- Accounting Day

advertisement

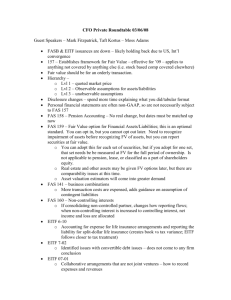

The Value of Experience REVENUE RECOGNITION Accounting Day 2008 May 12, 2008 Wayne R. Pinnell Managing Partner Haskell & White LLP Revenue Recognition 1. 2. 3. 4. 5. 6. 7. 8. 9. Revenue Recognition Overview Basic Revenue Recognition Criteria Multiple Elements in Revenue Recognition Other Revenue Recognition Considerations Company Internal Control Considerations Frauds Involving Revenue Recognition Auditor Considerations US GAAP vs. IFRS Conclusion and Q & A 1. Revenue Recognition Overview I. There are hundreds of references in authoritative guidance and interpretations under US GAAP covering revenue recognition. II. There are general standards and numerous standards written to apply to specific industries or situations. III. Codification from FASB came out Q1-2008. (http://asc.fasb.org) You can register and access the website for free. 1. Revenue Recognition Overview • Some of the more common revenue criteria include: – FASB Concepts Statement No. 5 (the foundation) – SEC Staff Accounting Bulletin (“SAB”) 104 applies to public companies, but is generally considered applicable to all companies – SFAS 66 applies to real estate – SOP 97-2 and its related interpretations applies to software – SOP 81-1 applies to contract accounting – EITF 99-19 applies to gross revenue as principal vs. net as agent – EITF 00-10 guidance on accounting for shipping & handling fees – EITF 00-21 applies to multiple deliverable arrangements 2. Basic Revenue Recognition Criteria FASB Concepts Statement No. 5 (December 1984): Revenues of an enterprise during a period are generally measured by the exchange values of the goods or services. Recognition of revenues in a given period requires that the revenues meet two criteria. The revenues must be: Realized or realizable, and Earned 2. Basic Revenue Recognition Criteria When is revenue realized or realizable? Revenue is realized when products, merchandise or services or other assets are exchanged for cash or claims to cash Revenue is realizable when related assets received or held are readily convertible to known amounts of cash or claims to cash When is revenue earned? Revenue is earned when the entity has substantially accomplished what it must do to be entitled to benefits represented by the benefits of the revenue. In other words, “the earnings process has been completed”. 2. Basic Revenue Recognition Criteria Major “recent” revenue recognition standards: In October 1997, the AICPA issued Statement of Position 97-2 on Software Revenue Recognition to address the evolving practices in the software industry. In December 1999, the SEC issued Staff Accounting Bulletin No. 101 on Revenue Recognition to “summarize” existing GAAP on the subject – adopting the basic principles from SOP 97-2. The SEC later amended SAB 101 with the issuance of SAB 104. 2. Basic Revenue Recognition Criteria SAB 104 and SOP 97-2 indicate that revenue is generally realized or realizable and earned when ALL of the following four criteria are met in: I. II. Persuasive evidence of an arrangement exists Delivery has occurred or services have been rendered III. Seller’s fee is fixed or determinable IV. Collection is reasonably assured 2. Basic Revenue Recognition Criteria I. Persuasive evidence of an arrangement is based on the Company’s customary and agreed upon business practice which may require a: Signed contract Purchase order Electronic communication Credit card authorization 2. Basic Revenue Recognition Criteria I. Persuasive evidence of an arrangement exists Complete = contract is signed by both parties before period end. If contract is not signed by either party, terms and conditions are not final, revenue cannot be recognized. Does contract include all terms and conditions? Are there any side letters/agreements? Such agreements may include cancellation, termination, or return provisions that could affect revenue recognition No revenue can be recognized unless persuasive evidence of an arrangement exists, even if delivery has occurred. SAB 104 Discussion Question (summarized) Is there Persuasive Evidence of an Arrangement? Facts: Company A delivers product to Company B prior to quarter end. Company A’s normal and customary business practice for this class of customer is to enter into a written sales agreement that requires the signatures of the authorized representatives of the Company and its customer to be binding. Company A prepares a written sales agreement which is signed by their authorized representative prior to quarter end. Company B’s purchasing department has orally agreed to the sale and stated the contract will be approved the first week of the next quarter. SAB 104 Discussion Question (summarized) Question: Can Company A recognize revenue in the current quarter? Interpretive response: Revenue cannot be recognized in the current quarter. As a result of Company A’s business practice of requiring a written sales agreement for this class of customer, persuasive evidence of an arrangement would require a final agreement that has been executed. Company B’s execution of the sales agreement after the end of the quarter causes the revenue from the transaction to be recognized in the subsequent period. 