Federalism - Jessamine County Schools

Federalism

•

Sovereignty is shared between central and state (regional) governments

•

Sovereignty = no higher authority

•

Local units make some decisions without regard to national preferences

•

Germany, Canada, Australia, India

Advantages

• Recognizes local interests and differences

•

Prevents secession (usually)

• Check federal government power

•

Managing large country

• Promotes competition among jurisdictions

•

Flexibility

•

Innovation

• Citizen participation

•

A vital Congress

• Local autonomy

Disadvantages

• Policies are not uniform

•

Protects powerful local interests

• Inefficiency

•

Lack of Accountability

•

Obstructive

• harmful spillover effects

•

It can make for weak parties

• Can lead to a parochial Congress

•

Weakened nationalism

Other Systems

•

Confederation:

–

States are sovereign

–

Switzerland

•

Unitary:

–

National Government sovereign

–

England, France, Italy

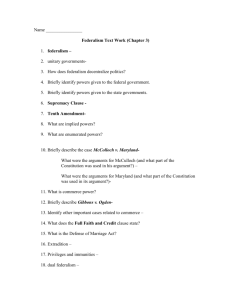

American Federalism

• Restrictions on states’ powers

–

Coining money

– No treaties

–

Bills of attainders

– Ex Post Facto Laws

American Federalism

•

Federal government guarantees

– Republican state governments

– Admitting new states

– Uniform taxes

– State to State

– “Full faith and credit” with respect to other state’s laws

–

Extradition

•

Elastic Clause

– Necessary and proper for carrying out congress’ powers

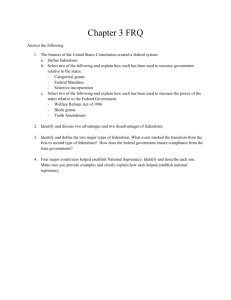

Problems arising from federalism

McCulloch v Maryland (1819)

Nullification

Gibbons v Ogden (1824)

McCulloch v. Maryland (1819)

• “Necessary and Proper” clause

•

National Bank is allowed

• States can’t tax federal government

•

Federal government is supreme

Nullification

• States can’t declare federal laws unconstitutional

•

States are not the Supreme Court

Gibbons v. Ogden (1824)

•

NY gave Ogden exclusive navigational rights

•

Federal Government gave Gibbons license

•

Gibbons won due to interstate commerce

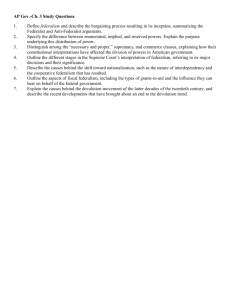

Different Types of Federalism

Dual Federalism (1789 – 1930)

•

Layer Cake (1865 – 1930)

•

Marble Cake (1930s – Present)

–

Cooperative Federalism (1930s – 1960s)

–

Creative Federalism (1960s)

–

Competitive Federalism (1970s –1980s)

Dual Federalism (1789 – 1930)

•

Federal Government supreme in its sphere

–

Articles I – IV, VI

•

States supreme in their sphere

–

Article IV, Tenth Amendment

•

Shared Powers

– Tenth Amendment

Layer Cake Federalism

(1865 – 1930)

• Each level sovereign in its own reign

•

Growing government at both levels, with states as senior partners in police powers and providing services, federal government in regulating commerce.

• "to perfect the free economy"

•

But Federal government becoming stronger to implement:

– 13 th , 14 th , 15 th Amendments

Layer Cake Federalism

(1865 – 1930)

•

The Morrill Act of 1862:

Land grants to states to support public institutions of higher education

First time the national government participated financially in a program of state welfare

Layer Cake Federalism

(1865 – 1930)

• Interstate Commerce Act 1887

•

Sherman Antitrust Act of 1890

• Both a part of the expansion of federal authority over commerce that took place during that period, often at the expense of states.

•

Thirty state railroad commissions, for example, were replaced by a federal authority, as were existing state antitrust and lottery laws

16th amendment (1913)

•

Federal Income tax

•

Watershed for twentieth century, modern federalism.

•

Size of the tax was extremely modest by today's standards

•

Emphasis on intergovernmental transfers and the use of taxing and spending powers to further national policies

1920s:11 Grant-in-Aid programs

• As the country moved from a primarily rural, agrarian society to an urban industrial one, largescale social institutions developed to cushion some of the worst social dislocations caused by the changes.

•

Even with the capacity to levy progressive income taxes, national efforts at social welfare programs were highly tentative at first.

1920s:11 Grant-in-Aid programs

•

By 1920 there were eleven grants-in-aid programs. Challenges to the legality of such grants were rejected by the court on the grounds that participation in the programs was voluntary on the part of the states and thus did not violate separation of powers.

• The earliest such program in health, the 1921 Sheppard-

Towner Act maternity and infancy health program aroused much opposition from state and professional groups, and was allowed to die in 1929.

Marble Cake Federalism (Cooperative Federalism):

1930s – 1960s

• Federal Government more interfering in local matters

•

Shared functions, focus on providing services, broadly collaborative patterns.

•

Federal Government provides funds

• States administer

•

1930s Examples:

–

FDIC

– Civilian Conservation Corps

Postwar

• 21 new grant-in-aid programs: 1946-1961

•

Eisenhower attempted to reverse the centralizing trend in the national government's involvement in domestic policy

• established the Commission on Intergovernmental

Relations to identify activities to return to the states.

