of service already provided will not be approved o State wanted to protect existing providers Quality of care (existing providers) Others: staffing requirements, etc. Procedure for Obtaining CON: - Step 1: Notice of intent to Apply for CON (30 days before filing application) - Step 2: File CON application with MDOH CON applications considered on schedule of “review cycles” Filing dates Dec 1, Mar 1, June 1, Sept 1 o Very important to file on right day to ensure the right state health plan will apply; only hospital with an application in at that time versus others trying to apply then, etc. Filing fee o Not less than $1250 or more than $75,000 - Step 3: Application must be “deemed complete” 30 days from filing opportunity to submit additional information - Step 4: Comment period 30 days - letters accepted from affected parties - Step 5: Department issues its “staff analysis” First indication of whether application will be approved or disapproved - Step 6: “Affected parties” may request a hearing on the application Called a hearing during the course of review Must be requested within 20 days after issuance of the staff analysis The applicant may request a hearing IF the application is recommended for disapproval - Step 7: Hearing within 60 days of hearing request Presided over by hearing officer (employee of AG) Parties submit proposed finding with 30 days of transcript - Step 8: Hearing officer’s findings/conclusions - Step 9: State health officer announces the Department’s decision at the next monthly CON announcement meeting Appeals from MDOH - First Appeal : Chancery Court Appeal within 20 days of MDOH Final Order Applicant may appeal to Hind Co. or home county Opponent may appeal only to Hinds Co. Chancellor must rule within 120 days from Final Order of MDOH or MDOH deemed affirmed - Second Appeal: MS Supreme Appeal within 30 days from Chancery decision Oral argument granted if requested - Standard of Review - same at both levels - Timeline - usually around 273 days for Final Decision from MDOH; day 423 Appeal to Supreme, sometimes can take a year just to wait at Supreme level SO CON Law - Pro’s: prevents unnecessary duplication; curtails free market/competition; increases efficiency; decreases costs; and maintains quality Con’s: Health Insurance Portability & Accountability Act 1/9/2012 4:22:00 AM Privacy Issues - FL: Woman brings teenaged daughter to work at hospital. Leaves her unattended at computer. Girl logs in, looks up patient phone numbers and calls people to tell them they’ve tested HIV positive. One patient attempted suicide Issues like the above situation lead to the need for privacy rules for medical files, information, etc. HIPAA: Background - Enacted in 1996 - HITECH Act (in ARRA) February 2009 HIPAA must be complied with; government must inspect hospitals & audit to ensure HIPAA is being complied with - Intended to Protect privacy & security (how to protect electronic info, communications, etc.) - Enormous source of practice due to government’s current treatment of it HIPAA’s Overall Goals - Provide continuity & portability of health insurance benefits to people in between jobs - Ensure security and privacy of individual health information (Only one you need to know) - Reduce administrative expenses in the heath care system - Provide uniform standards for electronic health information transactions - pro 1. Who is covered? Covered entities - determined by 3 Q test o Does business furnish, bill for, or receive payment for health care in the normal course of its business? (if YES, continue; if NO, not an entity) o Does business conduct covered transactions? (exchange of electronic healthcare info b/t payor and provider) o Are any of those covered transactions conducted in electronic format? I.e. anyone who takes Medicare/Medicaid must do so electronically o EX: hospitals, clinics, nursing homes, imaging centers, home health, counselors, social services, labs, ambulance services, physicians, etc. Business Associates: people or other businesses not a part of health provider’s workforce who assist covered entity which involves exchange of patient information o I.e. outside billing company, lawyer, data storage company/facility o ALSO covered under HIPAA; so they must have HIPAA compliance plan & train their employees to comply with HIPAA 2. What is protected & when? “Individually Identifiable Health Information” (IIHI) anything about one’s physical/mental health that is attached to name, SS#, phone #, address, etc. o Can de-identify information & then it isn’t protected “Protected Health Information” (PHI) o Relates to physical/mental health o Individually identifiable o Created or received by covered entity EX: medical records, billing information, prescriptions, patient charts, ID bracelets, Different formats: (white boards, spoken, emails, voicemails)etc. Even the fact that somebody has come to see them (leaving the sign-in sheet out) Serious penalties under HIPAA if PHI is used for marketing purposes o HIPAA 18 BASICALLY, you may not do anything with someone else’s PHI - unless: o HIPAA permits it; OR o You have a valid authorization from that person (a “HIPAA-compliant authorization”) - Do you have CE (covered entity) or BA (business associate)? if NO, HIPAA doesn’t apply; if YES, continue to next - Do you have PHI? if NO, HIPAA doesn’t apply; if YES, continue to next - Does HIPAA say you can release it? if NO, can NOT release it (unless authorization) TPO (typical permitted releases) = treatment, payment, operations hospital can fax/send medical records & PHI (example of if HIPAA does apply, but can release) Can send info to insurance company, medicare/medicaid, etc. If your state law is more stringent then you have to go by that (like CA's scheme basically supplants HIPAA, preemption, typically called a subpoena rule) BUT: how much can you release? o Minimum Necessary Standard Applies with every disclosure except: Treatment - when physician wants patient’s records, should send everything Law Enforcement Needs (some) Authorization - can turn over all unless limited by patient In every other circumstance, only turn over the Minimum Amount necessary to satisfy order, etc. Permitted Disclosures - Treatment - Payment - Healthcare Operations: peer review processes, quality assurances, etc. - When required by law: court order, etc. (BUT if patient has received notice of the subpoena & has had opportunity to object, then documents can be released) - To the patient (or his legal representative) - With Valid authorization EX: mother withdraws child from daycare due to learning another child was HIV positive in the course of her work = no problem EX2: nurse tells other mothers that other child with HIV positive = BIG problem 3. What duties does HIPAA impose? Requires training of ALL employees on how to comply with HIPAA Employee manuals must include notification of disciplinary action, termination, etc. 4. What rights does HIPAA grant? Patients’ rights notice of privacy practices; inspect/copy PHI; request amendment to PHI; request contact in particular manner; request restriction to uses/disclosures; and receive accounting of all disclosures (up to 7 years) o Entitled to know their rights; 30 days to inspect/copy their own records, etc. Authorizations - The Covered Entity is required to obtain HIPAA complaint authorizations for uses and disclosures of PHI not otherwise permitted - HIPAA requires that certain information and statements be