2. Basic Revenue Recognition II. Delivery has occurred or services have been rendered Delivery can vary based on the nature of the product a) Physical transfer b) Electronic transmission c) Availability for download d) Installation/Training requirements e) Customer acceptance If the undelivered element(s) are essential to the functionality of the delivered element(s), delivery may not have occurred 2. Basic Revenue Recognition Criteria Delivery has occurred or services have been rendered • • • Shipping terms impact revenue recognition, i.e. FOB shipping point vs. FOB destination Title and risk of loss must transfer The Company’s policy of replacing goods damaged in shipment at no charge to the customer creates FOB destination terms for revenue recognition purposes 2. Basic Revenue Recognition Criteria Delivery has occurred or services have been rendered (cont).: • • Bill and hold arrangements should be uncommon. It must be requested by the customer and has several other conditions specified in SAB 104 Revenue should not be recognized when customers have an unconditional right of return SAB 104 Discussion Question (summarized) Has Delivery Occurred? Facts: Company Z has an arrangement to deliver its products to Company A on a consignment basis. Pursuant to the terms of the arrangement, Customer A is a consignee, and title to the products does not pass from Company Z to Customer A until Customer A consumes the products in its operations. Company Z delivers product to Customer A under the terms of their arrangement. Question: May Company Z recognize revenue upon delivery of its product to Customer A? SAB 104 Discussion Question (summarized) Interpretive Response: No. Products delivered to a consignee pursuant to a consignment arrangement are not sales and do not qualify for revenue recognition until a sale occurs. The staff believes that revenue recognition is not appropriate because the seller retains the risks and rewards of ownership of the product and title usually does not pass to the consignee. SAB 104 Discussion Question (summarized) Has Delivery Occurred? Facts: Company A receives purchase orders for product. The customer is not ready to take delivery of the product for various reasons including lack of space and delays in customers’ production schedules. Company A ships the product to a thirdparty warehouse but retains title to the product and payment is dependent upon delivery to a customer specified site. Question: Can company A recognize revenue when the product is shipped? SAB 104 Discussion Question (summarized) Interpretive response: Revenue cannot be recognized. Delivery generally is not considered to have occurred unless the customer has taken title and assumed the risks and rewards of ownership of the product. This could be considered to be an inappropriate “bill and hold” transaction. SAB 104 Discussion Question (summarized) Has Delivery Occurred? Facts: Company E is an equipment manufacturer whose main product is generally sold in a standard model. The contracts for sale of that model provide for customer acceptance to occur after the equipment is received and tested by the customer. The acceptance provisions state that if the equipment does not perform to Company’s E published specifications, the customer may return the equipment for a full refund or a replacement unit. Title to the equipment passes upon delivery to the customer. Company E does not perform installation or other services on the equipment and tests each piece of equipment it sells before shipment. SAB 104 Discussion Question (summarized) Question: Company E receives an order from a new customer for a standard model of its main product. When should Company E recognize revenue from sales of this piece of equipment? Interpretive response: Revenue should be recognized upon delivery of the equipment. While the SEC staff presumes that customer acceptance provisions are substantive provisions that generally result in revenue deferral, that presumption can be overcome. Although the contract includes a customer acceptance clause, acceptance is based on meeting Company E’s published specifications for a standard model. SAB 104 Question (paraphrased) Have all conditions related to Delivery been met? Facts: Assuming the same facts as the previous example. Company E enters into an arrangement with a new customer to deliver a version of its standard product modified as necessary to be integrated into a customer’s new assembly line while still meeting all of the standard published vendor specifications. The customer may reject the equipment if it fails to meet the standard published performance specifications or cannot be satisfactorily integrated into the new line. continued >>> SAB 104 Question (paraphrased) Have all conditions related to Delivery been met? Facts (cont): Company E has never modified its equipment to work on an integrated basis in the type of assembly line the customer has proposed. Company has designed the equipment to meet the standard published performance specifications with the modifications necessary, but Company E is unable to replicate the new assembly line conditions in its testing. SAB 104 Discussion Question (summarized) Question: When should Company E recognize revenue from this transaction? Interpretive response: The contract includes a customer acceptance clause that is based in part on customer specific criterion and Company E cannot demonstrate that the equipment shipped meets that criterion prior to shipment. Therefore, Company E should wait until the product is successfully integrated at its customer’s location and meets the customerspecific criteria before recognizing revenue. 