•

Commission found few such programs,

•

No changes were implemented.

Civil Rights

• Courts, for the first time, asserted national authority in regards to civil rights under the equal protection clause of the fourteenth amendment

•

Southern states = deniers of liberty against national government.

•

Nullification = interposition:

• states defied federal orders to integrate schools in the wake of Brown v. Board of Education.

Creative Federalism (1960s)

• States are implementers of federal mandates

•

Federal Government and States share costs and administrative responsibilities

•

Guidelines, rules, funds from Federal Government

•

Intergovernmental fiscal transfers

•

Crosscutting regulation and responsibilities

•

Examples:

– Medicare, Medicaid, War on Poverty, Civil

Rights Legislation

Creative Federalism (1960s)

•

Federal government often bypassed states entirely

•

Programs aimed at both racial and economic injustice.

•

Categorical and project grants: aimed at specific problems or groups

•

Civil Rights Acts attached cross-cutting provisions on all grants

Competitive (Fiscal) Federalism

(1970s-1980s)

• New Federalism

•

Nixon, Carter, Reagan

• Reduce national control over the grants-in-aid programs

•

Move national programs to field regions

•

Streamline services

• Opposite has occurred

•

Power has not returned to states

Competitive (Fiscal) Federalism

(1970s-1980s)

If no compliance

–

Penalties

• Equal Opportunity Act (1982): criminal or civil penalties

States promise to develop their own programs

–

Restrictions on other programs

•

Over 60 federal programs

•

Crossover Requirements

–

State has to do something in return for money

– Emergency Highway Energy Conservation Act of 1974

Competitive (Fiscal) Federalism

(1970s-1980s)

•

Grants-in-Aid:

General Revenue Sharing

Block Grants

Categorical Grants

Block Grants and General

Revenue Sharing:

Reduce federal requirements

States have greater freedom while setting the stage for withdrawal of federal fiscal support.

(General) Revenue Sharing

•

Great freedom to spend money

• Distribution based on states’:

–

Population

–

Local tax effort

–

Wealth

Block Grants

• “Block” (chunk) of money

•

Block of programs combined

•

Few strings attached

•

Welfare Reform (1996)

Block Grant Types

•

Operational Grants

–

Running programs

•

Capital Grants

–

Building plants

•

Entitlement Grants

– Transfer money to individuals/families

Categorical Grants

• Specific purpose

•

Specific criteria

• Some matching state money

•

Example: Build an airport or dorm

•

Two Types:

– Project Grants

• Competitive applications from states and individuals

– Formula Grants

• Welfare programs

Block Grants and Revenue Sharing vs

Categorical Grants

•

Block Grants grew more slowly because:

Distrust of state governments

Federal government wanted more control

Revenue Sharing dilutes interests

Revenue Sharing gives all communities money

New Federalism (1980s-1990s)

•

Cooptive Federalism

•

Reagan tried to reduce 83 Categorical Grants into

6 large block grants

•

Congress replaced 57 categorical grants with 6 block grants but with many strings attached

• “state and local government responses to 1981 federal aid cuts—through replacement funding, through a variety of financial coping and delaying measures, and through administrative reforms” actually produced “higher service levels than otherwise would have been the case”

New Federalism (1980s-1990s)

•

Deregulation

•

Supply-side reductions

•

Deficit dominates: Revenue cuts without matching spending cuts

impasse in government.

•

Devolution Revolution (but not always carried out)…..

Devolution Revolution

• Republicans take over both Houses in 1994 election

•

Contract with America (1995-1997)

• “The era of big government is over”—Clinton

•

Welfare Reform

• Highway speed limits

•

States could administer certain programs in Safe

Drinking Water Act

•

States decide how federal rural development funds could be used

Devolution Revolution?

• “But we cannot go back to the time when our citizens were left to fend for themselves” (Clinton)

•

13 new block grant programs enacted, but also included major new restrictions on how the moneys could be spent.

• Court upholds the use of cross-over sanctions in tying highway funds to minimum drinking age.

•

Car-jacking, stalking federal crimes

• National criteria for drivers’ licenses, food safety

•

Nullified state laws restricting telecommunications competition

• The revolution “has mostly fizzled”

Second-Order Devolution

•

A flow of power and responsibility from the states to local governments

Third-Order Devolution

•

Increase role of nonprofit organizations and private groups in policy implementation

Federal Control

• “He who pays the piper calls the tune”

•

Conditions of Aid:

–

Requirements if states want money

–

Number of strings tends to increase

•

Mandates:

Requirements that states must carry out

Environmental Protection

• Ocean Dumping Ban (1988)

Civil Rights

• Americans with Disabilities (1990)

Mandates

•

Most concern civil rights and environmental protection

•

Different forms:

•

Regulatory statutes and amendments that expand on previous legislation

•

New areas of federal involvement

•

Some are easy to interpret and administer and others more difficult (Americans with

Disabilities Act- 1990)

•

School desegregation

Unfunded Mandates Reform Act

(1995)

• Stop Federal mandates (requirements) on States and local governments unless Federal government helps pay for the costs of programs

• Made Congress more aware of this issue, but…

• Not always effective:

Americans with Disabilities Act (1990)

EPA requires states to build auto pollution-testing stations

Conditions of Aid

•

Voluntary, in theory, but states receive 25% or more of its budget from federal government