contained in the authorization Enforcement - HIPAA is enforced by Dept of Health & Human Services - Complaint-driven process (investigations based on individual complaints; but now also government-initiated investigations into compliance) Can have complaints by patients, state AG’s, etc. - CE must have a process to receive & investigate complaints - Requires compliance plan Lose presumption of good faith effort if don't have Have to have compliance/privacy officer Patients' Rights Under HIPAA o Notice of Privacy Practices o Inspect/Copy PHI o Request Amendment to PHI o Request Contact in Particular Manner (ex. don't call my house (don't want family to know yet that I am going to cancer doc)) o Request Restriction to Uses/Disclosures o Receive Accounting of all Disclosures ARRA (HITECH Act) - American Recovery and Reinvestment Act (Feb. 17, 2009) - Breach Notification Rules CE’s must give notice to patient whose info has been breached - written letters sent to those who information has been compromised If breach affects 500+ patients, then CE must publish it to public (tv, paper, etc.) o Must also give notice to HHS who puts it on their website “Incidental breach” = no financial harm, no harm to reputation, etc. - Business Associate Compliance - Mandatory Enforcement Actions - Increased Penalties for Breach - Damages to Individuals - Required audits (HITECH) - AG suits - Penalties for Misuse of PHI by CE Tiered penalty system under HITECH (from $5 - 50,000) Top end penalty under HITECH - $1.5M per year (if deemed to be intentional violation) o Intentional has not been defined (discussion that if you didn't have compliance plan you could be deemed intentional) - Willful neglect - may also include CE who doesn’t have a HIPAA compliance plan (i.e. govt now considers this a “willful neglect” mistake Substantial fines Jail time (up to 10 years) Handout Hypo’s Informed Consent & Uniform Health Care Decisions Act 1/9/2012 4:22:00 AM - 50% severely ill persons with an advance directive - 12% of people whose physician participated in putting the advance directive together - 80-90% physicians who were unaware of the existence of patients’ advance directives Informed Consent Arose from the Nuremberg trials - where Nazi’s performed medical experiments/tests on prisoners SO, idea arose that no one should have any medical procedure without giving consent - 3 elements of “informed consent:” 1) Duty to warn patient or patient’s representative 2) Of all known risks of proposed surgery or treatment 3) So that patient or representative is in a position to make an intelligent decision as how to proceed with surgery or treatment - Consequences of failure to obtain informed consent Unless it specifically follows elements, then any consent obtained is a tort = battery (can lead to high damages) There is an emergency exception in the US (i.e. must be danger of immediate death) Rule of Thumb patient gets to say… always! (doctor may know better, BUT patient says) Exceptions to Consent Requirement - Emergencies Defined as “where treating physician using competent med knowledge that proposed treatment is immediately necessary and that delay from obtaining consent would result in death or serious bodily harm (life, limb, disfigurement, or impairment of faculties,etc.)” o UNLESS there’s an advance directive against proposed treatment - Testing for Infectious Disease Ex: AIDS, blood-born diseases 2 reasons: o Either doctor or hospital needs to know in order to give appropriate care to patient (safer) o Doctor or hospital needs to know in order to protect other patients Governing Law - Miss. Code Ann. §41-41-3, et seq. Governs un-emancipated minors - Modified by Uniform Health Care Decisions Act (UHCDA) July 1, 1998 (after this date, “living wills” are no longer valid & recognized in MS) Governs adults/emancipated minors o Allows “Individual Instructions” o Allows Powers of Attorney for Healthcare Decisions o Allows Advanced Healthcare Directives - Healthcare providers MAY decline to comply with an individual instruction or health care decision for reasons of conscience or if it is contrary to a policy of the institution Ex: Catholic hospital doesn’t believe in abortion ever & is allowed to decline to comply with individual instruction o Largely relies on individual hospital’s policies - UHCDA provides immunity for healthcare or institutions acting in good faith and in accordance with generally accepted healthcare standards Big Q: Can the patient consent? - 3 Key Categories of People: Un-emancipated Minors (MS = under 18) o Generally, if under 18, someone else must give consent for treatment o Who can consent for a Minor? (oral or written consent) (must go from top to bottom; if there is a guardian then if they don't consist then you don't go to parent or sister, etc.) The minor’s guardian or custodian The minor’s parent An adult brother or sister of the minor The minor’s grandparent If none of the above, any adult who has demonstrated “special care & concern” for minor and is available may consent for the minor Any female regardless of age/marital status can consent for herself in matters of pregnancy, etc. Can also consent for her child, but not herself in other matters not related to pregnancy EXCEPTIONS where no informed consent is required: 1) alcohol & drug treatment; 2) venereal disease; and 3) giving blood (if over 17) If minor at least 15 years old seeks help from psychiatrist, doctor can treat that patient without consent & doctor has no obligation to inform parents, BUT he can tell parents despite minor’s objections ((if he tells parents, it’s against HIPAA & then how can he get paid?)) Adults or Emancipated Minors with capacity o “Emancipated Minor” = person under 18 who is or has been married; adjudicated by court as emancipated; adjudicated by court for purpose of making healthcare provisions by court of competent jurisdictions o Who May Consent? Individual Individual instruction (to be documented) Must have capacity; oral or written; may be limited to take effect only upon specified conditions (whatever patient wants) Advanced Healthcare Directive (must be signed, dated & witnessed to be valid) Consent or refuse any treatment Designate healthcare providers Approve/disapprove of tests or life-sustaining machines Artificial nutrition and hydration issues Designated Agent for Healthcare Decisions Power of Attorney Appoints Agent to make decisions Must satisfy certain requirements of validity o Writing; dated on date it was executed; signed by patient; witnessed by 2 people or notary; agent can’t be owner/ee of nursing home where patient is living Agents’ powers are limited in time & scope o I.e. only takes effect when patient loses capacity (ceases to be able to make decisions) o Once patient regains capacity, agency ends o Only goes so far as document says (i.e. he is my agent, but under no circumstances may he consent to DNR for me) o Can't put someone who has capacity in mental health facility CANNOT be witnessed by: o Healthcare provider o Employee of provider/facility; or o Agent 1 witness must be someone other than: o Family member; o Person entitled to any part of estate upon death Revocation: Agent designation o Signed writing or personal communication to healthcare provider required for revocation o Except: divorce/annulment/legal separation - automatically revokes prior designation of spouse as agent Any other part of advanced directive o any clearly manifested