2. Basic Revenue Recognition Criteria III. Seller’s fee is fixed or determinable A fee required to be paid in a set amount that is not subject to refund or adjustment. If it cannot be concluded that a fee is fixed or determinable at the outset of an arrangement, revenue should be recognized as payments from customers become due (assuming all other conditions for revenue recognition have been satisfied). 2. Basic Revenue Recognition Criteria Additional factors impacting the “fixed or determinable” assessment include: Extended payment terms outside the Company’s customary terms or over 12 months. Can be overcome if Company can show a history of full payment. Cancellation privileges Forfeiture or refund clauses Customer acceptance clauses/right of return Concessions reduce the present value of amounts due under the original terms and can include: 1. 2. 3. 4. Additional discounts Future products at no fee or a reduced fee Extension of payment terms Additional payment terms 2. Basic Revenue Recognition Criteria IV. Collection is reasonably assured An assessment of collectibility should be made prior to recognition of revenue and should address differences amongst customers: Collectibility assessments of new customers should be more diligent Policy should establish time lines for review of customers creditworthiness (annually) It is about the customers ability to pay, not their willingness Need adequate documentation of assessment In general, bad debt expense and revenue should not be recorded for the customer in the same period Sample Software Company Issues • Former client, “V” had sales agreements for license fees of $2.0M. In turn, licensee was to sell and install the software to an end user. The final price payable to Z was dependent upon sale to end user, and licensee did not need to pay until sale was completed with user. • While there was persuasive evidence of an arrangement, delivery had not occurred, the price was not fixed and collection was not reasonably assured in the absence of an end-user customer. 3. Multiple Elements in Revenue Recognition Under EITF 00-21 EITF 00-21 was issued to address the increased complexities that exist when companies offer “bundled” products and services. These bundled products and services often: • Involve delivery of products and services at varying times • Have varying payment terms and payment streams The arrangements could create separate units of accounting for the elements of the product/services in the package deal. 3. Multiple Elements in Revenue Recognition Under EITF 00-21 Multiple revenue elements in one arrangement could include: the delivery or performance of multiple products, services, the rights to use assets initial installation, initiation, or activation services Payment arrangements can include consideration as: a fixed fee or fixed fee coupled with a continuing payment stream corresponding to the continuing performance, and the amount of the payments may be fixed, variable based on future performance, or a combination of fixed and variable payment amounts. 3. Multiple Elements in Revenue Recognition Under EITF 00-21 In an arrangement with multiple deliverables, the delivered item(s) should be considered a separate unit of accounting if ALL of the following criteria are met: 1. The delivered item(s) have value to the customer on a stand alone basis 2. There is objective and reliable evidence of the fair value of the undelivered item(s) 3. If there is a general right of return for the delivered item, delivery or performance of the undelivered item(s) must be considered probable and substantially in control of the vendor 3. Multiple Elements in Revenue Recognition Under EITF 00-21 The arrangement consideration allocable to delivered item(s) that does not qualify as a separate unit of accounting within the arrangements should be combined with the amount allocable to the other undelivered items within the arrangement. The appropriate recognition of revenue should then be determined for those combined deliverables as a single unit of accounting. 3. Multiple Elements in Revenue Recognition Under EITF 00-21 The following steps should be followed in reviewing multiple elements: 1. 2. 3. 4. Identify deliverables Determine if there is a higher level of literature (SFAS’s, SOP’s, FASB Interpretations and Technical Bulletins) Measure the arrangement consideration (must be fixed and determinable) Separate the deliverables 3. Multiple Elements in Revenue Recognition Under EITF 00-21 The following steps should be followed in reviewing multiple elements (cont.): 5. 