Federal Tax and Transactional Law Research (Boot Camp 2005)

advertisement

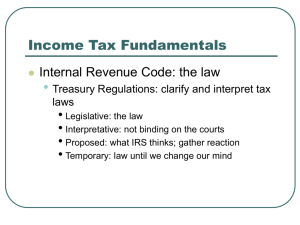

Federal Tax Hierarchies & Transactional Law Research Paul D. Callister, JD, MSLIS Director of the Leon E. Bloch Law Library & Associate Professor of Law University of Missouri-Kansas City School of Law http://www1.law.umkc.edu/faculty/callister/bootcamp/ppt/tax.ppt © 2005, Paul D. Callister Primary Authority (Caselaw) Institution Reported Binding Upon Supreme Court Supreme Court Reporter/US Tax Cases Parties and as precedent for all courts Courts of Appeals Federal Reporter/US Tax Cases Parties and as precedent for all courts of that circuit including cases before Tax Court District Court/Court of Claims Federal Supplement/US Tax Cases Parties and as precedent for that district (including Tax Court) Tax Court Tax Court Reports Tax Court Memo Parties and as precedent in Tax Court (unless other Fed. Court decided). Tax Court Reports are cases of first impression. Tax Court Memo for cases where the issue is how to apply settled law. Acquiescence v. Non-Acquiescence Deficiency Notice 90-Day Letter To Pay or Not to Pay Pay Tax and File Claim for Refund Not Pay & Petition Tax Ct. Tax Court Notice of Claim Disallowance Choice of Action File Petition Fed. Dist. Court Fed. Court of Claims Court of Appeals for your Circuit Court of Appeals for Fed. Circuit U.S. Supreme Ct. Primary Authority (Regulations & Rulings) Institution Document Reported in Binding upon/Who’s it for Treasury Treasury Regulations, aka Treasury Decisions or TDs (Final Regs) Federal Register, & Code of Federal Regulations. Final regulations are also published in the Internal Revenue Bulletin (which is bound as the Cumulative Bulletin). Also published by CCH, Mertens, etc. Treasury (IRS) interpretation of tax code (“general regulations”) or law-making function (“legislative regulations”) delegated by code. Difficult to challenge in court. Legislative regulations bear the greatest precedential value of any IRS pronouncement.” Temporary Regulations (TDs) Proposed Regulations (TDs) IRS National Office Revenue Ruling Issued for immediate guidance to tax papers as a result of new legislation. Issued without hearing or comment period. Three year expiration date. Must issue proposed regulations at the same time. Not binding if court finds to be an incorrect interpretation of tax code. No binding effect until made final (after hearings and comment period). Does give guidance as to IRS’ interpretation. Internal Revenue Bulletin (Cum. Bulletin). Published by CCH, Mertens, etc. An official position as to application of the Code or Regulations to a specific situation (usually submitted by taxpayer). “Second in importance to regulations.” Weight Primary Authority (Regulations & Rulings) Institution Document Reported in Binding upon/Who’s it for Treasury Treasury Regulations, aka Treasury Decisions or TDs (Final Regs) Federal Register, & Code of Federal Regulations. Final regulations are also published in the Internal Revenue Bulletin (which is bound as the Cumulative Bulletin). Also published by CCH, Mertens, etc Treasury (IRS) interpretation of tax code (“general regulations”) or law-making function (“legislative regulations”) delegated by code. Difficult to challenge in court. Legislative regulations bear the greatest precedential value of any IRS pronouncement.” Temporary Regulations (TDs) Proposed Regulations (TDs) IRS National Office Revenue Ruling Issued for immediate guidance to tax papers as a result of new legislation. Issued without hearing or comment period. Three year expiration date. Must issue proposed regulations at the same time. Not binding if court finds to be an incorrect interpretation of tax code. No binding effect until made final (after hearings and comment period). Does give guidance as to IRS’ interpretation. Internal Revenue Bulletin (Cum. Bulletin). Published by CCH, Mertens, etc. An official position as to application of the Code or Regulations to a specific situation (usually submitted by taxpayer). “Second in importance to regulations.” Weight Primary Authority (Regulations & Rulings) Institution Document Reported in Binding upon/Who’s it for Treasury Treasury Regulations, aka Treasury Decisions or TDs (Final Regs) Federal Register, & Code of Federal Regulations. Final regulations are also published in the Internal Revenue Bulletin (which is bound as the Cumulative Bulletin). Also