manner of revocation is sufficient Multiple Healthcare Directives o most recent one prevails to the extent of any conflict Court-Appointed Guardian Guardian: judicially appointed guardian or conservator Below Agent in authority o Cannot revoke designation of agent Must follow individual instructions/advanced directives of ward o Can't trump advanced directive, just answer questions Decisions require no judicial approval Surrogate Decisions-maker statute Surrogate: individual, other than patient’s agent or guardian, authorized under Act to make a healthcare decision for patient Descending priority: Spouse, unless legally separated; An adult child; (if multiple children, go with majority; if only 2, all disqualified & must go to court) A parent; or An adult brother or sister Court Judicial Decree May be obtained: Where no agent, no surrogate, or surrogate has refused to act There is written request from physician Proper documents are presented to the Court Expense to be borne by patient’s estate or by his or her caretaker (hospitals don’t receive payment) Adults or Emancipated Minors who are incapacitated Un-emancipated Minors & Abortion - MS laws strictest for this in nation; - If under 18, minor needs written consent from both parents or legal guardian REQUIRED If parents are divorced, written consent from the primary custodial parent is ok If one parent in married household isn’t available for giving consent, then the other can give consent If the natural father, adoptive father, or stepfather is also the father of the unborn child, his consent is insufficient Minor can petition court to remove requirement of consent IF it finds minor is mature, well-informed & able to make decision on her own OR that abortion is in minor’s best interest o Only 2 cases where child has petitioned court - both were denied o Grandmother characterized one as “emotionally fragile” and the other found girl was just scared of responsibility Adults/Emancipated Minors with Capacity - May consent to their own treatment - Have the right to refuse treatment - May execute documents recognized by UHCDA I.e. power of attorney, advance directives, etc. - If found to be incapable of making health care decisions, treatment decisions will be governed by UHCDA “Capacity” = Ability to understand significant benefits, risks, and alternatives to proposed treatment & to make/communicate decision about that treatment Adults presumed to have this capacity & there must be a determination that an adult lacks this capacity Determinations of Capacity - The primary physician must make the determination that an individual lacks or has regained capacity -Primary Physician - a physician desingnated " see powerpoint" - Record that determination in patient’s record MUST be recorded in chart; coded correctly; etc. If not written down, it didn’t happen in courts’ eyes (according to federal government) VERY important to document at all times during care - Communicate the determination to the patient, if possible, and to any other person then authorized to make health care decisions for the patient Definition: - Health Care Decision Selection of healthcare providers and institutions Approval of tests, procedures, programs of medication, DNR orders Directions to provide withhold or withdraw artificial nutrition and hydration and all other forms of health care - Does not in - See powerpoint Implementation of Health Care Decisions: - Duties of HC Providers & Institutions Communication Documentation Comply with Patient’s wishes May decline, under certain circumstances, to comply with an individual instruction or health care decision May NOT require advanced directive as condition for treatment Liability of HC Providers: - A HC provider or institution isn’t subject to civil or criminal liability or to discipline for (just on consent part; if they leave a scalpel inside can be liable): Complying with a HC decision of a person with apparent authority; Declining to comply with a HC decision of a person apparently without authority; OR Complying with an advance HC directive and assuming that the directive was valid when made and has not been revoked or terminated o Surrogates are also not liable for the medical decisions they make so long as they are made in good faith Medicare Appeals and RAC Audits 1/9/2012 4:22:00 AM 1. Overpayments 2. STARK violations (i.e. payments that were inappropriate) 3. AK violations (i.e. payments that were inappropriate) 4. False Claims Act - Medicare providers get specific & unique numbers for billing purposes (i.e. to submit bill/claim to government & get reimbursement); there are codes that apply for certain procedures & the code is on the form which is then sent to Medicare; EVERY expense submitted to Medicare must have a Code on it with his provider number - Medicare pays claims, but reserves right to come back & claim mistake and inappropriate payments (due to wrong coding, “up-coding” = claiming more time with a patient than actually spent, services medically unnecessary, billing for services not actually provided, services not properly provided = no supervision, improper licensing, etc.) - Ways to Discover Billing Issues: Government Audits Whistleblower Self-audits Background - Jan. 2008 OMB Report- Medicare 3rd highest abuse in federal funding Medicare Contracting Reform - “Recovery Audit Contractors” - Test to figure out if auditing system for overpayment discovery worked it did 3-Year Test Phase: - 4 concerns raised: Contingent Fee (contractors can receive almost up to 9% if overpayment identified to government) Unqualified Auditors (i.e. RAC’s themselves) adjusted to require professionals in determinations & reviews like what’s medically necessary No SOL of how far back they could look & how many overpayment claims they can find; so they adjusted to only allowing auditors to go back 3 years No limit on records reviewed by auditors which greatly inhibited providers; now adjusted to only 10% of average monthly claims up to 200 per 45 days for hospitals; for solo physician up to 10 per 45 days - Since program in place, auditors found 40-45% of all records reviewed have been Overpayments - 4 RAC’s nationwide geographically, we’re in C (started around Aug. 2009) - Automatic review = objective inaccurate billing (ex: tonsillectomy gets billed twice in one day); usually computers do this constantly - Complex review = site visits, interviews, pull records, issue letters… 5-level appeal process They request documents & review to let you know how many they find Handout Example First Level of Appeal = “Redetermination” - 120 days from receipt of initial demand BUT after 30 days, they begin recoupment & stop paying doctor for claims If no appeal by day 30, recoupment on day 41 - First review by same people who made the initial overpayment decision - Generally answer in 60 days, unless they want more time which is always given Second Level of Appeal = “Reconsideration” - “On the record” review (no in-person hearing) - MUST submit all documentation at this time if you ever want it in the record - Conducted by “Qualified Independent Contractor” employed by Medicare Reversal usually very rare If still unfavorable, recoupment MUST begin now out of reconsideration Third Level Appeal - Before Administrative Law Judge = first chance to be treated fairly & impartially Government employee still, but finally not on Medicare’s payroll - BEST shot at reversal - Basically a trial - Where