6. Allocate the arrangement consideration (should be based on fair value – contractually stated prices for individual products and/or services in an arrangement with multiple deliverables should not be presumed to be representative of fair value) Identify the revenue model EITF 00-21 – Example 1 Facts: CellularCo runs a promotion in which new customer who sign a two-year contract receive a “free” phone. The contract requires the customer to pay a cancellation fee of $300 if the customer cancels the contract. There is one-time “activation fee” of $50 and a monthly fee of $40 for the ongoing service. The same monthly fee is charged by CellularCo regardless of whether a “free” phone is provided. The phone costs CellularCo $100. Further, assume that CellularCo frequently sells the phone separately for $120. continued>>> EITF 00-21 – Example 1 (cont.) Facts (cont:) CellularCo is not required to refund any portion of the fees paid for any reason. CellularCo is a sufficiently capitalized, experienced, and profitable business and has no reason to believe that the two-year service requirement will not be met. CellularCo is considering whether (a) the phone and (b) the phone service (that is, the airtime) are separable deliverables in the arrangement. The activation fee is simply considered additional arrangement consideration to be allocated. The phone and activation are delivered first, followed by the phone service (which is provided over the twoyear period of the arrangement). EITF 00-21 – Example 1 (cont.) Evaluation: The first condition for separation is met for the phone. That is, the phone has a value on a standalone basis because it is sold separately by CellularCo. The second condition for separation also is met because objective and reliable evidence of fair value exists for the phone service. Finally, there are no general rights of return in this arrangement (third condition). Therefore, the phone and the phone service should be accounted for as separate units of accounting. EITF 00-21 – Example 1 (cont.) The total arrangement consideration is $1,010. The fair value of the phone service is $960 ($40 x 24 months), the price charged by CellularCo. The fair value of the phone is $120, the price of the phone when sold separately by CellularCo. Without considering whether any portion of the amount allocable to the phone is contingent upon CellularCo’s providing the phone service, CellularCo would allocate the arrangement consideration on a relative fair value basis as follows: $112.22 [$1,010 x ($120 ÷ [$120 + $960])] to the phone and $897.78 [$1,010 x ($960 ÷ [$120 + $960])] to the phone service. However, because a “free” phone is provided in the arrangement and the customer has no obligation to CellularCo if the phone service is not provided, $62.22 (assuming the customer has paid the nonrefundable activation fee) is contingent upon CellularCo’s providing the phone service. Therefore, the amount allocable to the phone is limited to $50 ($112.22 - $62.22), and the amount allocable to the phone service is increased to $960. EITF 00-21 – Example 5 Facts: Company S is an experienced home appliance dealer. Company S offers a number of services with the home appliances it sells. Company S regularly sells Appliance W on a standalone basis, but they also offer installation and maintenance services. Company S does not offer installation or maintenance services for Appliance W unless they sell the appliance. Their pricing for Appliance W is as follows: Appliance W only Appliance W with installation Appliance W with maintenance only Appliance W with installation and maintenance$1,000 $ 800 $ 850 $ 975 EITF 00-21 – Example 5 (cont.) Facts (cont.): The amount charged by Company S for installation ($50) approximates the amount charged by independent third party installers. Appliance W is sold subject to a general right of return. If a customer purchases Appliance W with installation and/or maintenance services, in the event Company S does not complete the services, the customer is entitled to a refund of the portion of the fee that exceeds $800. Assume that a customer purchases Appliance W with both installation and maintenance services for $1,000. Company S believes it is probable that the installation will be performed satisfactorily to the customer. Assuming the delivery of Appliance W and its installation occur in different accounting periods and that the maintenance services cover a one year period, how should the $1,000 of revenue be recognized? EITF 00-21 – Example 5 (cont.) Evaluation: The maintenance services are separately priced at $175 and should be accounted for based on the guidance of FTB 90-1 – on a straight line basis over the maintenance term unless some other basis is objectively determined to be more appropriate. Regarding Appliance W and the installation fee, the first condition for separation is met because it is sometimes sold separately by Company S. The second condition is met as there is objective and reliable evidence of the fair value of the installation service. The third condition is met because performance of the installation service is probable and the control of Company S. EITF 00-21 – Example 5 (cont.) Company S would allocate $175 of the arrangement to maintenance services and recognize in accordance with FTB 90-1, as noted above. Company S would allocate the remainder of the consideration ($825) to Appliance W and the installation service based on their relative fair values. Appliance W would be allocated $776 ($825 x (800 divided by [800 +50])) and installation would be allocated $49 ($825 x (50 divided by [800 + 50])). EITF 00-21 – Example 8 Facts: Company B sells computer systems. On April 20, a customer purchases a computer system from Company B for $1,000. The system consists of a CPU, a monitor, and a keyboard. On April 30, Company B delivers the CPU to the customer without the monitor or keyboard. Each of the items can be purchased separately at a cost of $700 for the CPU, $300 for the monitor, and $100 for the keyboard. The CPU could function with monitors or keyboards manufactured by others, who have them readily