published by CCH, Mertens, etc Treasury (IRS) interpretation of tax code (“general regulations”) or law-making function (“legislative regulations”) delegated by code. Difficult to challenge in court. Legislative regulations bear the greatest precedential value of any IRS pronouncement.” Temporary Regulations (TDs) Proposed Regulations (TDs) IRS National Office Revenue Ruling Issued for immediate guidance to tax papers as a result of new legislation. Issued without hearing or comment period. Three year expiration date. Must issue proposed regulations at the same time. Not binding if court finds to be an incorrect interpretation of tax code. No binding effect until made final (after hearings and comment period). Does give guidance as to IRS’ interpretation. Internal Revenue Bulletin (Cum. Bulletin). Published by CCH, Mertens, etc. An official position as to application of the Code or Regulations to a specific situation (usually submitted by taxpayer). “Second in importance to regulations.” Weight Primary Authority (Regulations & Rulings) Institution Document Reported in Binding upon/Who’s it for Treasury Treasury Regulations, aka Treasury Decisions or TDs (Final Regs) Federal Register, & Code of Federal Regulations. Final regulations are also published in the Internal Revenue Bulletin (which is bound as the Cumulative Bulletin). Also published by CCH, Mertens, etc Treasury (IRS) interpretation of tax code (“general regulations”) or law-making function (“legislative regulations”) delegated by code. Difficult to challenge in court. Legislative regulations bear the greatest precedential value of any IRS pronouncement.” Temporary Regulations (TDs) Proposed Regulations (TDs) IRS National Office Revenue Ruling Issued for immediate guidance to tax papers as a result of new legislation. Issued without hearing or comment period. Three year expiration date. Must issue proposed regulations at the same time. Not binding if court finds to be an incorrect interpretation of tax code. No binding effect until made final (after hearings and comment period). Does give guidance as to IRS’ interpretation. Internal Revenue Bulletin (Cum. Bulletin). Published by CCH, Mertens, etc. An official position as to application of the Code or Regulations to a specific situation (usually submitted by taxpayer). “Second in importance to regulations.” Weight Primary Authority (Regulations & Rulings Cont.) Institution Document Reported in Binding Upon/Who’s it for IRS National Office Revenue Procedure Internal Revenue Bulletin (Cumulative Bulletin). Also published by CCH, Mertens, etc. Official procedures for IRS and practitioners making filings or seeking rulings or information from the IRS. Private Letter Ruling Commercial Publisher Nonbinding ruling (except between IRS and applicant) requested by taxpayer on a specific issue from the IRS National Office. Determination Letter FOIA Same as a Private Letter Ruling except issued by a local office. Technical Advice Memo Commercial Publisher Requested by IRS agent with respect to prior event or a completed transaction (which local office couldn’t resolve). General Counsel’s Memo (“FSA”) Commercial Publisher Requested by IRS from its own legal counsel with respect to preparing letter or revenue rulings. Primary Authority (Regulations & Rulings Cont.) Institution Document Reported in Binding Upon/Who’s it for IRS National Office Revenue Procedure Internal Revenue Bulletin (Cumulative Bulletin). Published by CCH, Mertens, etc. Official procedures for IRS and practitioners making filings or seeking rulings or information from the IRS. Private Letter Ruling Commercial Publisher Nonbinding ruling (except between IRS and applicant) requested by taxpayer on a specific issue from the IRS National Office. Determination Letter FOIA Same as a Private Letter Ruling except issued by a local office. Technical Advice Memo Commercial Publisher Requested by IRS agent with respect to prior event or a completed transaction (which local office couldn’t resolve). General Counsel’s Memo (“FSA”) Commercial Publisher Requested by IRS from its own legal counsel with respect to preparing letter or revenue rulings. Primary Authority (Regulations & Rulings Cont.) Institution Document Reported in Binding Upon/Who’s it for IRS National Office Revenue Procedure Internal Revenue Bulletin (Cumulative Bulletin). Published by CCH, Mertens, etc. Official procedures for IRS and practitioners making filings