there has been an extrapolation, the ALJ must review each and every patient chart review determination to ensure number is correct Fourth Level Appeal - Back to Medicare Appeals Council (MAC) Fifth Level Appeal - Federal District Court where great deference is given to MAC Defenses: - Treating physician rule treating physician has best opportunity to know what patient needs at the time, thus he should be afforded more deference - Provider without fault - Reopening regulations - National Coverage Determination/Local Coverage Determinations opinions by governmental agencies; local = local opinions just persuasive not binding - Challenges to statistics/extrapolation didn’t follow their own rules; population was inappropriate, etc. Avoid RAC Audits? - Probably not; should try to limit your exposure to them - i.e. have proper & solid compliance plan, monitor areas that RAC may look for according to their website, develop process to properly respond to requests for records, develop process for appeals STARK - Makes it unlawful for: A physician o Includes immediate family members o BUT ask what kind of doctors some doctors can’t refer Ex: can’t send it to an entity owned by your husband since eventually that money will be coming to you “anti-self-referral law” o does not include mid-level providers, i.e. nurse practitioners, physicians assistants, CRNA’s, or RPA’s To refer o A request by physician for item/service that Medicare will pay for o NOT personally performed services Ex: referrals can occur between doctor & hospital where he performs service/item Federally Funded Patients o Non-federally funded patient referrals aren’t actionable under Stark, i.e. Blue Cross patients can be referred For Designated Health Services o Just about everything we deal with: clinical lab services, PT, OT, diagnostic radiation, radiation therapy services & supplies IF NOT DHS, then can’t violate Stark when referring Doesn’t count “personally performed services” Government keeps adding more services to this list If the physician has a Financial relationship with the entity o Compensation relationships Where doctor/family member is being paid something by entity; any K relationship that results in doc getting a fee (i.e. doc renting something from hospital, hospital providing space, MUST be exchange of money) o Ownership/Investment interest Where doctor owns an imaging center to which he sends all of his patients there - so he gets the money from the tests = VIOLATION of Stark I.e. leases, rent, etc. o Entity can be pretty much anyone, clinic, hospital, nursing home, lab, pharmacy, non-profit, HMO, etc. Referring physician isn’t an entity FIRST TEST from above FOR TEST 1. Physician? 2. Refer? 3. FFP’s? 4. DHS 5. Financial relationship? If all of the above, must find an exception to be able to Refer OR can’t do it!!! o Look at Stark first because if you satisfy all, then there IS a problem & don’t even have to do AKS analysis - Penalties by occurrence, knowing violations/schemes, or exclusion from program - Strict Liability - no intent necessary; if violation, you’re done - Qui Tam actions (actions begun by whistleblower) - False Claims Act - $11,000 per claim penalty + 3X amount claimed AKS: - Violated: Whenever any individual or entity o Not necessarily a physician Knowingly or willfully o If evidence of no intent, may be OK even without a safe harbor Solicits, offers, pays, or receives o EVEN an offer to reward Any remuneration o Not just money -- it’s the “transfer of anything of value, directly or indirectly, overtly or covertly, in cash or in kind” To induce or reward referrals of items or services o Applies to any transaction where ONE PURPOSE is to induce or reward referrals Payable by a federal healthcare program SECOND TEST from above FOR FINAL: 1. Any IND/Entity 2. KNOWING/WILLFUL 3. S O P R 4. ANY Remuneration 5. INDUCE or REWARD referrals 6. FF Items/Services If yes, find a “SAFE HARBOR” & then maybe you can still do it There are instances where even if no safe harbor, then may still can do it Penalties: criminal liability as felony (max fine of $25,000) & mandatory exclusion from federal healthcare program if convicted Even lawyers can go to jail if it violates AKS; so be careful in advising individuals or entities STARK/AKS Hypos 1/9/2012 4:22:00 AM Stark - If you’re tied to that entity by any dollar or kind (even $1), then you may not refer federally funded patients under Stark; SL for any violations - Physicians work at nursing homes, rent spaces, conduct surgeries/tests at hospitals, etc. - Must know the elements to a T: if you have a BCBS patient, if you have a DR that can’t refer (i.e. radiologist), etc. - 17-18 exceptions to STARK Stark Exceptions 1. Rental of Office Space (or equipment) In writing, signed, specify premises (equipment) At least 1 year o VERY important o Can have a “holdover” (i.e. when someone outlives their K, but can’t change terms) of up to 6 months (terms of lease can't change) Once holdover expires, must go back to STARK analysis Space rented is only what is needed o I.e. can’t give too much for lower amount Charge set in advance, not based on volume or value of referrals, but on FMV Commercially R/ o Number one fight between doctors and hospitals; doctors know the money that hospitals make from the derivative services from the doctors being there; thus they fight for more money 2. Bona Fide Employment (i.e. W2 employee - you are theirs; 1099 employee - principal and agent where agent gets job done wherever it’s done) Identifiable services (they can tell you what he is paid to do) o **OB-GYN’s, pediatricians, family physicians, etc. o OB-GYN’s always recruited by hospitals o Can have referrals to their own hospitals under this exception Compensation is: o FMV o Not determined based on volume or value of referrals Commercially R/ CAN have productivity bonuses based on personally performed services o Personally performed = patient visits o For example, hospitals can pay doctors for seeing 45 patients in a day since they know that 5 of those patients will more than likely end up in their hospital o Trick is to determine where FMV intersects the optimal number of personally performed services 3. Personal Service Arrangements (i.e. Medical Directors at hospitals) With doctor, group practice In writing, signed, specific about services Covers ALL services provided to the entity o In order to pay for what you’re getting from deal Services provided are least necessary o I.e. can’t hire 2 “Labor & Delivery Medical Directors” since that would provide more services than least necessary At least 1 year Compensation - set in advance, FMV, not tied to referrals Difference Between 2 & 3: Employment - #2 - doesn’t have time requirement Arrangement - #3 - has 1 year requirement 4. Recruitment: Hospital to Doctor Must be intended to induce doctor o To relocate medical practice into the “geographic service area” o In order to become member of hospital’s medical staff Must be legitimate employment In writing, signed Hire Not conditioned on referrals by doctor to hospital Remuneration/payment not tied to referrals o Payment not limited, just can’t be tied to referrals o It’s “commercially R/” to pay a doctor to relocate in order to bring someone to maybe an undesirable area No restriction on staff privileges elsewhere o Can’t restrict her practicing privileges at other hospitals Geographic area is lowest number of contiguous counties where 75% of inpatients