available. The customer is entitled to a refund equal to the separate price of any item composing the system that is not delivered. The arrangement does not include any general rights of return. Company B is evaluating whether delivery of the CPU represents a separate unit of accounting. EITF 00-21 – Example 8 (cont.) Evaluation: The first condition for separation is met for the CPU as it is sold separately by Company B. The second condition for separation is met because the fair values of the undelivered items (keyboard and monitor) are objectively and reliably determined based on the price of that equipment when sold separately by Company B. The third condition for separation is met because there are no general rights of return. Therefore, the CPU should be accounted for as a separate unit of accounting. EITF 00-21 – Example 8 (cont.) Evaluation (cont.): Without considering whether any portion of the amount allocable to the CPU is contingent upon delivery of the other items, Company B would allocate the arrangement consideration on a relative fair value basis. Therefore, the portion of the arrangement fee otherwise allocable to the CPU is $636.36 ($1,000 × [$700 ÷ $1,100]), of which $36.36 ($636.36 [$1,000 - $400]) is subject to refund if the monitor and keyboard are not delivered. Therefore, the amount allocable to the CPU is limited to $600, which is the amount that is not contingent upon delivery of the monitor and keyboard. 4. Other Revenue Recognition Considerations SOP 97-2 provides guidance on when revenue should be recognized and in what amounts for licensing, selling, leasing, or otherwise marketing computer software. May need to consider 97-2 and EITF 03-05 when there is embedded software in products that may be essential to the functionality to the product as a whole. • As noted previously, 97-2 contained the four basic revenue recognition criteria now included in SAB 104. EITF 99-19 provides guidance on reporting revenue gross as a principle versus net as an agent. Revenue and cost or revenue must be netted when a company acts as an agent or broker. • Key determinants here include consideration of whether Seller ever took title and risk of loss to inventory in the overall sales process. • Net accounting is appropriate when revenue earned is tantamount to a commission. 4. Other Revenue Recognition Considerations EITF 00-10 provides guidance on accounting for shipping and handling fees and costs. • Amounts billed for S&H are included in revenues • Accounting policy needs to be set for treatment of costs and are generally included in Costs of Sale. If classified outside of COS and significant, disclosure of amount and classification is required. SOP 81-1 provides guidance on accounting for performance of construction and production type contracts. Generally provides guidance for revenue recognition on long-term contracts. • Generally requires the percentage-of-completion method of accounting. • High risk area due to inherent nature of estimates required • Common in construction and longer-term development projects including custom software. 4. Other Revenue Recognition Considerations (cont.) Bill & Hold – Such are generally not recorded as revenues, unless meet stringent guidelines of SAB 104 including: 1. Risk of ownership passes to buyer 2. Customer has written commitment to purchase 3. The buyer must request the bill and hold 4. Fixed delivery schedule in line with buyer’s business 5. Seller does not retain specific performance obligations 6. Goods segregated from rest of seller inventory 7. Goods must be complete and ready for shipment 4. Other Revenue Recognition Considerations (cont.) Channel Stuffing – Sales are boosted or pushed to customers in amounts higher than they can promptly sell. (Hint: Watch out for those sales returns after QE/YE) Side Agreements – Formal or informal agreements that significantly alter the terms of sale. This also existed at Software Client “V” discussed previously. 4. Other Revenue Recognition Considerations (cont.) Right of Return – (SFAS 48) When a seller gives the buyer the right to return the product, revenue from the sales transaction shall be recognized at time of sale only if all of the following conditions (a-f) are met: a. The seller's price to the buyer is substantially fixed or determinable at the date of sale. b. The buyer has paid the seller, or the buyer is obligated to pay the seller and the obligation is not contingent on resale of the product. 4. Other Revenue Recognition Considerations (cont.) Right of Return (cont.) –: c. The buyer's obligation to the seller would not be changed in the event of theft or physical destruction or damage of the product. d. The buyer acquiring the product for resale has economic substance apart from that provided by the seller. e. The seller does not have significant obligations for future performance to directly bring about resale of the product by the buyer. f. The amount of future returns can be reasonably estimated 5. Company Internal Control Considerations Companies should have documented policy on when revenue is to be recognized including the following considerations: a. b. c. d. e. What constitutes evidence of an arrangement which should consider varying practices for different products and customers Policy for customer acceptance of product and customer returns Delivery – shipping methods and what constitutes delivery Typical credit