or seeking rulings or information from the IRS. Private Letter Ruling Commercial Publisher Nonbinding ruling (except between IRS and applicant) requested by taxpayer on a specific issue from the IRS National Office. Determination Letter FOIA Same as a Private Letter Ruling except issued by a district office. Technical Advice Memo Commercial Publisher Requested by IRS agent with respect to prior event or a completed transaction (which local office couldn’t resolve). General Counsel’s Memo (“FSA”) Commercial Publisher Requested by IRS from its own legal counsel with respect to preparing letter or revenue rulings. Primary Authority (Regulations & Rulings Cont.) Institution Document Reported in Binding Upon/Who’s it for IRS National Office Revenue Procedure Internal Revenue Bulletin (Cumulative Bulletin). Published by CCH, Mertens, etc. Official procedures for IRS and practitioners making filings or seeking rulings or information from the IRS. Private Letter Ruling Commercial Publisher Nonbinding ruling (except between IRS and applicant) requested by taxpayer on a specific issue from the IRS National Office. Determination Letter FOIA Same as a Private Letter Ruling except issued by a local office. Technical Advice Memo Commercial Publisher Requested by IRS agent with respect to prior event or a completed transaction (which local office couldn’t resolve). General Counsel’s Memo (“FSA”) Commercial Publisher Requested by IRS from its own legal counsel with respect to preparing letter or revenue rulings. Primary Authority (Regulations & Rulings Cont.) Institution Document Reported in Binding Upon/Who’s it for IRS National Office Revenue Procedure Internal Revenue Bulletin (Cumulative Bulletin). Published by CCH, Mertens, etc. Official procedures for IRS and practitioners making filings or seeking rulings or information from the IRS. Private Letter Ruling Commercial Publisher Nonbinding ruling (except between IRS and applicant) requested by taxpayer on a specific issue from the IRS National Office. Determination Letter FOIA Same as a Private Letter Ruling except issued by a local office. Technical Advice Memo Commercial Publisher Requested by IRS agent with respect to prior event or a completed transaction (which local office couldn’t resolve). General Counsel’s Memo (FSA) Commercial Publisher Requested by IRS from its own legal counsel with respect to preparing letter or revenue rulings. Other IRS Documents • Publications • Notices • Acquiescence and Non-acquiescence notices • Internal Revenue Manual Tax Research Institutional Process Institution Authoritative/ Primary Documents Secondary Documents Commercial Publishers Access Tools Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness Code Based Subject Based Handbook News & Awareness How do I . . . 1. . . . find a sample limited liability company operating agreement in print? On Westlaw? I n p r i n t On Westlaw 2. . . . find a sample contract of sale for a restaurant business in print? On lexis? In print On Lexis 3. . . . determine the minimum filing requirements for a small private placement offering in California? In print CCH Blue Sky Law Reporter On Lexis On Westlaw 4. . . . form a corporation in Nevada? What kind of search? Legal Information Institute--Listing by Jurisdiction http://www.law.cornell.edu/states/listing.html LexisOne State Resource Locator www.lexisone.com/legalresearch/legalguide/states/states_reso urces_index.htm 5. . . . find a sample Missouri revocable trust in print? On Lexis? On Westlaw? On the Web? On Lexis On Westlaw LexisOne Forms http://www.lexisone.com/ legalresearch/legalguide/ online_forms/forms_center _index.htm Findlaw Forms http://forms.lp. findlaw.com/ 6. On CCH On RIA . . . use looseleaf services like CCH Standard Federal Tax Reporter and RIA ? Online? 7. . . . understand the “control group rules” under IRC § 1563? On RIA On CCH On Lexis 8. On CCH . . . . understand Qualified Domestic Relations Orders (QDROs) and how to draft them? On RIA On Lexis 9. . . . research all relevant tax cases similar to the Federal Second Circuit case, Caplin v. US? On CCH On RIA On Lexis On Westlaw 10. . . . find Form 706 (federal estate tax return)? Find the equivalent state return in Maine? http://www.IRS.gov http://www.taxadmin.org/fta/link/forms.html 11. On CCH . . . find private letter rulings? On RIA On Lexis On Westlaw 12. . . . find tax rates and the “Applicable Federal Rate”? http://www.IRS.gov The End