come from Hospitals map out where all patients come from; then they have to tie the top 75% of business in a “contiguous area” (i.e. areas adjacent to one another) Relocated means EITHER: Moved medical practice from outside service area to inside service area and at least 25 miles; OR Less that 25 miles, but at least 75% of doctor’s revenues will come from new patients These patients must not follow doctor from establish practice, but distance him from that previous practice Relocation requirement Doesn’t apply if: Recruit has practice for one year or less or is a resident; OR Has been employed for 2 years immediately prior, with Department of Defense , VA, Prison Bureau, or Indian Health Service Since you can’t take these patients with you, etc. 5. Recruitment: Hospital Assisting Group Practice Agreement must be signed by party to whom payments are directly made o Can be new doctor or clinic (whoever receives the money) Hospital may pay: o Actual cost incurred by Group in recruiting o Money paid directly to recruited physician (must pass through) o Costs allocated to Group cannot exceed actual additional incremental costs attributable to recruited physician Can’t charge more for the space already utilized with the other doctors (if no space is added) If hire new nurse, then can pass those costs along as well Keep records 5 years Remuneration from Hospital not tied to referrals Group cannot restrict physician from practicing in hospital’s geographic area o i.e. no covenants to compete 6. Non-Monetary Compensation Up to $359 (in 2011) per year, per doctor o Must keep up with this by chart on what is given to each doctor o Flowers, cookies, Christmas gifts, trays to staff, etc. Cannot be solicited by doctor Not tied to referrals Cannot violate the AKS o Meaning doctor can’t threaten to stop sending patients if his solicitation or request isn’t complied with Inadvertent overpayment - OK IF: o Overpayment doesn’t exceed 50% of allowed o Is repaid in earlier of within 180 days, or in same calendar year Doctor repays overage o Can only be used once every 3 years as to same doctor 7. Medical Staff Incidental Benefits Items or services used on hospital’s campus o I.e. dining - cafeteria floor with amazing chef to keep doctors in hospitals away from drug reps; parking, car washes At times when doctors are making rounds or otherwise benefitting hospital Provided to ALL members of medical staff in same specialty Without regard to volume or value of referrals Low value per benefit o Less than $25 per benefits No violation of AKS *8. In Office Ancillary Services (i.e. lab in office, shots on site, etc.) Primary exception relied on by physicians to protect referrals for designated health services within their practices: 3-Part Test o Performance test Service must be performed by: Referring physician; Another member of the same “group practice”; An individual supervised by the referring physician (or member of same Group) o Billing test Services must be billed by: The performing or supervising physician The group practice (under group’s number) Third party billing company under Group’s billing number o Site of Service test Group Centric Test: Same building where physician or group practice has office open 35 hours/wk; and Referring physician/group practice regularly practices at least 30 hours per week Patient Centric Test: Patient receiving DHS generally comes to that building for services from referring physician or group; Referring physician or group owns or rents office normally open at least 8 hours/wk; and Referring physician/group members practice there at least 6 hours/wk Specialist Centric Test: DHS is provided when referring physician is present and is in connection with a patient visit; Referring physician or group owns or rents office normally open at least 8 hours/wk; and Referring physician/group members practice there at least 6 hours/ wk Group Practice 2 or more physicians legally organized Each member provides substantially the full range of services of his practice to the group (75%) Substantially all of the services rendered are billed by the group Income & Expenses distributed in a predetermined manner No physician receives compensation directly or indirectly based on referrals of designated health services Critical Issues relate to Compensation: o Compensation must be set in advance, but you can’t pay based on volume or value of referrals of DHS o You can pay profits and bonuses on other non-DHs factors though: RVU’s, patient encounters, number of non-DHS services, any combination 9. Rural Area Providers (get from PPT) Can do almost everything So long as 75% of patients are coming from rural areas - then you don’t have to worry about ownership o Still have to worry about FMV, etc. AKS VIOLATION - Safe Harbors Similar to Stark Exceptions - Remember same elements for STARK also apply here Rental of Space Equipment Rental Personal Services & Management K’s Employees 1. Practitioner Recruitment Remuneration does include amounts paid: o To induce a practitioner o Who has been practicing for less than 1 year OR any other to relocate o His primary place of practice o Into a HPSA for his specialty SO LONG AS ALL NINE OF THE FOLLOWING STANDARDS ARE MET o see PPT 2. Investment Interests - Large Investment interests - Small entity Providers Physicians can do business with group where they own less than 40% of interest 3. Joint Venture-Underserved Areas 75% area HYPO #2: - $150,000 not FMV - CAN’T do it on these terms but can give her something but must be on FMV or can be employed for 6 months as cardiologist - here: can’t just serve for 6 months, ask is it least necessary services HYPO #3: - when you see MRI & CT scanner, think DHS - you have a doctor and businessman: STARK = physician or immediate family member - Small Town Hospital want to pay the radiologists more; so 2 hospitals with Small Town’s borders being threatened HYPO #5: Radiologists DON’T REFER, so no more STARK analysis So, YES Small Town can do this - Relocation must be TO join the medical staff; for STARK purposes, doctor never left the Hospital’s Medical Staff - SO Can’t do it HYPO #7: - Would want to lease the equipment; Yes can do this under Rental of Office Space/Equipment STARK/AKS Hypo’s 1/9/2012 4:22:00 AM - Should always refer to Handout - exact language of exceptions for exam answers - Look to Financial Relationship first - 4 main differences between AKS & STARK Hypo 1 - “Medical directorships” = personal service arrangement exception - Physician - referring - assuming FFP - for DHS - and there’s a compensation financial relationship - THUS exception Personal Services Arrangements: written agreement, signed, specification of services provided (we assume these are satisfied in the Contract); Must be at least 1 year term (need more info on this); Compensation must be FMV and not tied to referrals (here - flagrant violation since compensation directly tied to referrals; the arrangement in itself violates the law regardless of how many referrals actually occur - i.e. if doctors never refer less than 5 patients monthly) SO can’t do it Hypo 2 - STARK analysis: doctor - referring to hospital - assuming FFP’s (if NOT, STARK doesn’t apply) - yes DHS - financial relationship of proposed work Bona Fide Employment exception identifiable services (assume it can be done); FMV; written agreement o Doesn’t have to be for 1 year either under this exception o This would’ve worked, but