terms Criteria and evaluation policy for determining credit worthiness of new and existing customers 5. Company Internal Control Considerations Procedures should be established for identifying unusual terms and conditions that may impact revenue recognition Be careful when using “industry” revenue recognition principles, they may be wrong 6. Frauds Involving Revenue Recognition The National Commission of Fraudulent Financial Reporting sponsored a study of incidences of fraudulent reporting, as reported in SEC Accounting and Auditing Enforcement Releases from 1985 through 1997. Researchers found inappropriate revenue recognition in 50 percent of the cases. Some Examples of Fraudulent Revenue Reporting: Peregrine Systems, Inc., a software developer. In order to meet analyst expectations, management entered sham deals with software resellers. When uncollectible receivables began to build, management obtained loans against the receivables that were treated as sales of receivables. Peregrine restated 2000-2002 financial statements reducing revenue by $507,000,000. 6. Frauds Involving Revenue Recognition ZZZZ Best Company, Inc. – A home carpet cleaning company that created tens of millions of fictitious revenues from non-existent restoration contracts. Records and paperwork were “manufactured” using copy machines and phony letterhead. Over $200,000,000 of market value evaporate in three months after discovery and the Company’s assets ultimately sold at auction for $62,000. California Micro Devices, Inc. – Revenues were recorded on products not yet shipped or even ordered. Revenues were not reduced for returned products. The Company also paid distributors “handling fees” to accept shipments of products for which they had unlimited rights of return and booked those shipments as sales. 6. Frauds Involving Revenue Recognition Campbell Soup Company – In the late 1990’s, Campbell’s recorded sales of product shipped to and stored in its own warehouses and trucks. They also reported sales incentives as SG&A instead of reductions of gross revenue. They also recorded large “guaranteed sales” at the end of periods; sales for which the customers had an unconditional right to return the product. Crazy Eddie, Inc. – This discount audio/video retailer sold extended warrantees for which the underlying costs were actually borne by the manufacturers and used deceptive sales practices to steer customers to higher priced products. Also, in order to retain the appearance of “same store sales” growth, wholesale shipments to other retailers were recorded as retail sales with higher gross profit by not relieving the full cost of inventory (also overstating inventory). 7. Auditor Considerations PCAOB’s Report on 2004, 2005, and 2006 Inspections of Firms who audit no more that 100 issuers was released in October 2007. Inspectors identified deficiencies relating to testing of issuers’ revenues, including failures to: Perform any or adequate substantive procedures to test existence, completeness and valuation of revenue Review contracts or appropriately evaluate the specific terms and provisions Test whether revenue was recorded in the appropriate period Corroborate management representations Perform adequate substantive analytical procedures on revenue 7. Auditor Considerations (cont.) Audit Engagement Basics: Understand the client’s business; observe them in action; ask questions. Understand the risks and potential for fraud. SAS 99 requires auditors to presume there is a risk of material misstatement in revenue. Be diligent in analyzing revenue – it’s not as easy as it looks! Follow good audit procedure basics: • Read contracts carefully; understand the business purpose • Test Cut-off of transactions • Confirm material transactions/contract terms • Corroborate management representations • Be professionally skeptical at all times! 8. US GAAP vs. IFRS (it’s coming fast!) Hundreds of references in US GAAP vs. ONE “principle” (IAS 18) under IFRS. IFRS – revenue from the sale of goods recognized only when risks and rewards of ownership have been transferred, the buyer has control of the goods, revenues can be measured reliably, and it is probable that the economic benefits will flow to the company (seller). 8. US GAAP vs. IFRS (it’s coming fast!) IFRS – revenue from rendering services recognized in accordance with long-term contract accounting, including considering the stage of completion, whenever revenues and costs can be measured reliably and it is probable the economic benefits will flow to the company (seller). 8. US GAAP vs. IFRS (it’s coming fast!) IFRS – Multiple Elements – IAS 18 requires recognition of revenue on an element of a transaction if that element has commercial substance on its own; otherwise, the separate elements must be linked and accounted for as a single transaction. (No other specific guidance, yet.) 8. US GAAP vs. IFRS (it’s coming fast!) IFRS – Construction Contracts – IAS 18 requires the use of the percentage-ofcompletion method if certain criteria are met. Otherwise, revenue recognition is limited to recoverable costs incurred. (Completed contract method is not permitted.) 9. Conclusion and Questions & Answers Wayne R. Pinnell Managing Partner Haskell & White LLP 16485 Laguna Canyon Road 12707 High Bluff Drive 3rd Floor Suite 200 Irvine, CA 92618 San Diego, CA 92130 T (949) 450-6200 T (858) 350-4215 F (949)753-1224 F (858) 350-4218