cardiologist doesn’t want to be employed Personal Services exception must be 1 year (here 6 months won’t work); in writing, setting forth all terms; must be FMV - Hospital must make her Medical Director for 1 year under PS; OR employed by hospital Hypo 3 - Dr. J is under STARK analysis: Dr. J is a physician, referring to the hospital, probably FFP’s, providing DHS, and Small Town wants to lease land from the LLC and Dr. J’s husband Money is going to LLC thus Rental of Space exception: lease must be in writing, signed by parties, at least for 1 year, specifics involved, not based on value/volume of referrals, and lease price must be FMV o No problem leasing land from LLC Hospitals competing over group of radiologists thus no STARK problem since Radiologists don’t refer! Hypo 4 - STARK analysis: doctor - referring to hospital - probably FFP’s - providing DHS - and financial relationship with hospital ($50,000) Recruitment exception regardless, Doctor must be moving practice from outside geographic area of hospital in inside of it (unless he’s in his residency, worked with Indians, or the VA for at least 2 years, or in first year of practice o As lawyer, you could pay $50,000 back and tell officer of mistake Hypo 5 - STARK analysis Recruitment doctor is already on medical staff, thus the purpose is no longer to induce doctor to JOIN medical staff; so Hospital cannot do this arrangment, BUT Hospital could always employ the doctor or make him a medical director under personal services arrangement Hypo 6 - “Pre-certification” = insurance may require doctor to call & basically get permission/ensure patient’s coverage before procedure is conducted - STARK analysis: doctor (Spyne) referring FFP’s for DHS, and financial relationship is in the form of a Service (i.e. more secretary hours, etc.) It’s legitimate business reason for doctor to assume all pre-cert’s since she’s the one actually being paid in the end (just not solely for main referral source) Not really an exception Hypo 7 - STARK analysis: all satisfied - financial benefit of getting the x-ray equipment for free Can’t be given for free - must be FMV transaction o Equipment rental o Non-monetary compensation (if enough physicians for the $300) Hypo 8 - NOT a STARK violation -- the money is going to the volunteer organization, not the surgeon’s family - Where the money goes is important Hypo 9 - STARK analysis -- all 5 satisfied so there is a problem Hypo 10 Recruitment exception -- relocation requirements are satisfied; BUT Dr had already applied for privileges on staff, thus what the hospital is offering isn’t being offered to induce the move - No problem since anesthesiologists don’t usually refer patients - Could use bona fide employment or personal services arrangement Personal services not for medical purposes; more so for administrative purposes - could offer medical directorship (generally $25-50,000/year) - When group wants a new physician Recruitment: Hospital assisting group practice - special requirements plus relocation requirements, etc. Hypo 11 - “all of the practice group’s overhead attributable to Dr. Jung” = actual additional incremental expense then OK - Recruitment exception - hospital assisting group practice Teaching Hospital can recruit as a resident; relocation rqt doesn’t apply to her since she’s a resident Issue is whether she has already accepted the first offer - whether she has accepted the first income guarantee o If already accepted, then can’t offer another longer income guarantee Hypo 12 - Physicians self-referring in both centers In-Office Ancillary Services: 3 tests must be met - 1) performance test; 2) billing test; 3) site of service test o Billing not specifically mentioned - but probably meet this, just mention the need for more information o Second center doesn’t meet site of service test - so can’t refer to 2nd center False Claims Act 1/9/2012 4:22:00 AM - History 1863-Also known as Lincoln Law Since 1986, over $12 billion in FCA settlements and judgments Fraud and abuse adds 10% to total health care spending (1994) 1999 - Medicare paid $13.5 billion in improper payments -FCA was designed to protect the government from paying for goods or services that have not been provided or were not provided in accordance with government regulations - -31 usc 3729 first 2 subsections occur most often (a) Liability for certain acts: Any person who... o (1)Knowingly presents to US government a false or fraudulent claim for payment o (2)Knowingly makes or uses a false record or statement to get a false or fraudulent claim paid by the government o (3)Conspires to defraud the government by getting a false or fraudulent claim paid -Knowing, knowingly... Mean that a person: o Has actual knowledge of the information o Acts in deliberate ignorance of the truth or falsity of the information; or o Acts in reckless disregard of the truth or falsity of the information, and o no proof of specific intent to defraud is required (31 USC 3729(b)) -"Claim" Includes any request or demand for money or property if the government provides any part of the money or property requested or if the government will reimburse any portion of the money or property that is requested -Types of Causes of Action Billing for services not performed Billing for services performed by someone other than the billing provider Billing for services performed by unlicensed or unapproved personnel Billing for unreasonable costs -Reverse False Claims Anyone who knowingly makes, uses or causes to be made or used, a false record or statement to conceal, avoid or decrease an obligation to pay or transmit money or property to the government -Qui Tam Actions Civil Actions for False Claims Brought by "relators" One or more relators may bring suit Government has the right to o Intervene and join the action o Decline to intervene o Settle case before intervening -Deadline for Qui Tam Action Statute of limitations under FCA o 6 years from violation o 3 years from when Government knew or should have known of violation o Never more than 10 years after violation o If another relator files first, you lose your right to bring action -How is a Qui Tam Filed? Federal Court Complain and disclosure statement of all evidence in relator's possession must be served on Attorney General and US Attorney for district where brought Everything stays under seal - 60 days Violation of seal order may result in dismissal of action -How Long? Seal period may be extended. Can last up to a year. After Seal period, complaint is served on defendant and case proceeds normally -Damages Available Actual Damages to Government (Treble Damages) Civil Penalties per claim Whistleblowers/Relators receive money only if Government recovers money from defendant Can receive between 15 and 30% of the total recovery from the defendant -10 things to do if you get a visit on a Qui Tam action Ask the gov't for ID (keep record of who came, business card) If they ask to speak to particular people ask why Get a copy of search warrant and make sure they are only looking at things included Call you immediately Listen and keep a record of everything they hear, said - entitled to follow around (keep record of everything they look at, etc.) (ask for inventory of what they took) Ask to back up any computers that they want to take with them Send all non-essential personnel home on paid leave (as few people talking as possible) Clients instruct employees that they are free to talk to government but they don't have to talk to government (you will provide counsel and they can talk to them first) (If gov't asks for interview room say we don't have one available) (Call all absent employees and tell them the same thing) Not to destroy anything or otherwise impede the investigation in any way Want to debrief anybody the gov't did talk to Will cover preventative actions at some point - 3rd regulatory scheme - STARK or AKS violations can also be False Claims violations - Qui tam actions - “whistleblowers” could make good money under the Lincoln Law - went away around 1940 & now this actions back in 1986 when signed back into law Requirement of “knowing” intent is BROAD under this Act “Claim” = any demand for money from the government - Relator must gather a lot of evidence before raising concerns with employer/bringing it to government’s attention B/C their percentage of recovery increases with more amounts of evidence - ex: 1994 actual damages $250,000 on 8000 claims -- max damage award could’ve been $81 million EMTALA - Emergency Medical Treatment and Active Labor Act - Red Barnes Case (1985) - crackhead goes to hospital, ER doc calls neurosurgeon (says I’m not coming in for that type of patient), 2nd neuro says the same thing, Neuro at another hospital says don’t bring him there, a 5th says can bring him here if ER doc comes too (he dies on way there) -Before EMTALA no legal mandate to take these people - Also called anti-dumping law In a nutshell Background o Came out as part of COBRA in 1986 o Applies to every hospital that takes medicare and has an ER dept o Hospital and doctors involved in violation can o If hospital takes me Application General Req’s o Screen o Stabilize o Or, Under Certain conditions, TRANSFER Requirements for Transfers Out Requirements for Transfers In Have to keep documentation of transfer for 5 years On-Call Req’s Penalties for Violation Emtala Says...... - Medical Screening Requirement: In the case of a hospital that has an emergency dept, if an individual comes to the emergency depat, the hospital must provide an appropriate medical screening examination, including ancillary services routinely available to the emergency dept., to determine whether an emergency medical condition exists. Emergency Dept. - Dedicated Emergency Dept. o Any dept or facility of the Hospital that is: Licensed by the State as an emergency dept; or Held out to public as providing em. treatment Can be located on or off main campus - “comes to the emergency dept” means: o At the hospital’s dedicated emergency dept (“DED”) requesting treatment o On hospital property other than DED with what may be an emergency medical condition o In a hospital-owned ambulance (anywhere) o In a non-hospital-owned ambulance on hospital property If hospital says don’t come here (got too much business) once they come on property they have “come to the emergency dept.” - If taken to St. Dominic’s helipad to be transferred to Baptist they aren’t deemed to have “come to emergency dept” at SD unless he develops another condition A Little Bit About Ambulances... -Hospital Owned vs. Non - Only time that Hospital can turn away its own ambulance is when EMS puts them on diversion - Trauma System Issues - You have to pay into the system or you have huge fines - Level 1, 2, 3, or 4 (Med, UMC, UAB) - Appropriate Medical Screening Exam (MSE) -Conducted by qualified medical personnel -Personnel who are qualified set out in hospital bylawas -Purpose - to determine whether an emergency medical condition exists -Must be provided regardless of diagnosis, financial status, race, color, national origin and/or disability - May be requested by a minor child -CMS says... -“Emergency Medical Condition” means: -A medical condition manifesting itself by acute symptoms of sufficient severity such that the absence of immediate medical attention could reasonable be expected to result in Placing the health of the individual (or, with respect to a pregnant woman, the health of the woman or her unborn child) inserious jeopardy; Serious impairment to bodily functions; or Serious dysfunction of any bodily organ or part - Baby K case if child leaves stable & then comes back with same respiratory problems, hospital still must treat sick patient Not decision for doctor to make; must stabilize the baby -EMTALA Says... Stabilization Requirement o If any individual comes to the hospital and has an emergency me “Stabilized” means o no material deterioration of the condition is likely, within reasonable medical probability, to result from or occur o .... “Appropriate transfer” means: -A hospital that has specialized capabilities or facilities shall not refuse to accept an appropriate transfer of an individual who requires such specialized capabilities or facilities if the hospital has the capacity to treat the individual -On-Call Physicians - Each hospital must maintain an on-call list of physicians on its medical staff. -HOSPITAL has ultimate responsibility for ensuring adequate on-call coverage. -List to be maintained in manner that will best meet the needs of patients, in view of hospital’s resources. -Physician group names are not sufficient., must have individual names -In determining EMTALA compliance, CMC will consider “all relevant factors” -Fact based inquiry -Demands on Dr., how often hospital sees that condition, etc. -A physician who does not come to the hospital when called, but repeatedly or typically directs the patient to be transferre........ -A physician may be on call sumultaneously for more than one hospital -Physicians may perform elective surgery while on call - For both of these you must have back-up plan in hospitals document -Liability for selective response to call by physician -Physician may be liable. -Hospital may be liable for permitting. -Can’t be selective about call for any factor -Response time of on-call physicians. -The expected response time should be stated in minutes in the hospital policies -Terms such as “reasonable...... Physician Liability Slide.... Acceptable Responses to a call to come treat an ER Patient?... -No -Maybe -No -OK for physician, hospital should have call doc #2 -No -Update call schedule -No -No -No Duty to Report - Tranferring physician obligated to identify non-respon - Receiving hospital obligated to notify CMS of transferring hospital and on-call physician o Have to report w/in 72 hours (Not reporting is a separate violation) Duty Under EMTALA Ends: .... Hypo #1 a) You can do this b) Can’t turn him away Hypo #2 a) Not required to see him in office, only requires to emergency dept Hypo #3 a) You don’t have an option, AKS Hypo’s Hypo 1 - Violation of AKS, unless Safe Harbor Found Even if example didn’t have last sentence, still violation of AKS, but maybe ok under Personal Services (as long as complies with the particulars - BUT the remuneration is tied to the number of patient referrals as evidenced by the last sentence of the hypo thus NOT OK under any safe harbor (as written) With AKS, don’t have to fall squarely under Safe Harbor (word by word) o As opposed to STARK where it must be followed to the T Hypo 2 - Violation of AKS by hospital (as well as by cardiologist since she’s soliciting money from hospital for referral patients) Safe Harbor of Personal Services (but must be 1 year) o Can change to 1 year & make it fit Safe Harbor of Bona Fide Employment o If she consented to be employed - BUT can’t do this under STARK Must always go through analysis however - can’t just say “not relevant since not allowed under STARK” - “Medical Director” is always a physician with an administrative component of a particular department of a hospital that provides treatment Hypo 3 - Violation of AKS, must find Safe Harbor o Look to Practitioner Recruitment safe harbor - must fit all 9 requirements This Safe Harbor would save the arrangement under AKS IF you clarify only IF 75% of revenues come from HPSA, MUA, or MUP patients, then it’s ok Hypo 5 - Violation of AKS Look to Recruitment safe harbor - must fit all 9 o Must clarify it’s ok as long as 75% of revenues come from HPSA, MUA, or MUP patients Hypo 6 - Violation of AKS remuneration here is the value of the pre-cert service While this is clear violation of AKS and there’s no safe harbor, you could still argue that the intent for this would instead be to ensure that you yourself get paid in the end versus reward for referrals (i.e. legit reason to pre-cert herself) Hypo 7 - Violation of AKS by physicians Can’t do this as written - no safe harbor applies Could try to rent it out to doctors - or doctors could buy it from hospital under other safe harbors Hypo 8 - NO Violation since money is going to the Junior League Immediate family members do not matter under AKS ON ALL THESE, REMEMBER IF THE DOCTORS HAVE ALREADY ASKED FOR SOMETHING THEY HAVE BROKEN THE LAW Final Review 1/9/2012 4:22:00 AM - Bring exceptions/safe harbor handout (only highlighted/underlined though) & calculator - Format: Part 1 20 questions, only 12 answers (1.5 hours) o 8 of those marked with Star MUST be answered o Then can choose 4 others from the remaining 12 Covering CON and its formulas, HIPAA, UHCDA, EMTALA, fraud/abuse (STARK, AKS, False Claims Act, and overpayments) , Medicare/aide operations -- with headings Variety of short discussion, listing, MPC, etc. Part 2 3 longer discussion questions -- all of Fraud/Abuse o 2 STARK/AKS o 1 False Claims Act/Government investigations (1.5 hours) Part 3 BONUS questions o 4 short questions Can write on exam - but must turn it back in with number on it - Grading: both parts are equally weighted; Bonus about 8-10 points Government Investigations 1/9/2012 4:22:00 AM - Relates to False Claims Act, Qui Tam, etc. - Ex: whistleblower takes all his information/findings to government; government then either 1) takes the claim or 2) whistleblower pursues case at own risk (i.e. not worth pursuing) If government takes claim, then government will probably continue to gather information, or go directly after offender by showing up at hospital o 1. Issuing grand jury subpoenas (requiring testimony from clients) Clients can plead the 5th or if some attorney-client privilege comes up Grand jury is without client’s lawyer DA can ask any question within all scopes - so lawyer will want to de-brief client to learn what all DA knows/has of claim o 2. Issuance of search warrants/showing by surprise at places of business to search client’s documents (to search/examine/take documents within warrant); can issue document subpoenas, etc. Government while at place of business will almost always try to interview client’s employees at the same time o 3. Covert operations -- monitoring phone calls (with that party’s consent) What to do to be Ready in Advance of Government’s Presence: - Be sure that clients have compliance program in place (required) *A good way to show you don't have intent under AKS and to negotiate settlement in STARK Essentially rules/guidelines for how to comply with all government regulations in place (i.e. AKS, STARK, FCA, etc.) o 1) Plan document: stating client, location information & client’s plan for compliance - always available to employees o 2) Must provide training on plan to ALL employees (also apprise them of law) o 3) Must provide for internal audits of client’s business Can be yearly, quarterly, etc. - at client’s discretion Audit = internal review of every piece of business; i.e. coding, billing, referrals; to ensure compliance o 4) Designation of compliance officer Including monitoring client’s operations to ensure following its compliance program o 5) Provision for internal investigation (once you find something wrong from internal audit; someone reports a problem; etc.) Anonymous reporting system best - drop box, hotline, etc. Should also immediately call lawyer - arguable to also increase privilege o 6) Provision for Remedial Measures (i.e. re-paying any overpayments from govt; any additional training because of problem; billing issue by billing office There are now self-disclosure protocols under STARK and AKS; i.e. client must decide when they discover the violation whether to report it No self-disclosure under STARK yet - most clients are hoping that problem just doesn’t get discovered IF possibility of whistleblower, then always self-disclose to get benefit of doubt when govt decides penalty counseling and training o 7) Provision for Internal investigation If you discover, suspect, or someone reports a problem - 10 things to get clients to ask govt 1) ID before giving them access to documents 2) Ask for copy of search warrant - either original or make copy 3) Call your lawyer immediately 4) Listen to everything that is said when government is there - walk behind and record everything said between them, to your employees, everything 5) Try to compile inventory of everything government takes - can ask, but they’re not obligated 6) Client should back-up any computer database before leaving office (to be able to continue its operation) 7) NEVER agree to expand search beyond what warrant states 8) Deal appropriately with employees: 1- send all non-essential personnel home for the day on paid leave; 2- tell employees that they may/not talk to government & that client will provide lawyer if they wish before they talk to govt; 3- contact absent employees to alert them to possible home contact by government & offer lawyer to advise them before speaking if they’d like; 4- do not designate a room on site for interviews with employees (if willing to speak, must go outside) 9) DO NOT destroy anything/otherwise impeded government’s investigation 10) De-brief any employee who gets interviewed by government immediately after that encounter - Clients must understand that all textual communication/electronic/online may come back, be reproduced, always STARK/AKS Approach: 1. Is there a problem under either of these schemes? 2. Is there an easy fix? I.e. is there some piece of fact pattern that could easily be changed to eliminate the problem? Ex: client wants to do this = STARK violation; if client doesn’t refer federally funded patients, then OK 3. Is there an Exception or Safe Harbor? STARK Exception - how does it apply? STRICT fit with exception; is it satisfied? AKS Safe Harbor - how does it apply? looser fit - not everything must be satisfied (as long as an intent to induce referrals isn’t shown); is it satisfied? 4. Final answer STARK hypo’s -- don’t worry about numbers 13 & 14 TEST -Structure of Healthcare System -Medicare & Medicaid, -Changes under PPACA -Overpayments and Audits - Appeals under RAC -STARK & AKS -FCA -Gov't investigations and preparing client -HIPAA -Informed Consent -UHCA -EMTALA EXAM (Review the 17th) 3 sections -20 short answer, a paragraph maybe, short answer, multile choice (8 you have to answer, pick out of the others) - HIPAA, EMTALA, etc. -2nd Fraud and Abuse Laws, STARK, AKS -3rd Bonus Question section